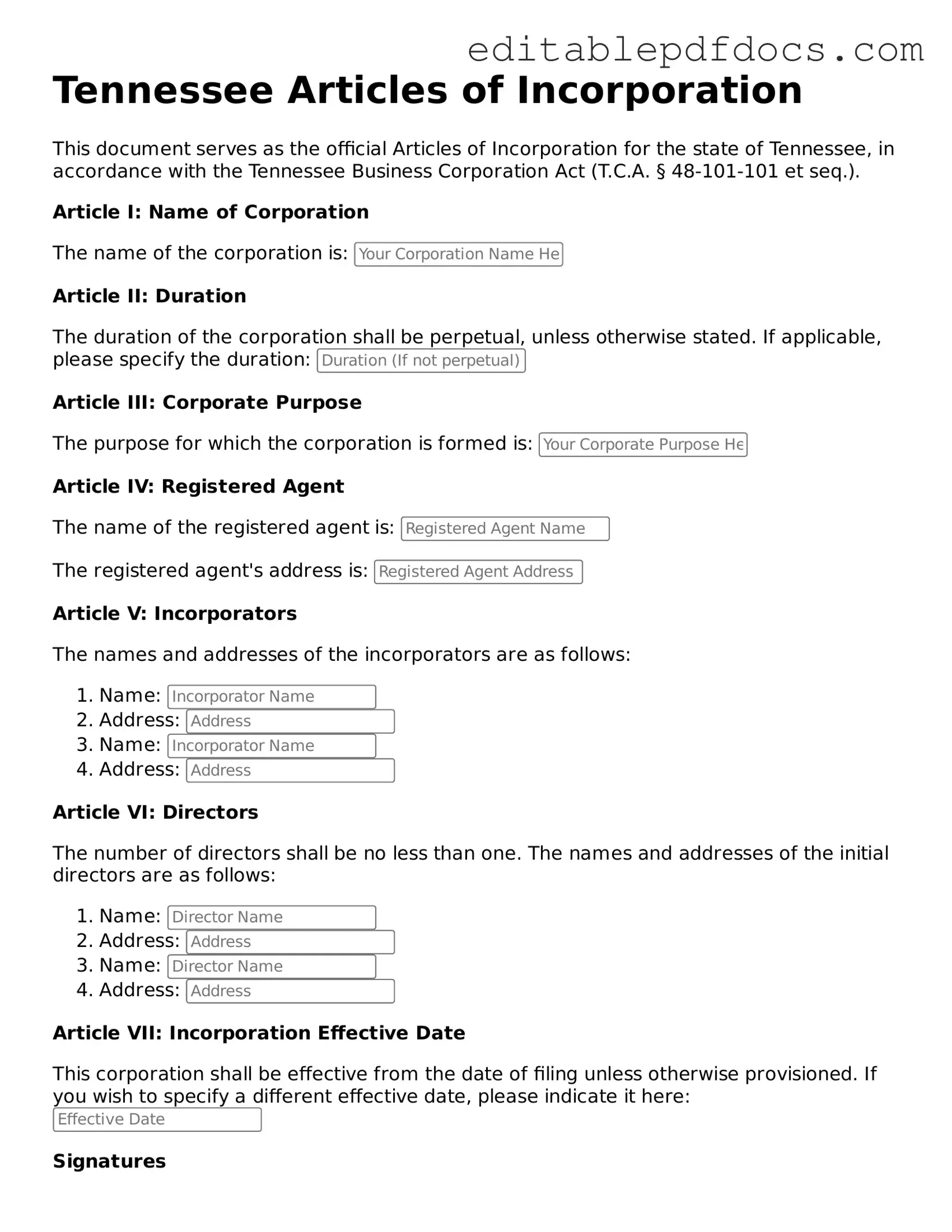

Articles of Incorporation Document for Tennessee

In Tennessee, the Articles of Incorporation form serves as a foundational document for individuals looking to establish a corporation within the state. This essential form outlines key information about the corporation, including its name, principal office address, and the purpose for which it is being formed. Additionally, it requires details regarding the registered agent, who acts as the official point of contact for legal matters. The form also includes provisions related to the number of shares the corporation is authorized to issue, which is crucial for potential investors. Furthermore, the Articles of Incorporation must specify whether the corporation will be managed by directors or members, influencing its governance structure. Filing this document with the Tennessee Secretary of State is a critical step in the incorporation process, as it grants the corporation legal recognition and the ability to operate within the state. Understanding these components is vital for anyone considering forming a corporation in Tennessee.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Tennessee Articles of Incorporation are governed by the Tennessee Business Corporation Act, specifically Title 48, Chapter 101 of the Tennessee Code Annotated. |

| Purpose | The form is used to officially establish a corporation in Tennessee. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations operating in Tennessee. |

| Information Required | Key information includes the corporation's name, duration, registered agent, and address. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | The standard filing fee for the Articles of Incorporation in Tennessee is $100. |

| Online Filing | Corporations can file their Articles of Incorporation online through the Tennessee Secretary of State's website. |

| Processing Time | Typically, processing takes about 5 to 10 business days, depending on the volume of filings. |

| Amendments | If changes are needed, corporations must file an amendment to the Articles of Incorporation. |

| Importance of Accuracy | Accurate information is crucial; errors can lead to delays or rejection of the filing. |

Dos and Don'ts

When filling out the Tennessee Articles of Incorporation form, it’s crucial to approach the task with care and attention to detail. Here’s a list of important dos and don’ts to guide you through the process.

- Do ensure that you have a clear understanding of your business structure and purpose before starting the form.

- Do provide accurate and complete information, including the name of your corporation, registered agent, and principal office address.

- Do check for name availability through the Tennessee Secretary of State’s website to avoid potential conflicts.

- Do include the names and addresses of the initial directors if required by the form.

- Do review the form thoroughly before submission to catch any errors or omissions.

- Don't use a name that is too similar to an existing corporation, as this could lead to rejection of your application.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't forget to include the filing fee, as applications without payment will not be processed.

- Don't leave any required fields blank; incomplete forms can lead to delays or rejections.

By following these guidelines, you can navigate the process of completing the Articles of Incorporation form in Tennessee with greater confidence and clarity.

Documents used along the form

When incorporating a business in Tennessee, several additional forms and documents are often required to ensure compliance with state regulations. These documents play a crucial role in establishing your corporation and maintaining its good standing. Below is a list of commonly used forms that accompany the Tennessee Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. Bylaws typically cover topics such as the roles of officers, meeting procedures, and voting rights of shareholders.

- Residential Lease Agreement: Having a well-prepared Fillable Forms can help ensure that both landlords and tenants clearly understand their rights and responsibilities, thereby minimizing conflicts and enhancing the renting experience.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report provides essential information about the corporation, including its address, officers, and registered agent.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes and is required if the corporation plans to hire employees. This number is obtained from the Internal Revenue Service (IRS).

- Registered Agent Appointment: This document designates a registered agent who will receive legal documents on behalf of the corporation. It is essential for ensuring that the corporation can be contacted for legal matters.

Completing these documents accurately and promptly is essential for establishing a solid foundation for your corporation in Tennessee. Ensure that you have all necessary forms ready to facilitate a smooth incorporation process.

Consider Some Other Articles of Incorporation Templates for US States

Pennsylvania Department of Corporations - This form details how the corporation will operate internally.

For those interested in the intricate process of establishing a corporation in New York, it is essential to familiarize yourself with the necessary documentation, particularly the New York Certificate of Incorporation. This certificate not only outlines the critical details required by the state but also ensures compliance with Section 402 of the Business Corporation Law. For additional resources and templates that can assist in this process, you can visit nyforms.com/new-york-certificate-template.

How Do I Get a Copy of My Articles of Incorporation in Georgia - The document serves as a public record of the corporation’s creation.

How Much Does It Cost to Start an Llc in Arizona - Provides a framework for governance and operations.

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. They govern how the corporation operates, similar to how the Articles of Incorporation establish its existence.

- Operating Agreement: This document is used by LLCs and details the management structure and operational procedures. Like the Articles of Incorporation, it formalizes the entity's structure.

- Certificate of Incorporation: Often used interchangeably with Articles of Incorporation, this document serves the same purpose of legally establishing a corporation in a specific state.

- Business License: A business license grants permission to operate legally within a jurisdiction. It is similar to Articles of Incorporation in that both are necessary for legal operation.

- New Jersey Prenuptial Agreement: Ensure peace of mind in marriage with a comprehensive New Jersey prenuptial agreement guide that details asset distribution and responsibilities in case of a divorce.

- Partnership Agreement: This document outlines the terms of a partnership, including responsibilities and profit sharing. It is similar in that it formalizes the relationship between parties involved.

- Shareholder Agreement: This agreement governs the relationship between shareholders and the corporation. It is similar to Articles of Incorporation as it helps define ownership and control.

- Certificate of Good Standing: This certificate verifies that a corporation is legally registered and compliant with state requirements. It relates to the Articles of Incorporation as both confirm the corporation's legal status.

Common mistakes

Filling out the Tennessee Articles of Incorporation form is a crucial step for anyone looking to start a business in the state. However, many individuals make common mistakes that can lead to delays or complications in the incorporation process. One frequent error is failing to provide a clear and specific business name. A name that is too similar to an existing entity can lead to rejection. It’s essential to conduct a thorough name search to ensure uniqueness, as this is the first impression your business will make.

Another common pitfall involves incorrect or incomplete information about the registered agent. The registered agent serves as the official point of contact for legal documents. If the agent’s name or address is not accurately filled out, it could result in missed communications. This can have serious implications, especially if legal action is taken against the business. Always double-check this information to ensure it is current and correct.

Some applicants overlook the importance of specifying the purpose of the corporation. While it might seem straightforward, providing a vague or overly broad purpose can lead to complications. The state requires a clear description of what the business intends to do. A well-defined purpose not only meets legal requirements but also helps clarify the business's mission to potential investors and customers.

Additionally, many people forget to include the correct number of shares the corporation is authorized to issue. This section is critical because it determines the ownership structure of the company. If the number of shares is left blank or inaccurately reported, it could hinder future fundraising efforts or complicate ownership transfers. Being precise in this area is vital for the long-term health of the business.

Finally, neglecting to sign and date the form is a simple yet significant mistake. Without a signature, the Articles of Incorporation are not valid, and the application will be rejected. It’s a good practice to review the entire document before submission, ensuring that all required signatures are present. Taking these steps can help streamline the incorporation process and set a solid foundation for your new venture.