Rental Application Document for Washington

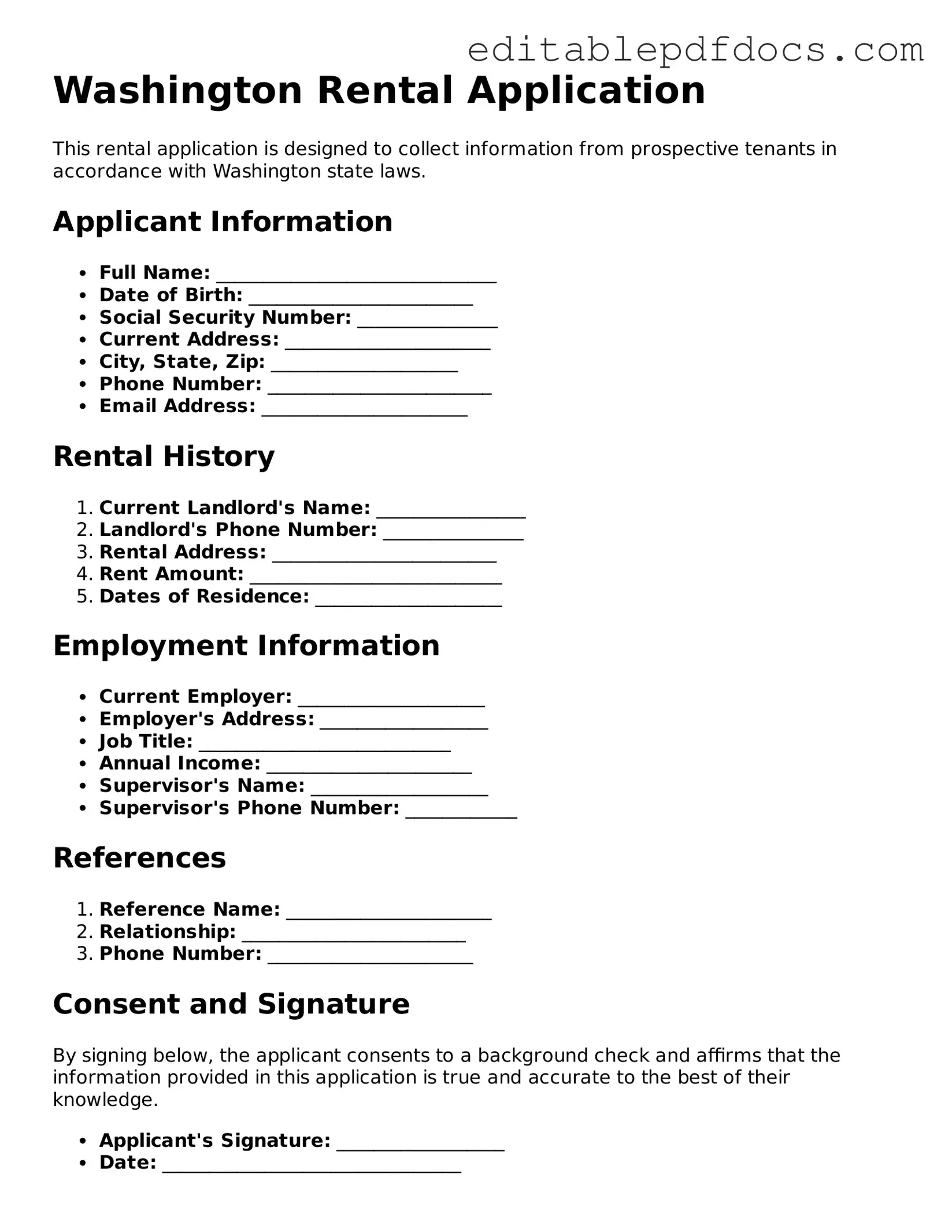

When seeking a new rental property in Washington, prospective tenants often encounter the Washington Rental Application form, a crucial document that plays a significant role in the leasing process. This form typically requests essential personal information, such as the applicant's name, contact details, and Social Security number, which landlords use to conduct background checks. Additionally, it may require details about employment history, income, and rental history, allowing landlords to assess the applicant's ability to pay rent consistently. The application often includes questions regarding pets, smoking preferences, and other lifestyle factors that could influence the landlord's decision. Applicants should be prepared to provide references and, in some cases, pay a non-refundable application fee. Understanding the components of this form is vital, as it not only impacts the likelihood of securing a rental but also sets the tone for the tenant-landlord relationship moving forward.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Washington Rental Application form is used by landlords to collect information from prospective tenants. |

| Governing Law | This form is governed by the Washington Residential Landlord-Tenant Act (RCW 59.18). |

| Required Information | Applicants must provide personal information, rental history, employment details, and references. |

| Application Fee | Landlords can charge an application fee, but it must be reasonable and disclosed upfront. |

| Screening Criteria | Landlords must inform applicants of the criteria used to evaluate applications, such as credit score and rental history. |

| Fair Housing Compliance | The application process must comply with federal and state fair housing laws, prohibiting discrimination. |

| Privacy Rights | Applicants have the right to privacy, and landlords must handle personal information securely. |

| Denial Notification | If an application is denied, landlords are required to provide a written notice to the applicant. |

Dos and Don'ts

When filling out the Washington Rental Application form, it's important to approach the process thoughtfully. Here’s a list of things you should and shouldn’t do to ensure a smooth application experience.

- Do read the entire application carefully before starting.

- Do provide accurate and truthful information.

- Do include all required documentation, like proof of income.

- Do double-check your contact information for accuracy.

- Do ask questions if you're unsure about any part of the application.

- Don't leave any sections blank unless instructed to do so.

- Don't falsify any information; this can lead to immediate disqualification.

- Don't forget to sign and date the application.

- Don't submit the application without reviewing it one last time.

Documents used along the form

When applying for a rental property in Washington, several forms and documents may be required alongside the Washington Rental Application form. These documents help landlords assess potential tenants and ensure compliance with legal requirements. Below is a list of commonly used forms and documents.

- Credit Report Authorization Form: This form allows landlords to obtain a credit report for the applicant. It provides insight into the applicant's financial history and creditworthiness.

- Background Check Consent Form: This document gives permission for the landlord to conduct a background check. It typically includes criminal history and may reveal any past evictions.

- Employment Verification Letter: A letter from the applicant's employer confirming their job status and income. This helps landlords verify the applicant's ability to pay rent.

- Pay Stubs or Bank Statements: Recent pay stubs or bank statements serve as proof of income. Landlords use these documents to assess financial stability.

- Rental History Verification Form: This form requests information about the applicant's previous rental experiences. It may include contact information for former landlords.

- Pet Application or Pet Agreement: If the applicant has pets, this form outlines the pet policy and any associated fees. It ensures that both parties understand the rules regarding pets.

- Motor Vehicle Bill of Sale: This document is crucial when transferring ownership of a vehicle, providing necessary proof for both the buyer and seller. For more details, visit https://nyforms.com/motor-vehicle-bill-of-sale-template/.

- Identification Documents: A copy of a government-issued ID, such as a driver's license or passport, is often required to verify the applicant's identity.

- Co-Signer Agreement: If the applicant requires a co-signer, this document outlines the responsibilities of the co-signer regarding the lease agreement.

Providing these documents along with the Washington Rental Application can streamline the rental process. It helps ensure that all necessary information is available for landlords to make informed decisions. Being prepared with these forms can facilitate a smoother application experience.

Consider Some Other Rental Application Templates for US States

House Rent Application - Indicate your availability for property viewings.

When engaging in the sale or purchase of a vehicle in California, having the appropriate documentation is vital, and the California Motor Vehicle Bill of Sale form plays a central role in this process. It not only facilitates a clear record of the ownership transfer but also protects both parties by outlining the details of the transaction. For those interested in streamlining this process, resources such as Fillable Forms can be incredibly helpful in ensuring accuracy and compliance with state requirements.

Rental Application Form Arizona - Co-applicants' names if leasing with others.

Similar forms

Job Application Form: Both documents require personal information, work history, and references. They assess the applicant's suitability for a position or tenancy.

Credit Application: Similar to a rental application, a credit application seeks financial information to evaluate an individual's creditworthiness for loans or credit cards.

Lease Agreement: A lease agreement outlines the terms of renting a property, much like a rental application sets the stage for entering into that agreement.

Background Check Authorization: This document allows landlords to verify an applicant's history, paralleling the rental application in its purpose to assess risk.

Tenant Screening Form: Similar in intent, this form gathers information to evaluate potential tenants based on their rental history and financial stability.

Employment Verification Form: This form confirms an applicant's employment status and income, which is often a key component of the rental application process.

Financial Aid Application: Like a rental application, this document collects personal and financial information to determine eligibility for assistance.

-

Bill of Sale: The New York Bill of Sale serves as a crucial document that records the transfer of ownership for personal property, ensuring clarity between parties involved in the transaction. For more information, visit topformsonline.com.

Insurance Application: Both applications require detailed personal and financial information to assess risk and eligibility for coverage.

Membership Application: This document gathers personal information and qualifications, similar to how a rental application assesses a tenant's fit for a property.

Loan Application: A loan application requests personal and financial details to evaluate creditworthiness, akin to the financial scrutiny found in rental applications.

Common mistakes

Completing a rental application can be a straightforward process, but many people make common mistakes that can hinder their chances of securing a rental property. One frequent error is incomplete information. Applicants often forget to fill out all required fields or leave sections blank. This can lead to delays in processing or even rejection of the application.

Another mistake is providing inaccurate information. It's essential to ensure that all details, such as income and employment history, are correct. Misrepresenting facts can result in disqualification or legal consequences down the line.

Some applicants fail to disclose necessary financial details, such as additional sources of income or outstanding debts. Landlords typically look for a comprehensive picture of an applicant's financial situation, and omitting this information can raise red flags.

Additionally, many people neglect to check their credit history before submitting an application. A poor credit score can be a significant barrier to approval. Understanding one’s credit status beforehand can help applicants address any issues proactively.

Another common oversight is not providing references. Many rental applications require personal or professional references. Failing to include these can make the application appear incomplete or unprofessional.

Some applicants also overlook the importance of proof of income. Landlords often require documentation, such as pay stubs or bank statements, to verify an applicant's financial stability. Without this proof, an application may be deemed insufficient.

Timing can be crucial in the rental market, yet many applicants do not submit their applications promptly. Delays can result in losing out on a desired property, as rentals can be filled quickly.

Moreover, failing to read the fine print of the application can lead to misunderstandings. Terms and conditions, as well as fees, should be reviewed carefully to avoid unexpected obligations later.

Many people also forget to include a cover letter or personal statement. While not always required, a brief introduction can help applicants stand out and provide context for their application.

Lastly, some individuals do not follow up after submitting their application. A polite inquiry about the status can show interest and initiative, which may positively influence the landlord's decision.