Promissory Note Document for Washington

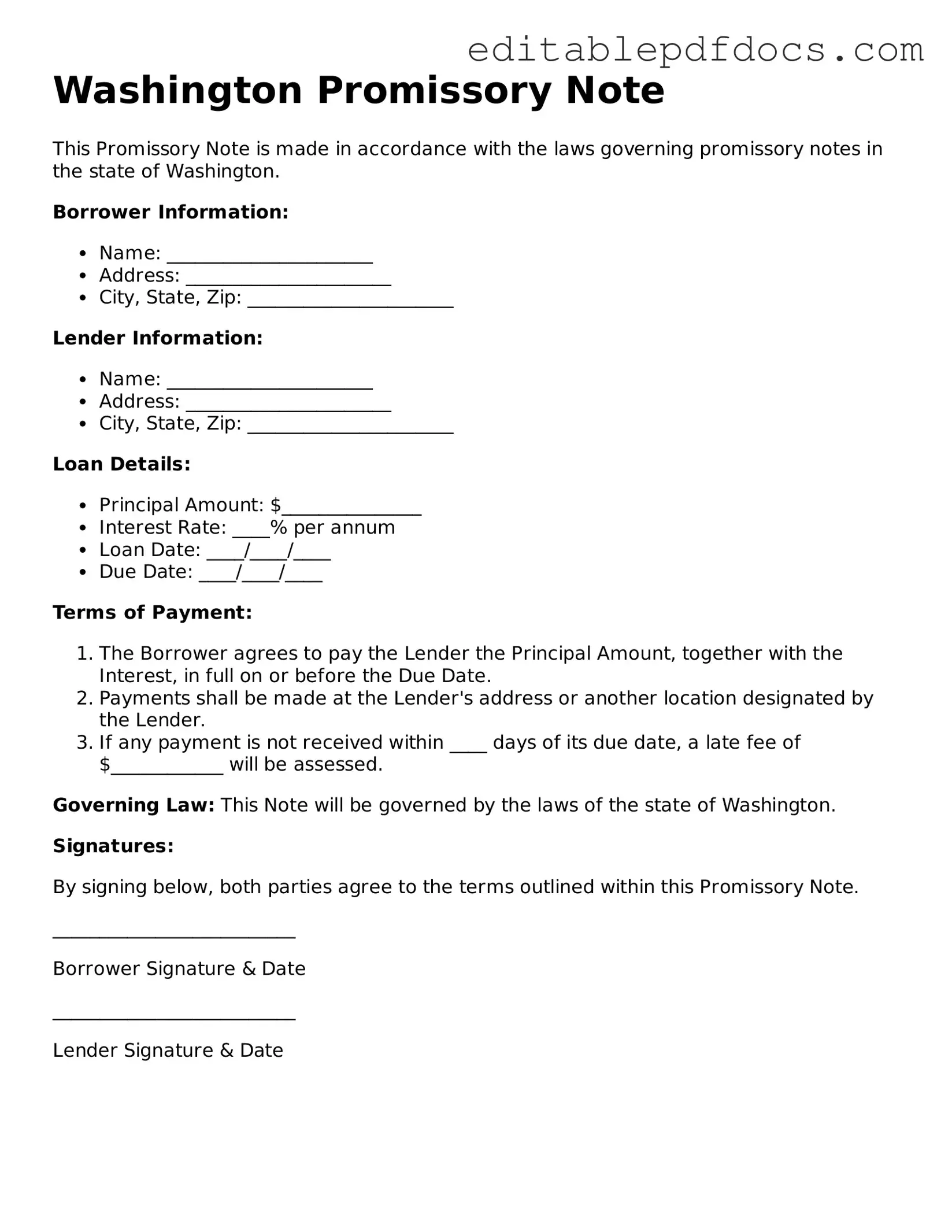

The Washington Promissory Note form is a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form includes essential details such as the principal amount borrowed, the interest rate, and the repayment schedule. It also specifies the rights and responsibilities of both parties, ensuring clarity and legal protection. In Washington, the form must adhere to specific state laws to be enforceable, making it important for users to understand the requirements. Additionally, the document may include provisions for late fees, default conditions, and any collateral securing the loan. By utilizing the Washington Promissory Note form, individuals and businesses can formalize their lending agreements, fostering trust and accountability in financial transactions.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Washington Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The Washington Promissory Note is governed by the Revised Code of Washington (RCW) Title 62A, which covers the Uniform Commercial Code. |

| Interest Rates | Interest rates on promissory notes in Washington can vary, but they must comply with state usury laws, which limit the maximum interest rate that can be charged. |

| Signatures | For a promissory note to be enforceable, it must be signed by the borrower. The lender's signature is not required but is often included for clarity. |

| Enforcement | If the borrower defaults, the lender has the right to take legal action to recover the owed amount, including interest and any applicable fees. |

Dos and Don'ts

When filling out the Washington Promissory Note form, it is important to follow certain guidelines to ensure the document is completed accurately. Below is a list of things you should and shouldn't do.

- Do read the entire form carefully before starting to fill it out.

- Do provide clear and legible information, using black or blue ink.

- Do include all required information, such as names, addresses, and loan amounts.

- Do double-check the figures and terms to avoid any mistakes.

- Do sign and date the document where indicated.

- Don't leave any blank spaces; if something does not apply, write "N/A."

- Don't use abbreviations that may cause confusion.

- Don't alter the form or use any correction fluid on it.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure accuracy.

Documents used along the form

When dealing with financial transactions, a Washington Promissory Note is often accompanied by several other important documents. Each of these forms serves a specific purpose, helping to clarify the terms of the agreement and protect the interests of all parties involved. Below is a list of commonly used forms that complement the Washington Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are being pledged. It details the rights of the lender to claim the collateral in case of default.

- Motorcycle Bill of Sale: This document is essential for recording the sale of a motorcycle in New York, ensuring both parties have proof of the transaction. For more details, you can visit nyforms.com/motorcycle-bill-of-sale-template/.

- Personal Guarantee: In some cases, a borrower may need to provide a personal guarantee. This document ensures that an individual agrees to take personal responsibility for repaying the loan if the borrower defaults.

- Disclosure Statement: This form provides borrowers with important information about the loan, including fees, interest rates, and potential risks. It is designed to ensure transparency and help borrowers make informed decisions.

- Amortization Schedule: This document breaks down the repayment plan into manageable parts, showing how much of each payment goes toward principal and interest over time. It can help borrowers understand their financial obligations more clearly.

- Default Notice: If a borrower fails to make payments, a default notice may be issued. This document formally notifies the borrower of the default and outlines the lender’s rights and potential actions that may follow.

These documents, when used in conjunction with the Washington Promissory Note, create a more robust framework for managing loans. Each form plays a critical role in ensuring that both parties understand their rights and obligations, ultimately fostering a smoother transaction process.

Consider Some Other Promissory Note Templates for US States

Promissory Note Template California Word - This form may be used in various financial transactions, making it a versatile tool.

The New York Operating Agreement form is a crucial document for Limited Liability Companies (LLCs) operating within the state. This agreement outlines the management structure, member responsibilities, and profit distribution among members. Understanding its importance can help ensure that an LLC functions smoothly and in accordance with its members' intentions, and further information can be found at https://topformsonline.com.

Tennessee Promissory Note - The specifics of repayment, including any grace periods, should be directly outlined in the note.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it often includes more detailed conditions and obligations for both parties.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. Like a promissory note, it requires the borrower to repay the loan amount, but it also grants the lender a claim on the property if the borrower defaults.

- Installment Agreement: This document allows a borrower to repay a debt in regular installments. It shares similarities with a promissory note in that it specifies the repayment terms, but it may cover various types of debts beyond loans.

- Security Agreement: A security agreement provides the lender with a security interest in specific assets. While a promissory note is a promise to pay, a security agreement ensures that the lender has collateral if the borrower defaults.

- Personal Guarantee: A personal guarantee is a commitment by an individual to repay a debt if the primary borrower defaults. It is similar to a promissory note in that it creates a personal obligation, but it does not specify repayment terms directly.

- Letter of Credit: This document is a guarantee from a bank that a buyer's payment to a seller will be received on time. It is similar to a promissory note in that it assures payment but is often used in international trade.

-

Release of Liability: The California Release of Liability form protects organizations and individuals from liability for injuries during specific activities. By signing this form, participants acknowledge the risks involved and agree not to hold the provider responsible. For more information, you can access Fillable Forms.

- Debt Acknowledgment: A debt acknowledgment is a simple statement confirming that a borrower owes money to a lender. It is similar to a promissory note in that it recognizes the debt, but it typically lacks detailed repayment terms.

- Payment Plan Agreement: This agreement outlines the terms for paying off a debt over time. Like a promissory note, it specifies payment amounts and due dates, but it may also include provisions for missed payments.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily pause or reduce payments. It is similar to a promissory note in that it involves a debt, but it focuses on modifying the repayment terms due to financial hardship.

Common mistakes

Filling out the Washington Promissory Note form requires attention to detail. One common mistake is failing to include the correct names of the parties involved. Both the borrower and lender must be clearly identified. Omitting or misspelling names can lead to complications in enforcing the note.

Another frequent error is neglecting to specify the loan amount. The amount should be written both numerically and in words to avoid any ambiguity. If the two figures do not match, it may result in disputes over the actual amount owed.

Many individuals also overlook the importance of including the interest rate. The form should clearly state whether the loan is interest-bearing and, if so, what the rate is. Without this information, the terms of repayment can become unclear, leading to misunderstandings later on.

People often fail to indicate the repayment schedule. It is essential to detail when payments are due and how they should be made. A lack of clarity in this section can create confusion and may result in missed payments.

Another mistake involves not signing the document. Both parties must sign the Promissory Note for it to be legally binding. Failing to obtain signatures can render the note unenforceable, which may lead to further complications.

Some individuals forget to date the document. The date is crucial as it establishes when the agreement was made. Without a date, it can be difficult to determine the timeline for repayment and any applicable interest.

People sometimes ignore the need for witnesses or notarization. Depending on the circumstances, having a witness or notarizing the document may be necessary for legal validity. Skipping this step can jeopardize the enforceability of the note.

Lastly, individuals may not keep a copy of the completed Promissory Note. Retaining a copy is vital for both parties to refer to in case of disputes. Without a copy, one party may have difficulty proving the terms of the agreement.