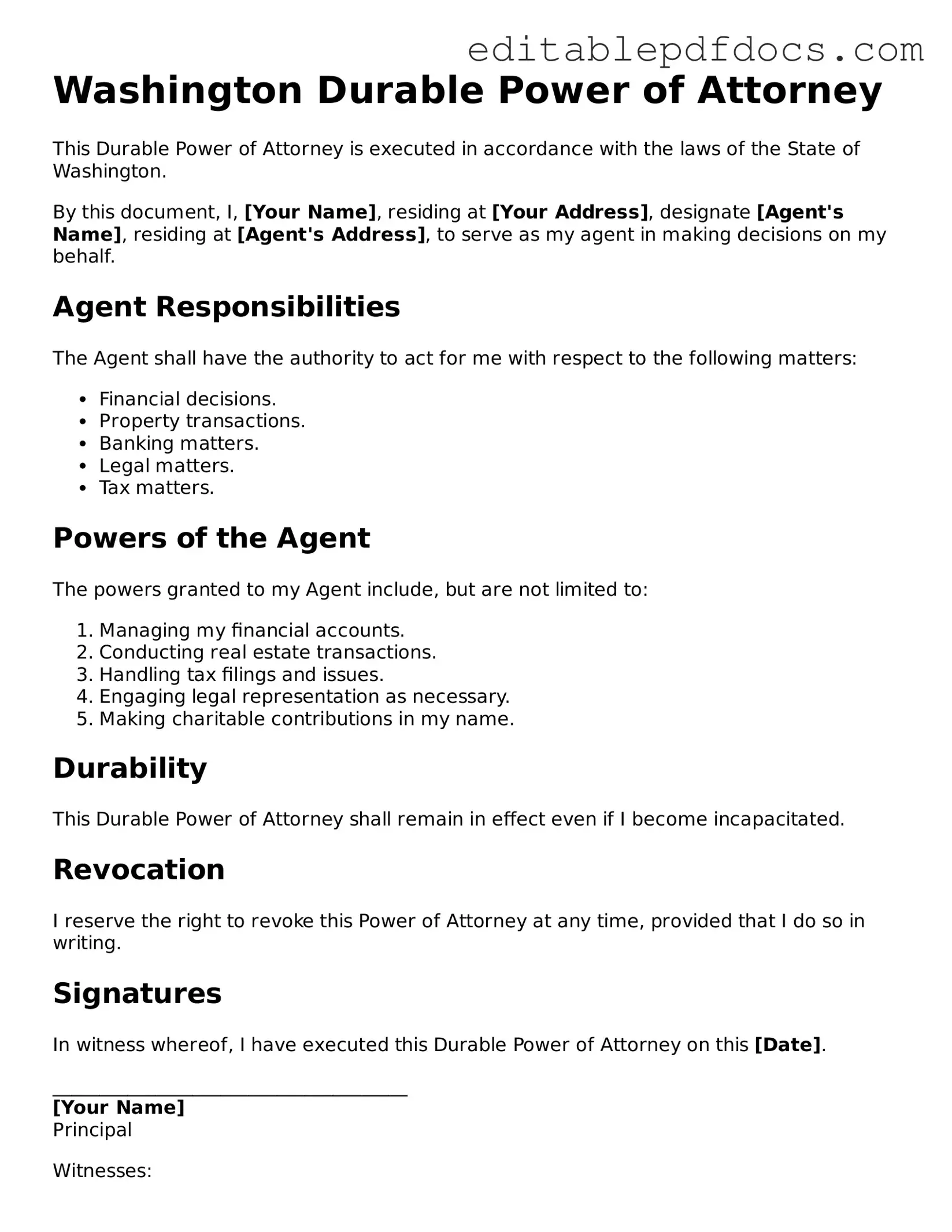

Durable Power of Attorney Document for Washington

The Washington Durable Power of Attorney form is an essential legal document that empowers individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This form covers a wide range of financial and health-related decisions, ensuring that your affairs are managed according to your wishes. One of the key features of this document is its durability; it remains effective even if the principal becomes incapacitated. By appointing an agent, you can ensure that your financial matters, such as managing bank accounts or handling real estate transactions, are taken care of seamlessly. Additionally, the form allows for specific limitations and instructions, giving you control over the scope of authority granted to your agent. Understanding the nuances of this form is crucial for anyone looking to safeguard their interests and provide clarity during challenging times. Properly completing and executing the Durable Power of Attorney can provide peace of mind, knowing that your chosen representative will act in your best interest when needed most.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Washington Durable Power of Attorney allows an individual to appoint someone else to make financial and legal decisions on their behalf. |

| Durability | This form remains effective even if the principal becomes incapacitated, ensuring continued management of their affairs. |

| Governing Law | The Washington Durable Power of Attorney is governed by the Revised Code of Washington (RCW) Chapter 11.125. |

| Principal and Agent | The individual creating the power of attorney is called the principal, while the person designated to act is known as the agent or attorney-in-fact. |

| Scope of Authority | The form can grant broad or limited powers, depending on the principal's preferences and needs. |

| Signing Requirements | The document must be signed by the principal and witnessed by one person or notarized to be legally valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

| Agent's Responsibilities | The agent must act in the best interest of the principal, maintaining transparency and accountability in their actions. |

Dos and Don'ts

When filling out the Washington Durable Power of Attorney form, it is essential to approach the task with care. Here are five important dos and don'ts to consider:

- Do clearly identify the person you are appointing as your agent. This individual will have the authority to make decisions on your behalf.

- Do specify the powers you are granting. Be as detailed as possible to avoid confusion later.

- Do sign the document in the presence of a notary public. This step is crucial for the form's validity.

- Don't rush through the process. Take your time to ensure that all information is accurate and complete.

- Don't overlook discussing your choices with your agent. Open communication can prevent misunderstandings in the future.

Documents used along the form

A Durable Power of Attorney is an important document that allows you to designate someone to make decisions on your behalf if you become unable to do so. However, there are several other forms and documents that may be relevant to your situation. Below is a list of commonly used documents that often accompany the Durable Power of Attorney in Washington State.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and appoints someone to make healthcare decisions for you if you are unable to communicate your wishes.

- Living Will: A Living Will specifies your wishes regarding end-of-life care and medical interventions, providing guidance to your loved ones and healthcare providers.

- HIPAA Release Form: This form allows you to designate individuals who can access your medical records and health information, ensuring your privacy is respected while allowing trusted people to make informed decisions.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document specifically grants someone the authority to manage your financial affairs, such as paying bills and managing investments.

- Will: A Will outlines how you want your assets distributed after your death. It can also designate guardians for minor children, ensuring your wishes are followed.

- Trust: A Trust can help manage your assets during your lifetime and after your death. It allows for more control over how and when your assets are distributed to beneficiaries.

- Mobile Home Bill of Sale: For those acquiring a mobile home, the official mobile home bill of sale guidelines are essential for a smooth and legally recognized transaction.

- Property Deed: This document transfers ownership of real estate. It is important to ensure that property is titled correctly, especially if you want to avoid probate.

- Beneficiary Designation Forms: These forms specify who will receive your assets upon your death, such as life insurance policies or retirement accounts, bypassing the probate process.

- Guardianship Documents: If you have minor children, these documents outline who you wish to care for them in the event of your passing, ensuring their well-being is prioritized.

Each of these documents serves a unique purpose and can work in conjunction with a Durable Power of Attorney to ensure your wishes are honored and your loved ones are supported. It is advisable to consult with a legal professional to determine which documents best suit your individual needs and circumstances.

Consider Some Other Durable Power of Attorney Templates for US States

How to File for Power of Attorney in Florida - A Durable Power of Attorney is a crucial component of an effective estate plan for many people.

An Employment Verification Form is a document used by employers to confirm the employment history and credentials of a job applicant. This form typically includes details such as the individual’s job title, dates of employment, and other relevant information. Having this verification helps ensure that candidates meet the qualifications for the position they are applying for. To streamline this process, many employers utilize templates from sources such as Fillable Forms.

Durable Power of Attorney Forms - Having a Durable Power of Attorney can alleviate stress for your loved ones during difficult times.

Similar forms

The Durable Power of Attorney (DPOA) is a significant legal document that allows one person to make decisions on behalf of another. Several other documents serve similar purposes, providing authority and decision-making power in various contexts. Here are ten documents that share similarities with the Durable Power of Attorney:

- General Power of Attorney: This document grants broad authority to someone to act on behalf of another person in financial and legal matters. Unlike a DPOA, it may not remain in effect if the person becomes incapacitated.

- Healthcare Power of Attorney: This specific type of power of attorney allows an individual to make medical decisions for someone else if they are unable to do so themselves. It is focused solely on health-related matters.

- Cease and Desist Letter: If you need to formally halt harmful actions, consider using the legal framework of the Cease and Desist Letter form to initiate resolution before escalating to litigation.

- Living Will: A living will outlines an individual’s wishes regarding medical treatment in situations where they cannot communicate their preferences. While it does not appoint someone to make decisions, it complements a healthcare power of attorney.

- Advance Healthcare Directive: This combines a healthcare power of attorney and a living will, providing both decision-making authority and specific treatment preferences in medical situations.

- Financial Power of Attorney: Similar to a general power of attorney, this document specifically addresses financial matters, allowing someone to manage another person's finances, pay bills, and make investments.

- Revocable Living Trust: A revocable living trust allows a person to transfer assets into a trust while retaining control over them during their lifetime. It can provide for management of assets if the person becomes incapacitated.

- Guardianship Documents: In cases where an individual cannot make decisions due to incapacity, guardianship documents appoint someone to make personal and financial decisions on their behalf, similar to a DPOA.

- Conservatorship Documents: These documents establish a legal relationship where one person is appointed to manage the financial affairs of another, often used when someone cannot manage their own finances due to incapacity.

- Agent Authorization Forms: These forms allow individuals to appoint someone to act on their behalf in specific situations, such as real estate transactions, providing limited authority compared to a DPOA.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization: This document allows individuals to designate others who can access their medical information, ensuring that healthcare decisions can be made by trusted individuals.

Each of these documents serves a unique purpose but shares the underlying principle of allowing one person to act on behalf of another, especially in times of need or incapacity.

Common mistakes

Filling out the Washington Durable Power of Attorney form can be straightforward, but many people make common mistakes that can lead to complications. Understanding these pitfalls can help ensure that your intentions are clear and legally binding.

One frequent error is failing to specify the powers granted to the agent. The form allows for broad or limited powers, but if you leave this section vague, your agent may not have the authority to act as you intended. Be clear about what decisions your agent can make on your behalf.

Another mistake is not signing the document in the presence of a notary. In Washington, a Durable Power of Attorney must be notarized to be valid. Skipping this step can render the document ineffective, leaving your agent without the legal authority to act.

People often overlook the importance of choosing the right agent. Selecting someone who is trustworthy and capable of making decisions in your best interest is crucial. Avoid appointing someone who may have conflicts of interest or who might not be available when needed.

Additionally, failing to update the form can create issues. Life circumstances change, and your choice of agent or the powers you want to grant may evolve. Regularly review and revise your Durable Power of Attorney to ensure it reflects your current wishes.

Some individuals neglect to inform their agents about the existence of the Durable Power of Attorney. If your agent is unaware of the document, they cannot act on your behalf when necessary. Communication is key to ensuring your wishes are carried out.

Another common oversight is not considering alternate agents. Life is unpredictable, and your primary agent may become unavailable due to illness or other reasons. Designating an alternate ensures that someone can step in when needed.

Finally, individuals sometimes fail to keep copies of the completed form. After filling it out and notarizing it, make sure to provide copies to your agent, any alternate agents, and relevant family members. This step is essential for ensuring that everyone is aware of your decisions.