Fill a Valid Western Union Template

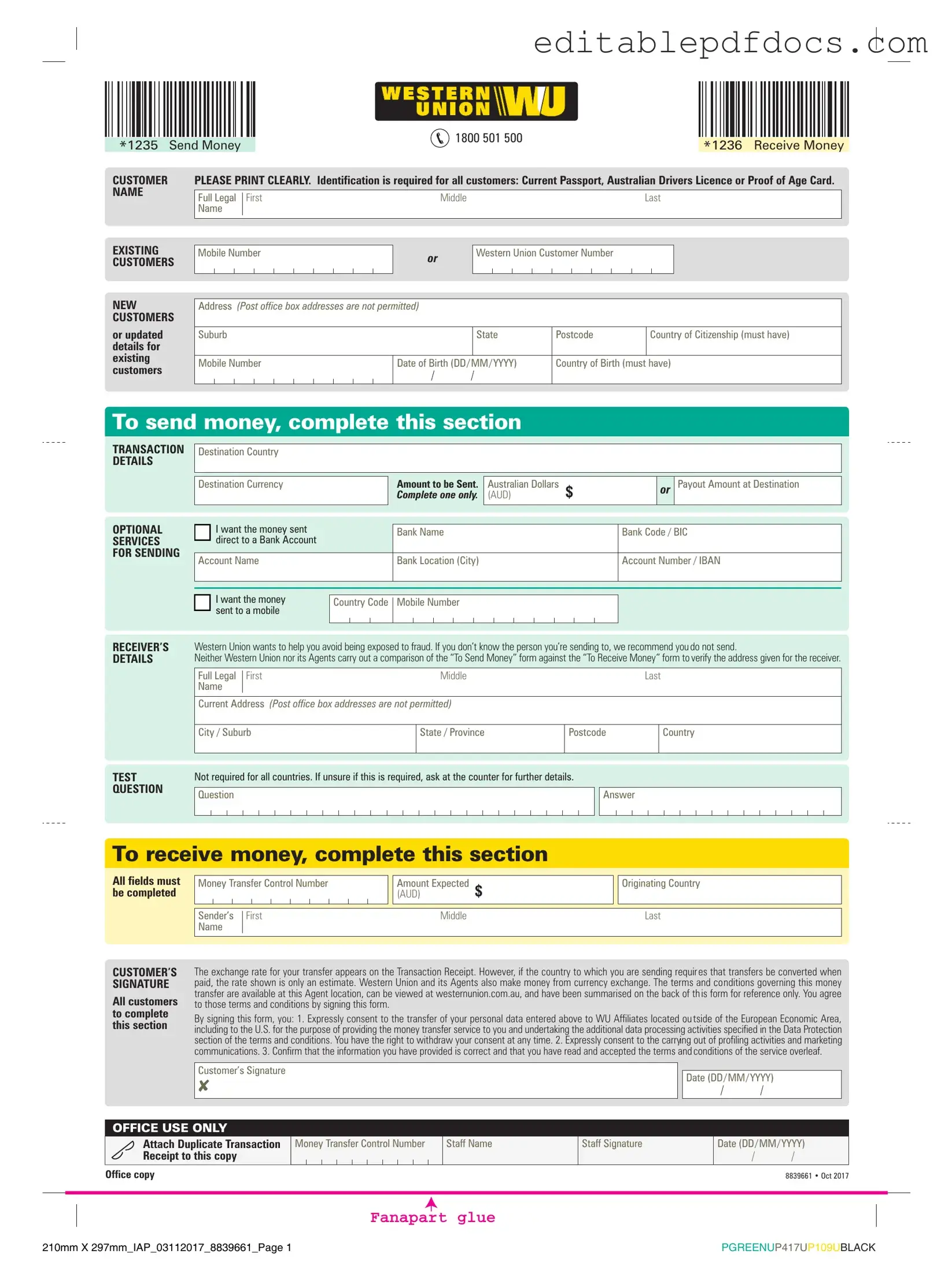

The Western Union form is a crucial document used for various financial transactions, particularly for sending and receiving money across different locations. When you fill out this form, you provide essential details such as the sender's and receiver's names, addresses, and contact information. Additionally, the form requires you to specify the amount of money being sent, which is vital for processing the transaction accurately. It's important to note that the Western Union form also includes sections for payment options, allowing you to choose how you want to fund the transfer. Security features are built into the form to protect your personal information and ensure the safety of your transaction. Understanding how to properly complete this form can streamline your experience and help you avoid common pitfalls, making it easier to send money to loved ones or conduct business transactions with confidence.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | The Western Union form is primarily used for money transfers and related services. |

| Sender Information | The form requires the sender's name, address, and contact information for identification. |

| Recipient Information | Details about the recipient, including name and location, must be provided for successful transactions. |

| Transfer Amount | The sender must specify the amount of money to be transferred on the form. |

| Fees | Transaction fees are outlined on the form, varying based on the amount and destination. |

| Payment Method | Acceptable payment methods, such as cash, debit, or credit card, are indicated on the form. |

| Tracking Number | Upon completion, the sender receives a tracking number for monitoring the transfer. |

| State-Specific Regulations | Different states may have specific regulations governing money transfers, such as California's Money Transmission Act. |

| Privacy Policy | The form includes a reference to the company's privacy policy regarding the handling of personal information. |

| Signature Requirement | A signature from the sender is typically required to authorize the transaction. |

Dos and Don'ts

When filling out the Western Union form, it’s important to follow certain guidelines to ensure accuracy and efficiency. Here’s a list of things you should and shouldn’t do:

- Do double-check all personal information for accuracy.

- Don't leave any required fields blank.

- Do use clear and legible handwriting if filling out a paper form.

- Don't use abbreviations that might confuse the reader.

- Do provide a valid identification if required.

- Don't forget to sign the form where indicated.

- Do review the form for any errors before submission.

- Don't submit the form without verifying the payment amount.

- Do keep a copy of the completed form for your records.

Documents used along the form

When sending money through Western Union, several other forms and documents may be required to ensure the transaction is completed smoothly. Each of these documents serves a specific purpose and helps facilitate the transfer of funds. Here is a list of common forms and documents used alongside the Western Union form:

- Identification Card: A government-issued ID, such as a driver's license or passport, is often required to verify the sender's identity.

- Money Transfer Control Number (MTCN): This unique number is generated for each transaction and is essential for tracking the transfer and ensuring it is received by the intended recipient.

- Recipient Information Form: This document collects details about the person receiving the funds, including their name, address, and contact information.

- Payment Receipt: After sending money, a receipt is issued. This serves as proof of the transaction and may be needed for future reference.

- Transaction Agreement: Some transactions may require a signed agreement outlining the terms of the money transfer, including fees and delivery methods.

- Bill of Sale: This legal document facilitates the transfer of ownership of personal property, including buyer and seller details, and is essential for proper documentation. For more information, check out Fillable Forms.

- Currency Exchange Form: If the transfer involves different currencies, this form may be needed to confirm the exchange rate and any applicable fees.

- Compliance Documentation: In certain cases, additional documentation may be required to comply with regulations, especially for large transfers or international transactions.

- Power of Attorney: If someone is sending money on behalf of another person, a power of attorney document may be needed to authorize the transaction.

Understanding these documents can help streamline the process of sending money through Western Union. Being prepared with the necessary forms can reduce delays and ensure that funds reach their destination without complications.

Popular PDF Forms

Employee Incident Report - This report helps comply with workplace safety regulations.

The EDD DE 2501 form is crucial for Californians seeking Disability Insurance benefits, as it collects vital information regarding one's health and work situation. Properly completing this form is essential for the Employment Development Department (EDD) to determine your eligibility. For additional resources and guidance on filling out this form, visit PDF Documents Hub.

Place of Birth on Passport Application - The application includes a declaration to ensure the information provided is true.

Texas Odometer Statement - This document plays an important role in vehicle registration processes.

Similar forms

The Western Union form serves various purposes, primarily related to the transfer of money and the documentation of transactions. Several other documents share similarities with it in terms of their functions and the information they require. Below is a list of seven documents that are comparable to the Western Union form.

- MoneyGram Transfer Form: This form is used for sending money through MoneyGram. Like the Western Union form, it collects sender and receiver information and transaction details.

- PayPal Transaction Receipt: This document confirms a money transfer made through PayPal. It includes sender and recipient information, as well as transaction amounts, paralleling the data captured by the Western Union form.

- Wire Transfer Form: Banks use this form for electronic transfers. It requires similar details about the sender and receiver, ensuring that funds are sent accurately.

- Check Payment Stub: A check stub provides a record of a payment made via check. It includes the payer's information and the amount, much like the Western Union form documents a transaction.

- Remittance Advice: This document is sent to inform a payee that a payment has been made. It includes details about the transaction, similar to the information collected in the Western Union form.

- Hold Harmless Agreement Form: This legal document protects parties against liabilities from the other party's actions, similar to how the Western Union form safeguards financial transactions. For more details, you can visit nyforms.com/hold-harmless-agreement-template.

- Cash Deposit Slip: Used at banks, this slip records cash deposits. It gathers information about the depositor and the amount, akin to the data collected in a money transfer form.

- Invoice: An invoice details goods or services provided and the amount due. It includes sender and recipient information, similar to the Western Union form's structure.

Common mistakes

When individuals fill out the Western Union form, several common mistakes can lead to delays or complications in their transactions. One prevalent error is providing incorrect recipient information. It is crucial to ensure that the name, address, and contact details of the recipient are accurate. A simple typo can result in the funds being sent to the wrong person or location.

Another frequent mistake involves the selection of the payment method. Users often overlook the various options available, such as credit cards, debit cards, or cash payments. Choosing the wrong method can complicate the transaction process and may lead to additional fees or rejected payments.

Inadequate attention to the amount being sent is also a common issue. People may miscalculate the total, forgetting to include transaction fees or mistakenly entering the wrong figure. This can create confusion and necessitate further communication with Western Union to rectify the error.

Additionally, individuals sometimes fail to review the terms and conditions associated with the transaction. Ignoring these details can result in misunderstandings regarding the service fees, delivery times, or refund policies. It is essential to read through this information to avoid unexpected surprises.

Another mistake arises when users neglect to check their own personal information. Errors in the sender's name, address, or contact number can lead to complications when tracking the transaction or resolving issues that may arise.

Moreover, individuals often underestimate the importance of providing a valid form of identification. Many transactions require identification to verify the sender's identity. Failing to provide this can lead to delays or even a refusal of service.

In some cases, users may skip the step of confirming the transaction details before submission. This oversight can lead to sending incorrect amounts or to the wrong recipient. Taking a moment to double-check all information can save time and prevent frustration.

Another common error is neglecting to keep a record of the transaction details. Users should always save the receipt or confirmation number for future reference. This information is vital if there are any issues with the transfer or if the recipient does not receive the funds.

Lastly, many individuals do not consider the time it takes for the funds to be available to the recipient. Different payment methods and locations can affect the speed of the transaction. Being aware of these factors can help set realistic expectations for both the sender and the recipient.