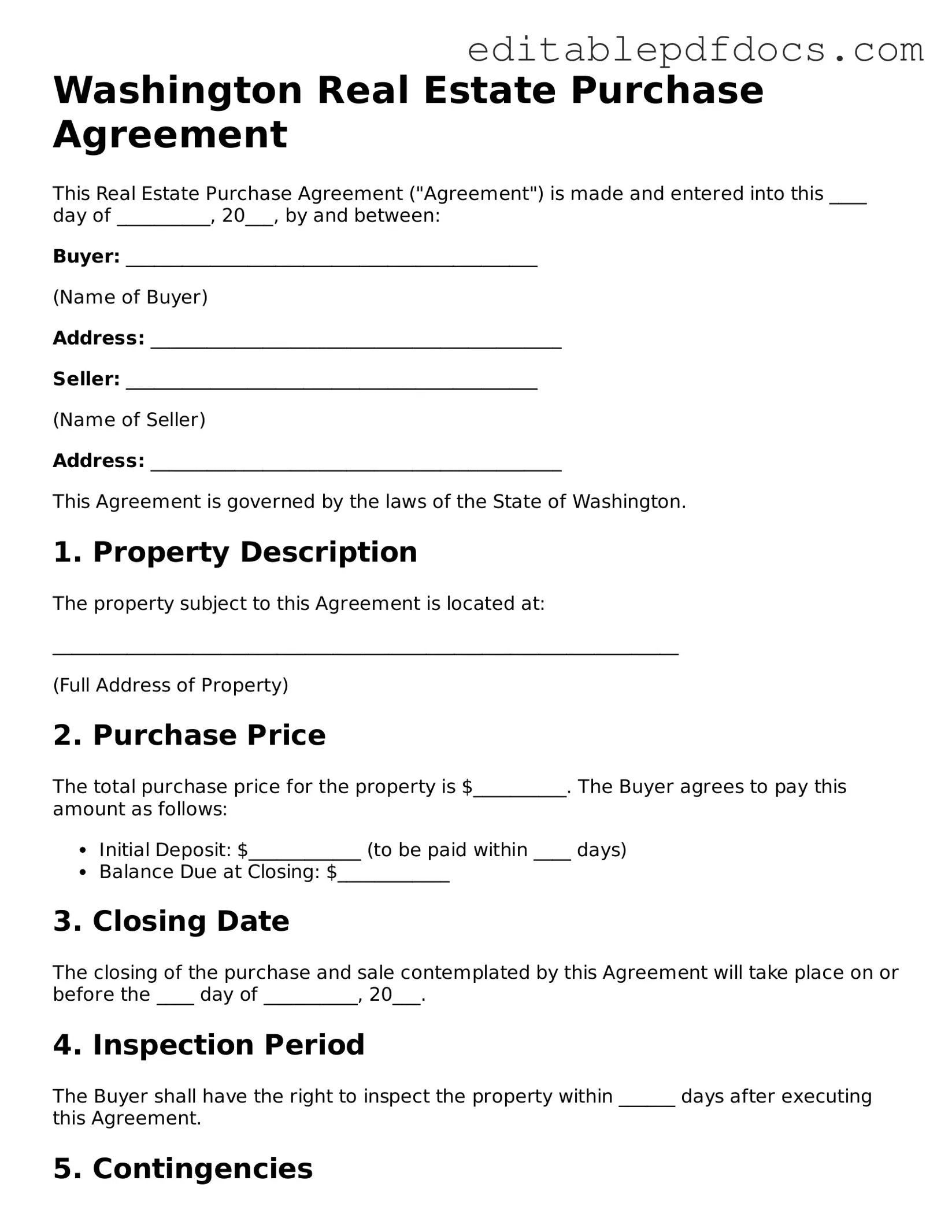

Real Estate Purchase Agreement Document for Washington

The Washington Real Estate Purchase Agreement is a crucial document in the home buying process, serving as a formal contract between a buyer and a seller. This agreement outlines the terms and conditions under which the property will be sold, ensuring both parties understand their rights and obligations. Key components include the purchase price, financing details, and any contingencies that must be met before the sale can proceed. Additionally, the agreement addresses important aspects such as the closing date, property disclosures, and the allocation of closing costs. By clearly defining these elements, the form helps prevent misunderstandings and disputes, creating a smoother transaction process. Whether you are a first-time buyer or an experienced investor, understanding this agreement is essential to navigating the real estate market in Washington.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Washington Real Estate Purchase Agreement is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Washington, ensuring compliance with local real estate regulations. |

| Offer and Acceptance | The form facilitates the process of making an offer and allows for acceptance by the seller, creating a binding agreement once signed. |

| Contingencies | Buyers can include contingencies such as financing, inspections, or appraisal, which must be satisfied for the sale to proceed. |

| Earnest Money | An earnest money deposit is typically required to demonstrate the buyer's commitment and is held in trust until closing. |

| Closing Timeline | The agreement outlines a timeline for closing, which is the final step in the transaction where ownership is transferred. |

| Disclosures | Sellers are required to provide disclosures regarding the property's condition, ensuring transparency and informed decision-making by the buyer. |

Dos and Don'ts

When filling out the Washington Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are six things to do and avoid:

- Do read the entire form carefully before starting.

- Do provide accurate information about the property and parties involved.

- Do include all necessary signatures and dates.

- Do consult with a real estate professional if you have questions.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific in your descriptions.

Documents used along the form

When engaging in a real estate transaction in Washington, several key documents accompany the Real Estate Purchase Agreement. These forms help clarify terms, protect the interests of all parties, and ensure compliance with state laws. Below is a list of important documents commonly used in conjunction with the purchase agreement.

- Disclosure Statement: Sellers provide this document to inform buyers of any known issues with the property, such as structural problems or environmental hazards.

- California Boat Bill of Sale: This legal form is used to document the transfer of boat ownership in California, ensuring both buyer and seller have a clear record of the transaction. For convenience, you can find a variety of templates including a Fillable Forms that can be tailored to your needs.

- Earnest Money Agreement: This form outlines the buyer's deposit to show their serious intent to purchase the property. It details the amount and conditions for its return.

- Title Report: A title report reveals the legal ownership of the property and any liens or encumbrances that may affect the sale.

- Inspection Contingency Addendum: This addendum allows the buyer to conduct a property inspection and negotiate repairs or price adjustments based on the findings.

- Financing Addendum: This document outlines the buyer's financing arrangements, including loan details and any contingencies related to securing a mortgage.

- Closing Statement: Also known as a settlement statement, this form summarizes the financial aspects of the transaction, including fees, costs, and the final purchase price.

- Property Survey: A survey provides a detailed map of the property boundaries and any structures, ensuring clarity on what is being purchased.

- Home Warranty Agreement: This optional agreement offers coverage for repairs or replacements of major home systems and appliances, providing peace of mind to the buyer.

These documents work together to facilitate a smooth real estate transaction. Understanding each form's purpose can help buyers and sellers navigate the process more effectively.

Consider Some Other Real Estate Purchase Agreement Templates for US States

For Sale by Owner Contract Pdf - May require modifications to fit specific transaction needs.

The New York Last Will and Testament form is a crucial document that allows individuals to specify how their property and assets are to be distributed after their death. It’s the way for people to ensure their final wishes are carried out exactly as they intend. Importantly, it also lets them appoint a guardian for any minor children they may have, making it essential to have a reliable template, such as this one: https://nyforms.com/last-will-and-testament-template/.

Florida as Is Contract Inspection Period - Sets expectations for communication between buyer and seller.

Pa Agreement of Sale 2023 Pdf - It should be reviewed by legal counsel to ensure fairness and compliance with local laws.

Tennessee Real Estate Forms Free - The Real Estate Purchase Agreement can include financing details.

Similar forms

- Lease Agreement: This document outlines the terms under which a property is rented. It includes details such as rent amount, duration, and responsibilities of both parties.

- Option to Purchase Agreement: This agreement gives a tenant the right to buy the property at a later date. It specifies the purchase price and the time frame for exercising the option.

- Motorcycle Bill of Sale: For those needing a legal document for motorcycle ownership transfer, consider the essential motorcycle bill of sale form requirements to ensure all transaction details are accurately recorded.

- Seller's Disclosure Statement: Sellers provide this document to inform buyers about the condition of the property. It includes details on any known issues or repairs needed.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be recorded to be effective.

- Closing Disclosure: This form outlines the final terms of the loan and all costs associated with the purchase. It is provided to the buyer before closing.

- Title Insurance Policy: This document protects buyers against any claims or issues with the property's title. It ensures that the buyer has clear ownership.

- Escrow Agreement: This agreement involves a neutral third party holding funds or documents until certain conditions are met. It helps ensure a smooth transaction.

Common mistakes

When filling out the Washington Real Estate Purchase Agreement form, many individuals overlook critical details that can lead to complications later on. One common mistake is failing to provide accurate property descriptions. Buyers should ensure that the legal description of the property is complete and matches what is listed in public records. Inaccuracies can create confusion and potentially delay the closing process.

Another frequent error involves not specifying the purchase price clearly. Buyers might write the price in words but forget to include the numerical figure, or vice versa. This inconsistency can lead to misunderstandings between the parties involved. It is essential to double-check that both the written and numerical amounts align perfectly.

Many people also neglect to include contingencies in their agreements. Contingencies are conditions that must be met for the sale to proceed, such as securing financing or completing a satisfactory home inspection. Omitting these can leave buyers vulnerable if issues arise after the agreement is signed.

Additionally, some buyers fail to understand the importance of signing and dating the agreement correctly. Each party must sign the document to make it legally binding. A missing signature or date can render the agreement invalid, leading to potential disputes down the line.

Buyers often overlook the section regarding earnest money. This deposit shows the seller that the buyer is serious about the purchase. If the amount is not specified, or if the buyer fails to submit it in a timely manner, it can jeopardize the entire transaction.

Another mistake is not reviewing the closing date thoroughly. Buyers may assume that the date is flexible, but it is crucial to agree on a specific date that works for all parties involved. Miscommunication about the timeline can lead to frustration and delays.

Some individuals forget to include personal property in the agreement. If there are appliances, fixtures, or other items that the buyer expects to remain with the property, they should be explicitly listed. Otherwise, there could be misunderstandings about what is included in the sale.

Buyers might also neglect to consult with their real estate agent or attorney before finalizing the agreement. Having a professional review the document can help catch errors and ensure that all terms are clear and favorable. Seeking expert advice can save time and prevent potential issues.

Lastly, failing to keep a copy of the signed agreement is a common oversight. Once the agreement is signed, both parties should retain a copy for their records. This document serves as a reference for the terms agreed upon and can be crucial if any disputes arise in the future.