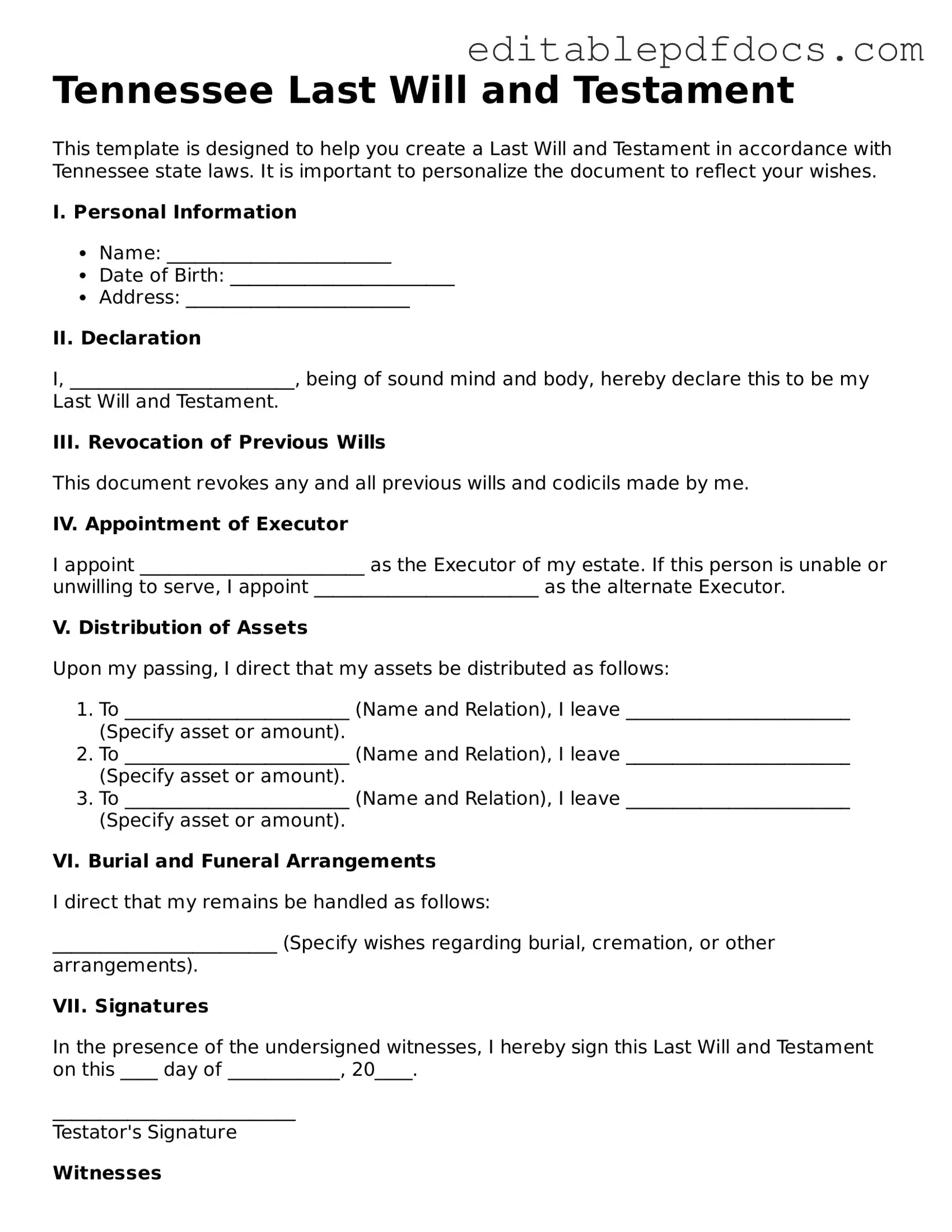

Last Will and Testament Document for Tennessee

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Tennessee, this legal document serves several important functions. It allows individuals to designate beneficiaries for their assets, appoint guardians for minor children, and specify any final wishes regarding burial or cremation. The form is structured to ensure clarity and compliance with state laws, which helps prevent disputes among heirs. A valid will must be signed by the testator, the person making the will, and witnessed by at least two individuals who are not beneficiaries. Additionally, Tennessee recognizes holographic wills, which are handwritten and signed by the testator, offering more flexibility in certain situations. Understanding the components and requirements of the Tennessee Last Will and Testament form is crucial for anyone looking to secure their legacy and provide for their loved ones effectively.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Tennessee Last Will and Testament is governed by Tennessee Code Annotated, Title 32. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Tennessee. |

| Signature Requirement | The testator must sign the will at the end of the document. |

| Witnesses | At least two witnesses must sign the will in the presence of the testator. |

| Holographic Wills | Tennessee recognizes holographic wills, which are handwritten and signed by the testator. |

| Revocation | A will can be revoked by a subsequent will or by physically destroying the original document. |

| Notarization | Notarization is not required for a will to be valid in Tennessee. |

| Self-Proving Wills | A self-proving will includes an affidavit signed by the witnesses, simplifying the probate process. |

| Beneficiary Designation | Beneficiaries can be individuals or entities, and they must be clearly identified in the will. |

| Probate Process | Wills must be submitted to probate in the county where the testator resided at the time of death. |

Dos and Don'ts

Creating a Last Will and Testament is an important step in ensuring your wishes are honored after your passing. Here are some guidelines to follow when filling out the Tennessee Last Will and Testament form:

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Do clearly identify yourself and include your full name and address.

- Do specify how you want your assets distributed among your beneficiaries.

- Do appoint an executor who will be responsible for carrying out your wishes.

- Do sign the document in the presence of at least two witnesses who are not beneficiaries.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date your will to establish its validity.

- Don't include any conditions that might complicate the distribution of your assets.

- Don't neglect to review and update your will regularly, especially after major life changes.

Following these guidelines can help ensure that your Last Will and Testament accurately reflects your wishes and is legally enforceable in Tennessee.

Documents used along the form

When planning your estate, it's important to consider several key documents that work alongside your Tennessee Last Will and Testament. Each of these forms plays a unique role in ensuring your wishes are honored and your loved ones are taken care of. Here’s a brief overview of some essential documents you might need.

- Durable Power of Attorney: This document allows you to appoint someone to make financial decisions on your behalf if you become incapacitated.

- New Jersey Prenuptial Agreement: To safeguard your financial interests before marriage, consider our detailed New Jersey prenuptial agreement options for clarity in asset distribution.

- Healthcare Power of Attorney: This form designates a trusted person to make medical decisions for you when you are unable to do so.

- Living Will: A living will outlines your preferences for medical treatment in situations where you cannot communicate your wishes, especially at the end of life.

- Revocable Living Trust: This trust holds your assets during your lifetime and allows for a smoother transfer to beneficiaries after your death, avoiding probate.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, like life insurance or retirement accounts, directly upon your death.

- Letter of Instruction: While not a legal document, this letter provides guidance to your loved ones about your wishes, funeral arrangements, and other personal matters.

- Pet Trust: If you have pets, this document ensures they will be cared for according to your wishes after your passing.

By understanding these documents, you can create a comprehensive estate plan that addresses your needs and protects your loved ones. It's wise to consult with a professional to ensure everything is set up correctly and reflects your intentions.

Consider Some Other Last Will and Testament Templates for US States

How to Create a Will in California - A document outlining an individual's wishes for the distribution of their assets after death.

For those interested in forming a corporation in New York, accessing a reliable template can simplify the process significantly. Resources such as https://nyforms.com/new-york-certificate-template provide essential guidance and examples that ensure all requirements are met, making it easier for individuals to navigate the complexities of compliance with state regulations.

Does an Attorney Have to Prepare a Will - Helps delineate which family heirlooms go to whom after death.

Similar forms

- Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Like a Last Will and Testament, it reflects personal choices and intentions but focuses on healthcare rather than asset distribution.

- Durable Power of Attorney: This document grants someone the authority to make financial or legal decisions on behalf of another person. Similar to a Last Will, it involves the delegation of control but takes effect during the individual’s lifetime.

- Healthcare Proxy: A healthcare proxy allows a person to designate someone else to make medical decisions if they become incapacitated. This document shares the intent of ensuring that personal wishes are honored, akin to how a Last Will expresses desires for asset distribution.

- Trust: A trust holds assets for the benefit of specific individuals or entities. Like a Last Will, it governs the distribution of property, but it can take effect during the grantor's lifetime and can provide greater control over how assets are managed.

- Letter of Intent: This informal document communicates an individual's wishes regarding their estate or other matters. While a Last Will is a legal instrument, a letter of intent serves as a guide, providing context and additional instructions for the executor.

- Residential Lease Agreement: The Fillable Forms for a Residential Lease Agreement provide comprehensive templates to ensure all necessary terms are properly outlined, promoting clarity and understanding between landlords and tenants.

- Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes without drafting a new Last Will. This document maintains the original will's validity while updating specific provisions.

- Beneficiary Designation: This document specifies who will receive certain assets upon death, such as life insurance policies or retirement accounts. It operates similarly to a Last Will in that it dictates asset distribution, but it often bypasses the probate process.

Common mistakes

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. However, many individuals make mistakes when filling out the Tennessee Last Will and Testament form. One common error is failing to properly identify heirs. It's crucial to clearly list all beneficiaries, including their full names and relationships to you. Omitting someone or using nicknames can lead to confusion and potential disputes among family members.

Another frequent mistake involves not signing the document correctly. In Tennessee, a will must be signed by the testator, which is the person making the will. Additionally, it should be witnessed by at least two individuals who are not beneficiaries. If these requirements are not met, the will may be deemed invalid. It's important to ensure that everyone involved understands their role in the signing process to avoid complications later.

Many people also overlook the need to update their will after major life changes. Events such as marriage, divorce, or the birth of a child can significantly impact your wishes regarding asset distribution. Failing to revise your will can result in unintended consequences, such as leaving assets to an ex-spouse or excluding new family members. Regularly reviewing and updating your will ensures that it accurately reflects your current situation and intentions.

Lastly, individuals often neglect to keep their will in a safe yet accessible location. Storing the will in a safety deposit box or a location that is difficult to access can create challenges for your loved ones when they need to locate it. It's advisable to inform trusted family members or friends about where the document is kept. This ensures that your wishes can be honored without unnecessary delays or complications.