Fill a Valid Tax POA dr 835 Template

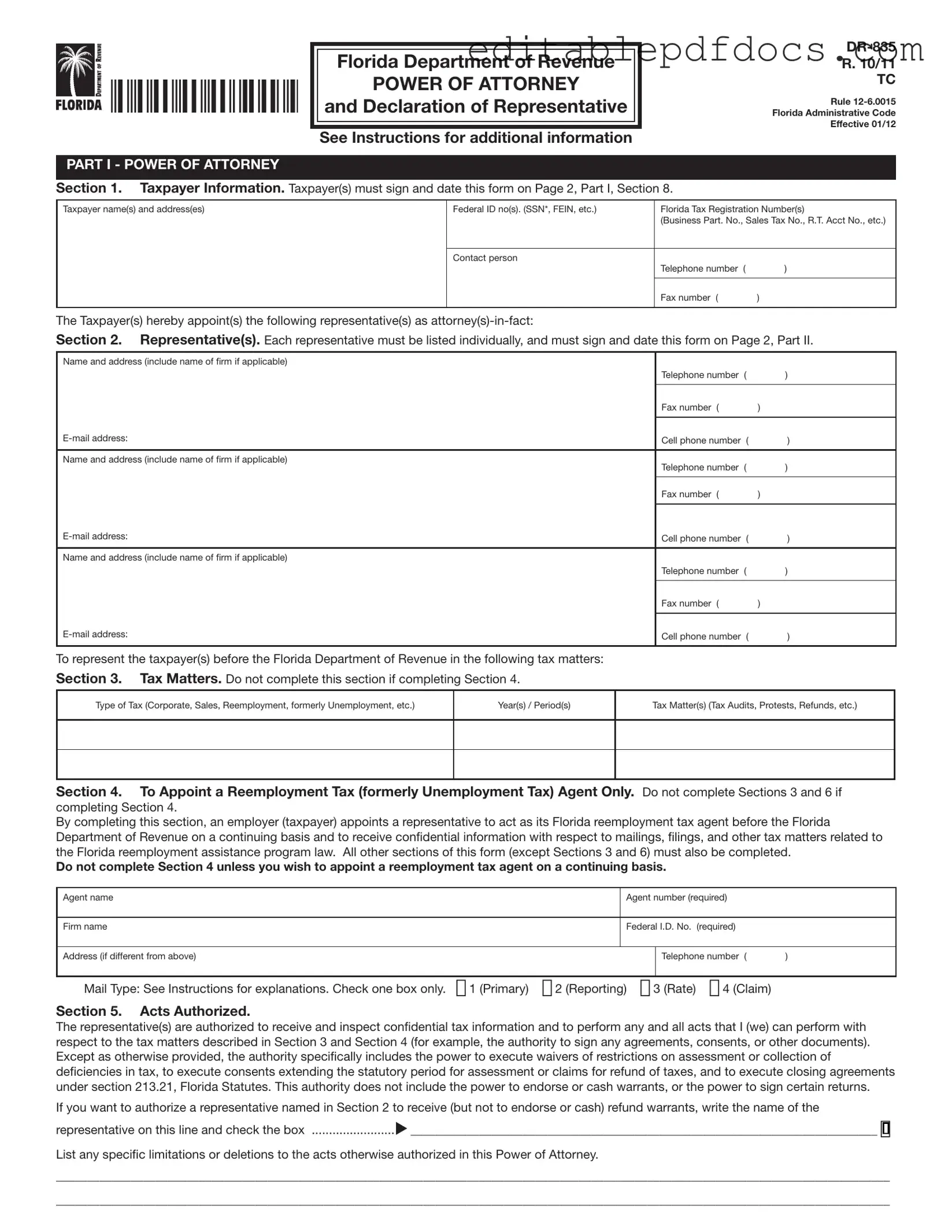

The Tax Power of Attorney (POA) DR 835 form is an essential document for individuals and businesses seeking to authorize someone else to act on their behalf in tax matters. This form allows taxpayers to designate a representative, such as an accountant or attorney, to communicate with the tax authorities, file returns, and make decisions regarding tax-related issues. By completing the DR 835, taxpayers can ensure that their interests are adequately represented, especially when dealing with complex tax situations or audits. It is important to note that the form specifies the scope of authority granted to the representative, which can be tailored to meet the unique needs of the taxpayer. Additionally, the DR 835 must be signed by the taxpayer and may require specific identification details to validate the authorization. Understanding how to properly complete and submit this form can significantly streamline interactions with tax agencies and provide peace of mind during tax season and beyond.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Tax POA DR 835 form is used to authorize an individual or organization to represent a taxpayer before the state tax authority. |

| Governing Law | This form is governed by the tax laws of the specific state where it is filed. For example, in Colorado, it falls under the Colorado Revised Statutes Title 39. |

| Eligibility | Any individual or business entity can be appointed as a representative, provided they meet the requirements set by the state tax authority. |

| Filing Process | The completed form must be submitted to the state tax authority, either online or by mail, depending on state regulations. |

| Duration of Authority | The authority granted by this form remains in effect until revoked by the taxpayer or until the specific tax matter is resolved. |

| Revocation | Taxpayers can revoke the authorization at any time by submitting a written notice to the state tax authority. |

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) Form DR 835, it's important to follow certain guidelines to ensure your form is completed correctly. Here are some things you should and shouldn't do:

- Do double-check your personal information for accuracy, including your name, address, and Social Security number.

- Do ensure that the person you are designating as your representative is qualified and understands the responsibilities involved.

- Do clearly specify the tax matters and years for which the Power of Attorney is granted.

- Do sign and date the form where indicated to validate your authorization.

- Don't leave any sections of the form blank; incomplete forms can lead to delays or rejection.

- Don't forget to provide your representative's contact information, as it is essential for communication.

- Don't use outdated versions of the form; always check for the latest version on the official website.

- Don't assume that your representative will automatically have access to all your tax information without specifying it in the form.

By following these guidelines, you can help ensure that your Tax POA Form DR 835 is processed smoothly and effectively.

Documents used along the form

The Tax Power of Attorney (POA) DR 835 form is a critical document used to authorize someone to act on your behalf regarding tax matters. Along with this form, there are several other documents that can support your tax-related processes. Below is a list of these forms and documents, each serving a specific purpose.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative form. It allows you to appoint an individual to represent you before the IRS for various tax matters.

- Form 8821: This form is used to authorize an individual to receive your confidential tax information from the IRS, without giving them the authority to represent you.

- Form 4506: The Request for Copy of Tax Return form allows you to request copies of your previously filed tax returns, which can be useful for verification or record-keeping.

- Form 1040: This is the standard individual income tax return form. It is essential for reporting your income and calculating your tax liability.

- Operating Agreement Form: To establish clear operational guidelines, refer to our important Operating Agreement form resources for LLCs in New Jersey.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages, as well as to calculate the employer’s portion of Social Security and Medicare taxes.

- Form 1099: This series of forms is used to report various types of income other than wages, salaries, and tips. They are crucial for independent contractors and freelancers.

- Form W-2: Employers must provide this form to employees to report annual wages and the amount of taxes withheld from their paychecks.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It allows taxpayers to request an extension to file their tax return.

- Form 9465: This form is used to request a monthly installment plan if you cannot pay the full amount of taxes owed. It helps taxpayers manage their tax liabilities over time.

Understanding these documents can significantly simplify the process of handling your tax affairs. Each form serves a unique function, ensuring that your rights and responsibilities are clearly defined and managed effectively.

Popular PDF Forms

Reg 262 - The applicant must sign and date Section H, declaring the truthfulness of their statements under penalty of perjury.

Creating a Last Will and Testament is an essential step in planning for the future, as it allows individuals to stipulate their wishes regarding the distribution of their property and assets after their passing. This important document not only helps ensure that final wishes are respected but also permits the appointment of a guardian for minor children. For those looking to draft a will, resources such as nyforms.com/last-will-and-testament-template/ can be immensely helpful.

Florida Realtors Commercial Contract - The seller is responsible for paying real estate taxes up to the closing date, while the buyer assumes them thereafter.

Donation Slips - Confirmation of your donation to support local employment initiatives.

Similar forms

The Tax POA DR 835 form, which allows individuals to authorize someone else to act on their behalf regarding tax matters, shares similarities with several other important documents. Here are four documents that are comparable to the Tax POA DR 835 form:

- General Power of Attorney: This document grants someone the authority to act on behalf of another person in a wide range of legal and financial matters, not limited to taxes. Like the Tax POA, it allows for representation but covers broader responsibilities.

- Limited Power of Attorney: A Limited Power of Attorney restricts the agent's authority to specific tasks or time periods. Similar to the Tax POA, it provides a clear scope of what actions the agent can take, focusing on particular issues, such as tax filings or transactions.

- California Dog Bill of Sale: This document formalizes the transfer of dog ownership and ensures all necessary details are documented. For those interested in creating such a document, templates can be found at Fillable Forms.

- IRS Form 2848 (Power of Attorney and Declaration of Representative): This form is specifically designed for tax matters and allows individuals to appoint a representative to handle their tax affairs with the IRS. It functions similarly to the Tax POA DR 835 by enabling representation in tax-related issues.

- Healthcare Power of Attorney: While focused on medical decisions, this document allows someone to make healthcare choices on behalf of another person. Like the Tax POA, it involves granting authority to act for someone else, emphasizing the importance of trust and clear communication.

Common mistakes

Filling out the Tax POA DR 835 form can be a daunting task for many individuals. Mistakes during this process can lead to delays or complications in handling tax matters. One common error is not providing complete information. When a person leaves out essential details, it can hinder the processing of the form and create unnecessary confusion.

Another frequent mistake is failing to sign the form. A signature is crucial because it verifies that the individual authorizes the representative to act on their behalf. Without it, the IRS may reject the form outright. It’s also important to ensure that the signature matches the name provided on the form. Discrepancies can raise red flags and lead to additional scrutiny.

People often overlook the importance of using the correct version of the form. Tax forms can change from year to year, and using an outdated version can result in rejection. Always check for the most current version before filling it out.

Additionally, many individuals neglect to specify the scope of authority granted to the representative. The form allows taxpayers to limit the powers of their representative, but failing to do so can lead to misunderstandings. Clearly outlining the authority helps prevent any misuse of the power granted.

Another common mistake is not providing accurate identification numbers. Whether it’s the taxpayer's Social Security number or the representative's identification number, inaccuracies can lead to significant delays. Double-checking these numbers is essential to avoid issues.

Some people also forget to include a valid address for both the taxpayer and the representative. This information is necessary for communication purposes. Without it, the IRS may struggle to reach the parties involved, leading to further complications.

Moreover, many individuals fail to keep a copy of the completed form for their records. Having a copy is beneficial for future reference and can help resolve any disputes that may arise later. It serves as proof of what was submitted.

Lastly, individuals sometimes rush through the process without reviewing the form thoroughly. Taking the time to double-check for errors or omissions can save a lot of hassle down the line. A careful review ensures that the form is filled out correctly and completely, paving the way for smoother interactions with the IRS.