Free Vehicle Repayment Agreement Document

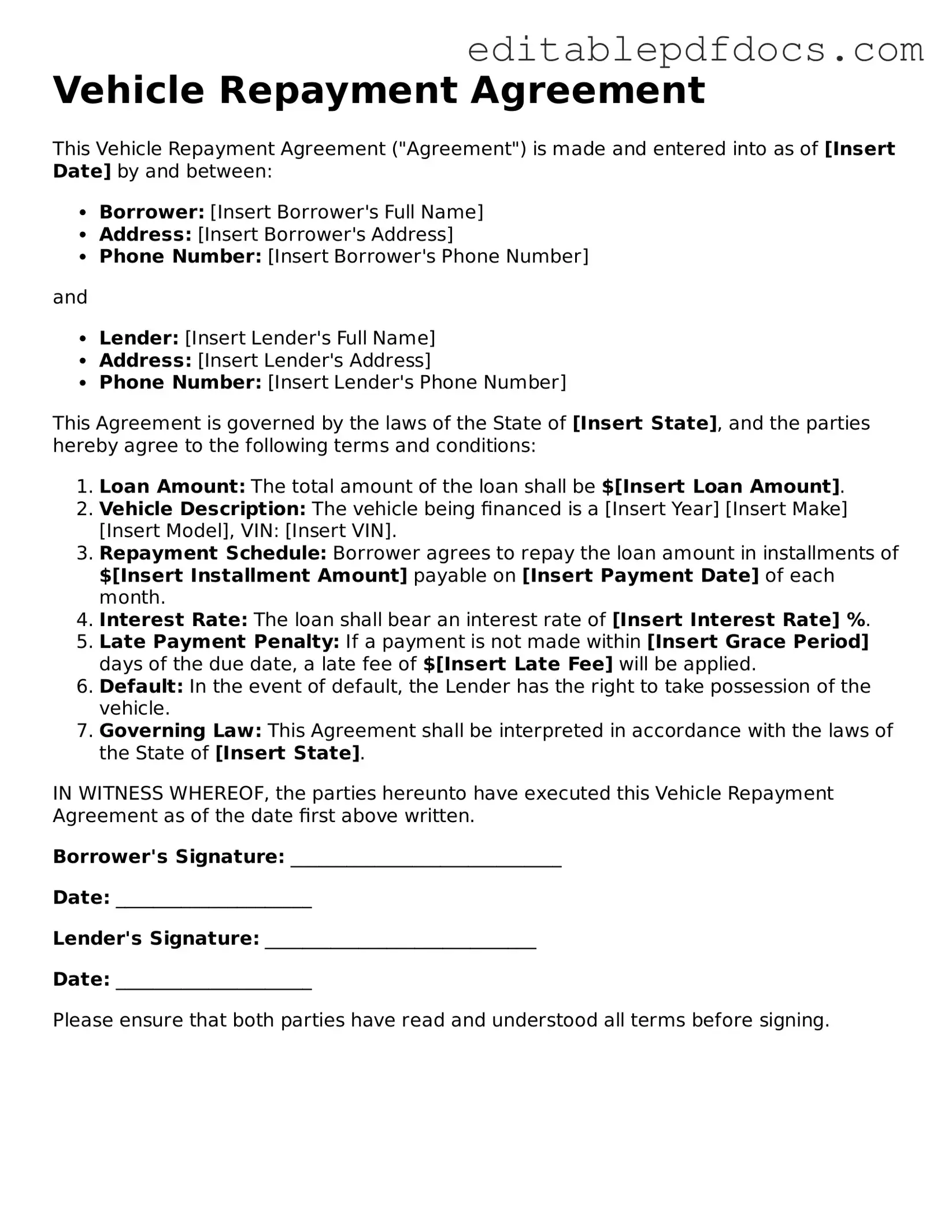

The Vehicle Repayment Agreement form plays a crucial role in the financing of vehicles, serving as a binding contract between the borrower and the lender. This document outlines the terms and conditions under which the borrower agrees to repay the loan for the vehicle, detailing the repayment schedule, interest rates, and any fees associated with the loan. It is essential for both parties to understand their rights and obligations as specified in the agreement. The form typically includes information about the vehicle, such as its make, model, and identification number, ensuring clarity regarding the asset being financed. Additionally, it may address the consequences of default, including potential repossession of the vehicle. By clearly outlining these aspects, the Vehicle Repayment Agreement form helps to establish a transparent and structured approach to vehicle financing, fostering trust between lenders and borrowers.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms under which a borrower agrees to repay a loan taken out for a vehicle purchase. |

| Parties Involved | This agreement typically involves two parties: the lender (often a financial institution) and the borrower (the individual purchasing the vehicle). |

| Governing Law | The laws governing the Vehicle Repayment Agreement may vary by state. For example, in California, it is governed by the California Civil Code. |

| Payment Terms | The form includes specific details about payment amounts, due dates, and the total loan amount, ensuring clarity for both parties. |

| Default Consequences | It outlines the consequences of defaulting on the loan, which may include repossession of the vehicle and damage to the borrower’s credit score. |

| Signatures Required | Both parties must sign the agreement to make it legally binding, confirming their understanding and acceptance of the terms outlined. |

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four key actions to take and avoid:

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and complete information about the vehicle and repayment terms.

- Do: Double-check all entries for spelling and numerical accuracy.

- Do: Sign and date the form where required.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that may cause confusion.

- Don't: Submit the form without reviewing it for errors.

- Don't: Forget to keep a copy of the completed form for your records.

Documents used along the form

When entering into a Vehicle Repayment Agreement, several other forms and documents may be required to ensure clarity and protection for all parties involved. Each document serves a specific purpose and can help facilitate a smooth transaction.

- Loan Application Form: This document collects personal and financial information from the borrower, helping lenders assess creditworthiness and determine loan eligibility.

- Credit Report Authorization: By signing this form, the borrower allows the lender to obtain their credit report, which is crucial for evaluating their financial history and risk level.

- Notice to Quit: This form is essential for landlords initiating the eviction process, and tenants should familiarize themselves with its stipulations found at https://nyforms.com/notice-to-quit-template.

- Promissory Note: This legal document outlines the borrower's promise to repay the loan under specified terms, including interest rates and payment schedules.

- Title Transfer Document: This form is used to officially transfer ownership of the vehicle from the seller to the buyer, ensuring that the new owner has legal rights to the vehicle.

- Insurance Verification Form: This document confirms that the borrower has obtained the necessary insurance coverage for the vehicle, which is often a requirement for financing.

- Payment Schedule: This outlines the timeline for repayments, detailing due dates and amounts, helping both parties keep track of the repayment process.

- Default Notice: In the event of missed payments, this document serves as a formal notification to the borrower, outlining the consequences of defaulting on the agreement.

Understanding these documents can help you navigate the process more effectively. Each one plays a vital role in ensuring that both the lender and borrower are protected throughout the vehicle financing journey.

More Templates

Mortgage Interest Form for Taxes - Late fees are an important consideration for maintaining timely payments.

The Employment Verification Form is essential for confirming an individual's employment status and history, making it a valuable tool for potential employers and lenders. To streamline the process of completing this form accurately, you can refer to resources such as PDF Documents Hub, which offers helpful guidance and templates.

Chick Fil a Careers - Enhance your resume with experience from a national brand.

Similar forms

- Loan Agreement: Similar to a Vehicle Repayment Agreement, a loan agreement outlines the terms under which money is borrowed. Both documents specify repayment terms, interest rates, and consequences for non-payment.

- Lease Agreement: A lease agreement is akin to a Vehicle Repayment Agreement in that it details the terms of using a vehicle. It includes payment schedules and responsibilities for maintenance, similar to how repayment obligations are structured.

- Promissory Note: A promissory note is a promise to pay a specified amount of money. Like the Vehicle Repayment Agreement, it includes details about the repayment schedule and interest, making it a legally binding commitment.

- Sales Contract: This document outlines the sale of a vehicle and includes payment terms. It shares similarities with the Vehicle Repayment Agreement by detailing the buyer's obligations and the seller's rights.

General Bill of Sale: To document the transfer of personal property ownership, refer to the essential guide for General Bill of Sale forms to ensure proper legal protection for both parties.

- Credit Agreement: A credit agreement defines the terms under which credit is extended to a borrower. It parallels the Vehicle Repayment Agreement by establishing repayment terms and conditions for borrowing funds for vehicle purchases.

- Service Agreement: While primarily focused on services, a service agreement can include payment terms for maintenance or repairs. This is similar to how a Vehicle Repayment Agreement outlines financial obligations related to vehicle ownership.

- Financing Agreement: A financing agreement details the terms under which a vehicle is financed. It is similar to a Vehicle Repayment Agreement as it specifies payment amounts, schedules, and interest rates for the financed vehicle.

Common mistakes

Filling out the Vehicle Repayment Agreement form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is providing inaccurate personal information. This includes misspellings of names, incorrect addresses, or wrong contact numbers. Such inaccuracies can delay processing and create issues in communication.

Another mistake involves the failure to read the terms and conditions carefully. Many people rush through the form, overlooking important details. This can result in misunderstandings about payment schedules, interest rates, or penalties for late payments. It is crucial to understand the obligations before signing the agreement.

In addition, individuals often neglect to include all required documentation. The Vehicle Repayment Agreement form may require proof of income, identification, or vehicle ownership documents. Failing to attach these documents can lead to delays or even rejection of the application.

Some people also make the mistake of not double-checking their calculations. When it comes to payment amounts, interest rates, and total repayment sums, accuracy is essential. Errors in calculations can lead to incorrect payment amounts, which may result in financial strain or default.

Another common oversight is not signing the form. While it may seem obvious, many individuals forget to provide their signature, rendering the agreement invalid. A signature is a critical part of the process, as it indicates consent and understanding of the terms.

Finally, individuals sometimes fail to keep a copy of the completed form. This can create problems if there are disputes or if clarification is needed later. Retaining a copy ensures that individuals have a reference point for their agreement and can help resolve any potential issues that arise.