Fill a Valid Texas residential property affidavit T-47 Template

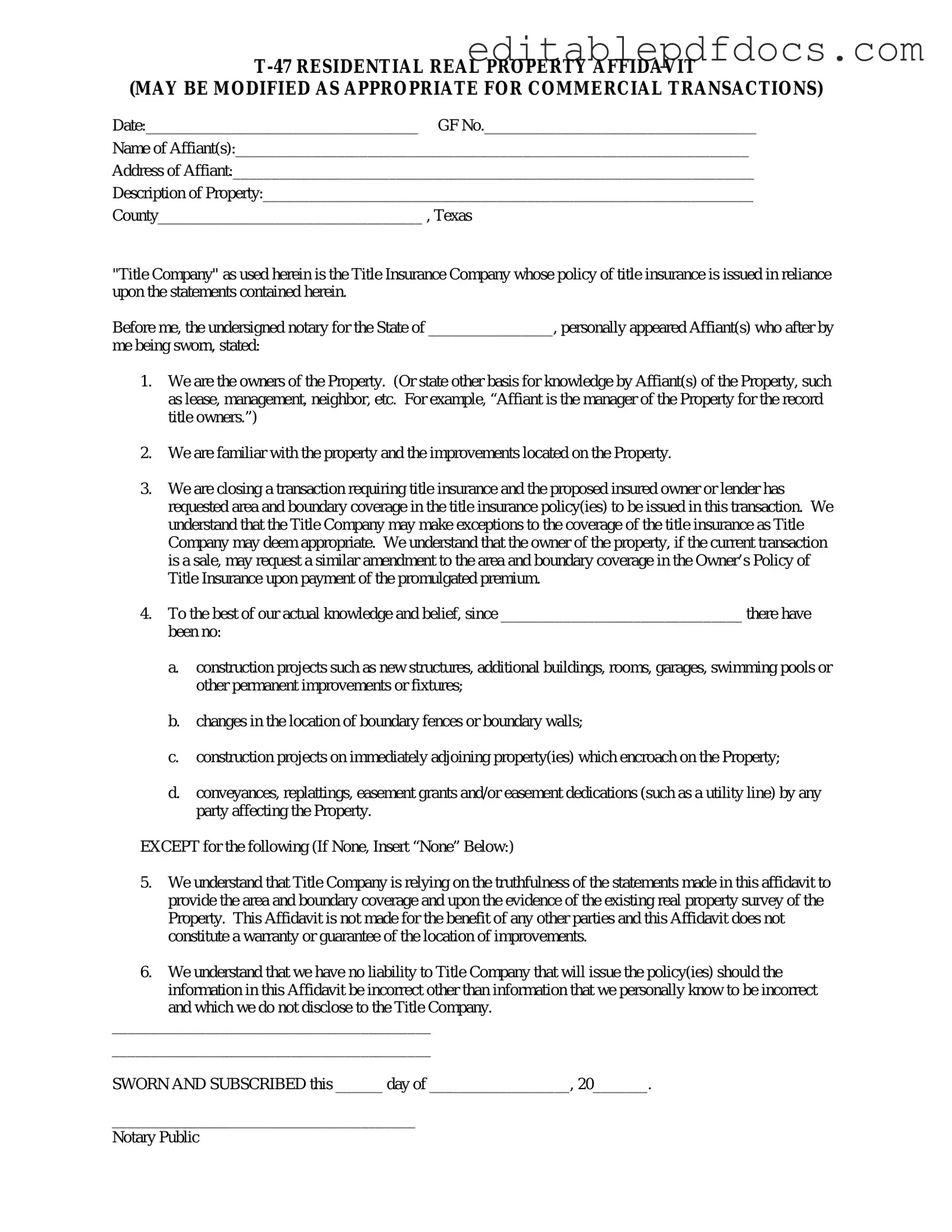

The Texas residential property affidavit T-47 form is an important document in real estate transactions, particularly for those involved in the purchase or sale of residential properties. This form serves as a sworn statement regarding the property's ownership and any existing liens or encumbrances. It is typically used to confirm that the seller has clear title to the property, which is crucial for buyers seeking to avoid legal complications after the transaction. Additionally, the T-47 form helps to clarify any potential issues related to property boundaries and improvements made to the property. By providing essential information about the property’s history and condition, this affidavit supports a smoother closing process and protects the interests of all parties involved. Understanding the nuances of the T-47 form is vital for both buyers and sellers to ensure compliance with Texas property laws and to facilitate a successful real estate transaction.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Texas residential property affidavit T-47 form is used to confirm the ownership of a property and to provide information about any existing liens or encumbrances on the property. |

| Governing Law | This form is governed by Texas Property Code and is often required in real estate transactions to ensure clear title transfer. |

| Usage | It is commonly utilized by sellers during the closing process to affirm the accuracy of the information provided about the property. |

| Filing Requirements | The T-47 form must be signed and notarized, and it is typically filed with the county clerk's office where the property is located. |

Dos and Don'ts

When filling out the Texas residential property affidavit T-47 form, it's important to approach the task carefully. Here are some things you should and shouldn't do:

- Do: Read the instructions thoroughly before starting.

- Do: Provide accurate and complete information.

- Do: Double-check your entries for any errors.

- Do: Sign and date the form where required.

- Don't: Leave any sections blank unless instructed.

- Don't: Use abbreviations or shorthand.

- Don't: Submit the form without reviewing it first.

- Don't: Forget to keep a copy for your records.

Documents used along the form

The Texas residential property affidavit T-47 form is an important document used in real estate transactions, particularly when dealing with title insurance. Alongside this form, several other documents are commonly utilized to ensure a smooth process. Below is a list of these documents, each serving a specific purpose in the context of property transactions.

- Deed of Trust: This document secures a loan by creating a lien on the property. It outlines the terms of the loan and the responsibilities of both the borrower and the lender.

- Title Commitment: Issued by a title company, this document outlines the terms under which a title insurance policy will be issued. It provides information about the property's title status and any liens or encumbrances.

- Survey: A survey provides a detailed map of the property, indicating boundaries, easements, and any existing structures. It is essential for verifying property lines and identifying any potential issues.

- Durable Power of Attorney: This document allows an individual to appoint someone to manage their financial affairs during incapacitation, ensuring that their wishes are followed. For convenience, you can access an editable document download to create this important legal form.

- Property Disclosure Statement: This form requires sellers to disclose known issues with the property, such as structural problems or environmental hazards. It helps buyers make informed decisions.

- Closing Disclosure: This document outlines the final terms of the loan, including the closing costs and the amount the buyer will need to bring to the closing table. It must be provided to the buyer at least three days before closing.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as appliances or fixtures. It ensures that all items agreed upon in the sale are legally transferred.

- Affidavit of Heirship: Used when a property owner passes away without a will, this document helps establish the heirs to the property. It provides a legal basis for transferring ownership to the rightful heirs.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community. They are crucial for buyers to understand their obligations.

- Warranty Deed: This document conveys ownership of the property from the seller to the buyer. It guarantees that the seller has the right to sell the property and that it is free of liens, except those disclosed.

Each of these documents plays a vital role in the real estate transaction process. Understanding their purposes can help both buyers and sellers navigate the complexities of property ownership and ensure a successful closing.

Popular PDF Forms

USCIS Form I-864 - Once filed, the form stays active as long as the immigrant has not become a citizen.

The Employment Verification form is essential for confirming a person's employment status and history, making it invaluable in situations such as job applications or loan approvals. For those needing additional documentation, a helpful resource is the Job Verification Letter, which can simplify the verification process even further.

Create Gift Card Online Free - Serves as proof that a financial contribution is a gift, not a loan.

Chick Fil a Careers - Participate in ongoing training and personal development opportunities.

Similar forms

- Affidavit of Heirship: This document is used to establish the rightful heirs of a deceased property owner. Similar to the T-47, it provides a sworn statement to clarify ownership and can help in transferring property without going through probate.

- Warranty Deed: A warranty deed guarantees that the seller holds clear title to the property and has the right to sell it. Like the T-47, it serves to confirm ownership and ensures that the buyer is protected against any future claims.

- Quitclaim Deed: This form transfers whatever interest the grantor has in the property without any warranties. While the T-47 focuses on affirming ownership, a quitclaim deed can be used to relinquish claims, making both documents vital in property transactions.

- Motor Vehicle Bill of Sale: This document is crucial for proving the transfer of ownership of a vehicle, containing necessary details about the buyer, seller, and the vehicle itself, similar to the clarity provided in real estate transactions. For more information, visit https://topformsonline.com.

- Title Commitment: A title commitment outlines the terms under which a title company will insure the title to a property. Both the T-47 and title commitment are essential in confirming ownership and ensuring that there are no liens or claims against the property.

- Property Disclosure Statement: This document informs potential buyers about the condition of the property and any known issues. The T-47, while focused on ownership, complements this by providing assurance of clear title, allowing buyers to make informed decisions.

- Deed of Trust: This legal document secures a loan by placing a lien on the property. Similar to the T-47, it involves the transfer of interest in real estate and is crucial in real estate transactions, ensuring that lenders have a claim to the property if the borrower defaults.

Common mistakes

Filling out the Texas residential property affidavit T-47 form can be straightforward, but mistakes can easily occur. One common error is not providing accurate property descriptions. When the property description is vague or incorrect, it can lead to complications during the transaction. Ensure that the legal description matches what is on the property deed.

Another frequent mistake is failing to include all required signatures. The form must be signed by all parties involved in the transaction. If someone neglects to sign, it can delay the process or even invalidate the affidavit. Always double-check that everyone has signed before submitting the form.

People often overlook the importance of dates. Filling in the wrong date or leaving the date section blank can cause confusion. It's crucial to provide the correct date of the affidavit to ensure that it aligns with other documents in the transaction.

Additionally, some individuals mistakenly assume that the T-47 form is optional. In reality, it is often a necessary part of the closing process. Not submitting it when required can result in delays or issues with title insurance. Always confirm whether the form is needed for your specific situation.

Another common error is providing incomplete information about the property’s condition. The affidavit requires a truthful statement regarding any known defects or issues. Omitting this information can lead to legal complications down the line, so be thorough and honest.

People sometimes misinterpret the purpose of the affidavit. It is meant to confirm the property’s ownership and any relevant details, not to serve as a sales contract. Misunderstanding this can lead to improper use of the form and potential disputes.

Finally, many individuals fail to keep copies of the completed form. After submission, it’s important to retain a copy for personal records. This can be helpful if any questions arise in the future regarding the transaction or property ownership.