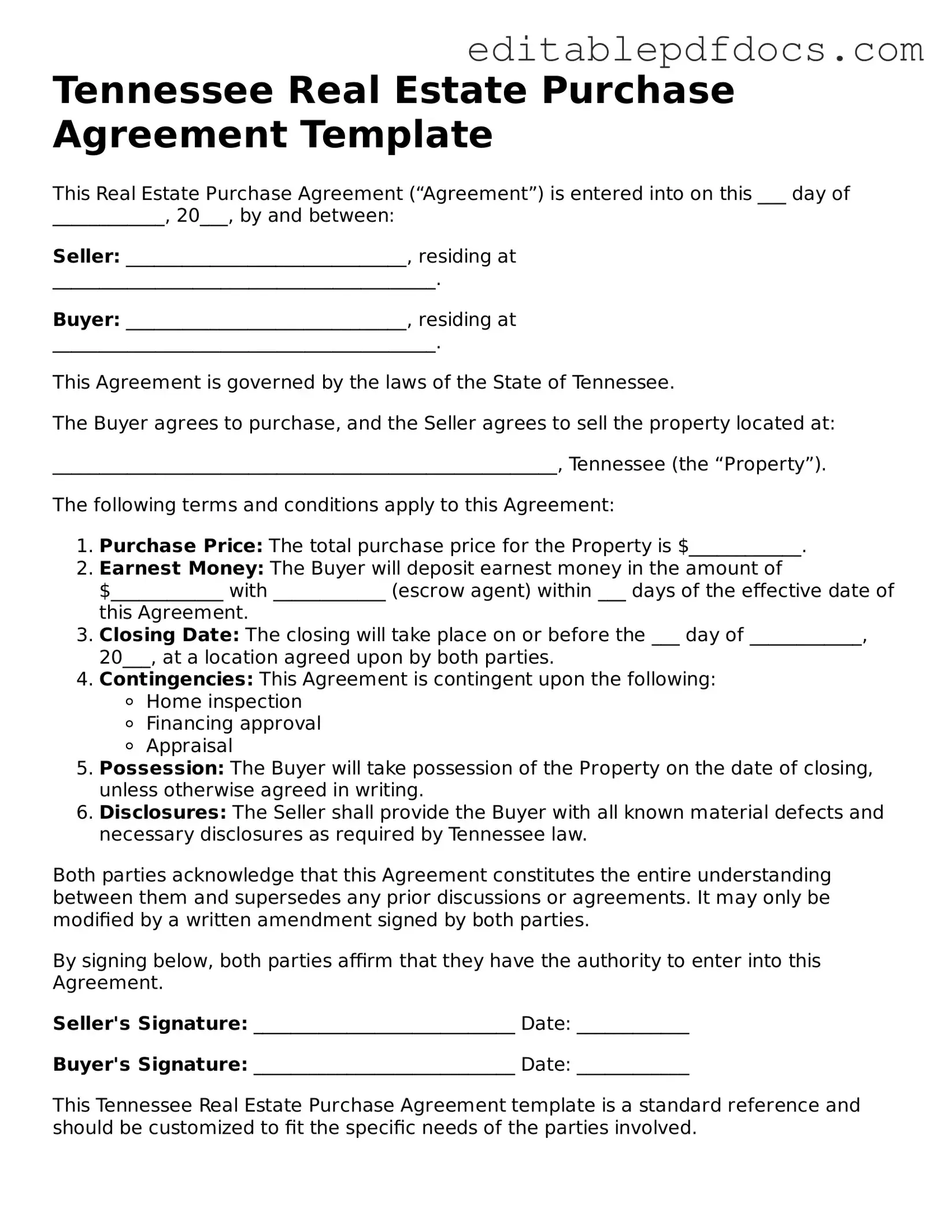

Real Estate Purchase Agreement Document for Tennessee

When embarking on the journey of buying or selling property in Tennessee, understanding the Tennessee Real Estate Purchase Agreement form becomes essential. This document serves as the backbone of the transaction, outlining the terms and conditions agreed upon by both the buyer and the seller. It includes critical elements such as the purchase price, the property description, and the closing date, ensuring that all parties are on the same page. Additionally, it addresses contingencies, which are conditions that must be met for the sale to proceed, such as financing approval or a satisfactory home inspection. The form also stipulates the earnest money deposit, a sign of good faith from the buyer, and details regarding any included fixtures or appliances. By clearly defining the responsibilities and rights of each party, the Tennessee Real Estate Purchase Agreement helps to minimize misunderstandings and provides a structured framework for a successful transaction. As you navigate the complexities of real estate, familiarizing yourself with this important document will empower you to make informed decisions and protect your interests throughout the buying or selling process.

File Information

| Fact Name | Detail |

|---|---|

| Governing Law | The Tennessee Real Estate Purchase Agreement is governed by the laws of the State of Tennessee. |

| Purpose | This form outlines the terms and conditions under which real estate is bought and sold in Tennessee. |

| Parties Involved | The agreement typically includes the buyer and seller, who are the primary parties in the transaction. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Contingencies | The form allows for contingencies, such as financing and inspections, which can protect the buyer's interests. |

| Closing Date | The agreement specifies a closing date, which is the date when the property transfer is finalized. |

Dos and Don'ts

When filling out the Tennessee Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do: Read the entire agreement carefully before filling it out.

- Do: Provide accurate and complete information for all parties involved.

- Do: Include all necessary details about the property, such as the address and legal description.

- Do: Specify the purchase price clearly and outline any contingencies.

- Do: Sign and date the agreement where required.

- Don't: Leave any sections blank; this can lead to confusion or disputes.

- Don't: Use vague language that may cause misunderstandings.

- Don't: Rush through the process; take your time to ensure everything is correct.

- Don't: Ignore state-specific requirements that may apply to the agreement.

Documents used along the form

When engaging in real estate transactions in Tennessee, various forms and documents are often utilized alongside the Tennessee Real Estate Purchase Agreement. Each of these documents serves a specific purpose, ensuring clarity and legal compliance throughout the buying or selling process. Below is a list of commonly used forms that may accompany the purchase agreement.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are required to disclose certain information to potential buyers, helping to promote transparency.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint and provides guidelines for safe practices.

- Title Commitment: This document is issued by a title company and outlines the terms under which the title will be insured. It confirms the legal ownership of the property and identifies any liens or encumbrances.

- Earnest Money Agreement: This agreement details the amount of earnest money the buyer will put down to show their commitment to the purchase. It also outlines the conditions under which the money may be forfeited or returned.

- Closing Disclosure: This document provides a detailed account of the final terms of the loan, including all costs associated with the purchase. It must be provided to the buyer at least three days before closing.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be effective.

- Home Inspection Report: This report is generated after a professional inspection of the property. It details the condition of various systems and structures, helping buyers make informed decisions.

- Appraisal Report: Conducted by a licensed appraiser, this report assesses the market value of the property. It is often required by lenders to ensure the property is worth the loan amount.

- Hold Harmless Agreement: This crucial document protects parties against liabilities stemming from the actions of others, ensuring smooth transactions. For more information, visit https://nyforms.com/hold-harmless-agreement-template/.

- Financing Addendum: This document outlines the terms of the buyer’s financing arrangements, including contingencies related to obtaining a mortgage.

Understanding these documents is crucial for both buyers and sellers. Each plays a vital role in facilitating a smooth transaction, protecting the interests of all parties involved. Being well-informed can lead to a more successful real estate experience in Tennessee.

Consider Some Other Real Estate Purchase Agreement Templates for US States

Contract for Real Estate Sale - This form can be essential in the event of disputes about the property sale terms.

For Sale by Owner Contract Pdf - May stipulate involvement of real estate agents or brokers.

Pa Agreement of Sale 2023 Pdf - Disclosures regarding the property’s condition are required in this agreement to inform the buyer of any known issues.

A California Bill of Sale form is a legal document that facilitates the transfer of ownership of personal property from one individual to another. It provides important information about the transaction, including the details of the buyer, seller, and the item being sold. For those looking to simplify the process, using Fillable Forms can ensure that all necessary information is gathered effectively. Understanding this form is essential for ensuring a smooth exchange and proper documentation.

Purchase and Sale Agreement Washington State - Identifies the legal description of the property being sold.

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property, similar to how a purchase agreement details the terms of buying a property. Both documents specify the rights and responsibilities of each party.

- Option to Purchase Agreement: This form grants a buyer the right to purchase a property at a later date. Like a purchase agreement, it includes terms such as price and conditions, but it offers flexibility for the buyer.

- Sales Contract: Often used interchangeably with a purchase agreement, a sales contract serves the same purpose: to formalize the sale of a property. It includes details about the property, purchase price, and closing date.

- Counteroffer Form: When the initial terms of a purchase agreement are not acceptable, a counteroffer form allows one party to propose different terms. This is similar to negotiating terms in a real estate purchase agreement.

- FedEx Bill of Lading: This critical shipping document outlines the details of a freight shipment and establishes the carrier's responsibility for the goods. For more information, visit https://topformsonline.com.

- Disclosure Statement: This document informs buyers about any known issues with the property. It complements the purchase agreement by ensuring that buyers are fully aware of the property’s condition before finalizing the sale.

- Escrow Agreement: This form outlines the terms under which a third party holds funds or documents during a real estate transaction. It is similar to a purchase agreement in that it helps facilitate the sale and protects the interests of both parties.

- Title Transfer Document: This document is necessary to legally transfer ownership of the property from the seller to the buyer. It is closely related to the purchase agreement, as both are essential for completing the sale.

Common mistakes

When filling out the Tennessee Real Estate Purchase Agreement form, individuals often make several common mistakes that can lead to complications in the transaction process. One significant error is failing to include all necessary parties in the agreement. If a spouse or co-owner is not listed, it could create issues later regarding ownership rights and responsibilities.

Another frequent mistake is neglecting to specify the purchase price clearly. Ambiguity in this section can lead to disputes between the buyer and seller. It is essential to write the amount in both numerical and written form to avoid any confusion.

People sometimes forget to include important contingencies in the agreement. These contingencies, such as financing or inspection clauses, protect the buyer’s interests. Without them, buyers may find themselves committed to a purchase that does not meet their expectations or financial capabilities.

Additionally, errors in the property description are common. It is crucial to provide a complete and accurate legal description of the property. Omitting details or using vague terms can create misunderstandings and legal challenges down the line.

Another mistake involves the failure to adhere to deadlines. The agreement often includes specific time frames for inspections, financing approvals, and closing dates. Missing these deadlines can result in the loss of the deal or additional costs.

Buyers and sellers sometimes overlook the importance of signatures. Every party involved must sign the agreement for it to be legally binding. Missing signatures can invalidate the contract, leaving both parties without legal recourse.

Inaccurate or incomplete information about earnest money can also lead to issues. Buyers should ensure that the amount and method of payment are clearly stated. This detail is vital for demonstrating serious intent to purchase.

Misunderstanding the terms of the agreement is another common pitfall. Buyers and sellers should take the time to read and comprehend all clauses. Failing to understand the implications of certain terms can lead to disputes and dissatisfaction.

People may also neglect to consult with a real estate professional or attorney before finalizing the agreement. Professional guidance can help identify potential issues and ensure compliance with state laws and regulations.

Finally, individuals often fail to keep copies of the signed agreement. Retaining a copy is essential for both parties to reference in the future. Without it, resolving disputes or misunderstandings can become significantly more challenging.