Articles of Incorporation Document for Washington

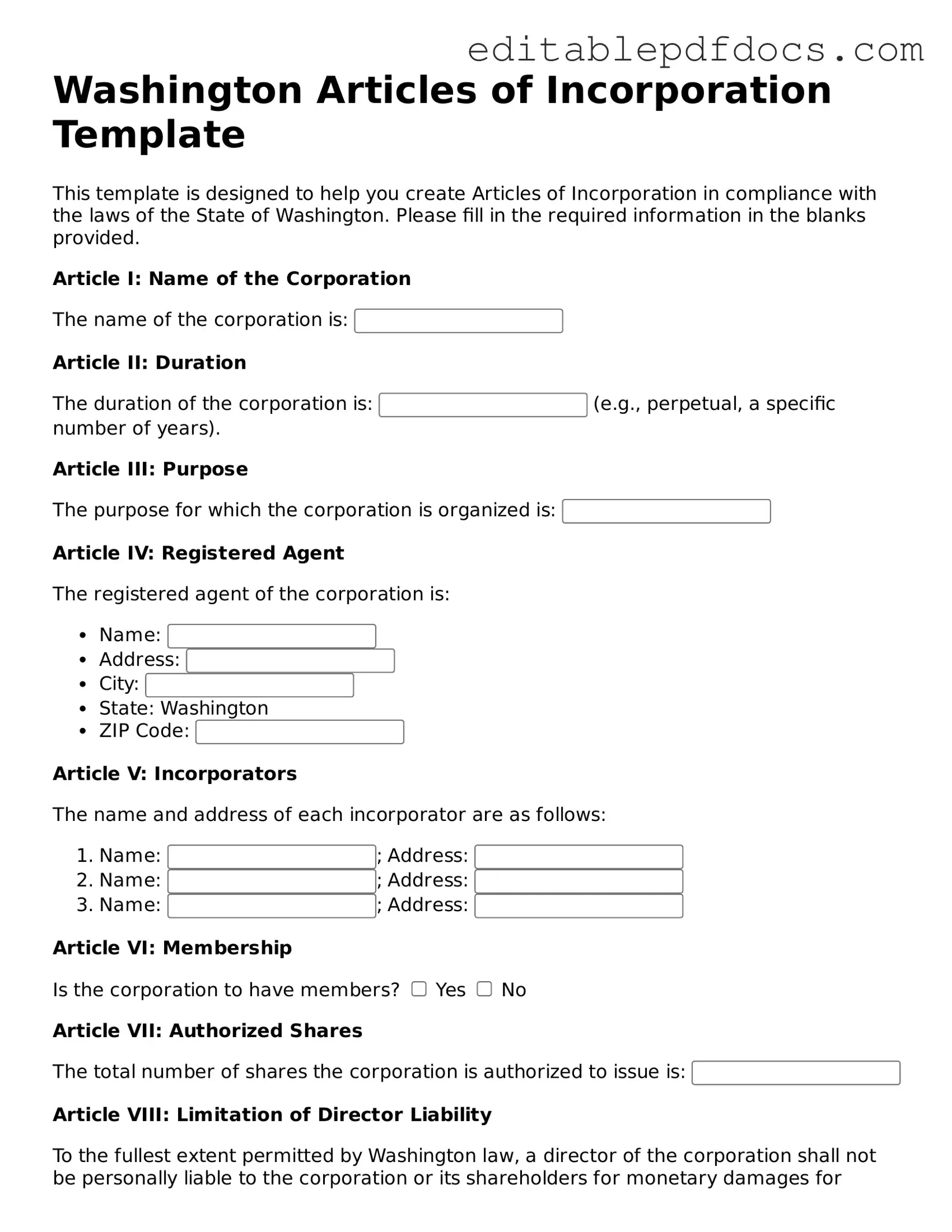

The Washington Articles of Incorporation form serves as a foundational document for individuals looking to establish a corporation in the state. This essential form outlines key information about the corporation, including its name, duration, and the purpose for which it is created. Additionally, it requires the identification of the registered agent, who will serve as the point of contact for legal documents and official correspondence. The form also mandates the listing of the incorporators, who are responsible for filing the Articles and initiating the corporate structure. Furthermore, it addresses the corporation's stock structure, specifying the number of shares and their par value, if applicable. Completing this form accurately is crucial, as it not only facilitates the legal formation of the corporation but also ensures compliance with state regulations. By carefully filling out the Articles of Incorporation, business owners can lay a solid groundwork for their enterprise, paving the way for future growth and legal protection.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Washington Articles of Incorporation form is used to legally create a corporation in the state of Washington. |

| Governing Law | This form is governed by the Washington Business Corporation Act, specifically RCW 23B. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory to establish the corporation's legal existence. |

| Information Required | Key information includes the corporation's name, registered agent, and the number of shares authorized to be issued. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

Dos and Don'ts

When filling out the Washington Articles of Incorporation form, it is essential to approach the task with care and attention to detail. Below are ten key actions to consider—five that you should do and five that you should avoid.

- Do ensure that the name of your corporation is unique and complies with state naming requirements.

- Do provide the correct address for the principal office of the corporation.

- Do include the names and addresses of the initial directors in the form.

- Do specify the purpose of your corporation clearly and concisely.

- Do sign and date the form, ensuring that the signatures are from authorized individuals.

- Don't forget to review the form for any errors or omissions before submission.

- Don't use abbreviations or acronyms that are not widely recognized in the name of the corporation.

- Don't leave any required fields blank; incomplete forms can lead to delays or rejection.

- Don't ignore the filing fees; ensure that payment is included with your submission.

- Don't neglect to check for any additional local requirements that may apply to your specific business type.

By adhering to these guidelines, you can navigate the process of completing the Articles of Incorporation more effectively, laying a solid foundation for your new corporation in Washington.

Documents used along the form

When forming a corporation in Washington, the Articles of Incorporation is just the beginning. Several other documents are often required or recommended to ensure compliance with state laws and to establish the corporation's operational framework. Below is a list of essential forms and documents that may accompany the Articles of Incorporation.

- Bylaws: This document outlines the internal rules governing the corporation's operations. It includes details about the management structure, voting procedures, and the responsibilities of officers and directors.

- Florida Motor Vehicle Bill of Sale: This important document serves as proof of sale and transfer of ownership for a vehicle in Florida, and can be conveniently accessed and filled out at PDF Documents Hub.

- Initial Report: Washington requires newly formed corporations to file an initial report within 120 days of incorporation. This report provides updated information about the corporation's officers and registered agent.

- Registered Agent Consent Form: This form confirms that the designated registered agent agrees to accept legal documents on behalf of the corporation. It is essential for maintaining good standing with the state.

- Employer Identification Number (EIN) Application: Corporations must obtain an EIN from the IRS for tax purposes. This number is necessary for opening bank accounts and hiring employees.

- Shareholder Agreements: While not mandatory, this document defines the rights and responsibilities of shareholders. It can help prevent disputes by outlining procedures for selling shares and making decisions.

- Business Licenses and Permits: Depending on the nature of the business, various local, state, and federal licenses may be required. These documents ensure compliance with regulations specific to the industry.

- Operating Agreement: For corporations that will be treated as LLCs for tax purposes, this document outlines the management structure and operational procedures, similar to bylaws for traditional corporations.

- Minutes of the Organizational Meeting: This record documents the initial meeting of the board of directors. It includes decisions made regarding the corporation's structure and the appointment of officers.

These documents collectively help establish a solid foundation for a new corporation. Ensuring that each is prepared and filed correctly can significantly impact the corporation's future operations and compliance with state regulations.

Consider Some Other Articles of Incorporation Templates for US States

How Much Does It Cost to Start an Llc in Arizona - Sets the stage for operational and financial agreements.

Starting an Llc in California - Additional provisions can be included if they are not contrary to state law.

Obtaining a California Release of Liability form is essential for anyone organizing events as it clarifies the responsibilities of both the organizer and the participants. By signing this document, individuals can better understand the potential risks involved, ensuring they are well-informed about the implications of their participation. For more detailed guidance on creating such documents, refer to the Waiver of Liability to help mitigate legal risks associated with your activities.

How Do I Get a Copy of My Articles of Incorporation in Georgia - The Articles specify the types and classes of shares the corporation can issue.

Florida Company Registration - The document must be submitted to the appropriate state authority for the corporation to be recognized.

Similar forms

-

Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. Like the Articles of Incorporation, they are essential for establishing the structure of the organization, but they focus more on governance than formation.

-

Operating Agreement: Similar to the Articles of Incorporation, an Operating Agreement is used by LLCs to define the management structure and operating procedures. Both documents are foundational for their respective entities.

-

Partnership Agreement: This document governs the relationship between partners in a business. Like the Articles of Incorporation, it lays out the framework for how the business will operate, but it specifically addresses partnerships.

-

Certificate of Formation: This document is often used interchangeably with the Articles of Incorporation in some states. It serves the same purpose of officially establishing a business entity.

-

Business License: While not a formation document, a business license is required for legal operation. Both documents ensure compliance with state regulations, but the license is focused on permission to operate.

-

Tax Identification Number (EIN): Obtaining an EIN is crucial for tax purposes. Like the Articles of Incorporation, it is a necessary step in the formation of a business, helping to establish its identity.

- Lease Agreement: To ensure a clear understanding of rental terms, review our comprehensive Lease Agreement resources designed for effective property management.

-

Shareholder Agreement: This document outlines the rights and responsibilities of shareholders. Similar to the Articles of Incorporation, it governs the relationships within the corporation, focusing on ownership and control.

-

Certificate of Good Standing: This document verifies that a corporation is compliant with state regulations. It complements the Articles of Incorporation by demonstrating that the business is legally recognized and operational.

-

Annual Report: Corporations are often required to file annual reports to maintain their good standing. This document is similar to the Articles of Incorporation in that it provides essential information about the business to the state.

-

Foreign Qualification: If a corporation wants to operate in a state other than where it was incorporated, it must file for foreign qualification. This process is similar to filing Articles of Incorporation, as it establishes legal recognition in a new jurisdiction.

Common mistakes

When completing the Washington Articles of Incorporation form, many individuals make common mistakes that can delay the process or lead to rejection. One frequent error is failing to provide a clear and accurate business name. The name must be unique and not already in use by another corporation in Washington. If the name does not comply, it will be rejected, and the applicant must start over.

Another mistake is neglecting to include the correct registered agent information. The registered agent must have a physical address in Washington and be available during business hours. Omitting this information or providing an incorrect address can result in complications for the corporation's legal notifications.

People often overlook the importance of specifying the purpose of the corporation. The purpose should be clearly defined and align with the business activities. A vague or overly broad purpose may lead to questions from the state, causing unnecessary delays in processing the application.

Additionally, many applicants fail to include the required number of incorporators. Washington law mandates that at least one incorporator is needed to sign the Articles of Incorporation. Omitting this information can result in the application being deemed incomplete.

Another common error is not properly indicating the duration of the corporation. While many businesses intend to operate indefinitely, failing to specify this or providing an incorrect duration can lead to confusion and potential issues down the line.

Finally, individuals sometimes neglect to sign the form. The Articles of Incorporation must be signed by an incorporator. Without a signature, the form is invalid and cannot be processed. Ensuring all necessary signatures are in place is crucial for a smooth filing process.