Mobile Home Bill of Sale Document for Tennessee

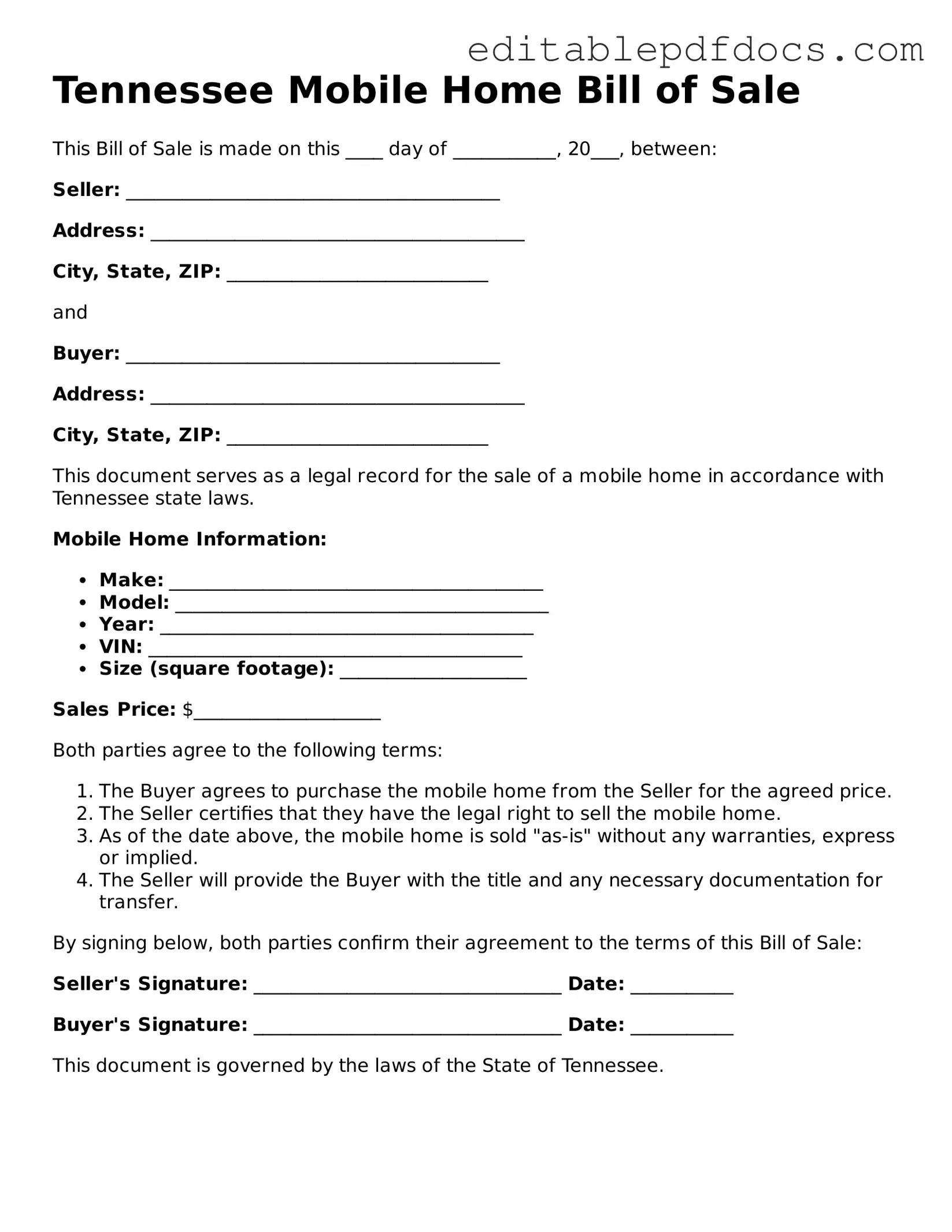

The Tennessee Mobile Home Bill of Sale form serves as a crucial document in the transfer of ownership for mobile homes within the state. This form not only provides a written record of the transaction but also ensures that both the buyer and seller have a clear understanding of their rights and obligations. Essential details such as the names and addresses of both parties, a description of the mobile home—including its make, model, year, and identification number—are included to establish the specific asset being sold. Additionally, the form outlines the purchase price and any terms related to payment, which may include deposits or financing arrangements. Importantly, the Mobile Home Bill of Sale also addresses the transfer of any warranties or representations made by the seller regarding the condition of the mobile home. By completing this form, both parties can protect themselves legally and facilitate a smooth transaction, making it an indispensable tool in the mobile home buying and selling process in Tennessee.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Tennessee Mobile Home Bill of Sale form is used to document the sale of a mobile home between a seller and a buyer. |

| Governing Law | This form is governed by Tennessee state law, specifically under Title 55, Chapter 4 of the Tennessee Code Annotated. |

| Required Information | Both parties must provide their names, addresses, and signatures. The mobile home’s details, including make, model, and VIN, are also necessary. |

| Notarization | While notarization is not mandatory, it is recommended to enhance the document's validity. |

| Transfer of Ownership | The form serves as proof of ownership transfer and may be required for registration with the state. |

| Record Keeping | Both the buyer and seller should keep a copy of the completed Bill of Sale for their records. |

Dos and Don'ts

When filling out the Tennessee Mobile Home Bill of Sale form, it’s essential to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn’t do:

- Do double-check all information for accuracy before submitting the form.

- Do include all required details, such as the buyer's and seller's names, addresses, and signatures.

- Do specify the make, model, year, and identification number of the mobile home.

- Do keep a copy of the completed form for your records.

- Don't leave any blank spaces; if a section doesn’t apply, write "N/A."

- Don't rush through the process; take your time to ensure everything is filled out correctly.

- Don't forget to have the form notarized if required, as this adds an extra layer of authenticity.

By following these guidelines, you can help ensure that your Mobile Home Bill of Sale is completed accurately and efficiently.

Documents used along the form

When buying or selling a mobile home in Tennessee, several other forms and documents may be necessary to ensure a smooth transaction. These documents can help clarify ownership, establish agreements, and protect both parties involved. Below is a list of common forms often used alongside the Tennessee Mobile Home Bill of Sale.

- Title Transfer Form: This document is essential for transferring ownership of the mobile home from the seller to the buyer. It includes details about the mobile home, such as the vehicle identification number (VIN) and the names of both parties.

- Manufacturer's Certificate of Origin (MCO): If the mobile home is new, the MCO serves as proof of ownership from the manufacturer. It is typically required for registration and must be provided to the buyer.

- Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, payment method, and any contingencies. It helps to formalize the agreement between the buyer and seller.

- Inspection Report: An inspection report details the condition of the mobile home. It can be beneficial for buyers to understand any potential issues before finalizing the purchase.

- Affidavit of Affixation: This document may be necessary if the mobile home is being converted from personal property to real property. It certifies that the mobile home is permanently affixed to a foundation.

- Doctors Excuse Note: This form is essential for individuals needing to provide proof of illness. For easy access, refer to Fillable Forms.

- Bill of Sale for Personal Property: If the sale includes personal items or appliances within the mobile home, a separate bill of sale can be used to document these transactions.

- Financing Agreement: If the buyer is financing the purchase, a financing agreement outlines the terms of the loan, including interest rates and payment schedules.

- Warranty Deed: In some cases, a warranty deed may be used to transfer ownership of the land on which the mobile home sits, especially if it is being sold along with the home.

- Tax Certificate: This document verifies that all property taxes related to the mobile home have been paid, ensuring that the buyer will not inherit any tax liabilities.

Having these documents ready can facilitate a smoother transaction and help both parties feel secure in their agreement. It’s always advisable to consult with a legal professional to ensure all necessary paperwork is completed accurately.

Consider Some Other Mobile Home Bill of Sale Templates for US States

Selling a Mobile Home in a Trailer Park - The document may serve as a basis for future discussions about the mobile home’s status.

Bill of Sale for Mobile Home - Ensures all essential details about the mobile home are documented.

State of Florida Bill of Sale - It can also indicate if the mobile home is sold "as-is" or with disclosed issues.

Understanding the nuances of the New York MV-51 form is crucial for anyone involved in the sale or transfer of older vehicles. This form not only acts as a certification of sale but also ensures that the process is transparent and legitimate. For those seeking additional resources or templates related to this document, you can visit nyforms.com/new-york-mv51-template/ to find helpful information that aids in the transaction process.

How to Handwrite a Bill of Sale - Having a Mobile Home Bill of Sale can streamline the process of financing or insuring the mobile home.

Similar forms

-

Vehicle Bill of Sale: Similar to the Mobile Home Bill of Sale, this document transfers ownership of a vehicle from one party to another. It includes details like the vehicle's make, model, year, and Vehicle Identification Number (VIN), along with the seller's and buyer's information.

-

Boat Bill of Sale: This document serves a similar purpose for boats. It outlines the transaction details, including the boat's specifications and the parties involved. Just like with mobile homes, it provides proof of ownership transfer.

- General Bill of Sale: This versatile document can be used for any type of personal property sale, capturing crucial details like buyer and seller information, item description, and price, similar to what you'll find at topformsonline.com/, ensuring clarity and protection for both parties.

-

Real Estate Purchase Agreement: While more complex, this agreement also facilitates the transfer of property ownership. It includes terms of sale, property description, and buyer and seller information, much like the Mobile Home Bill of Sale.

-

Motorcycle Bill of Sale: This document operates similarly to the Vehicle Bill of Sale but is specifically for motorcycles. It captures essential details about the motorcycle and ensures that ownership is officially transferred.

-

Trailer Bill of Sale: Like the Mobile Home Bill of Sale, this form is used to document the sale of a trailer. It includes the trailer's specifications and the parties involved, providing a clear record of the transaction.

Common mistakes

Completing the Tennessee Mobile Home Bill of Sale form requires attention to detail. One common mistake is failing to provide accurate information about the mobile home itself. Buyers and sellers must ensure that the make, model, year, and vehicle identification number (VIN) are correctly listed. An incorrect VIN can lead to complications during registration and ownership transfer.

Another frequent error involves not including the correct names and addresses of both the buyer and seller. Each party’s full legal name and current address must be clearly stated. Omitting or misspelling these details can create confusion and may delay the processing of the sale.

Some individuals neglect to include the purchase price of the mobile home. This figure is essential for tax purposes and should reflect the agreed-upon amount. Leaving this section blank can lead to misunderstandings between the parties involved.

Additionally, failing to sign and date the form is a critical oversight. Both the buyer and seller must provide their signatures to validate the transaction. Without these signatures, the document may not hold up in legal situations.

People often forget to indicate whether the sale includes any personal property. Items such as appliances or furniture should be explicitly listed if they are part of the sale. This clarity helps prevent disputes after the transaction is complete.

Another mistake is not providing a clear description of the mobile home’s condition. Buyers should be aware of any existing issues or repairs needed. A vague description can lead to dissatisfaction and potential legal disputes later on.

Some individuals may also overlook the importance of having witnesses or notarization. While not always required, having a third party sign can add an extra layer of legitimacy to the transaction. This step can be particularly beneficial if any disagreements arise in the future.

Finally, failing to keep a copy of the completed form is a common error. Both parties should retain a copy for their records. This documentation can be crucial for future reference, especially when it comes to title transfers or tax assessments.