Deed Document for Tennessee

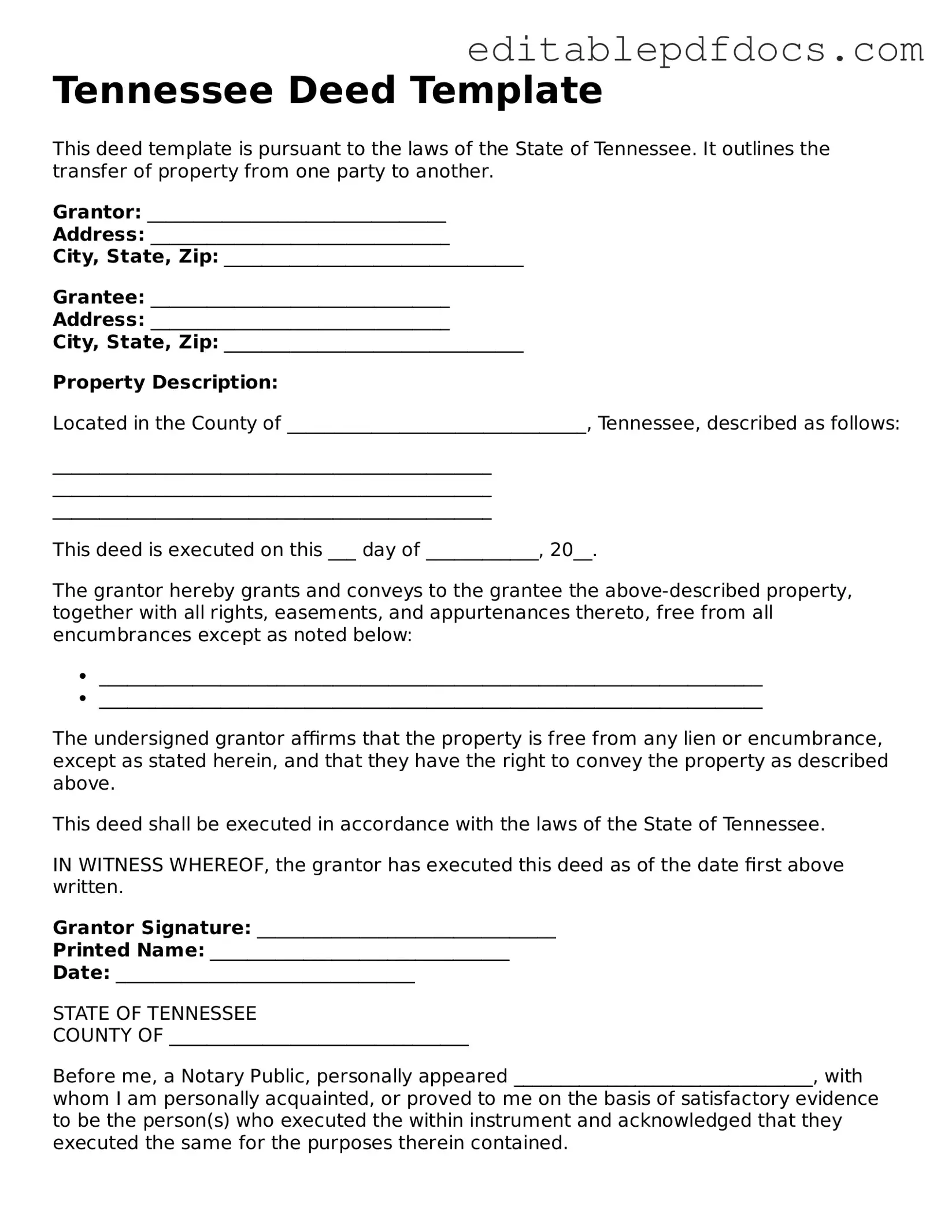

When it comes to transferring property in Tennessee, the Tennessee Deed form plays a crucial role in ensuring that the transaction is legally recognized and properly documented. This form serves as the official record of the transfer of ownership from one party to another, outlining essential details such as the names of the grantor and grantee, the legal description of the property, and any applicable consideration involved in the sale. Additionally, the form may include information about any encumbrances or liens on the property, which can significantly impact the transaction. It is important to note that the Tennessee Deed form must be signed by the grantor and notarized to be valid, ensuring that all parties involved have a clear understanding of their rights and responsibilities. By adhering to the requirements set forth in state law, individuals can facilitate a smooth transfer process, ultimately safeguarding their interests and promoting transparency in real estate transactions.

File Information

| Fact Name | Description |

|---|---|

| Type of Deed | The Tennessee Deed form can be a warranty deed, quitclaim deed, or special warranty deed. |

| Governing Law | This form is governed by Tennessee Code Annotated, Title 66, Chapter 5. |

| Signature Requirement | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To be effective against third parties, the deed must be recorded in the county where the property is located. |

Dos and Don'ts

When filling out the Tennessee Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do double-check the names of all parties involved to ensure they are spelled correctly.

- Do include a complete legal description of the property being transferred.

- Do sign the deed in the presence of a notary public.

- Do ensure that the deed is properly dated.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Don't forget to record the deed with the appropriate county office after completion.

Documents used along the form

When engaging in real estate transactions in Tennessee, various forms and documents accompany the Deed form to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the terms of the transaction. Below is a list of commonly used forms and documents alongside the Tennessee Deed form.

- Title Search Report: This document provides an examination of the property’s title history, revealing any liens, encumbrances, or ownership disputes that may exist.

- Property Disclosure Statement: Sellers are often required to disclose any known defects or issues with the property. This statement helps buyers make informed decisions.

- Purchase Agreement: This legally binding contract outlines the terms of the sale, including price, financing, and contingencies agreed upon by both buyer and seller.

- Closing Statement: Also known as a HUD-1 statement, this document details all financial aspects of the transaction, including closing costs, fees, and the final amount due at closing.

- Affidavit of Title: This sworn statement, typically provided by the seller, affirms their ownership of the property and discloses any potential claims or liens.

- Power of Attorney: In some cases, a buyer or seller may authorize another person to act on their behalf in the transaction, necessitating this legal document.

- Release of Liability Form: This document protects organizations and individuals from liability for injuries during specific activities, ensuring that participants acknowledge the risks involved and agree not to hold the provider responsible. For more information and to access a sample form, visit Fillable Forms.

- Loan Documents: If financing is involved, various forms related to the mortgage or loan agreement will be required, detailing the terms and conditions of the loan.

- IRS Form 1099-S: This tax form is used to report the sale of real estate and must be filed with the IRS to ensure compliance with tax regulations.

- Title Insurance Policy: This document protects the buyer and lender against any potential title issues that may arise after the purchase is completed.

Understanding these documents is essential for anyone involved in a real estate transaction in Tennessee. Each form plays a critical role in ensuring that the transaction is clear, transparent, and legally binding, ultimately protecting the interests of all parties involved.

Consider Some Other Deed Templates for US States

What Does a House Deed Look Like in Pa - A Deed may offer protections against future legal claims regarding the property.

How to Get a Copy of My House Deed - Properly executed Deeds can prevent future disputes over property ownership.

When selling or purchasing a motorcycle in New York, it is essential to complete a New York Motorcycle Bill of Sale form to ensure a clear transfer of ownership and to avoid any ambiguities. This document not only serves as proof of purchase but also includes vital details such as the purchase price, motorcycle specifics, and the signatures of both involved parties. To facilitate this process, you can find a convenient template at nyforms.com/motorcycle-bill-of-sale-template/, which can help streamline the required documentation for registration and tax purposes.

Florida Deed Form - Integral to the process of buying or selling a home.

Similar forms

Mortgage Agreement: Similar to a deed, a mortgage agreement transfers an interest in property as security for a loan. Both documents require signatures and are recorded to protect the lender's rights.

Lease Agreement: A lease grants a tenant the right to use property for a specified time. Like a deed, it must be signed and may be recorded to establish legal rights.

Title Transfer Document: This document formally transfers ownership of property from one party to another. Both it and a deed serve to establish legal ownership.

Quitclaim Deed: This is a specific type of deed that transfers any interest in property without guaranteeing that the title is clear. It is simpler than a warranty deed but still serves to convey ownership.

Bill of Sale: This document transfers ownership of personal property. Like a deed, it requires signatures and serves as proof of the transaction.

Power of Attorney: A power of attorney allows someone to act on another's behalf in legal matters. It can be used to sign a deed, thus facilitating property transfers.

Trust Agreement: A trust can hold property on behalf of beneficiaries. The trust document outlines how property is managed and transferred, similar to a deed's purpose.

Settlement Statement: Used in real estate transactions, this document summarizes the financial aspects of the sale. It complements a deed by detailing the financial obligations associated with the property transfer.

- Nursing Application: The Florida Board Nursing Application Form is crucial for licensure, detailing eligibility and necessary steps. For more information, click here for the pdf.

Affidavit of Title: This document certifies that the seller has the legal right to sell the property. It supports the deed by affirming the seller's ownership and right to transfer.

Warranty Deed: This type of deed provides a guarantee that the seller holds clear title to the property. It is similar to a standard deed but offers additional protections to the buyer.

Common mistakes

Filling out a Tennessee Deed form can seem straightforward, but many people make common mistakes that can lead to complications down the road. One frequent error is not including the complete legal description of the property. The legal description must be precise and detailed, clearly identifying the boundaries and location. Omitting this information can create confusion and may even invalidate the deed.

Another common mistake is failing to include all necessary parties. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. If a co-owner is left off the deed, it can lead to disputes and potential legal issues in the future.

People often overlook the importance of signatures. All parties involved must sign the deed for it to be legally binding. Additionally, signatures should be notarized to ensure authenticity. Without notarization, the deed may not be accepted by the county recorder's office, which can delay the transfer process.

Many individuals also forget to check the date on the deed. The date of execution is crucial, as it establishes when the transfer of property took place. If the date is missing or incorrect, it could lead to misunderstandings regarding the timeline of ownership.

Lastly, not filing the deed with the appropriate county office can be a significant oversight. After completing the deed, it is essential to record it with the local county clerk’s office. Failing to do so means that the transfer may not be recognized legally, leaving the new owner vulnerable to claims from others regarding the property.