Promissory Note Document for Tennessee

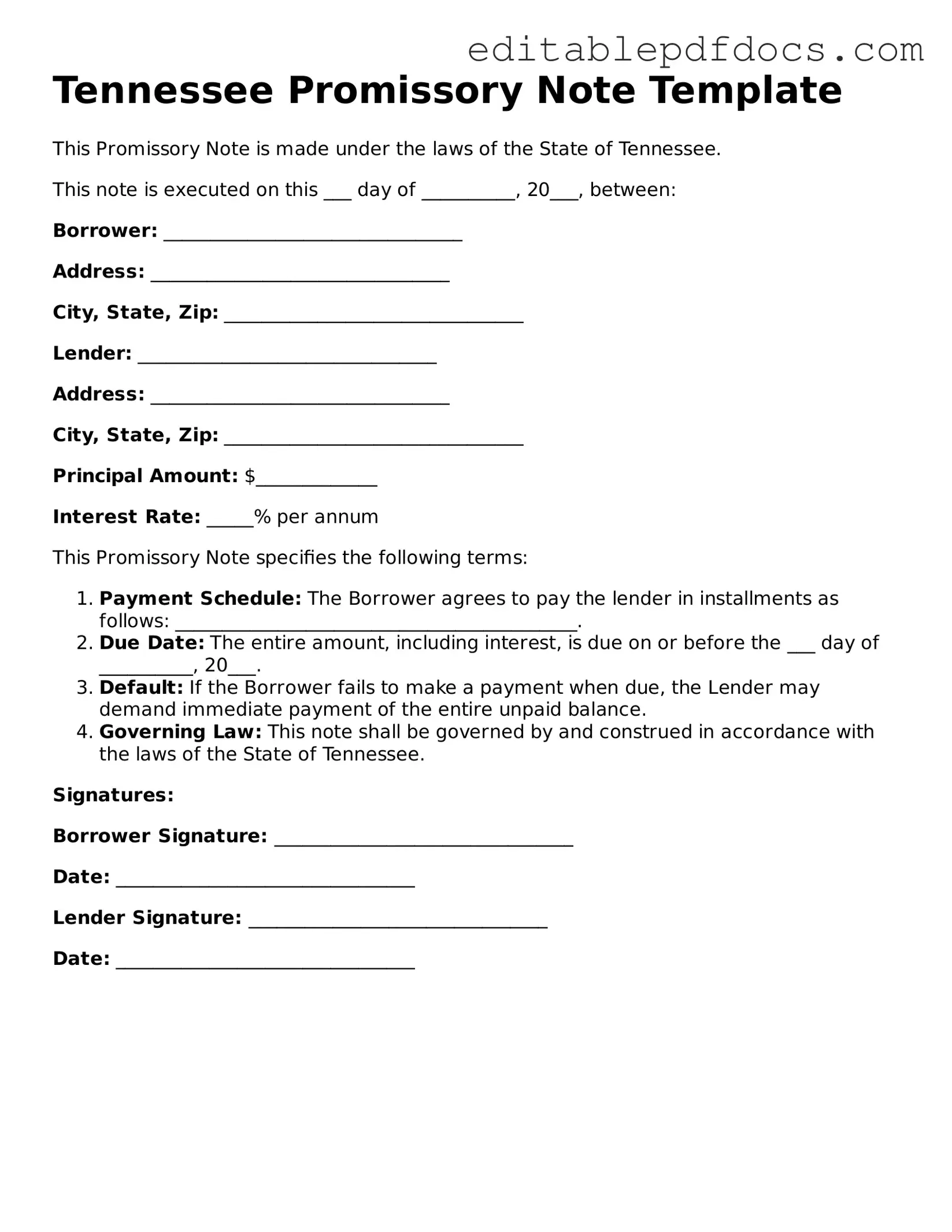

When navigating the world of personal and business finance, understanding the tools available for borrowing and lending is crucial. One such tool is the Tennessee Promissory Note form, a straightforward yet powerful document that outlines the terms of a loan agreement between a borrower and a lender. This form serves several key purposes: it specifies the principal amount borrowed, the interest rate applicable, and the repayment schedule. Additionally, it addresses what happens in the event of a default, providing both parties with clarity and protection. The Tennessee Promissory Note is designed to be user-friendly, allowing individuals and businesses alike to formalize their financial arrangements without unnecessary complexity. By laying out the rights and responsibilities of each party, this form fosters trust and transparency, making it a vital component of responsible financial practices in Tennessee.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Tennessee Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Tennessee Promissory Note is governed by the Tennessee Uniform Commercial Code (UCC), specifically Title 47, Chapter 3. |

| Interest Rate | The interest rate on the note can be fixed or variable, but it must be clearly stated in the document. |

| Signatures | Both the borrower and lender must sign the note for it to be legally binding. |

Dos and Don'ts

When filling out the Tennessee Promissory Note form, it is essential to ensure accuracy and clarity. Here are some important dos and don'ts to consider:

- Do provide accurate information regarding the borrower and lender.

- Do clearly state the loan amount and interest rate.

- Do specify the repayment terms, including the due date.

- Do include any collateral details if applicable.

- Don't leave any sections blank; all fields must be completed.

- Don't use vague language; be precise in your terms.

- Don't forget to sign and date the document.

Following these guidelines will help ensure that the promissory note is valid and enforceable. Careful attention to detail can prevent misunderstandings in the future.

Documents used along the form

When entering into a loan agreement in Tennessee, the Promissory Note is a crucial document. However, it is often accompanied by other forms and documents that help clarify the terms of the loan and protect the interests of both parties involved. Below is a list of commonly used documents that you may encounter alongside the Tennessee Promissory Note.

- Loan Agreement: This document outlines the specific terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets being used as security. It establishes the lender's rights to the collateral in the event of default.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and other financial terms. It ensures that the borrower fully understands the financial implications of the loan.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the loan if the borrowing entity defaults, providing additional security for the lender.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components over the life of the loan. It helps borrowers understand how their payments will affect the outstanding balance over time.

- FedEx Bill of Lading - This vital shipping document, which can be found at topformsonline.com/, outlines the details of a freight shipment and establishes the carrier's responsibility for the goods.

- Default Notice: Should the borrower fail to meet the terms of the loan, this document serves as a formal notification of default. It outlines the steps that will be taken by the lender to recover the owed amount.

Having these documents in place can create a clearer understanding between the lender and borrower, reducing the likelihood of disputes in the future. Each document plays a vital role in ensuring that both parties are protected and informed throughout the loan process.

Consider Some Other Promissory Note Templates for US States

Washington Promissory Note - It’s important to keep a copy of the signed promissory note for records.

For those looking to understand their obligations when transferring ownership, the important New Jersey Motorcycle Bill of Sale document outlines the specifics needed for a seamless process. You can find more information in the clear motorcycle bill of sale requirements to ensure compliance with state laws.

Promissory Note Florida - The Promissory Note may refer to any existing collateral agreements.

Promissory Note Template Arizona - It is advisable to seek legal advice if uncertain about the terms of a promissory note.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of borrowing money, including repayment schedules and interest rates.

- IOU (I Owe You): An informal document acknowledging a debt, an IOU serves a similar purpose to a promissory note but lacks detailed terms.

- Mortgage: A mortgage is a secured loan for purchasing property, where the property itself serves as collateral, similar to how a promissory note can be secured.

- Bill of Sale: This document is crucial for the transfer of ownership of personal property. It includes essential details about the buyer, seller, and item sold, ensuring clarity and proper documentation. For templates and resources, you can access Fillable Forms.

- Security Agreement: This document details the collateral backing a loan, akin to how a promissory note may specify the assets tied to the debt.

- Installment Agreement: This outlines a plan for repaying a debt in installments, much like the structured payments in a promissory note.

- Credit Agreement: This document defines the terms under which credit is extended, similar to the terms set forth in a promissory note.

- Repayment Plan: A repayment plan lays out how a borrower will pay back a loan, which is a key feature of a promissory note.

- Lease Agreement: While primarily for renting property, a lease can include payment terms that resemble those in a promissory note.

- Personal Guarantee: This document involves a third party agreeing to repay a debt if the borrower defaults, similar to the obligations in a promissory note.

- Debt Settlement Agreement: This outlines the terms for settling a debt for less than the full amount, sharing similarities in negotiation and repayment terms with a promissory note.

Common mistakes

When filling out the Tennessee Promissory Note form, individuals often make several common mistakes that can lead to confusion or legal issues. One frequent error is the omission of essential information. This includes not providing the full names and addresses of both the borrower and the lender. Accurate identification is crucial for the enforceability of the note.

Another common mistake involves incorrect amounts. Borrowers sometimes miscalculate the principal amount or fail to specify the interest rate. It is important to ensure that the figures are accurate and clearly stated to avoid disputes in the future.

People also tend to overlook the importance of the repayment terms. Failing to specify the payment schedule, including due dates and the frequency of payments, can lead to misunderstandings. Clear terms help both parties understand their obligations and expectations.

Signatures are another area where mistakes occur. Some individuals forget to sign the document or do not have the required witnesses or notarization, depending on the situation. A signature is a critical component that validates the agreement.

Additionally, individuals may neglect to review the entire document before submission. Skimming through the terms can lead to overlooking clauses that may be unfavorable. It is advisable to read the note thoroughly to ensure all terms are understood.

Lastly, not keeping a copy of the signed Promissory Note is a mistake that can have significant consequences. Both parties should retain a copy for their records. This can provide important evidence in case of a dispute regarding the loan.