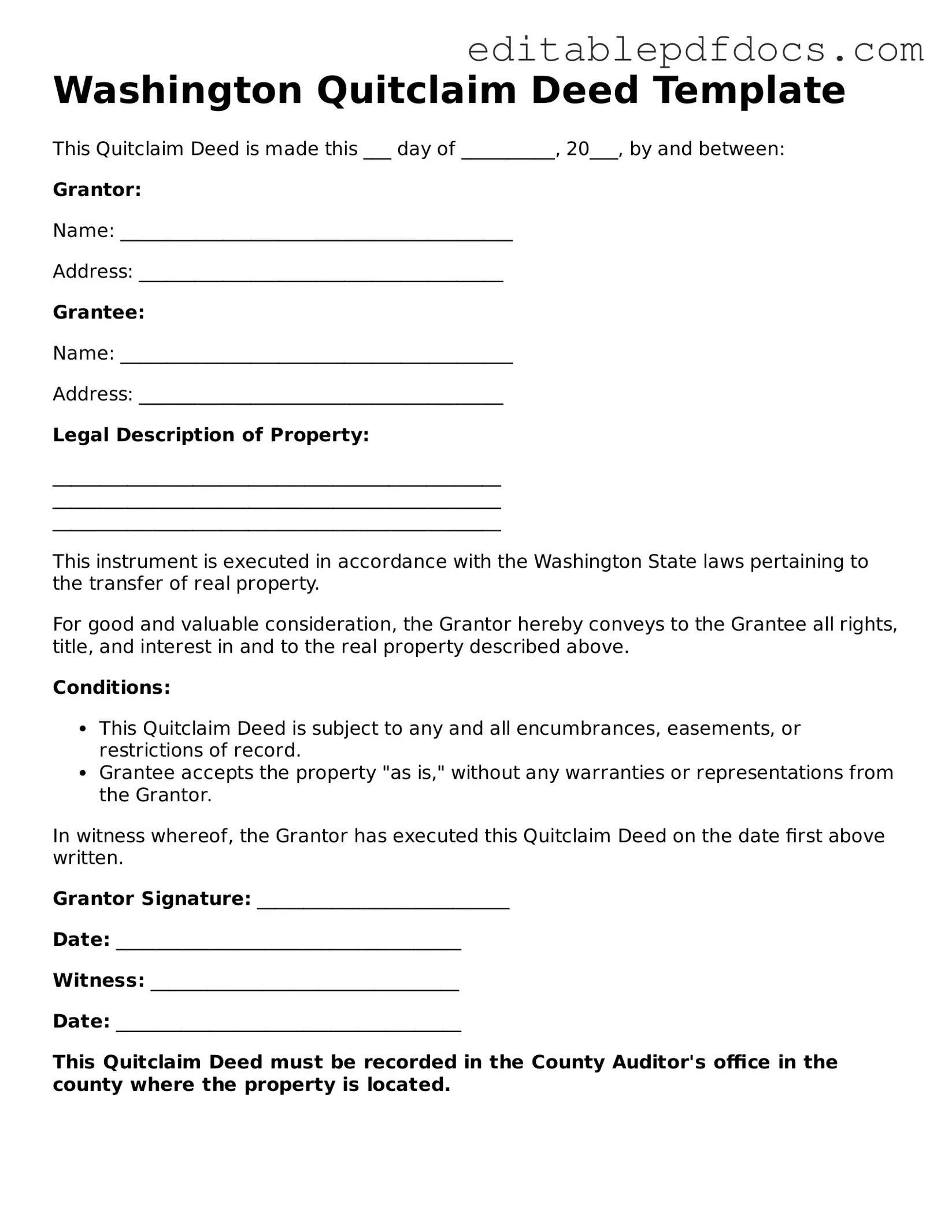

Quitclaim Deed Document for Washington

In the realm of real estate transactions, the Washington Quitclaim Deed form serves as a crucial instrument for transferring property rights. This legal document allows an individual, known as the grantor, to relinquish any claim they may have to a property, thereby enabling another party, the grantee, to assume ownership. Unlike other types of deeds, the quitclaim deed does not guarantee that the grantor holds clear title to the property; rather, it conveys whatever interest the grantor possesses, if any. This characteristic makes it particularly useful in situations such as divorce settlements, estate transfers, or when property is given as a gift among family members. While the form itself is relatively straightforward, it must be executed with care, as it requires the grantor’s signature, the identification of the property, and often the notarization of the document. Additionally, understanding the implications of using a quitclaim deed is essential, as it can affect the rights of both the grantor and the grantee. By exploring the intricacies of the Washington Quitclaim Deed form, individuals can better navigate their property transactions and ensure that their interests are adequately protected.

File Information

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real estate from one party to another without any guarantees about the title. |

| Purpose | This form is often used to transfer property between family members or to clear up title issues. |

| Governing Law | The Washington Quitclaim Deed is governed by Washington State law, specifically under Revised Code of Washington (RCW) 65.04. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) in front of a notary public. |

| Recording | To be effective against third parties, the quitclaim deed must be recorded with the county auditor's office where the property is located. |

| No Warranty | A quitclaim deed offers no warranty or guarantee of title, meaning the grantor is not responsible for any claims against the property. |

| Common Uses | It is frequently used in divorce settlements, estate planning, and transferring property into a trust. |

| Tax Implications | Transfer of property via a quitclaim deed may have tax implications, including potential gift tax considerations. |

| Form Availability | Washington Quitclaim Deed forms are readily available online and at legal stationery stores. |

| Limitations | This deed does not clear any liens or encumbrances on the property; the new owner takes it subject to any existing claims. |

Dos and Don'ts

When filling out the Washington Quitclaim Deed form, it is essential to approach the task carefully. Here are some important do's and don'ts to keep in mind:

- Do ensure all names are spelled correctly. Accurate spelling is crucial for legal documents.

- Do include a complete legal description of the property. This helps avoid confusion about which property is being transferred.

- Do sign the document in front of a notary public. This adds an essential layer of authenticity to the deed.

- Do keep a copy of the completed deed for your records. It’s important to have documentation of the transaction.

- Don't leave any fields blank. Incomplete forms can lead to delays or rejections.

- Don't use outdated versions of the form. Always check for the most current version to ensure compliance with state requirements.

- Don't forget to pay any required fees. Failing to do so can result in the deed not being recorded.

- Don't rush through the process. Taking your time can help prevent mistakes that may complicate the transfer.

Documents used along the form

The Washington Quitclaim Deed form is a legal document used to transfer ownership of real property from one party to another. While this form is essential for the transfer process, several other documents may accompany it to ensure a smooth transaction. Below is a list of forms and documents often used in conjunction with the Quitclaim Deed.

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to transfer it. It offers more protection to the grantee than a quitclaim deed.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property and includes implied warranties regarding the title, ensuring that the property has not been sold to anyone else.

- Title Report: A title report provides information about the property’s ownership history, outstanding liens, and any encumbrances that may affect the title.

- Affidavit of Title: This sworn statement by the seller confirms that they own the property and that there are no undisclosed liens or claims against it.

- Employment Application PDF: This standardized document is essential for employers to collect crucial information from job candidates, including their work history and qualifications. For more details, you can check out Fillable Forms.

- Property Transfer Declaration: This form is often required by local authorities to assess property taxes and must be filed with the deed to document the transfer.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price and conditions, and serves as a binding agreement between the buyer and seller.

- Closing Statement: This document details all financial transactions involved in the closing process, including fees, taxes, and the final amount due from the buyer.

- Power of Attorney: If a party cannot be present to sign the deed, a power of attorney allows another individual to act on their behalf in the transaction.

- Homestead Declaration: This document may be filed to protect a portion of the property from creditors, providing additional security for the homeowner.

- Notice of Completion: In certain cases, this document is filed to inform the public that a construction project has been completed, which can affect property value and ownership.

These documents play crucial roles in the real estate transaction process, ensuring clarity and legal compliance. Each form serves a specific purpose and contributes to the overall integrity of the property transfer.

Consider Some Other Quitclaim Deed Templates for US States

Tennessee Quitclaim Deed - It is essential to have the Quitclaim Deed notarized for it to be valid.

How to Do a Quick Claim Deed - The document is straightforward and generally used for quick transfers.

Quick Claim Deeds in Florida - A quitclaim deed is beneficial for maintaining familial ties in property ownership.

Understanding the importance of the Notice to Quit is crucial for both parties involved in a rental agreement, especially since failure to adhere to this legal obligation can lead to complicated eviction proceedings. For landlords seeking a template to ensure they meet all necessary legal requirements, resources like nyforms.com/notice-to-quit-template/ can be invaluable in guiding them through the process.

Warranty Deed - It is a simple and efficient way to transfer real estate ownership.

Similar forms

Warranty Deed: This document provides a guarantee that the seller has clear title to the property and the right to sell it. Unlike a quitclaim deed, which offers no warranties, a warranty deed assures the buyer that there are no undisclosed claims against the property.

Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes assurances that the property has not been sold to anyone else. However, it does not provide the same level of protection as a warranty deed, making it less secure than a quitclaim deed in terms of ownership claims.

Deed of Trust: This document is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose than a quitclaim deed, both documents facilitate the transfer of property rights, albeit in different contexts.

Special Purpose Deed: This type of deed is used for specific situations, such as transferring property between family members or for tax purposes. Like a quitclaim deed, it often lacks warranties, focusing instead on the particular needs of the transaction.

- Bill of Sale: This document transfers ownership of personal property rather than real estate. It provides proof of the sale and describes the items being transferred in a straightforward manner, ensuring clarity in transactions. For further information, visit https://topformsonline.com.

Life Estate Deed: This document allows a person to transfer property to another while retaining the right to live there for the rest of their life. While it shares similarities with a quitclaim deed in terms of transferring ownership, it also includes specific rights for the original owner, adding complexity to the ownership structure.

Common mistakes

Filling out a Washington Quitclaim Deed form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is not including the correct legal description of the property. This description is essential for identifying the property being transferred. If the description is vague or incorrect, it could create confusion or disputes in the future.

Another mistake involves neglecting to sign the document properly. Both the grantor and grantee must sign the Quitclaim Deed for it to be valid. If either party fails to sign, the deed could be considered incomplete. Additionally, it's important to ensure that the signatures are notarized. A notarized signature adds an extra layer of authenticity and can help prevent issues later on.

People often overlook the importance of including the date of the transfer. While it may seem minor, the date serves as a critical reference point for the transaction. Without it, there could be misunderstandings regarding when ownership officially changed hands. This can be particularly problematic in cases of disputes or when dealing with taxes.

Lastly, individuals sometimes forget to record the Quitclaim Deed with the county auditor. Recording the deed is essential for making the transfer public. If the deed is not recorded, the new owner may face challenges in asserting their rights to the property. Proper recording protects the interests of the grantee and ensures that the transfer is recognized legally.