Rental Application Document for Tennessee

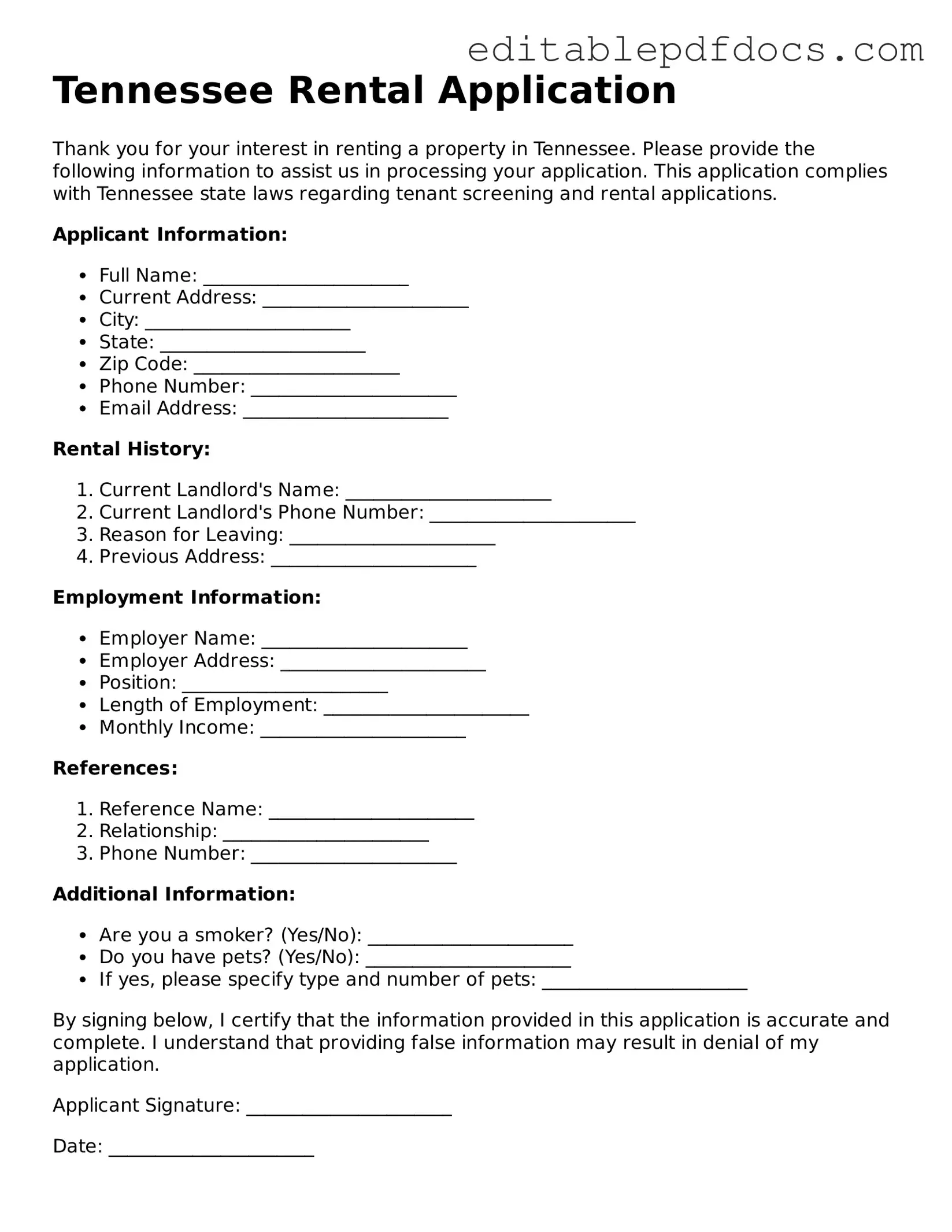

When searching for a new rental home in Tennessee, completing a rental application form is a crucial step in the process. This document serves as a gateway for potential tenants to express their interest in a property while providing essential information to landlords or property managers. Typically, the form requires details such as your personal information, rental history, employment status, and income verification. Additionally, applicants may need to provide references and consent to background checks, which help landlords assess their suitability as tenants. Understanding the various components of the Tennessee Rental Application form can streamline your application process and improve your chances of securing your desired rental property. With the right information at hand, you can confidently present yourself as a responsible and reliable tenant.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Tennessee Rental Application form is used by landlords to screen potential tenants. |

| Information Required | Applicants typically need to provide personal information, rental history, and employment details. |

| Application Fee | Landlords may charge an application fee to cover background checks and processing costs. |

| Governing Laws | The application process is governed by Tennessee Code Annotated § 66-28-201. |

| Fair Housing Compliance | Landlords must comply with the Fair Housing Act, ensuring no discrimination occurs during the application process. |

| Credit Check | Landlords often perform a credit check as part of the application process to assess financial responsibility. |

| Approval Process | Once submitted, the landlord reviews the application and decides whether to approve or deny it. |

| Privacy Considerations | Landlords are required to handle applicant information confidentially and securely. |

Dos and Don'ts

When filling out the Tennessee Rental Application form, it's important to approach the process carefully. Here are some key dos and don’ts to keep in mind:

- Do provide accurate and complete information. Ensure that all sections of the application are filled out thoroughly to avoid delays.

- Do include all necessary documentation. Attach any required identification or proof of income to support your application.

- Do review your application before submission. Check for any errors or omissions that could impact your chances of approval.

- Do be honest about your rental history. Disclosing past rental issues can help build trust with the landlord.

- Don’t provide false information. Misrepresenting facts can lead to denial of your application or eviction later.

- Don’t leave questions unanswered. Incomplete applications may be disregarded by landlords.

- Don’t forget to sign the application. An unsigned form may be considered invalid.

- Don’t ignore the application fee. Ensure that you submit the correct payment, as this is often required to process your application.

Documents used along the form

When a prospective tenant applies for a rental property in Tennessee, several forms and documents are typically utilized alongside the Tennessee Rental Application form. These documents help landlords assess the applicant's suitability and ensure a smooth leasing process. Below is a list of commonly used forms.

- Credit Report Authorization Form: This document allows landlords to obtain a credit report on the applicant. It provides insight into the applicant's credit history and financial responsibility.

- Background Check Consent Form: This form grants permission for landlords to conduct a background check, which may include criminal history and eviction records. It helps landlords make informed decisions regarding tenant safety and reliability.

- Income Verification Documents: Applicants may need to provide pay stubs, tax returns, or bank statements to verify their income. This information demonstrates the applicant's ability to pay rent consistently.

- Motorcycle Bill of Sale Form: To ensure smooth ownership transfers, reference the detailed Motorcycle Bill of Sale form requirements for accurate documentation during transactions.

- Rental History Verification Form: This form allows landlords to contact previous landlords to confirm the applicant's rental history. It provides details on the applicant's behavior as a tenant, including payment history and any lease violations.

- Pet Policy Agreement: If the rental property allows pets, this document outlines the rules and regulations regarding pet ownership. It may include pet deposits, breed restrictions, and care requirements.

These documents, when used in conjunction with the Tennessee Rental Application form, help landlords evaluate potential tenants more effectively. They contribute to a thorough understanding of the applicant's background, financial stability, and overall fit for the rental property.

Consider Some Other Rental Application Templates for US States

Residential Application Form - Document your current housing situation with clarity.

When entering into agreements, it is essential to understand the significance of a Hold Harmless Agreement form, especially in New York, where parties often seek to mitigate their liabilities from each other's actions. This legal document provides a framework for clarity and security, allowing individuals and businesses to proceed with confidence in their transactions. For those looking for a reliable resource, you can find a useful template at nyforms.com/hold-harmless-agreement-template/.

Washington State Rental Application - Criminal history questions are essential for maintaining tenant safety.

California Residential Rental Application - State your date of birth for identity verification.

Similar forms

- Lease Agreement: This document outlines the terms and conditions under which a tenant agrees to rent a property. Similar to a rental application, it requires personal information and can include background checks.

- Credit Application: A credit application assesses an individual’s creditworthiness. Like a rental application, it gathers financial information to determine eligibility for renting.

- Employment Verification Form: This form confirms a tenant’s employment status and income. It shares similarities with a rental application by requiring personal and financial details.

-

Bill of Sale: This legal document is crucial for the transfer of ownership of personal property. To ensure compliance and accuracy, templates like the Fillable Forms can be utilized, streamlining the documentation process for both buyers and sellers.

- Background Check Authorization: This document allows landlords to conduct a background check on potential tenants. It parallels a rental application by collecting consent and personal information.

- Tenant Screening Report: This report compiles information about a potential tenant’s rental history and credit score. It is similar to a rental application as it evaluates the applicant’s reliability.

- Personal Reference Form: This form collects references from individuals who can vouch for the applicant’s character. It resembles a rental application in that it seeks information about the applicant's background.

- Income Verification Document: This document proves a tenant’s income, often through pay stubs or tax returns. Like a rental application, it is essential for assessing financial stability.

- Rental History Report: This report details a tenant’s previous rental experiences. It is similar to a rental application as it provides insight into the applicant’s reliability and behavior as a tenant.

Common mistakes

Completing a rental application can be a straightforward process, but many applicants often overlook important details. One common mistake is failing to provide complete contact information. Landlords need to reach potential tenants easily, so missing phone numbers or email addresses can hinder communication. It is crucial to double-check that all contact information is accurate and up-to-date.

Another frequent error involves not disclosing all sources of income. Applicants may list only their primary job, neglecting to mention additional income streams such as part-time work, freelance jobs, or rental income. Providing a comprehensive view of financial stability is essential for landlords to assess an applicant's ability to pay rent.

Many individuals also forget to include references. A lack of personal or professional references can raise red flags for landlords. It is advisable to think ahead and prepare a list of reliable references who can vouch for an applicant's character and rental history. This step can significantly enhance an application.

Inaccurate or incomplete rental history is another mistake that can negatively impact an application. Applicants should provide detailed information about previous residences, including addresses, landlord names, and rental durations. Omitting this information may lead to suspicions about an applicant's rental background.

Additionally, failing to read the application thoroughly can lead to misunderstandings. Some applicants may overlook specific questions or requirements outlined in the form. It is essential to take the time to read each section carefully and ensure that all questions are answered completely and accurately.

Another common oversight is neglecting to sign and date the application. Many applicants may focus on providing the necessary information but forget this critical step. A missing signature can render the application invalid, causing unnecessary delays in the rental process.

Lastly, not being honest about credit history can be detrimental. Some applicants may attempt to hide negative credit information or provide misleading details. It is always best to be truthful, as landlords often conduct background checks. Transparency can foster trust and potentially lead to better outcomes.