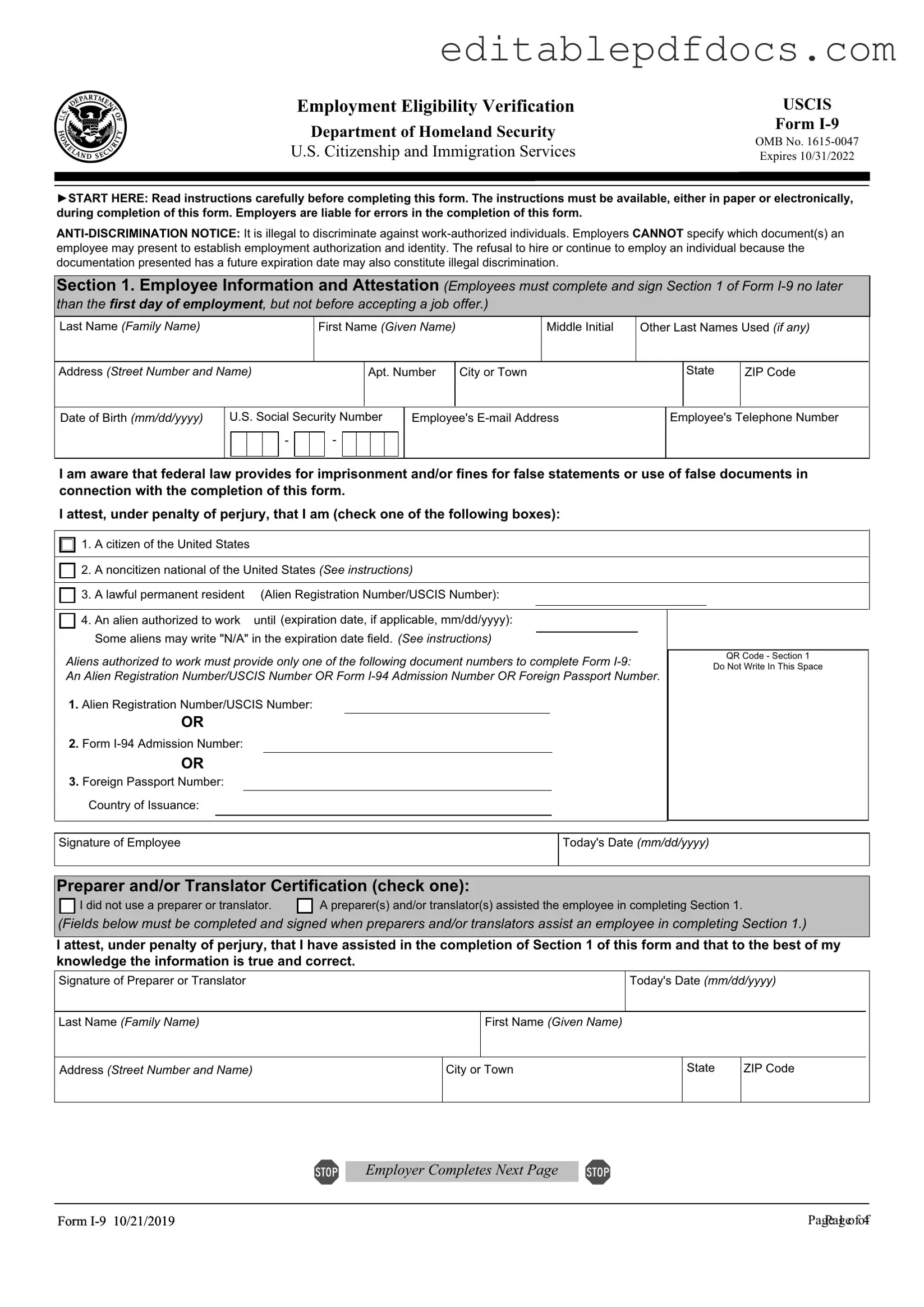

Fill a Valid USCIS I-9 Template

The USCIS I-9 form plays a crucial role in the employment process for both employers and employees in the United States. This form is designed to verify the identity and employment eligibility of individuals hired for work. Employers must complete the I-9 form for each new employee, ensuring that the information provided is accurate and up-to-date. The form requires specific documentation, such as proof of identity and authorization to work in the U.S., which can include a passport, driver's license, or social security card. It is important to note that the I-9 form must be completed within three days of an employee's start date. Employers are responsible for retaining these forms for a designated period, typically three years after the hire date or one year after the employee's termination, whichever is longer. Understanding the requirements and proper handling of the I-9 form is essential to comply with federal regulations and avoid potential penalties.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The I-9 form verifies an employee's identity and eligibility to work in the United States. |

| Who Must Complete | All employers must have their employees complete the I-9 form, regardless of their citizenship status. |

| Completion Timeline | Employees must complete the I-9 form within three days of starting work. |

| Documents Required | Employees must present documents that establish identity and employment authorization, such as a passport or driver's license and Social Security card. |

| Retention Period | Employers must retain completed I-9 forms for three years after the date of hire or one year after the employee's termination, whichever is later. |

| State-Specific Forms | Some states may have additional requirements. For example, California requires the use of the I-9 form in compliance with state labor laws. |

Dos and Don'ts

When filling out the USCIS I-9 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Do provide accurate information. Double-check your entries.

- Do use black or blue ink when completing the form.

- Do sign and date the form after you have filled it out.

- Do ensure that all required sections are completed.

- Don't leave any fields blank unless instructed to do so.

- Don't use correction fluid or tape to alter any information.

- Don't forget to provide acceptable documents to verify your identity and employment eligibility.

- Don't submit the form without reviewing it for errors.

- Don't ignore the deadlines for submission and verification.

Documents used along the form

The USCIS I-9 form is an essential document used for verifying the identity and employment eligibility of individuals hired for work in the United States. Alongside the I-9 form, several other forms and documents may be required or beneficial in the employment process. Below is a list of common forms and documents that often accompany the I-9 form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from an employee's paycheck.

- Employment Agreement: This document outlines the terms of employment, including job responsibilities, compensation, and duration of employment, ensuring both parties understand their commitments.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. It allows employees to specify how much state tax should be withheld from their paychecks.

- Direct Deposit Authorization Form: Employees complete this form to authorize their employer to deposit their pay directly into their bank account, making the payment process more convenient.

- Background Check Consent Form: Employers may require this form to obtain permission from the employee to conduct a background check, which can include criminal history and employment verification.

- Employee Handbook Acknowledgment: This document confirms that the employee has received and understood the company’s policies and procedures as outlined in the employee handbook.

- FedEx Release Form: This critical document authorizes FedEx to deliver your package in your absence. Ensure you complete it correctly for a hassle-free delivery process—review the details at PDF Documents Hub.

- Benefits Enrollment Form: Employees use this form to enroll in company-sponsored benefits such as health insurance, retirement plans, and other perks offered by the employer.

- Job Application: This document collects information about the applicant’s work history, education, and skills, serving as a basis for the hiring decision.

- Offer Letter: This letter formally extends a job offer to the candidate and includes details such as job title, salary, and start date, solidifying the employment agreement.

Each of these documents plays a role in the employment process and helps ensure that both the employer and employee are on the same page regarding their rights and responsibilities. Understanding these forms can facilitate a smoother hiring experience and contribute to a positive workplace environment.

Popular PDF Forms

Dekalb County Water New Service Application - The application ensures that the county has accurate records for water service delivery.

For those looking to understand their rental obligations, a well-crafted basic Lease Agreement template serves as a vital resource. It can help clarify terms, protect both parties, and ensure that all conditions are formally recognized.

Employer's Quarterly Federal Tax Return - Timely submission of Form 941 is essential to keep the IRS informed of tax obligations.

Roof Warranty - Infrastructural integrity beneath the roof is the homeowner's responsibility to maintain.

Similar forms

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. Like the I-9, it requires personal information and helps ensure compliance with federal regulations.

- Form 1040: This is the individual income tax return form. While it serves a different purpose, it also collects personal information and verifies identity, similar to the I-9.

-

California Trailer Bill of Sale: This legal document records the sale or transfer of ownership of a trailer in California and serves as a receipt for both the buyer and seller. It's essential for documenting the transaction correctly, ensuring your rights are protected. For more details, you can find the Bill of Sale for a Trailer online.

- Employment Application: Job seekers fill out this form to apply for positions. It gathers personal details and employment history, much like the I-9 collects identity and eligibility information.

- Form I-765: This application for work authorization is filed by individuals seeking permission to work in the U.S. It requires personal information and is related to employment eligibility, similar to the I-9.

- Social Security Card Application: This form is used to apply for a Social Security number. It requires personal identification details, akin to the information required on the I-9.

- Form I-131: This application for a travel document is used by individuals who may need to re-enter the U.S. It collects personal information and can impact employment eligibility, similar to the I-9.

- Passport Application: This form is used to apply for a U.S. passport. It requires personal identification and verifies citizenship, paralleling the identity verification aspect of the I-9.

- Form I-20: This document is issued to international students. It provides information about the student’s status and eligibility to work, similar to the employment eligibility focus of the I-9.

Common mistakes

Completing the USCIS I-9 form accurately is crucial for both employers and employees. Mistakes can lead to delays, penalties, and complications in the employment verification process. Here are nine common mistakes individuals make when filling out this important document.

One frequent error is not providing a signature. The I-9 form requires the employee's signature to certify that the information provided is true and complete. Omitting this signature can render the form invalid, leading to compliance issues for the employer.

Another common mistake is failing to complete the form within the designated time frame. Employees must fill out Section 1 of the I-9 form no later than their first day of work. Employers, on the other hand, must complete Section 2 within three business days of the employee's start date. Missing these deadlines can result in penalties.

People often overlook the requirement to use the full legal name. The I-9 form requires the employee's name to match the documentation provided. Any discrepancies between the name on the I-9 and the identification documents can create confusion and potential issues with employment eligibility.

Providing incorrect or incomplete information is another mistake that can occur. Employees should ensure that all fields are filled out accurately, including the date of birth and social security number. Incomplete sections may lead to unnecessary follow-up and verification delays.

Some individuals neglect to check the box indicating their citizenship or immigration status. This step is essential as it helps the employer determine the appropriate documentation needed to verify employment eligibility. Failing to make this selection can complicate the verification process.

Using outdated versions of the I-9 form is also a common error. The USCIS periodically updates the form, and using an old version can lead to compliance issues. It is vital to ensure that the most current version is being utilized to avoid penalties.

Another mistake involves not providing acceptable documentation. Employees must present original documents that establish their identity and employment authorization. Submitting copies or documents that do not meet the USCIS requirements can lead to disqualification from employment.

Some individuals may forget to review the form before submission. A final review can help catch any errors or omissions that could cause problems later. Taking the time to double-check the information can save time and effort in the long run.

Lastly, failing to retain the completed I-9 form for the required period is a significant oversight. Employers must keep the form for three years after the date of hire or one year after the employee's termination, whichever is longer. Not adhering to this retention policy can result in legal complications.