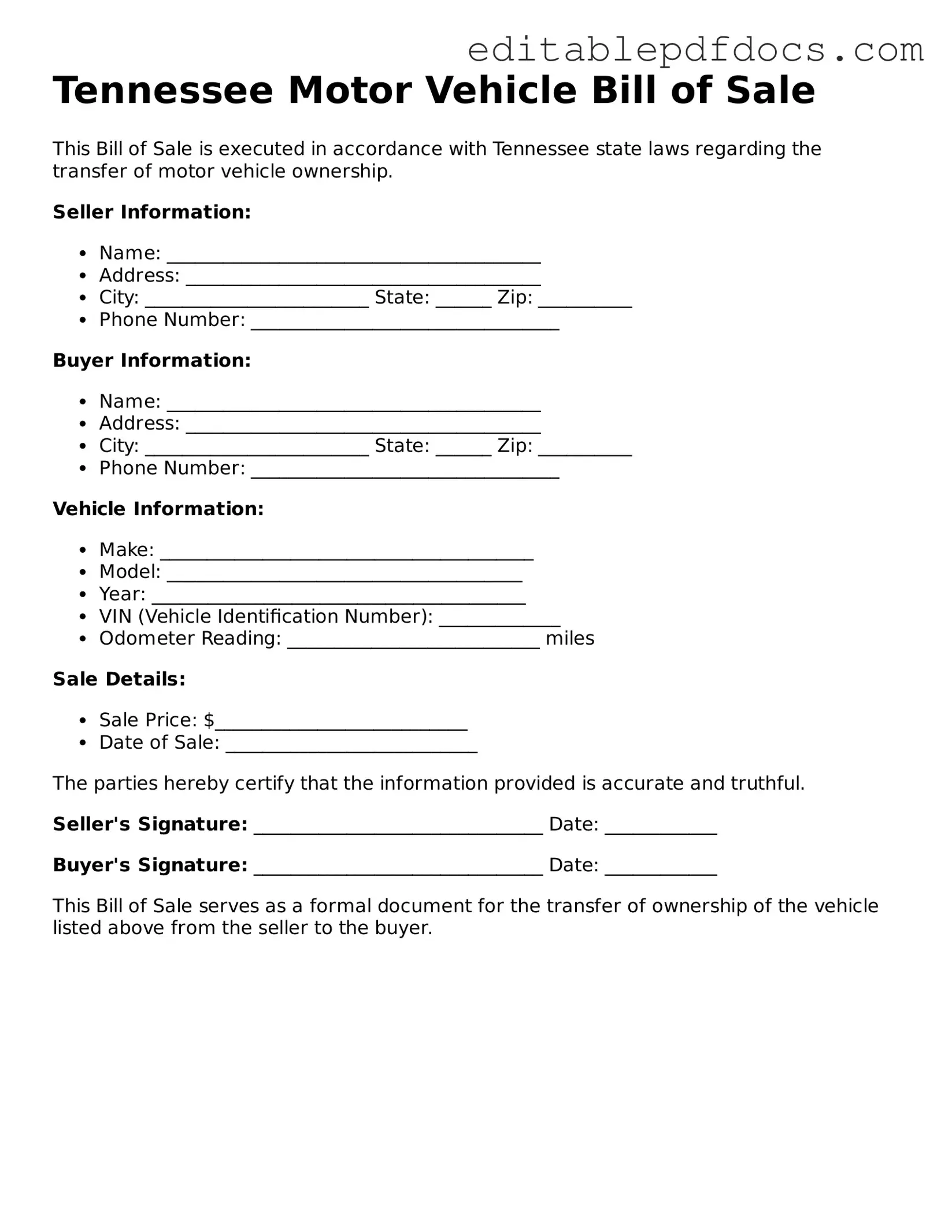

Motor Vehicle Bill of Sale Document for Tennessee

The Tennessee Motor Vehicle Bill of Sale form is an essential document for anyone involved in the buying or selling of a vehicle in the state. This form serves as a legal record of the transaction, providing crucial details such as the names and addresses of both the buyer and seller, a description of the vehicle, and the sale price. It also includes important information about the vehicle's identification number (VIN) and odometer reading at the time of sale. By completing this form, both parties can ensure that their rights are protected and that the transfer of ownership is properly documented. Additionally, the Bill of Sale may be required for vehicle registration and title transfer, making it a vital step in the process. Understanding the significance of this form can help facilitate a smooth transaction, allowing both buyers and sellers to feel confident in their dealings.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Tennessee Motor Vehicle Bill of Sale form is used to document the sale or transfer of ownership of a vehicle between a seller and a buyer. |

| Governing Law | This form is governed by Tennessee Code Annotated, Title 55, Chapter 3, which outlines vehicle registration and titling requirements. |

| Required Information | Essential details include the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price. |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction, ensuring both parties agree to the terms. |

| Notarization | While notarization is not mandatory, having the form notarized can provide additional legal protection for both parties. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Usage for Title Transfer | The completed Bill of Sale is often required when applying for a new title at the local Department of Motor Vehicles (DMV). |

Dos and Don'ts

When filling out the Tennessee Motor Vehicle Bill of Sale form, attention to detail is crucial. Here are some guidelines to help ensure the process goes smoothly.

- Do: Provide accurate information about the vehicle, including make, model, year, and VIN.

- Do: Include the names and addresses of both the buyer and the seller.

- Do: Clearly state the purchase price to avoid any misunderstandings later.

- Do: Sign and date the form to validate the transaction.

- Don't: Leave any fields blank; incomplete information can lead to complications.

- Don't: Use white-out or other correction methods on the form; it’s best to start over if mistakes occur.

- Don't: Forget to keep a copy of the completed form for your records.

Following these dos and don’ts will help facilitate a smooth transaction and ensure that all necessary information is correctly documented.

Documents used along the form

The Tennessee Motor Vehicle Bill of Sale form is an essential document for transferring ownership of a vehicle. However, several other forms and documents often accompany this transaction to ensure a smooth and legal transfer. Below are some commonly used documents that complement the bill of sale.

- Title Transfer Document: This document officially transfers the title of the vehicle from the seller to the buyer. It includes details such as the vehicle identification number (VIN), the names of both parties, and their signatures.

- New York DTF-84 Form: Essential for individuals needing to request state tax records, this form allows authorized persons to access important tax information and can be found at nyforms.com/new-york-dtf-84-template/.

- Odometer Disclosure Statement: Required for most vehicle sales, this statement records the vehicle's mileage at the time of sale. It helps prevent fraud by ensuring that the odometer reading is accurate.

- Application for Title: This form is submitted to the local Department of Motor Vehicles (DMV) to obtain a new title in the buyer's name. It typically requires information from the bill of sale and the previous title.

- Sales Tax Form: This document is used to report and pay any applicable sales tax on the vehicle purchase. It provides the necessary information for the state to calculate the tax owed based on the sale price.

Using these documents alongside the Tennessee Motor Vehicle Bill of Sale ensures that all aspects of the vehicle transfer are properly handled. This not only protects both parties but also simplifies the process of registering the vehicle with the state.

Consider Some Other Motor Vehicle Bill of Sale Templates for US States

Georgia Trailer Bill of Sale - Encourages thorough communication about the vehicle between both parties.

It is essential for landlords and tenants to familiarize themselves with the Ohio Residential Lease Agreement, which can be accessed at https://topformsonline.com/, as it helps to clarify the terms and conditions of their rental relationship and ensures both parties are aware of their rights and obligations.

Bill of Sale Template - This form helps document the transaction’s date, essential for record-keeping and tax purposes.

Free Automobile Bill of Sale Template - Includes the date of sale for record-keeping purposes.

What Does a Bill of Sale Look Like - Documents any contingencies that may need to be satisfied before sale completion.

Similar forms

- Real Estate Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this document transfers ownership of property. It includes details about the property, the buyer, and the seller, ensuring a clear record of the transaction.

- Boat Bill of Sale: This document serves a similar purpose for watercraft. It outlines the specifics of the boat, including its identification number, and confirms the transfer of ownership from seller to buyer.

- Equipment Bill of Sale: Often used in business transactions, this document details the sale of machinery or tools. It specifies the equipment's condition and any warranties, paralleling the vehicle sale process.

- California Vehicle Purchase Agreement: This form is crucial for any vehicle sale in California, ensuring that both parties are aware of their rights and obligations. For those looking for a convenient option, Fillable Forms are available to streamline the process.

- Motorcycle Bill of Sale: This form is tailored for motorcycle transactions. It includes similar elements, such as vehicle identification and buyer-seller information, ensuring a proper transfer of ownership.

- Mobile Home Bill of Sale: This document facilitates the sale of mobile homes. Like the Motor Vehicle Bill of Sale, it provides necessary details about the mobile home and the parties involved in the transaction.

- Aircraft Bill of Sale: This form is used for the sale of aircraft. It captures vital information about the aircraft and the transaction, mirroring the structure and intent of a vehicle bill of sale.

- Trailer Bill of Sale: This document is used for the sale of trailers. It includes details about the trailer, similar to those found in a motor vehicle sale, ensuring clarity in ownership transfer.

Common mistakes

When filling out the Tennessee Motor Vehicle Bill of Sale form, many people make common mistakes that can lead to confusion or delays. One frequent error is not providing all the required information. The form asks for specific details about the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN). Omitting any of this information can result in the form being rejected.

Another mistake involves incorrect VIN entries. The VIN is a unique identifier for each vehicle. If someone accidentally transposes numbers or letters, it can cause issues when registering the vehicle. It is crucial to double-check this information to ensure accuracy.

People often forget to include the purchase price. This detail is important for both the buyer and seller. It affects tax calculations and can impact future transactions involving the vehicle. Leaving this blank can lead to complications down the line.

Additionally, signatures are sometimes missing. Both the buyer and seller must sign the form to validate the transaction. Without these signatures, the document may not be considered legally binding.

Another common oversight is failing to date the form. The date of the transaction is important for record-keeping and legal purposes. Without a date, it may be unclear when the sale took place.

Some individuals also overlook the need for a notary signature. While not always required, having the form notarized can add an extra layer of legitimacy to the transaction. This step can help prevent disputes in the future.

People may also misunderstand the importance of keeping copies of the completed form. After the sale, both parties should retain a copy for their records. This can be helpful if any questions arise later regarding the transaction.

Lastly, failing to follow up on title transfer can be a significant mistake. After completing the Bill of Sale, the buyer must ensure that the title is transferred to their name. Neglecting this step can lead to complications with ownership and registration.