Fill a Valid Auto Insurance Card Template

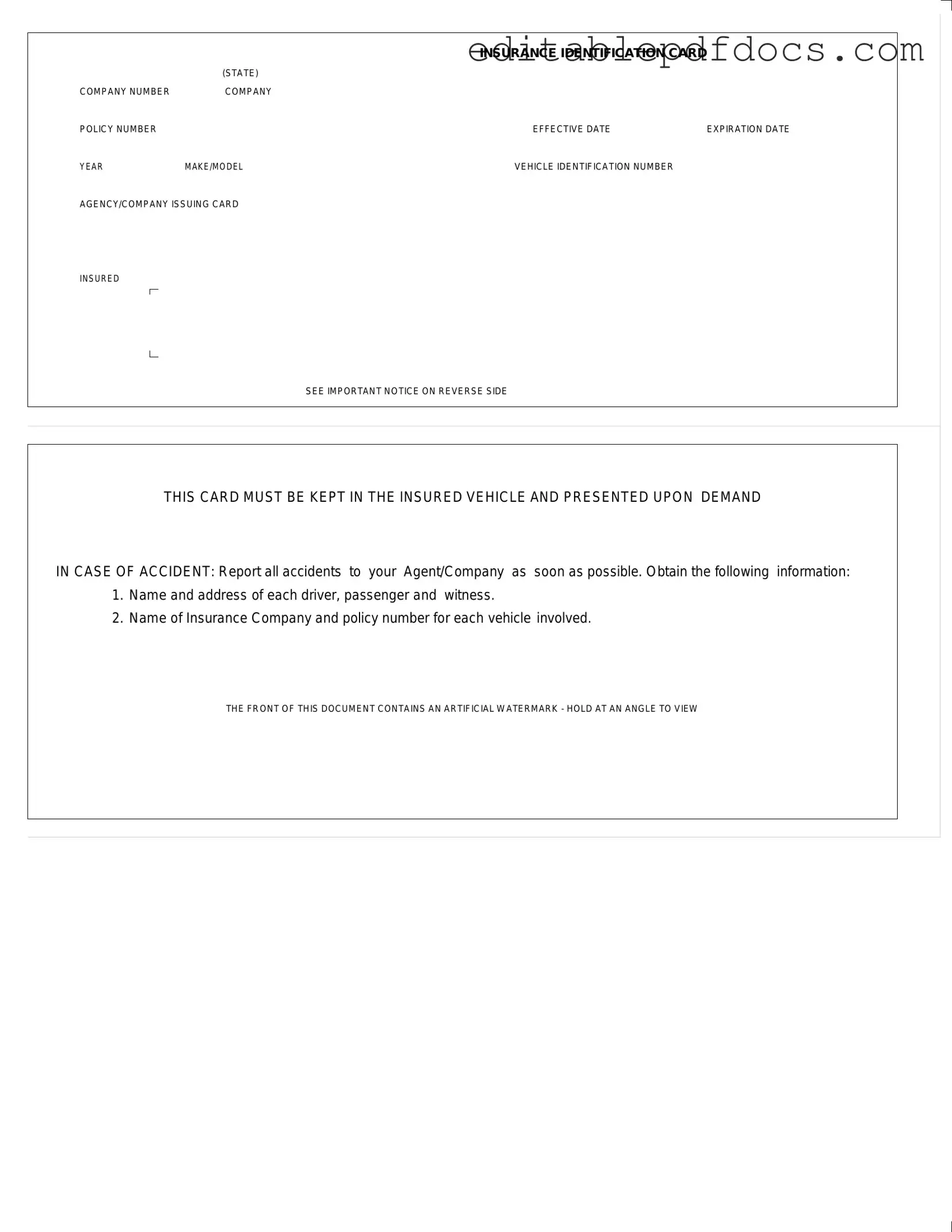

When navigating the world of auto insurance, one crucial document stands out: the Auto Insurance Card. This card serves as proof of insurance and contains essential details that both drivers and law enforcement need to verify coverage. Prominently displayed on the front of the card are the insurance identification number, the policy number, and the effective and expiration dates, all of which confirm that the vehicle is insured for a specified period. Additionally, the card lists the make and model of the vehicle, along with the Vehicle Identification Number (VIN), ensuring that the information is tailored to the specific car being driven. Issued by the insurance agency or company, this card must be kept in the vehicle at all times and presented upon request in the event of an accident. It is important to note that in case of an incident, drivers should promptly report the accident to their insurance agent or company, collecting necessary details such as the names and addresses of all parties involved, including drivers, passengers, and witnesses. Furthermore, the card features an artificial watermark for added security, which can be viewed by tilting the card at an angle. This multifaceted document not only provides peace of mind but also plays a pivotal role in ensuring compliance with state regulations.

Document Details

| Fact Name | Description |

|---|---|

| Document Title | This form is officially known as the Insurance Identification Card, which serves as proof of auto insurance coverage. |

| State-Specific Requirement | Each state has its own regulations governing the format and contents of the insurance card, ensuring compliance with local laws. |

| Company Information | The card includes critical details such as the insurance company number and policy number, which are essential for identification during claims. |

| Effective and Expiration Dates | Both the effective date and expiration date are clearly indicated, informing the insured of the coverage period. |

| Vehicle Details | Information about the vehicle is included, such as the year, make/model, and vehicle identification number (VIN), which helps in verifying the insured vehicle. |

| Legal Obligation | Most states require that this card be kept in the insured vehicle and presented upon request, particularly in the event of an accident. |

| Accident Reporting Instructions | The card provides important instructions for reporting accidents, emphasizing the need to gather information from all parties involved. |

Dos and Don'ts

When filling out the Auto Insurance Card form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of what to do and what to avoid:

- Do double-check all information for accuracy before submission.

- Do keep the card in your vehicle at all times.

- Do report any accidents to your insurance agent as soon as possible.

- Do include the correct vehicle identification number (VIN).

- Don't leave any fields blank; fill in all required information.

- Don't provide outdated or incorrect policy numbers.

- Don't ignore the instructions on the reverse side of the card.

By following these guidelines, you can ensure that your Auto Insurance Card is filled out correctly and that you are prepared in case of an accident.

Documents used along the form

The Auto Insurance Card is a critical document for drivers, as it provides proof of insurance coverage. However, several other forms and documents are often used in conjunction with the Auto Insurance Card. Below is a list of these documents, each serving a specific purpose.

- Insurance Policy Document: This document outlines the terms and conditions of the insurance coverage. It includes details such as coverage limits, deductibles, and exclusions. Drivers should review this document to understand their rights and responsibilities.

- Claim Form: In the event of an accident, a claim form is necessary to report damages or injuries to the insurance company. This form requires information about the incident, including date, time, and involved parties.

- Vehicle Registration: This document proves that the vehicle is registered with the state. It includes details such as the vehicle identification number (VIN), make, model, and owner information. Carrying this document is essential for legal compliance.

- New York City Apartment Registration Form: This essential document for landlords includes detailed information regarding rental units in NYC and can be accessed here: https://nyforms.com/nyc-apartment-registration-template.

- Accident Report: After an accident, an accident report may be filed with local law enforcement. This report provides an official account of the incident, which can be crucial for insurance claims and legal matters.

- Proof of Payment: This document serves as evidence that the insurance premiums have been paid. It can be a receipt or a statement from the insurance company. Keeping this document handy can prevent issues related to lapses in coverage.

Understanding these documents and their purposes can help ensure that drivers are adequately prepared in case of an accident or other insurance-related situations. Keeping all relevant paperwork organized can facilitate smoother interactions with insurance companies and law enforcement.

Popular PDF Forms

Miscarriage Paperwork From Doctor Template - Physicians use this document to recognize early pregnancy loss and its implications.

Florida Realtors Commercial Contract - The contract allows for a due diligence period, giving the buyer a chance to assess the property thoroughly.

The Texas Motor Vehicle Power of Attorney form is essential for those who need to delegate responsibilities regarding their vehicle. By completing this document, you can appoint someone trustworthy to manage tasks such as transferring ownership or applying for a title. This legal arrangement not only simplifies the process but also provides the peace of mind that your vehicle-related matters are handled properly. For further details about this process, you can visit https://topformsonline.com.

Profits or Loss From Business - Schedule C helps in identifying the net profit or loss from the business for the tax year.

Similar forms

The Auto Insurance Card serves as a crucial document for drivers, indicating proof of insurance coverage. Several other documents share similarities with this card in terms of purpose and the information they convey. Below is a list of nine such documents:

- Vehicle Registration Certificate: This document provides proof that a vehicle is registered with the state. It includes details such as the vehicle identification number (VIN), owner’s information, and registration dates.

- Proof of Insurance Letter: Issued by the insurance company, this letter confirms that the insured has an active policy. It includes similar details like policy number and effective dates.

- Driver's License: A government-issued identification that verifies a person's right to operate a vehicle. It contains personal information and may also indicate any restrictions on driving.

- Mobile Home Bill of Sale: When transferring ownership of a mobile home, utilize the necessary Mobile Home Bill of Sale documentation to ensure all legal requirements are met.

- Accident Report Form: This form is completed after an accident and includes details about the incident, involved parties, and insurance information, similar to the information required after an accident as noted on the insurance card.

- Title Document: This document proves ownership of a vehicle. It contains the owner's name, vehicle details, and may also include lienholder information, akin to the ownership information on the insurance card.

- Insurance Policy Document: This comprehensive document outlines the terms and conditions of the insurance coverage. It includes policy limits, coverage types, and details about the insured vehicle.

- Temporary Insurance Card: Issued when a policy is newly created or updated, this card serves the same purpose as the standard insurance card but is often valid for a limited time.

- SR-22 Form: Required for high-risk drivers, this form verifies that a driver has the required insurance coverage and is similar in function to the auto insurance card, as it must be presented when requested.

- Proof of Financial Responsibility: This document may be required by certain states to demonstrate that a driver can cover damages in the event of an accident. It shares the same goal of proving insurance coverage.

Each of these documents plays a vital role in ensuring that drivers are compliant with state laws and are protected in the event of an accident or vehicle-related issue.

Common mistakes

Filling out the Auto Insurance Card form may seem straightforward, but many people make common mistakes that can lead to confusion or complications later. One frequent error occurs when individuals fail to accurately enter their insurance policy number. This number is crucial for identifying your coverage. If you transpose numbers or write down the wrong digits, it can create significant issues when you need to file a claim or prove you have insurance. Always double-check this information to ensure accuracy.

Another common mistake is neglecting to include the effective date and expiration date of the policy. These dates are essential for confirming that your insurance is current. If an officer or another party checks your card and finds that the policy has expired, it could lead to fines or penalties. Make sure these dates are filled in correctly to avoid any misunderstandings.

Some individuals also overlook the importance of the vehicle identification number (VIN). This unique code is specific to your vehicle and is critical for identifying it in case of an accident or theft. If the VIN is missing or incorrect, it could complicate any claims or legal matters that arise. Take the time to locate this number on your vehicle and enter it accurately on the form.

Lastly, many people forget to keep the card in the vehicle as required. The form explicitly states that it must be presented upon demand in case of an accident. If you leave it at home or misplace it, you may face legal repercussions or difficulties when trying to prove you have insurance. To avoid this, make it a habit to store the card in your glove compartment or another easily accessible location in your vehicle.