Power of Attorney Document for Washington

The Washington Power of Attorney form serves as a crucial legal tool that empowers individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This form encompasses various types of authority, allowing the appointed agent to manage financial affairs, healthcare decisions, or other specific tasks. By clearly outlining the scope of authority granted, the form ensures that the principal's wishes are respected and upheld. It is essential to understand the different types of Power of Attorney available in Washington, including durable and springing options, which dictate when the authority becomes effective. Additionally, the form requires careful consideration of the agent's responsibilities and the principal's preferences, making it vital to choose someone who is reliable and understands the principal's values. As you navigate the process of creating a Power of Attorney, it is important to keep in mind the legal requirements and potential implications, ensuring that your choices reflect your intentions and provide peace of mind for you and your loved ones.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Washington Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. |

| Governing Law | The Washington Power of Attorney is governed by Chapter 11.125 of the Revised Code of Washington (RCW). |

| Types of Powers | The form can grant general or specific powers, allowing the agent to handle various matters, such as financial or medical decisions. |

| Durability | A Power of Attorney in Washington can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, provided they are mentally competent to do so. |

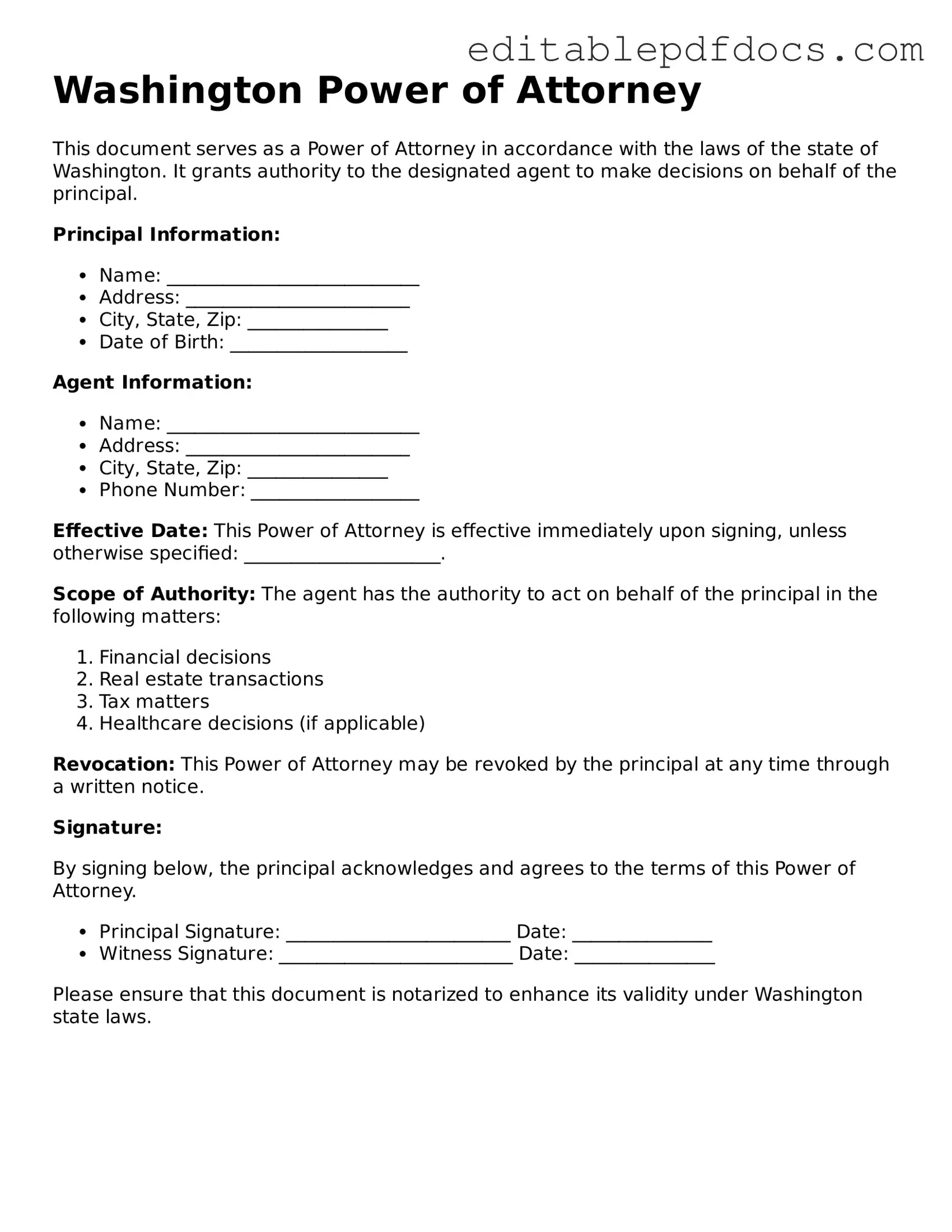

| Signing Requirements | The form must be signed by the principal and notarized or signed by two witnesses to be valid. |

Dos and Don'ts

When filling out the Washington Power of Attorney form, it is essential to approach the process with care. This legal document grants someone the authority to make decisions on your behalf, so ensuring accuracy and clarity is crucial. Here is a list of things you should and shouldn't do:

- Do ensure you understand the responsibilities of the agent. Before appointing someone, make sure they are trustworthy and capable of handling the responsibilities.

- Do use clear and specific language. Ambiguities can lead to misunderstandings, so be precise in your wording.

- Do sign the document in the presence of a notary. A notary public adds an extra layer of authenticity to the document.

- Do keep copies of the signed document. Store them in a safe place and provide copies to your agent and relevant parties.

- Don't rush through the process. Take your time to ensure all information is accurate and complete.

- Don't appoint an agent without discussing it with them first. Open communication is vital to ensure they are willing and able to take on the role.

- Don't forget to review and update the document as needed. Life circumstances change, and your Power of Attorney should reflect your current wishes.

Documents used along the form

When considering a Power of Attorney (POA) in Washington, it is essential to understand that several other documents may complement this form. Each of these documents serves a unique purpose and can help ensure that your legal and financial matters are managed according to your wishes.

- Advance Healthcare Directive: This document allows you to specify your healthcare preferences in case you become unable to communicate your wishes. It can include decisions about medical treatment, end-of-life care, and appointing a healthcare agent.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you are terminally ill or permanently unconscious. This document provides guidance to your loved ones and healthcare providers about the type of care you wish to receive.

- Durable Power of Attorney: Similar to a standard POA, a durable power of attorney remains effective even if you become incapacitated. This ensures that your appointed agent can continue to make decisions on your behalf without interruption.

- Financial Power of Attorney: This specific type of POA grants authority to an agent to handle your financial matters. It can include managing bank accounts, paying bills, and making investment decisions, ensuring your financial affairs are in capable hands.

- Will: A will is a legal document that outlines how your assets should be distributed after your death. It can also appoint guardians for minor children and specify your funeral arrangements, providing clarity and peace of mind for your loved ones.

- Employment Verification Form: This document is essential for confirming a candidate's previous employment history, ensuring the accuracy of information provided by job applicants. For guidance on the process, refer to PDF Documents Hub.

- Trust: A trust allows you to transfer your assets to a trustee, who will manage them for the benefit of your beneficiaries. Trusts can help avoid probate and provide more control over how and when your assets are distributed.

Understanding these documents can empower you to make informed decisions about your future. Each serves a distinct role in ensuring your wishes are honored, and together they can provide a comprehensive plan for your legal and financial well-being.

Consider Some Other Power of Attorney Templates for US States

Power of Attorney in Georgia - A legal document granting someone authority to act on another's behalf.

Power of Attorney in Pa After Death - This document grants legal authority to another person to manage your affairs.

For anyone looking to securely document the transfer of a mobile home, the necessary Mobile Home Bill of Sale document can be a vital asset. This form clearly delineates the specifics of the transaction, ensuring all parties have a mutual understanding of the sale details.

Power of Attorney Form Tn Free - Clear instructions can help guide your agent in fulfilling your wishes.

Similar forms

The Power of Attorney (POA) form serves as a vital legal document that allows one person to act on behalf of another. While it has its unique features, several other documents share similarities with the POA. Below are seven such documents, each with a brief explanation of how they relate to the Power of Attorney.

- Living Will: A living will outlines a person's wishes regarding medical treatment in case they become unable to communicate. Like a POA, it allows individuals to express their preferences and designate someone to make decisions on their behalf.

- Healthcare Proxy: This document specifically appoints someone to make healthcare decisions for another person if they are incapacitated. Similar to a POA, it empowers an individual to act in the best interest of another in medical situations.

- Durable Power of Attorney: This is a specific type of POA that remains effective even if the principal becomes incapacitated. It shares the same purpose of granting authority to another person but adds the layer of durability in times of need.

- Financial Power of Attorney: This document allows someone to manage financial affairs on behalf of another person. It is similar to a general POA but focuses specifically on financial matters, ensuring that the appointed individual can handle banking, investments, and bills.

Employment Verification Form: An Employment Verification Form is a document used by employers to confirm the employment history and credentials of a job applicant. This form typically includes details such as the individual’s job title, dates of employment, and other relevant information. Having this verification helps ensure that candidates meet the qualifications for the position they are applying for. For more details, you can refer to Fillable Forms.

- Trust Agreement: A trust agreement allows a person to place their assets into a trust, managed by a trustee. While it differs in structure, it shares the common goal of ensuring someone else can manage assets for the benefit of another.

- Guardian Appointment: When a court appoints a guardian for a minor or incapacitated adult, this document grants authority similar to a POA. It allows the guardian to make decisions on behalf of the individual, focusing on their welfare and needs.

- Authorization for Release of Information: This document allows one person to access another's private information, such as medical records. Like a POA, it grants authority to act on behalf of someone else, though it is typically limited to information sharing rather than broader decision-making.

Common mistakes

When filling out the Washington Power of Attorney form, many individuals inadvertently make mistakes that can lead to complications down the line. One common error is failing to clearly identify the agent. The agent is the person who will act on your behalf, and it’s essential to provide their full name and contact information. If this information is incomplete or unclear, it can create confusion and may even render the document invalid.

Another frequent mistake is neglecting to specify the powers granted to the agent. Some people assume that general language will suffice, but it’s crucial to be specific about what decisions the agent can make. For example, if you want your agent to handle financial matters, clearly state that. Vague language can lead to misunderstandings and limit the agent’s ability to act effectively.

Additionally, many individuals forget to sign and date the document. A Power of Attorney is not legally binding without the appropriate signatures. In Washington, the principal must sign the form, and it’s often necessary to have it notarized or witnessed to ensure its validity. Failing to complete this step can result in the form being challenged or deemed unenforceable.

Finally, people often overlook the importance of reviewing the form after completion. Errors in the details, such as misspellings or incorrect dates, can undermine the entire document. Taking the time to double-check the information helps ensure that everything is accurate and reflects your intentions. It’s always a good idea to have someone else review the document as well, as a fresh set of eyes may catch mistakes you might have missed.