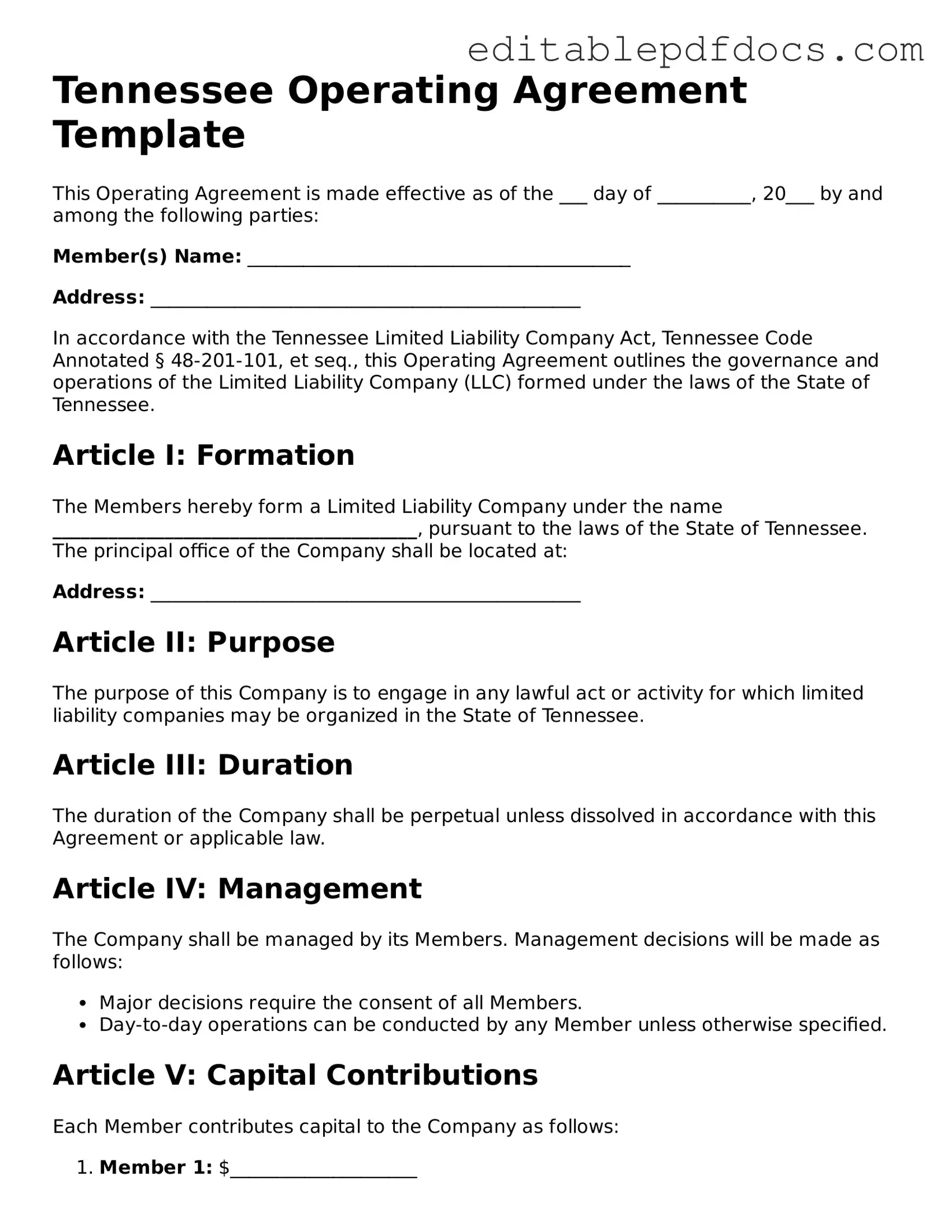

Operating Agreement Document for Tennessee

In Tennessee, the Operating Agreement form serves as a crucial document for Limited Liability Companies (LLCs), outlining the internal structure and operating procedures of the business. This agreement is not mandated by state law, yet it is highly recommended for all LLCs to establish clear guidelines and expectations among members. Key aspects of the form include the definition of ownership percentages, the distribution of profits and losses, and the roles and responsibilities of each member. Additionally, it addresses decision-making processes, voting rights, and procedures for adding or removing members. The Operating Agreement also provides a framework for resolving disputes, ensuring that all members have a clear understanding of how to navigate potential conflicts. By setting these parameters, the agreement fosters transparency and stability within the LLC, ultimately contributing to its long-term success.

File Information

| Fact Name | Description |

|---|---|

| Definition | The Tennessee Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Tennessee. |

| Governing Law | This agreement is governed by the Tennessee Limited Liability Company Act, specifically Title 48, Chapter 249 of the Tennessee Code Annotated. |

| Purpose | It serves to clarify the roles and responsibilities of members and managers, helping to prevent disputes among LLC members. |

| Flexibility | Tennessee law allows for a high degree of flexibility in how the agreement is structured, accommodating various business needs and preferences. |

| Not Mandatory | While it's highly recommended, an Operating Agreement is not legally required in Tennessee for LLCs, but it is beneficial for establishing clear guidelines. |

| Member Contributions | The agreement typically includes details on member contributions, outlining what each member brings to the LLC, whether it's cash, property, or services. |

| Amendments | Members can amend the Operating Agreement as needed, provided that the process for making changes is outlined within the document itself. |

Dos and Don'ts

When filling out the Tennessee Operating Agreement form, there are several important guidelines to follow. Here is a list of things to do and avoid:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do consult with a legal professional if you have questions.

- Do ensure all members sign the agreement.

- Don't leave any required fields blank.

- Don't use vague language or terms that could be misinterpreted.

Documents used along the form

When forming a Limited Liability Company (LLC) in Tennessee, the Operating Agreement is a crucial document that outlines the management structure and operating procedures. However, several other forms and documents are often used alongside it to ensure compliance and facilitate smooth operations. Here’s a look at some of these important documents.

- Articles of Organization: This is the foundational document that officially establishes your LLC with the state. It includes basic information such as the name of the LLC, its purpose, and the registered agent's details.

- Bylaws: While not always required, bylaws provide a detailed framework for the internal governance of your LLC. They cover aspects such as voting rights, meeting procedures, and the roles of members and managers.

- Member Consent Forms: These forms are used to document the agreement of members on important decisions, especially in cases where unanimous consent is needed. They help ensure that all members are on the same page.

- Doctors Excuse Note: This form is essential for individuals who need to present proof of medical conditions and time off from work or school. For easy access, consider using Fillable Forms to obtain this document.

- Operating Procedures: This document outlines the day-to-day operations of the LLC. It can include processes for handling finances, decision-making, and member responsibilities.

- Membership Certificates: Issuing membership certificates can provide tangible proof of ownership in the LLC. These certificates can be important for internal record-keeping and for members to have a clear understanding of their stake.

- Tax Forms: Depending on your LLC's structure, you may need to file specific tax forms with the IRS and state tax authorities. These forms help ensure compliance with tax obligations.

- Employment Agreements: If your LLC has employees, these agreements outline the terms of employment, including job responsibilities, compensation, and benefits. They help establish clear expectations for both parties.

- Financial Statements: Regular financial statements are essential for tracking the LLC's performance. These documents include balance sheets, income statements, and cash flow statements, providing insights into the company’s financial health.

- Annual Reports: Many states, including Tennessee, require LLCs to file annual reports. These documents provide updated information about the LLC and help maintain good standing with the state.

Having these documents in place not only helps in managing your LLC effectively but also ensures that you are compliant with state regulations. Each document plays a unique role in supporting the structure and operations of your business. Stay organized, and you’ll set your LLC up for success!

Consider Some Other Operating Agreement Templates for US States

How Do I Create an Operating Agreement for My Llc - It can outline how to handle changes in the ownership of the LLC.

This Transfer-on-Death Deed serves as a crucial element in New Jersey’s estate planning toolkit, enabling individuals to efficiently manage the transition of their property. For more details, visit the comprehensive guide on Transfer-on-Death Deed processes.

Does California Require an Operating Agreement for an Llc - It can specify how the business will be dissolved if necessary.

Operating Agreement Llc Florida - An Operating Agreement can outline the mission and values of the business.

Similar forms

The Operating Agreement is a crucial document for limited liability companies (LLCs). It outlines the management structure and operating procedures of the business. Several other documents share similarities with the Operating Agreement in terms of purpose and function. Below is a list of seven such documents:

- Bylaws: Similar to an Operating Agreement, bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting protocols, and voting procedures.

- Vehicle Bill of Sale: This document documents the transaction of vehicle ownership. Similar to the New York MV-51 form, it is important for certifying the sale of vehicles, especially when dealing with older models. For more information on the MV-51 form, refer to nyforms.com/new-york-mv51-template.

- Partnership Agreement: This document outlines the rights and responsibilities of partners in a partnership, similar to how an Operating Agreement defines the roles of members in an LLC.

- Shareholder Agreement: This agreement is used by corporations to manage the relationship between shareholders, covering aspects like share transfer, voting rights, and dispute resolution, akin to the member relations in an Operating Agreement.

- Joint Venture Agreement: This document governs the collaboration between two or more parties on a specific project, detailing contributions and profit-sharing, much like an Operating Agreement outlines contributions and distributions among LLC members.

- Franchise Agreement: This agreement establishes the terms between a franchisor and franchisee, detailing operational guidelines and support, similar to how an Operating Agreement provides operational structure for an LLC.

- Employment Agreement: This document defines the terms of employment between an employer and employee, including duties and compensation, which parallels the way an Operating Agreement defines member roles and responsibilities.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can include terms about how business operations are conducted, similar to the confidentiality clauses often found in an Operating Agreement.

Common mistakes

When filling out the Tennessee Operating Agreement form, individuals often overlook critical details that can lead to complications down the road. One common mistake is failing to specify the management structure of the business. It's essential to clarify whether the company will be managed by its members or by appointed managers. Without this information, the agreement may create confusion about who is responsible for decision-making.

Another frequent error involves neglecting to outline the financial contributions of each member. The agreement should detail how much each member is investing in the business. Omitting this information can lead to disputes over ownership percentages and profit distribution later on. Clarity in financial contributions helps prevent misunderstandings and ensures that all members are on the same page.

People also sometimes forget to include provisions for resolving disputes. An Operating Agreement should contain a clear process for handling conflicts among members. Without this, disagreements can escalate, potentially harming the business and its relationships. Including a method for conflict resolution can save time, money, and emotional strain in the future.

Additionally, individuals may not update the Operating Agreement as the business evolves. Changes in membership, management, or business goals necessitate revisions to the agreement. Failing to keep the document current can lead to complications, especially if a member leaves or new members join. Regularly reviewing and updating the agreement is crucial for maintaining its relevance.

Lastly, some people underestimate the importance of legal compliance. Each state has specific laws governing Operating Agreements, and Tennessee is no exception. Ignoring these regulations can result in an invalid agreement, leaving the business vulnerable to legal challenges. Consulting with a legal professional to ensure compliance can provide peace of mind and protect the business's interests.