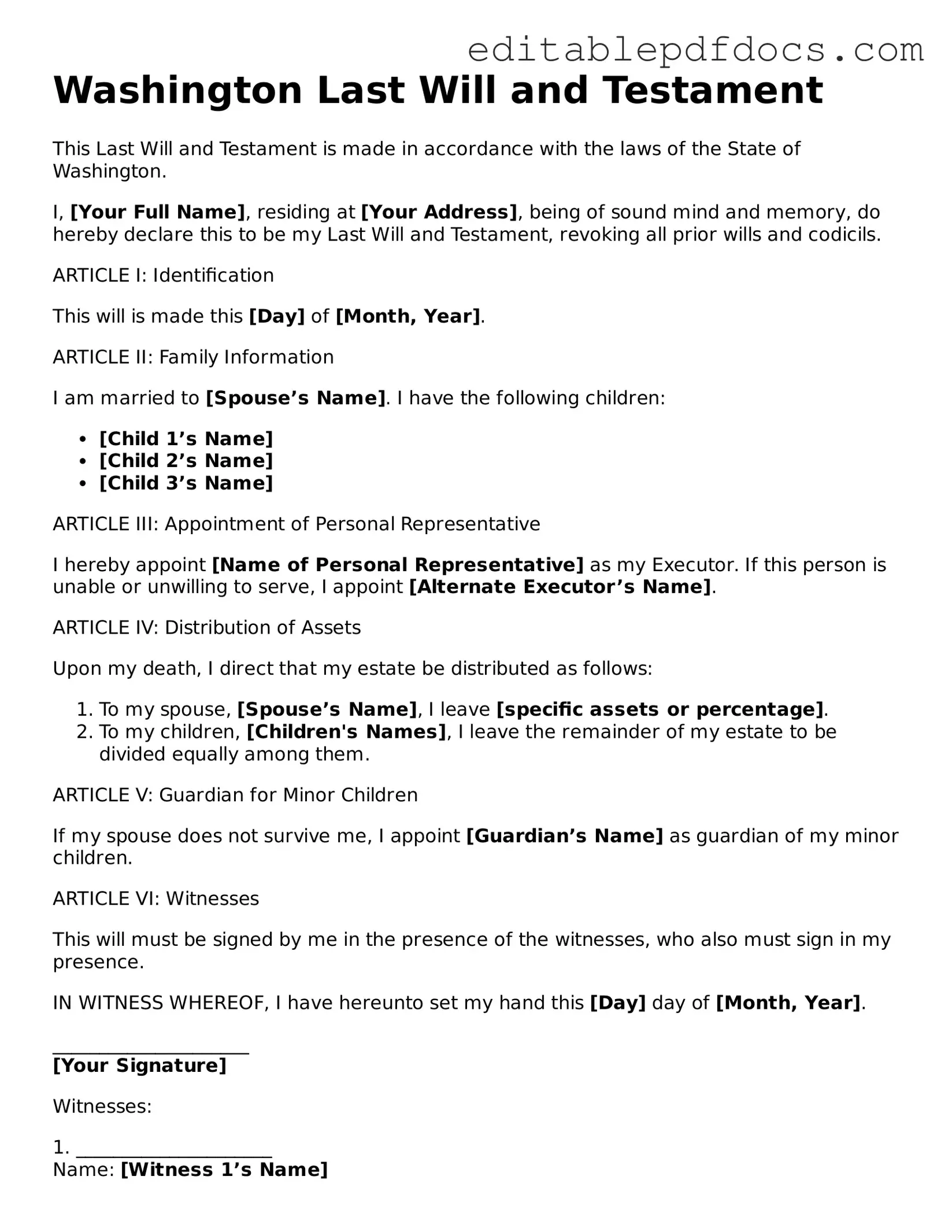

Last Will and Testament Document for Washington

Creating a Last Will and Testament is an important step for anyone looking to ensure their wishes are honored after their passing. In Washington, this legal document serves several key purposes, including the distribution of assets, naming guardians for minor children, and appointing an executor to manage the estate. The form typically requires the testator, or the person making the will, to be at least 18 years old and of sound mind. It must be signed in the presence of two witnesses, who also need to sign the document. Additionally, the will can be revoked or modified at any time, providing flexibility as life circumstances change. Understanding these aspects is crucial for anyone considering this process, as a well-drafted will can help avoid potential disputes and ensure that loved ones are taken care of according to the testator's wishes.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Washington Last Will and Testament form allows individuals to specify how their assets will be distributed after their death. |

| Governing Law | This form is governed by the Revised Code of Washington (RCW) Title 11, which covers wills and probate. |

| Requirements | To be valid, the will must be signed by the testator and witnessed by at least two individuals who are not beneficiaries. |

| Revocation | A will can be revoked at any time by the testator through a new will or by destroying the original document. |

| Executor Appointment | The form allows the testator to appoint an executor, who will manage the estate and ensure the will is executed as intended. |

| Age Requirement | The testator must be at least 18 years old and of sound mind to create a valid will in Washington. |

Dos and Don'ts

When filling out the Washington Last Will and Testament form, it's important to follow certain guidelines to ensure your wishes are clearly stated and legally valid. Here’s a list of things to do and avoid:

- Do clearly state your full name and address at the beginning of the will.

- Do appoint an executor who will carry out your wishes.

- Do list your assets and specify how you want them distributed.

- Do sign the will in the presence of at least two witnesses.

- Do ensure your witnesses are not beneficiaries of the will.

- Don't use vague language that could lead to confusion.

- Don't forget to date the will when you sign it.

- Don't make changes to the will without following proper procedures.

- Don't assume verbal agreements will hold up; everything should be in writing.

Following these guidelines will help ensure that your Last Will and Testament is valid and reflects your true intentions.

Documents used along the form

When creating a Last Will and Testament in Washington, there are several other important documents that can complement it. Each of these documents serves a unique purpose and can help ensure that your wishes are carried out effectively.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become unable to do so yourself. It remains effective even if you become incapacitated.

- Ohio Living Will Form: To ensure your healthcare preferences are respected, consider the essential Ohio Living Will document that guides medical decisions when you're unable to communicate.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this document designates a person to make medical decisions for you if you cannot make them yourself. It ensures that your healthcare preferences are respected.

- Living Will: A Living Will outlines your preferences regarding medical treatment and end-of-life care. It guides your healthcare providers and loved ones about your wishes in critical situations.

- Revocable Trust: A Revocable Trust allows you to place your assets in a trust during your lifetime. You can manage the trust and change its terms as needed. Upon your passing, the assets can be distributed without going through probate.

- Beneficiary Designation Forms: These forms are used for certain assets, like life insurance policies and retirement accounts. They allow you to specify who will receive these assets upon your death, bypassing the probate process.

Using these documents together with your Last Will and Testament can help ensure that your wishes are clear and legally binding. It's always a good idea to consult with a legal professional to make sure everything is in order.

Consider Some Other Last Will and Testament Templates for US States

Writing a Will in Tennessee - A method of appointing a guardian for your minor children, ensuring their security.

Does an Attorney Have to Prepare a Will - Serves as a tool for estate planning and organization.

Free Will Template Georgia - Offers clarity on debts and obligations that must be addressed after passing.

To facilitate the verification process, you can access the necessary forms and guidelines at PDF Documents Hub, where you'll find valuable resources to assist you in completing your Employment Verification Form effectively.

How to Create a Will in California - A framework for managing one's legacy and ensuring that one's voice is heard after death.

Similar forms

- Living Will: A living will outlines your preferences regarding medical treatment in case you become unable to communicate your wishes. While a Last Will and Testament deals with the distribution of assets after death, a living will focuses on health care decisions during your lifetime.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. Similar to a Last Will, it designates authority, but it takes effect during your lifetime rather than after death.

- Trust Agreement: A trust agreement is a legal document that creates a trust, allowing you to manage your assets during your life and dictate their distribution after your death. Like a Last Will, it ensures your wishes are honored, but it can also help avoid probate.

- Healthcare Proxy: This document appoints someone to make medical decisions on your behalf if you are unable to do so. While a Last Will governs asset distribution, a healthcare proxy focuses on your health care preferences.

- Emotional Support Animal Letter: This document, essential for those with mental health conditions, validates the therapeutic role of pets; you can find useful templates for this letter at Fillable Forms.

- Letter of Intent: This informal document expresses your wishes regarding the distribution of your assets and can provide additional guidance to your executor. Although it is not legally binding like a Last Will, it serves as a helpful supplement.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. This differs from a Last Will, which addresses the distribution of all assets, but both documents ensure your wishes regarding asset transfer are respected.

Common mistakes

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. However, many people make common mistakes when filling out the Washington Last Will and Testament form. Understanding these pitfalls can help you avoid them and create a valid will.

One frequent mistake is not being specific enough about the distribution of assets. When listing beneficiaries, it’s important to clearly identify who gets what. Vague language can lead to confusion and disputes among loved ones. For instance, saying "my jewelry" is less clear than specifying "my diamond ring" and "my gold bracelet."

Another common error is failing to update the will after major life events. Changes such as marriage, divorce, or the birth of a child can significantly affect your wishes. If your will doesn’t reflect your current situation, it may not serve its intended purpose.

Many individuals also overlook the importance of having witnesses. In Washington, your will must be signed in the presence of at least two witnesses who are not beneficiaries. Not adhering to this requirement can render the will invalid, leaving your estate to be distributed according to state law rather than your wishes.

Additionally, some people mistakenly assume that a handwritten will is automatically valid. While Washington does allow for holographic wills (those written entirely in the testator's handwriting), they must still meet specific criteria. If the document lacks clarity or proper signatures, it may be challenged in court.

Another mistake involves not including a self-proving affidavit. This is a legal document that can simplify the probate process. Including it with your will can help verify its validity without requiring witnesses to testify about its execution.

Furthermore, individuals often forget to consider tax implications. Estate taxes can impact how much your beneficiaries receive. It’s wise to consult with a financial advisor to understand how best to structure your assets to minimize tax burdens.

In some cases, people neglect to communicate their wishes to family members. A will is only effective if your loved ones know it exists and understand its contents. Open discussions can prevent misunderstandings and ensure that your intentions are clear.

Lastly, failing to store the will in a safe place is a significant oversight. Whether it’s a safe deposit box or a secure digital format, ensure that your will is accessible to those who may need it. If no one can find it, your wishes may go unfulfilled.

Avoiding these mistakes can help ensure that your Last Will and Testament accurately reflects your desires and provides peace of mind for you and your loved ones.