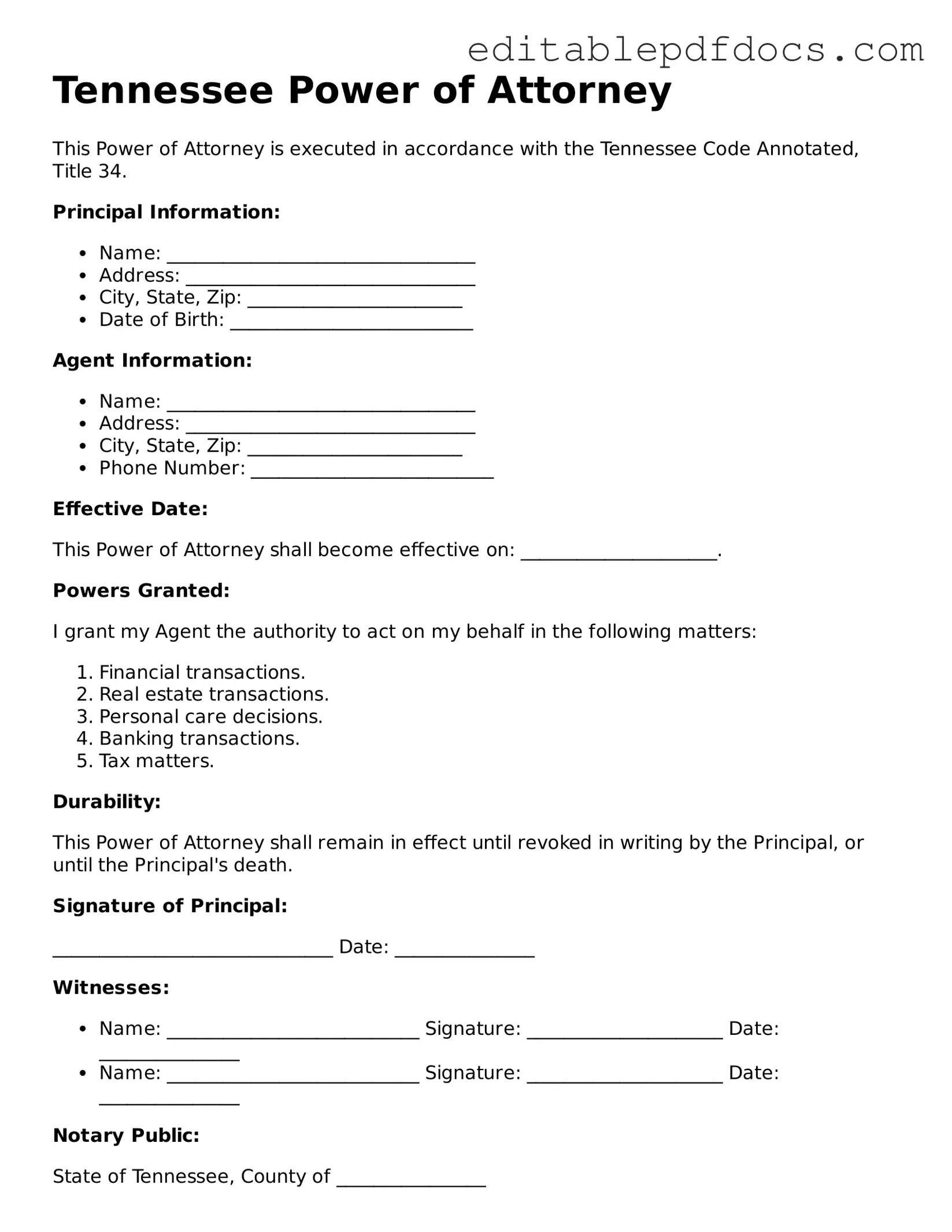

Power of Attorney Document for Tennessee

In Tennessee, a Power of Attorney (POA) form is a crucial legal document that allows one person to grant another the authority to act on their behalf in various matters, including financial decisions, medical care, and property management. This form is particularly important for individuals who may become incapacitated or wish to ensure their affairs are handled according to their wishes when they cannot do so themselves. The POA can be tailored to be either general, granting broad powers, or specific, limited to certain tasks or timeframes. Additionally, the document requires clear identification of both the principal—the person granting the authority—and the agent—the person receiving it. It is essential for the principal to choose someone they trust, as this person will have significant control over their financial and personal affairs. Understanding the nuances of the Tennessee Power of Attorney form can provide peace of mind and safeguard your interests, making it a vital step in responsible planning for the future.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | The Tennessee Power of Attorney is governed by the Tennessee Code Annotated, Title 34, Chapter 6. |

| Types | There are different types of POAs in Tennessee, including durable, springing, and medical POAs. |

| Durability | A durable POA remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke a Power of Attorney at any time, as long as they are mentally competent. |

Dos and Don'ts

When filling out the Tennessee Power of Attorney form, there are several important steps to follow and common mistakes to avoid. Below is a list of things you should and shouldn't do.

- Do ensure that you clearly identify the principal and the agent.

- Do specify the powers being granted to the agent.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the signed document for your records.

- Don't leave any sections of the form blank.

- Don't grant powers that you are not comfortable with.

- Don't forget to date the form when signing.

- Don't assume the form is valid without proper notarization.

Documents used along the form

When creating a Power of Attorney in Tennessee, several other documents may be useful to ensure that your wishes are clearly stated and legally recognized. Here’s a list of common forms and documents that often accompany a Power of Attorney.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment in case you become unable to communicate those wishes yourself.

- Living Will: A living will specifies your desires regarding life-sustaining treatments in situations where you may be terminally ill or in a persistent vegetative state.

- Durable Power of Attorney for Healthcare: Similar to a general Power of Attorney, this document specifically grants someone the authority to make healthcare decisions on your behalf.

- Financial Power of Attorney: This form allows someone to handle your financial matters, including banking and real estate transactions, in addition to the general Power of Attorney.

- Will: A will outlines how you want your assets distributed after your death. It can work alongside a Power of Attorney for comprehensive estate planning.

- Trust Document: A trust can manage your assets during your lifetime and after your death, providing an alternative to a Power of Attorney for financial matters.

- Texas Motor Vehicle Bill of Sale: This form is essential for documenting the ownership transfer of vehicles in Texas, ensuring that both the seller and buyer have a clear record of the transaction. More information can be found at https://topformsonline.com/.

- HIPAA Release Form: This document allows designated individuals to access your medical records and health information, which can be crucial when making healthcare decisions.

- Property Deed: If you wish to transfer property ownership, a property deed may be necessary. It can complement your Power of Attorney by specifying property management authority.

These documents can help clarify your intentions and ensure that your needs are met, especially in difficult situations. It’s important to consider each one carefully and consult with a professional if needed.

Consider Some Other Power of Attorney Templates for US States

Power of Attorney in Pa After Death - With this document, a designated agent can pay your bills and manage your finances.

Understanding the Notice to Quit form is crucial for landlords and tenants alike, as it outlines the necessary steps in the eviction process. For those seeking a reliable template to navigate this important legal requirement, you can find one at https://nyforms.com/notice-to-quit-template, ensuring that all legal obligations are met adequately and properly.

Power of Attorney Form Arizona Free - It enables someone you trust to handle medical decisions if you’re unable to express your wishes.

Similar forms

- Living Will: A living will outlines your medical preferences in case you become incapacitated. Like a Power of Attorney, it allows you to designate someone to make decisions on your behalf, but it specifically focuses on healthcare choices.

- Employment Verification Form: This document is essential for confirming a job applicant's history and credentials, including job title and dates of employment. To easily access and fill out this form, check out Fillable Forms.

- Healthcare Proxy: This document appoints someone to make medical decisions for you when you cannot. Similar to a Power of Attorney, a healthcare proxy ensures that your health-related wishes are honored, but it is limited to medical matters.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if you become incapacitated. It provides ongoing authority to your agent, ensuring that your financial and legal matters are managed seamlessly.

- Financial Power of Attorney: This document grants someone the authority to handle your financial affairs. It is similar to a general Power of Attorney but focuses solely on financial transactions and decisions.

- Trust Agreement: A trust agreement allows you to transfer assets to a trustee who manages them for your benefit or the benefit of others. While a Power of Attorney appoints someone to act on your behalf, a trust agreement is more about asset management and distribution.

- Will: A will outlines how your assets should be distributed after your death. While a Power of Attorney is effective during your lifetime, a will takes effect posthumously, ensuring your wishes are carried out regarding your estate.

Common mistakes

Filling out a Power of Attorney (POA) form in Tennessee can be a straightforward process, but many individuals make mistakes that can lead to complications. One common error is failing to clearly identify the principal and the agent. The principal is the person granting authority, while the agent is the one receiving it. If names are misspelled or not fully written out, it can create confusion and legal issues down the line.

Another mistake occurs when individuals neglect to specify the powers granted to the agent. The form allows for broad or limited powers, but without clear definitions, the agent may not have the authority needed to act effectively. This can lead to delays or even disputes among family members or other parties involved.

People often overlook the importance of witnessing and notarization. In Tennessee, a POA must be signed in the presence of a notary public. If this step is skipped, the document may not be considered valid. Even if the form is filled out correctly, lacking proper signatures can render it useless.

Additionally, individuals sometimes fail to date the document. A POA without a date can lead to questions about its validity, especially if there are changes in circumstances or if the principal becomes incapacitated. Always include the date of signing to avoid any potential challenges.

Another frequent oversight is not considering the durability of the Power of Attorney. A durable POA remains effective even if the principal becomes incapacitated. If the form does not specify that it is durable, it may terminate upon the principal's incapacity, which can defeat its purpose.

Many people also forget to communicate their intentions with their chosen agent. It’s vital for the agent to understand their responsibilities and the principal's wishes. Without this communication, the agent may not act in accordance with the principal’s desires, leading to unintended consequences.

Lastly, individuals sometimes fail to update their POA after significant life events, such as marriage, divorce, or the death of a chosen agent. Life changes can affect the appropriateness of the designated agent or the powers granted. Regularly reviewing and updating the POA ensures it reflects the current situation and intentions of the principal.