Free Transfer-on-Death Deed Document

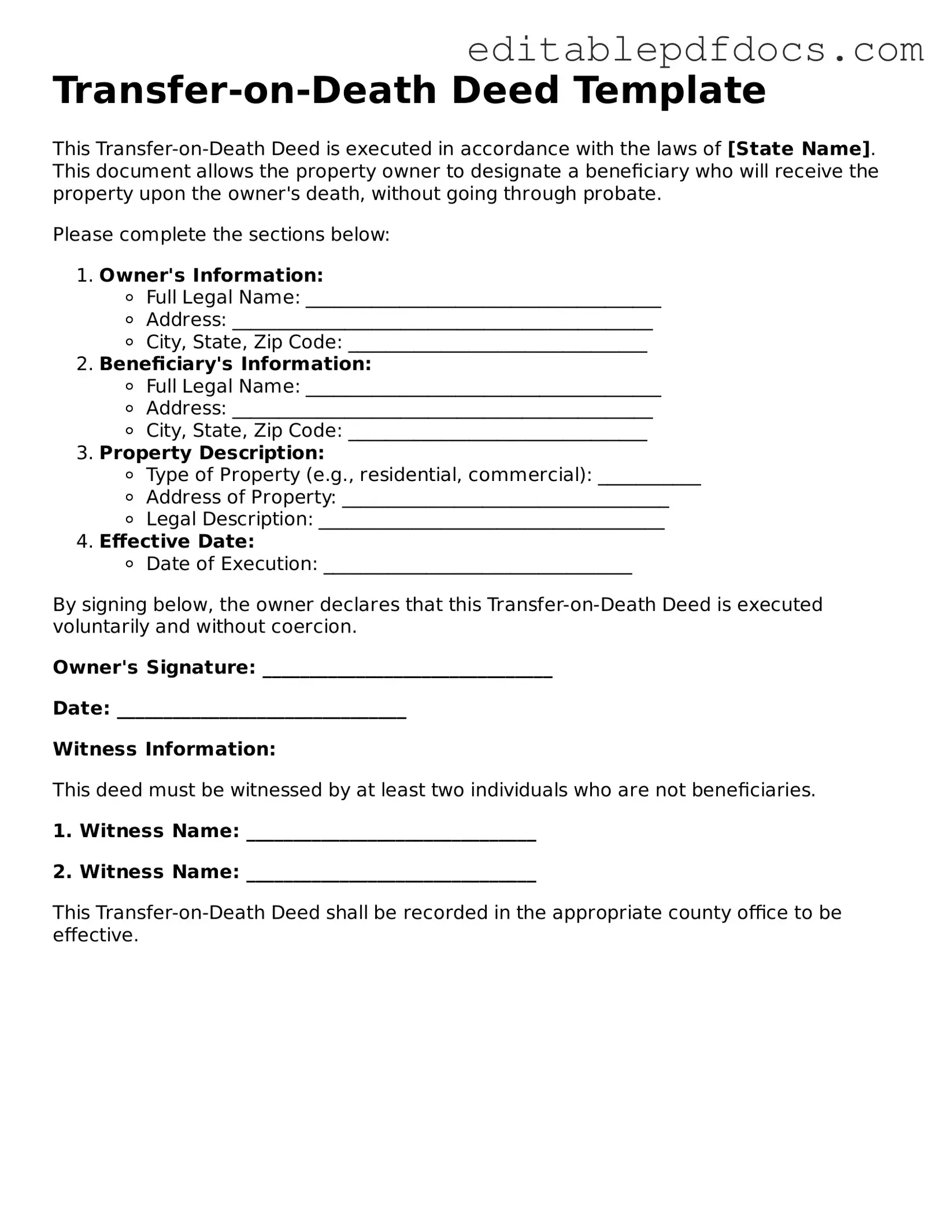

The Transfer-on-Death Deed (TOD Deed) is a powerful estate planning tool that allows property owners to designate beneficiaries who will inherit real estate upon their death, bypassing the often lengthy and costly probate process. This deed serves as a simple yet effective way to ensure that property is transferred directly to loved ones without the need for court intervention. By completing a TOD Deed, individuals can maintain full control over their property during their lifetime, retaining the ability to sell, modify, or revoke the deed at any time. This flexibility is a significant advantage, as it allows property owners to adapt their plans as circumstances change. Additionally, the TOD Deed is typically easy to execute, requiring only the signature of the property owner and proper recording with the county clerk. Beneficiaries named in the deed do not have any rights to the property until the owner's death, which helps to avoid potential disputes or claims during the owner's lifetime. Understanding the nuances of this deed, including its requirements and limitations, is essential for anyone looking to streamline their estate planning process and ensure a smooth transition of property to their chosen heirs.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to designate a beneficiary who will receive the property upon the owner's death, without going through probate. |

| State-Specific Laws | In the United States, the Transfer-on-Death Deed is governed by state laws. For example, in California, it is governed by California Probate Code Section 5600-5690. |

| Revocation | The deed can be revoked or changed at any time before the owner's death, giving the owner flexibility in their estate planning. |

| Benefits | This deed helps avoid probate, which can save time and money for the beneficiaries after the owner's passing. |

Transfer-on-Death Deed - Adapted for Each State

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's essential to approach the task with care. Here’s a helpful list of what to do and what to avoid:

- Do ensure you understand the laws in your state regarding Transfer-on-Death Deeds.

- Do provide accurate information about the property being transferred.

- Do include the full names and addresses of all beneficiaries.

- Do sign the deed in the presence of a notary public.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to file the deed with your local county recorder’s office.

- Don't assume that verbal agreements are sufficient; everything must be documented.

Documents used along the form

A Transfer-on-Death Deed (TOD) is a valuable tool for individuals seeking to transfer property upon their death without the need for probate. However, several other forms and documents often accompany a TOD deed to ensure a smooth transition of assets. Below is a list of these documents, each serving a distinct purpose in the estate planning process.

- Last Will and Testament: This document outlines how an individual wishes to distribute their assets upon death. It can include specific bequests, appoint guardians for minor children, and designate an executor to manage the estate.

- Durable Power of Attorney: This legal document allows a designated person to make financial and legal decisions on behalf of the individual, especially if they become incapacitated.

- Healthcare Proxy: A healthcare proxy designates someone to make medical decisions for an individual if they are unable to communicate their wishes due to illness or injury.

- Living Will: This document expresses an individual’s preferences regarding medical treatment and end-of-life care, providing guidance to healthcare providers and family members.

- Beneficiary Designation Forms: Often used for financial accounts and insurance policies, these forms specify who will receive the assets upon the individual's death, superseding any conflicting instructions in a will.

- California Release of Liability: This form serves to protect individuals and organizations against claims arising from injuries or damages during activities, ensuring clear acknowledgment of risks by participants. For more information, you can access Fillable Forms.

- Revocable Living Trust: A trust allows individuals to manage their assets during their lifetime and specify how they should be distributed after death, often avoiding probate altogether.

- Quitclaim Deed: This form is used to transfer ownership of property without warranties. It can be helpful in removing or adding names to property titles, often seen in family transfers.

- Property Tax Exemption Forms: These forms may be necessary to ensure that property taxes are managed appropriately after the transfer, especially if the property qualifies for certain exemptions.

- Affidavit of Heirship: This document establishes the heirs of a deceased person, which can help clarify ownership of property when no will exists.

Incorporating these documents into estate planning can provide clarity and ensure that an individual’s wishes are respected. Each form plays a crucial role in managing assets and responsibilities, making the transition smoother for loved ones left behind.

Consider Popular Types of Transfer-on-Death Deed Templates

Quick Title Deed - This deed can be recorded with the county for public notice.

When engaging in a transaction involving a motorcycle, it is essential to have a properly executed New York Motorcycle Bill of Sale form, which not only serves as proof of purchase but also protects both the buyer and seller. This document outlines key information such as the purchase price and specifics of the motorcycle, and is crucial for the legal transfer of ownership. For a streamlined process, you can find a helpful template at nyforms.com/motorcycle-bill-of-sale-template/.

Deed of Trust Sample - It standardizes the process of obtaining a loan secured by real estate.

Correction Deed California - A Corrective Deed is used to make amendments to an existing property deed.

Similar forms

- Will: Like a Transfer-on-Death Deed, a will allows you to specify who will receive your property after you pass away. However, a will goes through probate, while a Transfer-on-Death Deed does not.

- Trailer Bill of Sale: This legal document, essential for ownership transfer, includes vital information and streamlines the process, ensuring all parties are protected in their transaction. For more details, visit https://topformsonline.com/.

- Trust: A trust can manage your assets during your lifetime and distribute them after your death. Both documents can help avoid probate, but a trust is often more complex and requires ongoing management.

- Beneficiary Designation: Similar to a Transfer-on-Death Deed, beneficiary designations on accounts or policies directly transfer assets to named individuals upon death. This method is straightforward and avoids probate.

- Joint Tenancy: When two or more people own property as joint tenants, the property automatically transfers to the surviving owner(s) upon death. This is similar to a Transfer-on-Death Deed, as it bypasses probate.

- Life Estate: A life estate allows someone to live in a property for their lifetime, with the property passing to another person afterward. Like a Transfer-on-Death Deed, it can simplify the transfer process.

- Payable-on-Death Accounts: These accounts allow funds to be transferred directly to a designated beneficiary upon the account holder's death. They share the same goal of avoiding probate as a Transfer-on-Death Deed.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed form can be a straightforward process, but many people make mistakes that can complicate the transfer of property. One common error is not properly identifying the property. It’s crucial to provide a complete and accurate legal description of the property, including the address and any relevant parcel numbers. Omitting this information can lead to confusion and potential disputes later on.

Another frequent mistake is failing to include all necessary parties. The form must be signed by the property owner(s), and if there are multiple owners, all must consent to the transfer. Neglecting to have all owners sign can invalidate the deed, which could lead to complications in the future.

Many people also overlook the importance of witnessing and notarization. Some states require the TOD deed to be notarized or witnessed to be legally binding. Skipping this step may render the document ineffective, leaving your intentions unfulfilled.

Additionally, individuals often forget to record the deed with the appropriate county office. Even if the form is filled out correctly, if it is not recorded, the transfer may not take effect. Recording ensures that the deed is part of the public record, which is essential for legal recognition.

Another mistake is not considering the implications of the transfer on taxes. Some individuals do not understand how a TOD deed affects estate taxes or property taxes. Consulting with a tax professional can help clarify any potential tax obligations that may arise from the transfer.

People sometimes fail to update their TOD deed after significant life changes, such as marriage, divorce, or the birth of a child. If the deed does not reflect current relationships or intentions, it can lead to unintended consequences regarding who inherits the property.

Moreover, some individuals do not communicate their plans with family members. This lack of communication can create confusion and conflict among heirs, especially if they are unaware of the existence of the TOD deed or its implications.

Another common oversight is using outdated forms or templates. Laws regarding TOD deeds can change, and using an old version of the form may not comply with current legal requirements. Always ensure you are using the most recent version of the form.

People often underestimate the importance of clarity in naming beneficiaries. If the beneficiary’s name is misspelled or unclear, it can lead to complications during the transfer process. Being precise in this regard is essential to ensure that the right person receives the property.

Lastly, some individuals neglect to seek professional advice. While filling out a TOD deed may seem simple, seeking guidance from a legal expert can help avoid pitfalls and ensure that the document is executed correctly. Taking this step can save time, money, and stress down the line.