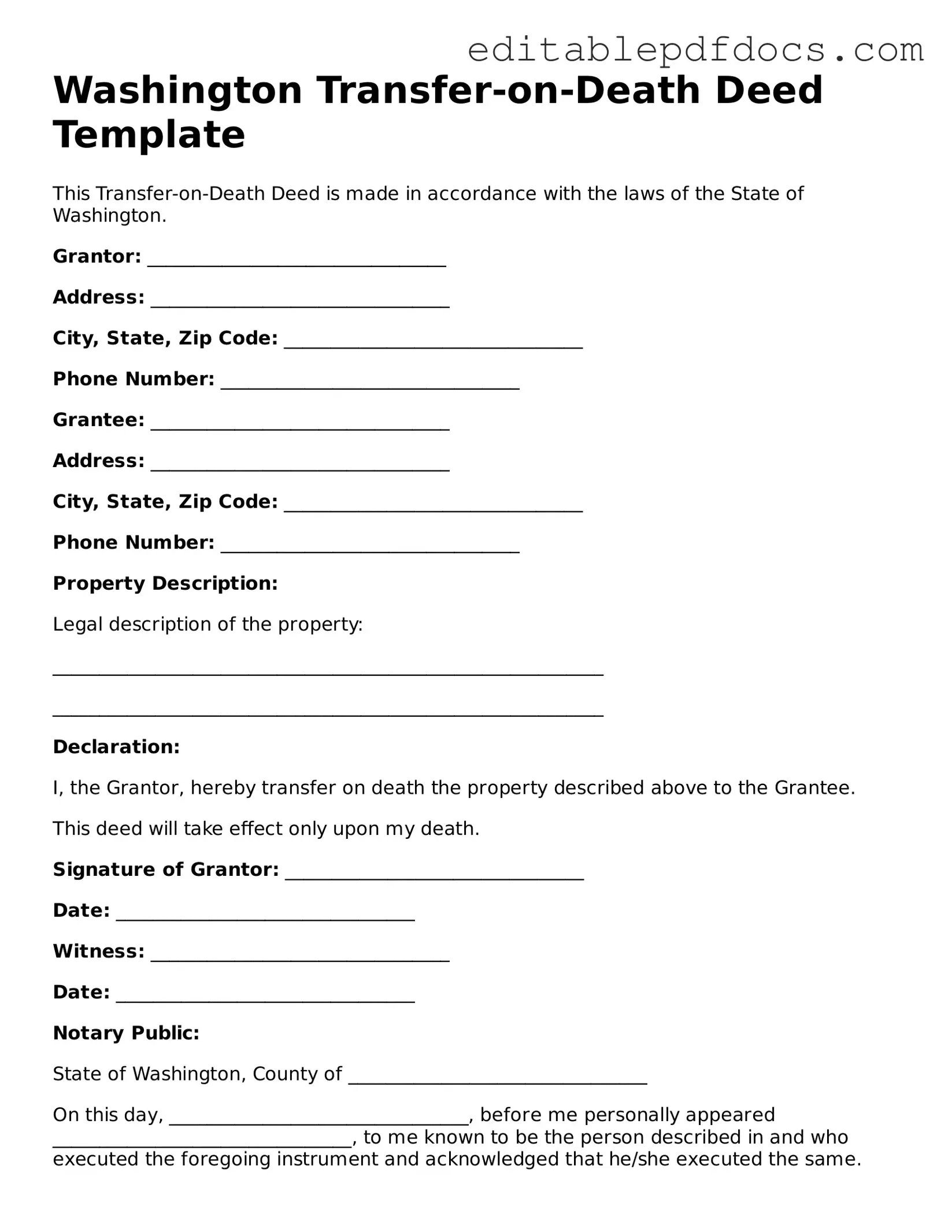

Transfer-on-Death Deed Document for Washington

The Washington Transfer-on-Death Deed form serves as a crucial tool for property owners looking to simplify the transfer of real estate upon their passing. This legal document allows individuals to designate a beneficiary who will automatically receive ownership of the property without the need for probate. By utilizing this form, property owners can ensure a smooth transition of assets, thereby reducing potential conflicts among heirs and minimizing the administrative burden on loved ones. It is essential to understand the specific requirements for executing the deed, including the necessity for proper notarization and recording with the county auditor. Additionally, the form can be revoked or modified at any time during the property owner's lifetime, providing flexibility and control over the estate planning process. As estate planning becomes increasingly important, the Washington Transfer-on-Death Deed form offers a straightforward solution for individuals seeking to secure their legacy and protect their beneficiaries. Understanding its implications and procedures can empower property owners to make informed decisions about their real estate assets.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Washington to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Washington State law, specifically RCW 64.38. |

| Eligibility | Any individual who owns real property in Washington can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, including individuals or entities. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, provided they follow the proper legal procedures. |

| Filing Requirements | The deed must be recorded with the county auditor where the property is located to be effective. |

| Effect on Creditors | The property transferred via a Transfer-on-Death Deed is still subject to the deceased owner's debts during probate. |

| Tax Implications | Beneficiaries may face tax implications based on the property's value at the time of transfer. |

| Homestead Rights | Transfer-on-Death Deeds do not affect the homestead rights of the property owner while they are alive. |

| Limitations | This deed cannot be used for all types of property; it is limited to real estate in Washington. |

Dos and Don'ts

When filling out the Washington Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure that the document is completed correctly. Here is a list of things you should and shouldn’t do:

- Do ensure that you fully understand the implications of a Transfer-on-Death Deed.

- Do provide accurate information about the property and the beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the county auditor's office where the property is located.

- Don’t leave any sections of the form blank; complete all required fields.

- Don’t forget to include the legal description of the property.

- Don’t use the form if you are not the owner of the property.

- Don’t overlook the need for witnesses if required by your specific situation.

Documents used along the form

In Washington State, the Transfer-on-Death Deed (TODD) allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. While the TODD is a critical document in estate planning, several other forms and documents may be used in conjunction with it to ensure a comprehensive approach to property transfer and estate management. Below is a list of related documents that can enhance the effectiveness of a Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how an individual wishes to distribute their assets upon death. It can include instructions for guardianship of minor children and other specific bequests.

- Revocable Living Trust: A trust that allows individuals to retain control over their assets during their lifetime while providing a mechanism for transferring those assets to beneficiaries after death, often avoiding probate.

- Motorcycle Bill of Sale Form: For those engaging in motorcycle transactions, our essential Motorcycle Bill of Sale form guide ensures all sales are documented legally.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts such as life insurance policies and retirement accounts, ensuring that these assets transfer directly to the named individuals upon death.

- Power of Attorney: This document grants someone the authority to act on another's behalf in financial or legal matters, which can be particularly useful if the property owner becomes incapacitated.

- Community Property Agreements: For married couples in Washington, this agreement can simplify the transfer of community property, ensuring that both spouses have a clear understanding of ownership and rights upon death.

- Real Estate Purchase Agreement: This contract outlines the terms of a real estate transaction. It is essential for documenting the sale or transfer of property, including terms and conditions agreed upon by the buyer and seller.

Utilizing these documents alongside the Transfer-on-Death Deed can provide clarity and security in estate planning. Each form serves a specific purpose and can significantly impact how assets are managed and transferred after death. Properly integrating these documents can lead to a more efficient and less complicated transfer process for beneficiaries.

Consider Some Other Transfer-on-Death Deed Templates for US States

How to Transfer a Deed After Death in Georgia - Property owners must be clear on their intentions when naming beneficiaries to avoid potential conflicts after their passing.

The Free And Invoice PDF form serves as a crucial tool for individuals and businesses to create detailed and professional invoices without incurring costs. This form allows users to organize transaction details such as products or services provided, payment terms, and total amounts due. By simplifying the invoicing process, it helps users maintain clear financial records and promote timely payments. For more information, you can visit https://topformsonline.com/.

How to Transfer a Land Deed - The form is a legal tool designed to ease the transfer of property to designated beneficiaries without court involvement.

How to Transfer Property After Death - This deed is often less complex and easier to create than a traditional will for real estate matters.

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate to execute the wishes of the deceased.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed after death. Unlike a Transfer-on-Death Deed, it avoids probate and provides more control over asset management.

- Beneficiary Designation: This document allows individuals to name beneficiaries for specific assets, like bank accounts or retirement plans. Similar to a Transfer-on-Death Deed, it enables direct transfer of assets without going through probate.

- Joint Tenancy: Property held in joint tenancy automatically transfers to the surviving owner upon death. This is similar to a Transfer-on-Death Deed in that it allows for a seamless transfer of ownership.

- Payable-on-Death (POD) Account: A POD account allows a bank account owner to name a beneficiary who will receive the funds upon the owner's death. This is akin to a Transfer-on-Death Deed in facilitating a direct transfer without probate.

- Boat Bill of Sale: The California Boat Bill of Sale form is essential for documenting the transfer of boat ownership in California. This legal document serves as proof of sale and protects the interests of both parties during the transaction. For those looking for templates, Fillable Forms can be a helpful resource.

- Transfer-on-Death Registration for Securities: This document allows individuals to designate a beneficiary for their securities. Like a Transfer-on-Death Deed, it provides a way to transfer ownership directly upon death without probate.

Common mistakes

Filling out the Washington Transfer-on-Death Deed form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is not including the full legal description of the property. This description is essential to clearly identify the property being transferred. Omitting this information can create confusion and may even invalidate the deed.

Another mistake involves failing to sign the form correctly. All parties involved must sign the deed in the presence of a notary public. If the signatures are missing or improperly executed, the deed may not be recognized. Ensuring that everyone signs in the right place is crucial for the document's validity.

People often overlook the requirement for a witness. In Washington, a Transfer-on-Death Deed must be signed by a witness who is not a beneficiary. Neglecting to have a witness present can render the deed ineffective, so it’s important to arrange for this step ahead of time.

Some individuals mistakenly assume that the Transfer-on-Death Deed automatically transfers all property rights. However, this deed only transfers ownership upon the death of the owner. Any debts or liens attached to the property will not disappear; they will still need to be addressed by the beneficiaries.

Another common issue is not recording the deed with the county auditor's office. Even if the form is filled out correctly, failing to file it can lead to problems. The transfer is not legally effective until it is recorded, so this step should not be overlooked.

People may also forget to check for any existing wills or trusts that might affect the property. If there are conflicting documents, the Transfer-on-Death Deed may not hold up in court. It’s essential to ensure that all estate planning documents are aligned to avoid disputes among heirs.

Lastly, some individuals do not keep a copy of the completed deed. After filling out and recording the form, it’s wise to retain a copy for personal records. This ensures that all parties have access to the necessary documentation when the time comes to transfer the property.