Fill a Valid Business Credit Application Template

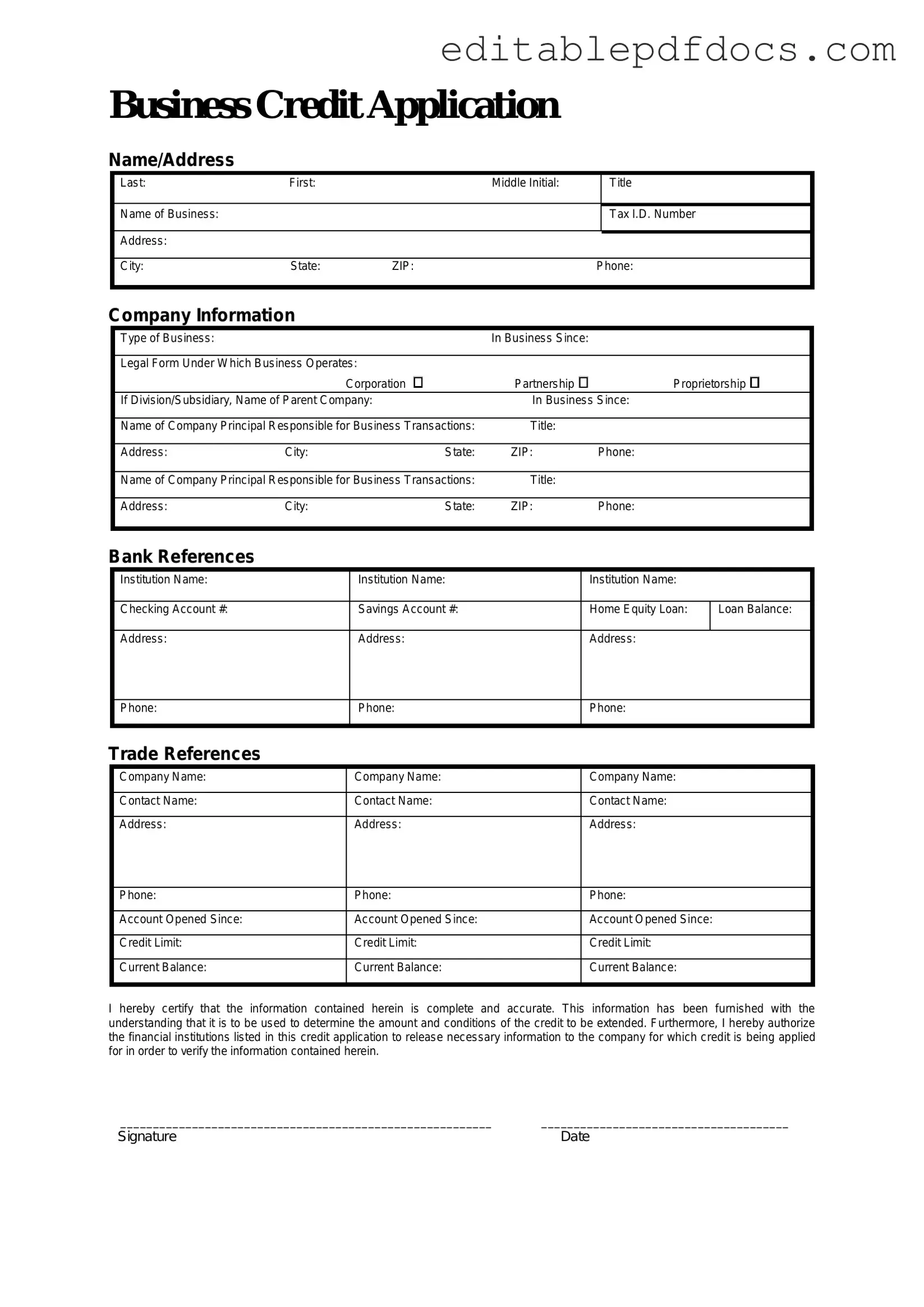

When embarking on the journey of establishing or expanding a business, securing credit can be a pivotal step. A Business Credit Application form plays a crucial role in this process, serving as a bridge between your company and potential lenders or suppliers. This form typically requires essential information about your business, including its legal structure, ownership details, and financial history. You’ll find sections that ask for your business’s tax identification number, contact information, and a brief description of your operations. Additionally, many forms include inquiries about your credit history, outstanding debts, and references from other suppliers or lenders. Completing this application accurately is vital, as it not only reflects your business's credibility but also influences the terms and limits of credit extended to you. Understanding each component of the form can empower you to present your business in the best light possible, thereby enhancing your chances of obtaining favorable credit terms.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used to assess a business's creditworthiness before extending credit. |

| Information Required | Typically, the form requests details such as business name, address, ownership structure, and financial information. |

| Governing Law | In California, the form is governed by the California Commercial Code. |

| Confidentiality | Information provided on the form is usually kept confidential and used solely for credit evaluation purposes. |

| Signature Requirement | A signature from an authorized representative of the business is generally required to validate the application. |

| Review Process | After submission, the credit department reviews the application and may request additional documentation. |

| Decision Notification | Businesses are typically notified of the credit decision within a few days to a couple of weeks, depending on the lender's process. |

Dos and Don'ts

When filling out a Business Credit Application form, it is important to follow certain guidelines to ensure a smooth process. Below are ten things you should and shouldn't do:

- Do read the entire application carefully before starting.

- Do provide accurate and complete information.

- Do double-check your financial statements for accuracy.

- Do include all required documentation.

- Do maintain a professional tone throughout the application.

- Don't leave any sections blank unless instructed.

- Don't provide misleading or false information.

- Don't forget to sign and date the application.

- Don't rush through the application process.

- Don't overlook any specific instructions provided by the lender.

Documents used along the form

When applying for business credit, several documents may accompany the Business Credit Application form. Each of these documents plays a crucial role in providing additional information and supporting your application. Below is a list of commonly used forms and documents.

- Personal Guarantee: This document is signed by an individual, often a business owner, agreeing to be personally responsible for the debt if the business defaults.

- Business Financial Statements: These include balance sheets and income statements that provide insight into the financial health of the business.

- Tax Returns: Recent tax returns help lenders assess the business's income and financial stability.

- Bank Statements: Providing several months of bank statements can demonstrate cash flow and the business's ability to manage finances.

- Trade References: A list of suppliers or vendors that the business has worked with, which can vouch for its creditworthiness.

- Business License: A copy of the business license shows that the business is legally registered and authorized to operate.

- Motorcycle Bill of Sale Form: To ensure a smooth ownership transfer, refer to the important motorcycle bill of sale documentation that validates the transaction details between the buyer and seller.

- Articles of Incorporation: This document outlines the business's formation and structure, providing essential details about its legal status.

- Operating Agreement: For LLCs, this document details the management structure and operational procedures of the business.

Providing these documents along with the Business Credit Application can enhance the credibility of the application and facilitate a smoother approval process. Make sure all information is accurate and up to date to improve your chances of obtaining credit.

Popular PDF Forms

Profits or Loss From Business - It includes sections for reporting gross receipts, cost of goods sold, and various expenses.

Uscis Form I-9 - The I-9 form must be completed by both the employer and the employee.

In addition to the critical details outlined in the FedEx Bill of Lading form, utilizing resources like Fillable Forms can streamline the process, ensuring that all necessary information is accurately captured and enhancing overall efficiency in shipping operations.

Hiv Elisa Test Normal Range - Clients use this form to stay informed about their HIV status.

Similar forms

Personal Credit Application: This document collects personal information from individuals applying for credit. Similar to the Business Credit Application, it requires details about income, employment, and financial history to assess creditworthiness.

Loan Application: A loan application is used when seeking funds from a lender. Like the Business Credit Application, it requests detailed financial information and purpose of the loan, helping lenders evaluate risk.

Vendor Credit Application: This form is filled out by businesses seeking credit from suppliers. It mirrors the Business Credit Application by requiring business details and financial information to determine credit limits.

Lease Application: When businesses apply for leasing equipment or property, they fill out a lease application. It shares similarities with the Business Credit Application in assessing financial stability and credit history.

- Articles of Incorporation: This essential document sets the foundation for your corporation in California, with detailed information that can simplify the incorporation process. To learn more about the necessary form, check out the Founding Articles.

Business Loan Proposal: A business loan proposal outlines a company's plan to secure funding. It parallels the Business Credit Application in that it includes financial data and projections to convince lenders of repayment ability.

Partnership Agreement: This document outlines the terms of a partnership. While not a credit application, it often requires financial disclosures similar to those found in a Business Credit Application to ensure all partners are financially stable.

Franchise Application: When applying for a franchise, potential franchisees submit this form. It requires financial information and business plans, akin to the Business Credit Application's focus on financial viability.

Insurance Application: This document is completed when seeking business insurance. It asks for financial details and risk assessments, paralleling the Business Credit Application's need for comprehensive financial information.

Merchant Account Application: Businesses seeking to accept credit card payments fill out this application. It collects financial data to evaluate risk, similar to the Business Credit Application's purpose of assessing creditworthiness.

Common mistakes

Filling out a Business Credit Application form can be a crucial step for any business seeking credit. However, many individuals make common mistakes that can hinder their chances of approval. Understanding these pitfalls can help ensure a smoother application process.

One frequent mistake is providing incomplete information. Applicants sometimes overlook sections or fail to provide necessary documentation. Missing details can raise red flags for lenders, leading to delays or outright denials.

Another common error is failing to check credit history before applying. Businesses should be aware of their credit score and any outstanding debts. A poor credit history can significantly impact the decision-making process of lenders.

Many applicants also neglect to include accurate financial statements. Lenders typically require up-to-date financial documents, such as balance sheets and income statements. Providing outdated or incorrect information can create doubts about the business's financial health.

Additionally, some individuals do not clarify the purpose of the credit. It is important to specify how the funds will be used. This transparency can build trust with lenders and demonstrate responsible financial planning.

Another mistake involves not reviewing the application for errors. Simple typos or inaccuracies can undermine the professionalism of the application. Taking the time to proofread can make a significant difference in the perception of the business.

Applicants may also fail to provide references. Lenders often look for character references or business relationships that can vouch for the applicant's credibility. Omitting this information can make the application feel incomplete.

Furthermore, some individuals do not understand the terms and conditions associated with the credit. It is vital to read and comprehend the fine print. Ignoring this step can lead to misunderstandings about repayment terms or fees.

Lastly, applicants sometimes rush the process, leading to poorly thought-out decisions. Taking the time to gather all necessary information and reflect on the application can lead to better outcomes. A careful approach often yields more favorable results.

By being aware of these common mistakes, applicants can enhance their chances of successfully obtaining business credit. A well-prepared application can pave the way for future financial opportunities.