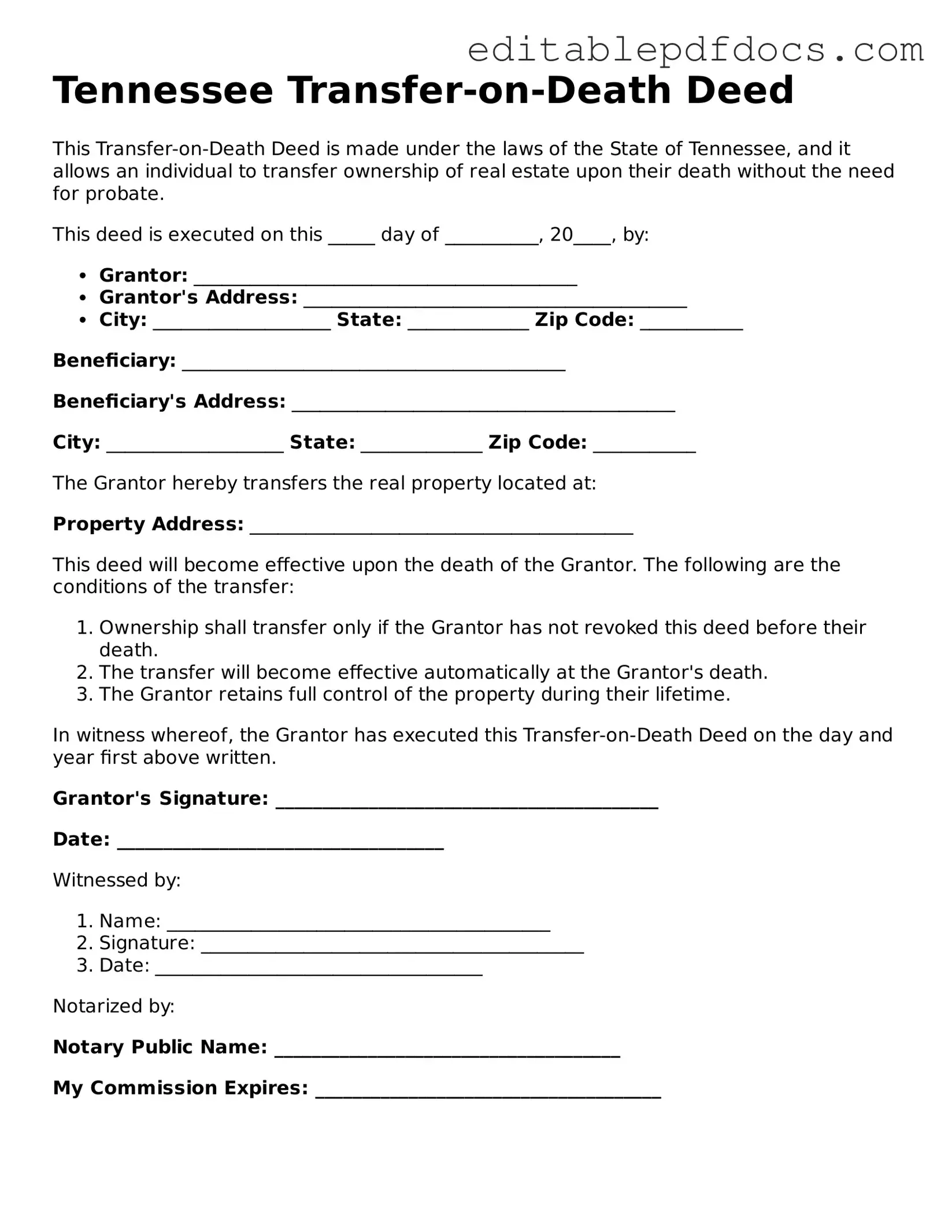

Transfer-on-Death Deed Document for Tennessee

The Tennessee Transfer-on-Death Deed form is a valuable tool for property owners looking to streamline the transfer of real estate upon their passing. This form allows individuals to designate one or more beneficiaries who will automatically receive the property without the need for probate. By filling out this deed, you can ensure that your loved ones inherit your property quickly and without unnecessary legal complications. The process is straightforward, yet it requires careful attention to detail. You must provide specific information, including the property description and the names of the beneficiaries. Additionally, the deed must be signed and notarized to be legally binding. This form not only simplifies the transfer process but also provides peace of mind, knowing that your wishes will be honored after you are gone. Understanding how to properly utilize the Transfer-on-Death Deed can help you secure your family's future and protect your assets effectively.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Tennessee Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Tennessee Code Annotated, Title 66, Chapter 4. |

| Eligibility | Only individuals who own real estate can create a Transfer-on-Death Deed in Tennessee. |

| Revocation | The property owner can revoke the deed at any time before their death, ensuring flexibility. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them as specified in the deed. |

| Filing Requirements | The deed must be signed and notarized, then filed with the county register of deeds to be effective. |

| Tax Implications | Beneficiaries typically receive the property with a stepped-up basis for tax purposes, which can reduce capital gains taxes. |

Dos and Don'ts

When filling out the Tennessee Transfer-on-Death Deed form, it’s important to get it right to ensure your wishes are honored. Here’s a helpful list of things to do and avoid:

- Do ensure you are the sole owner or have the authority to transfer the property.

- Do clearly identify the property you wish to transfer.

- Do include the full legal names of all beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do file the deed with the county register of deeds in a timely manner.

- Don’t use vague language when describing the property.

- Don’t forget to check for any outstanding liens or mortgages on the property.

- Don’t leave any sections of the form blank; complete all required fields.

- Don’t assume verbal agreements are sufficient; everything must be in writing.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is properly executed and that your property is transferred according to your wishes.

Documents used along the form

The Tennessee Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive the property upon their passing, without the need for probate. However, several other documents are often used in conjunction with this deed to ensure a smooth transfer of property and to clarify the wishes of the property owner. Below is a list of common forms and documents that may accompany the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets, including property, should be distributed upon their death. It can provide additional instructions that complement the Transfer-on-Death Deed.

- Beneficiary Designation Forms: These forms specify beneficiaries for certain assets, such as life insurance policies or retirement accounts. They ensure that these assets transfer directly to the named individuals, similar to the Transfer-on-Death Deed.

- Last Will and Testament: A https://nyforms.com/last-will-and-testament-template/ is essential for outlining the distribution of assets and appointing guardians for minor children, ensuring that all final wishes are honored.

- Power of Attorney: This legal document grants someone the authority to act on behalf of the property owner in financial or legal matters. It can be helpful if the owner becomes incapacitated before passing away.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person. It can help clarify ownership and simplify the transfer of property when a Transfer-on-Death Deed is not in place.

- Property Deed: The original deed to the property is essential for establishing ownership. It contains important details about the property and may need to be referenced when completing the Transfer-on-Death Deed.

Understanding these documents can help property owners make informed decisions about their estate planning. Each plays a unique role in ensuring that wishes are honored and that property transfers smoothly after death.

Consider Some Other Transfer-on-Death Deed Templates for US States

How to Transfer Property After Death - This instrument can be a vital part of planning for future events, ensuring a loved one’s future security.

The completion of the California Boat Bill of Sale form is streamlined with the help of Fillable Forms, which provide a user-friendly approach to ensure that all necessary details are correctly captured, thereby facilitating the reliable transfer of ownership and protecting the interests of both the buyer and seller throughout this important transaction.

Trust Avoid Probate - By ensuring that your property is passed directly to your chosen beneficiary, you can preserve family relationships during a challenging time.

Similar forms

The Transfer-on-Death Deed (TOD) form is a unique legal document that allows a property owner to designate a beneficiary who will receive the property upon the owner's death. Several other documents serve similar purposes in estate planning. Here are six documents that share similarities with the TOD deed:

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. Like a TOD deed, it allows for the transfer of property but requires probate, while the TOD deed does not.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. Upon death, the assets can be transferred to beneficiaries without going through probate, similar to a TOD deed.

- Beneficiary Designation Forms: Commonly used for financial accounts and insurance policies, these forms allow individuals to name beneficiaries who will receive assets directly upon death, much like a TOD deed for real property.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows co-owners to automatically inherit each other’s share upon death. It functions similarly to a TOD deed by avoiding probate.

Bill of Sale: The Illinois Bill of Sale form is essential for documenting the transfer of ownership of personal property in Illinois, providing proof of the transaction. For further details, visit https://topformsonline.com.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon the account holder’s death, similar to how a TOD deed transfers property.

- Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for stocks and bonds. The transfer occurs automatically upon death, much like the TOD deed for real estate.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed in Tennessee can be a straightforward process, but many people make common mistakes that can lead to complications later on. Understanding these pitfalls can help ensure that your intentions are properly documented and that your property transfers smoothly upon your passing.

One frequent mistake is failing to include the correct legal description of the property. It’s essential to use the exact language found in the property’s deed. Without this information, the transfer may be challenged or deemed invalid, leaving your heirs in a difficult situation.

Another common error is neglecting to sign the deed in the presence of a notary public. In Tennessee, the TOD deed must be notarized to be legally binding. If this step is skipped, the deed may not hold up in court, potentially causing significant delays in the transfer process.

Many people also overlook the importance of naming beneficiaries clearly. If the beneficiary is not specified or if there are ambiguities in naming them, it can lead to disputes among family members. Ensure that names are spelled correctly and that you clearly indicate who will inherit the property.

Some individuals mistakenly believe that a TOD deed can be revoked or changed easily after it has been recorded. While it is possible to revoke or modify a TOD deed, the process requires specific steps, including filing a new deed. Not understanding this can lead to unintended consequences.

Additionally, failing to consider the implications of joint ownership can be problematic. If you own the property jointly with someone else, the TOD deed may not work as intended. It’s crucial to understand how joint ownership affects the transfer of property and to plan accordingly.

Another mistake is not discussing the TOD deed with family members. Open communication about your intentions can help prevent misunderstandings and conflicts after your passing. Family discussions can clarify your wishes and ensure that everyone is on the same page.

Some people forget to check for existing liens or debts on the property before completing the deed. If there are outstanding obligations, those may need to be addressed before the property can be transferred. Ignoring this can create complications for your beneficiaries.

Failing to keep a copy of the completed and notarized deed in a safe place is another oversight. It’s important for your beneficiaries to know where to find the deed when the time comes. Without access to the deed, they may struggle to execute your wishes.

Lastly, many individuals do not consult with a legal professional when filling out the TOD deed. While it may seem straightforward, having an expert review your form can help catch mistakes and ensure that everything is in order. Legal advice can provide peace of mind and protect your interests.