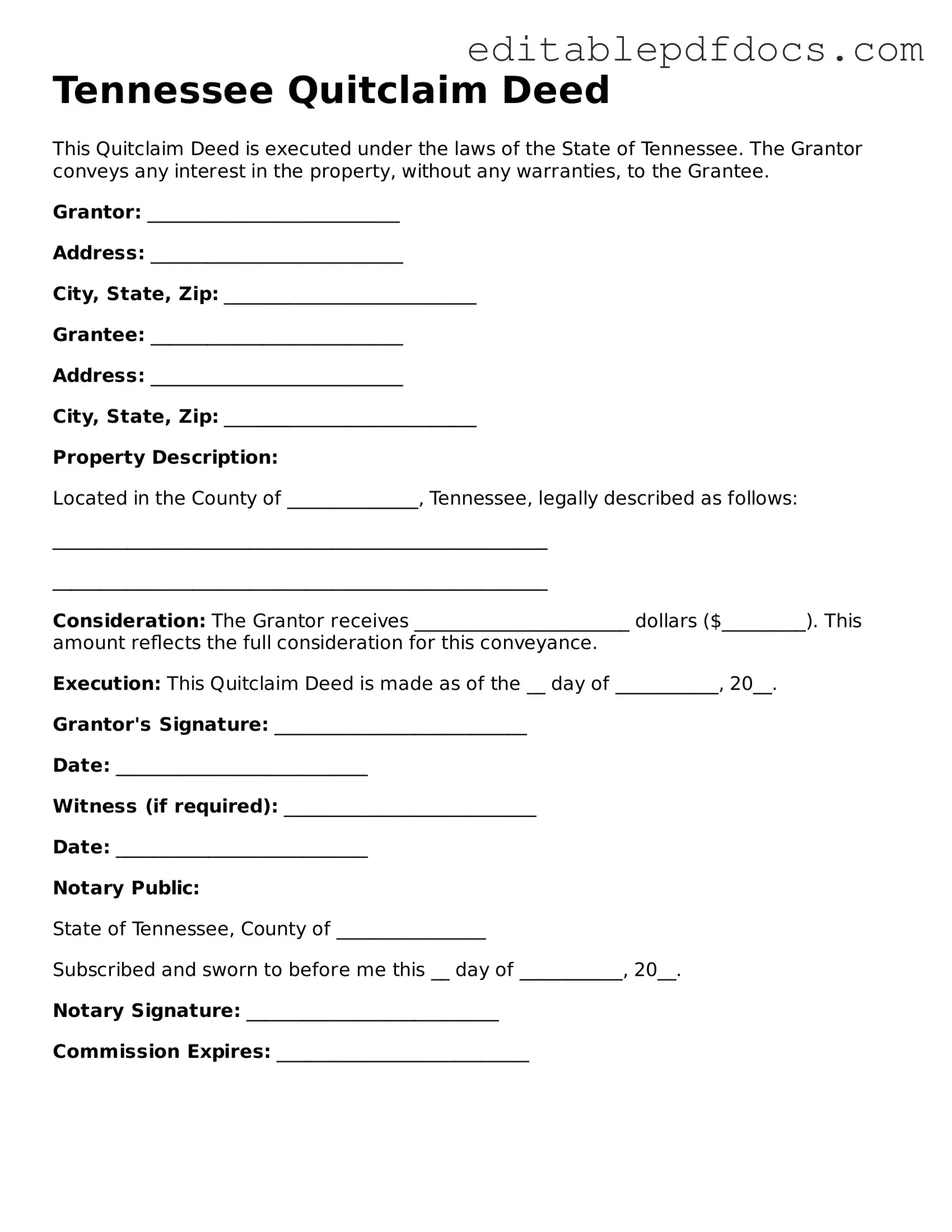

Quitclaim Deed Document for Tennessee

The Tennessee Quitclaim Deed form serves as a vital tool for property transfers, allowing individuals to convey their interest in real estate without making any guarantees about the title's validity. This form is particularly useful in situations where the grantor may not be able to provide a warranty deed, such as between family members or in divorce settlements. By using a quitclaim deed, the grantor relinquishes their claim to the property, while the grantee receives whatever interest the grantor had, if any. It’s important to note that this type of deed does not protect the grantee from potential claims by other parties. To ensure a smooth transfer, the form must be completed accurately, signed by the grantor, and notarized. After execution, the deed should be recorded with the local county register of deeds to provide public notice of the transfer. Understanding these key aspects will help individuals navigate the process effectively, whether they are transferring property as part of a settlement or simply changing ownership among family members.

File Information

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed transfers ownership interest in property without guaranteeing the title. |

| Governing Law | Tennessee Code Annotated § 66-5-201 governs quitclaim deeds in Tennessee. |

| Usage | Commonly used to transfer property between family members or in divorce settlements. |

| Title Guarantee | Offers no warranty on the title; the grantee accepts the property "as is." |

| Execution Requirements | Must be signed by the grantor and notarized to be legally binding. |

| Recording | Should be recorded with the county register of deeds to provide public notice. |

| Tax Implications | May have tax implications; consult a tax advisor for specific situations. |

| Revocation | A quitclaim deed cannot be revoked once executed without mutual consent. |

Dos and Don'ts

When filling out the Tennessee Quitclaim Deed form, it is important to follow specific guidelines to ensure accuracy and legality. Here are five things you should and shouldn't do:

- Do: Provide complete and accurate information for both the grantor and grantee.

- Do: Clearly describe the property being transferred, including the legal description.

- Do: Sign the document in the presence of a notary public.

- Don't: Leave any sections of the form blank; incomplete forms may be rejected.

- Don't: Forget to check local recording requirements; each county may have specific rules.

Documents used along the form

When dealing with property transfers in Tennessee, using a Quitclaim Deed is often just one part of the process. Several other forms and documents can be essential for ensuring a smooth transaction. Here’s a list of commonly used forms that accompany the Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. It provides more protection to the buyer than a Quitclaim Deed.

- Title Search Report: A report that outlines the legal ownership of a property. It helps identify any liens or claims against the property before the transfer.

- Property Transfer Tax Form: This form is often required to report the transfer of property for tax purposes. It ensures that all applicable taxes are paid at the time of transfer.

- Affidavit of Title: A sworn statement by the seller affirming their ownership of the property and disclosing any known issues. This adds an extra layer of assurance for the buyer.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including price and conditions. It serves as a legal agreement between the buyer and seller.

- Florida Marriage Application Form: It is essential to obtain this form when planning to marry in Florida, as it serves as the first step in legalizing the union. Couples must see the document to understand the necessary details required for obtaining a marriage license.

- Property Disclosure Statement: A document where the seller reveals any known issues with the property. It helps buyers make informed decisions about their purchase.

- Closing Statement: A summary of the financial aspects of the transaction, detailing all costs and payments. This document is typically reviewed at the closing of the sale.

- Power of Attorney: This form allows someone to act on behalf of another person in legal matters, including signing documents related to the property transfer.

Using these documents in conjunction with the Quitclaim Deed can help ensure a clear and legally sound property transfer. Each form plays a crucial role in protecting the interests of both the buyer and seller throughout the process.

Consider Some Other Quitclaim Deed Templates for US States

How to Do a Quick Claim Deed - This type of deed does not affect the outstanding mortgages on the property.

For those looking to understand the nuances of vehicle sales in New York, the New York MV-51 form is essential. Specifically tailored for vehicles from 1972 or older, or any non-titled cars, this document is mandated by the New York State Department of Motor Vehicles (DMV) to certify the sale or transfer of such vehicles. It acts as an official record of the sale by private sellers, excluding dealers, and must be paired with supporting bills of sale that confirm the ownership history without modifications. Prospective buyers should also be aware of the critical step of checking for liens against the vehicle at their County Clerk’s Office prior to completing the transaction. For additional guidance, you can access the relevant form at nyforms.com/new-york-mv51-template/.

Washington State Quit Claim Deed - The absence of warranties makes it crucial for grantees to research before accepting a Quitclaim Deed.

Warranty Deed - This document provides a straightforward method for property transfers.

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and will defend that title against any claims. Unlike a quitclaim deed, a warranty deed offers more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership but provides fewer guarantees. It assures that the seller has not sold the property to anyone else and that the property is free of undisclosed encumbrances.

- Doctors Excuse Note: This essential document, provided by healthcare professionals, validates a patient's medical condition and their need for time away from work or school. More information can be obtained from Fillable Forms.

- Deed of Trust: This document involves three parties: the borrower, the lender, and a trustee. It secures a loan by transferring the property title to the trustee until the borrower repays the loan, unlike a quitclaim deed, which transfers ownership without any loan obligations.

- Lease Agreement: While not a deed, a lease allows a person to use a property for a specified time in exchange for rent. A quitclaim deed transfers ownership, while a lease maintains the original owner's title.

- Life Estate Deed: This deed grants someone the right to use a property for their lifetime, after which the property passes to another person. Unlike a quitclaim deed, it establishes a future interest for another party.

- Partition Deed: This document is used when co-owners of a property want to divide their interests. It formalizes the separation of ownership, whereas a quitclaim deed simply transfers the seller's interest without division.

Common mistakes

Filling out a Tennessee Quitclaim Deed form can be a straightforward process, but mistakes can lead to complications in property transfer. One common error is failing to include all necessary parties involved in the transaction. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. Omitting one of these parties can render the deed ineffective.

Another frequent mistake is neglecting to provide a legal description of the property. A vague or incomplete description can create confusion about what property is being transferred. It is essential to include the full and accurate legal description, which can typically be found in previous deeds or property tax records.

Many individuals also overlook the requirement for notarization. A Quitclaim Deed must be signed in the presence of a notary public to be legally valid. Without this step, the deed may not be recognized by the county register or other authorities, leading to potential disputes.

Incorrectly stating the date of the transaction is another pitfall. The date must reflect when the grantor signed the deed. A wrong date can complicate matters, especially if there are subsequent transactions or legal proceedings related to the property.

Failing to record the Quitclaim Deed with the appropriate county office is a critical mistake. Recording the deed protects the new owner's interest in the property and provides public notice of the transfer. If the deed is not recorded, the grantee may face challenges in proving ownership.

Another mistake involves not considering potential tax implications. Individuals may forget to consult with a tax advisor regarding any taxes that may arise from the transfer of property. Understanding these implications can help avoid unexpected financial burdens in the future.

Using outdated or incorrect forms can lead to errors as well. It is vital to ensure that the latest version of the Quitclaim Deed form is used. Using an old version may result in missing information or outdated requirements that could invalidate the deed.

Lastly, many people fail to keep copies of the completed deed for their records. Retaining a copy is important for future reference and can be crucial if any disputes arise regarding ownership or the terms of the transfer.