Operating Agreement Document for Washington

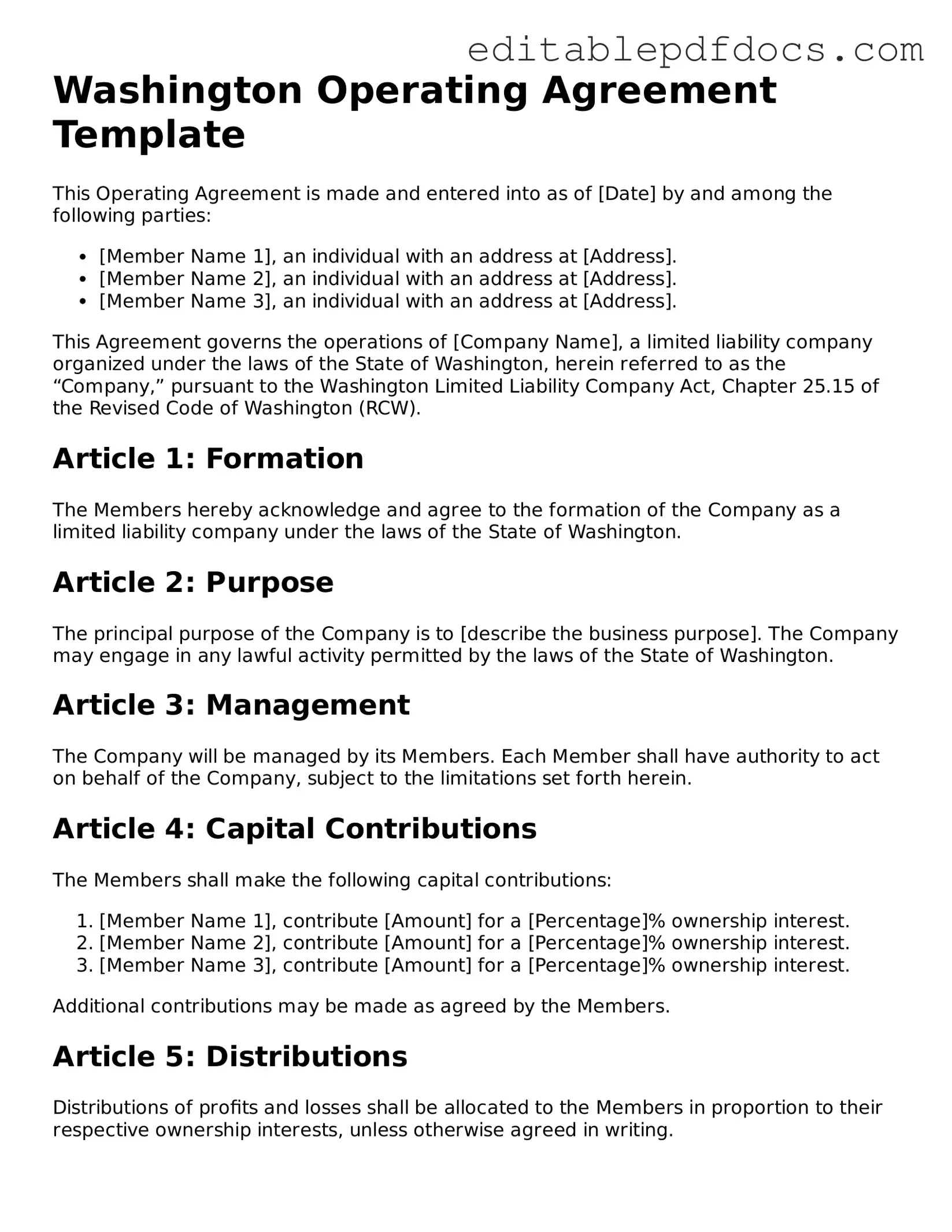

The Washington Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal structure and operational guidelines of the LLC, ensuring that all members understand their roles and responsibilities. Key elements include the management structure, profit distribution, and procedures for adding or removing members. Additionally, the agreement addresses how decisions are made, providing clarity on voting rights and procedures. By establishing these foundational aspects, the Operating Agreement not only promotes transparency among members but also helps to prevent disputes in the future. Furthermore, it serves as a protective measure, safeguarding the personal assets of members from potential business liabilities. Understanding the intricacies of this form is essential for anyone looking to form or manage an LLC in Washington, as it lays the groundwork for a successful and compliant business operation.

File Information

| Fact Name | Description |

|---|---|

| Governing Law | The Washington Operating Agreement is governed by the Revised Code of Washington (RCW) Title 25. |

| Purpose | This agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Washington. |

| Member Rights | The agreement specifies the rights and responsibilities of each member within the LLC. |

| Flexibility | Washington law allows LLCs to customize their operating agreements to suit their specific needs. |

| Not Mandatory | While having an operating agreement is not legally required in Washington, it is highly recommended to prevent disputes. |

| Amendments | The agreement can be amended as needed, provided that all members agree to the changes. |

| Dispute Resolution | Many operating agreements include provisions for resolving disputes among members, which can help avoid litigation. |

Dos and Don'ts

When filling out the Washington Operating Agreement form, it's essential to approach the task with care and attention to detail. Here’s a helpful list of things to do and avoid:

- Do read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do gather all necessary information about your business and its members beforehand. This includes names, addresses, and ownership percentages.

- Do consult with a legal advisor if you have any questions. Their expertise can clarify complex sections and ensure compliance.

- Do use clear and concise language. Avoid ambiguous terms that might lead to misunderstandings later.

- Do ensure all members sign the agreement. This step is crucial for validating the document.

- Don't rush through the form. Take your time to ensure all information is accurate and complete.

- Don't leave any sections blank unless instructed. Missing information can lead to delays or complications.

- Don't use outdated information. Make sure all data reflects the current status of your business and its members.

- Don't ignore state-specific requirements. Washington may have unique stipulations that must be followed.

- Don't overlook the importance of keeping a copy. Always retain a signed version of the Operating Agreement for your records.

Following these guidelines will help ensure that your Operating Agreement is completed correctly and serves its intended purpose effectively.

Documents used along the form

When forming a limited liability company (LLC) in Washington, the Operating Agreement is a crucial document. However, it is often accompanied by other important forms and documents that help establish and maintain the business's legal structure. Below is a list of commonly used forms that complement the Washington Operating Agreement.

- Articles of Organization: This document officially establishes your LLC with the state. It includes essential information such as the LLC's name, address, and registered agent.

- Initial Report: Required within 120 days of forming an LLC in Washington, this report provides updated information about the business, including its members and management structure.

- Member Consent: This document records the agreement of all members regarding significant decisions made prior to the formation of the LLC. It can help avoid disputes later on.

- Operating Agreement Addendum: If changes occur in the LLC's structure or management, this addendum can be used to update the original Operating Agreement without needing to rewrite it entirely.

- Membership Certificate: While not mandatory, this document can be issued to members as proof of their ownership stake in the LLC, detailing their percentage of interest.

- Bylaws: Though more common in corporations, bylaws can be helpful for LLCs to outline the internal management structure, including meeting protocols and voting procedures.

- Resolution of Members: This document is used to record decisions made by the members of the LLC. It can be helpful for documenting important actions taken outside of regular meetings.

- Tax Identification Number (EIN) Application: An EIN is essential for tax purposes and is required for opening a business bank account. This form can be completed online through the IRS.

- Chick-fil-A Job Application form: This essential document can provide prospective employees a streamlined way to apply for positions. To facilitate the process, consider utilizing Fillable Forms which can enhance your application experience.

- Business License Application: Depending on your location and the nature of your business, you may need to obtain various licenses or permits to operate legally.

These documents play a vital role in the overall management and legal compliance of your LLC. Ensuring you have all necessary forms in place not only streamlines operations but also protects your business and its members. Always consider consulting with a professional to ensure you meet all requirements specific to your situation.

Consider Some Other Operating Agreement Templates for US States

Creating an Operating Agreement - It can help streamline business operations by establishing clear procedures.

This legally binding document serves as a vital tool for landlords and tenants, ensuring clarity in their arrangements. For more information, see the comprehensive Room Rental Agreement details available at the New Jersey Room Rental Agreement guide.

How Do I Create an Operating Agreement for My Llc - The document can set restrictions on who can transfer ownership of membership interests.

Operating Agreement Llc Tennessee - This document acts as a roadmap for the company's future growth.

Similar forms

- Partnership Agreement: This document outlines the terms and conditions under which partners operate a business. Like an Operating Agreement, it defines roles, responsibilities, and profit-sharing among partners.

- Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they set forth rules regarding meetings, voting, and the roles of directors and officers.

- Employment Application PDF Form: Essential for job seekers, this document presents qualifications and experiences to employers. To start the application process, you can visit PDF Documents Hub for the necessary forms.

- Shareholder Agreement: This agreement is used among shareholders of a corporation. It details rights, obligations, and procedures for buying or selling shares, paralleling how an Operating Agreement addresses member interests in an LLC.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of collaboration between two or more parties. It is similar to an Operating Agreement in that it specifies contributions, profit-sharing, and management structure.

- Limited Partnership Agreement: This document governs a limited partnership, detailing the roles of general and limited partners. It shares similarities with an Operating Agreement in defining the management structure and profit distribution.

- Franchise Agreement: A Franchise Agreement establishes the relationship between a franchisor and franchisee. Like an Operating Agreement, it includes operational guidelines and responsibilities of each party.

- Nonprofit Bylaws: Nonprofit organizations use bylaws to govern their operations. Similar to an Operating Agreement, they outline the roles of directors, membership procedures, and voting rights.

Common mistakes

Filling out the Washington Operating Agreement form is a crucial step for any business entity. However, many people make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure that your agreement is both effective and compliant.

One frequent error is failing to specify the management structure. Whether your business is member-managed or manager-managed, this detail is essential. Without clarity, disputes may arise about who has the authority to make decisions, leading to confusion and potential conflicts among members.

Another mistake is not including a clear purpose statement. The purpose of the business should be explicitly stated in the agreement. This statement outlines the goals and objectives of the company, providing a framework for operations. Omitting this can create ambiguity about the business's direction and objectives.

People also often neglect to outline profit and loss distribution. Clearly defining how profits and losses will be allocated among members is critical. If this section is vague or missing, it can lead to disagreements and dissatisfaction among members, particularly when it comes time to distribute earnings.

Additionally, many individuals forget to address buyout provisions. These provisions are vital in the event that a member wishes to leave the company or if circumstances necessitate a buyout. Without a clear buyout process, the remaining members may face challenges in managing the transition smoothly.

Another common oversight is not updating the agreement regularly. As your business evolves, so should your Operating Agreement. Failing to revise it can result in outdated terms that no longer reflect the current state of the business, which can lead to legal complications.

Lastly, many people overlook the importance of having all members sign the agreement. An unsigned agreement may not hold up in legal situations. Ensuring that every member reviews and signs the document solidifies its validity and can help prevent disputes in the future.