Fill a Valid Stock Transfer Ledger Template

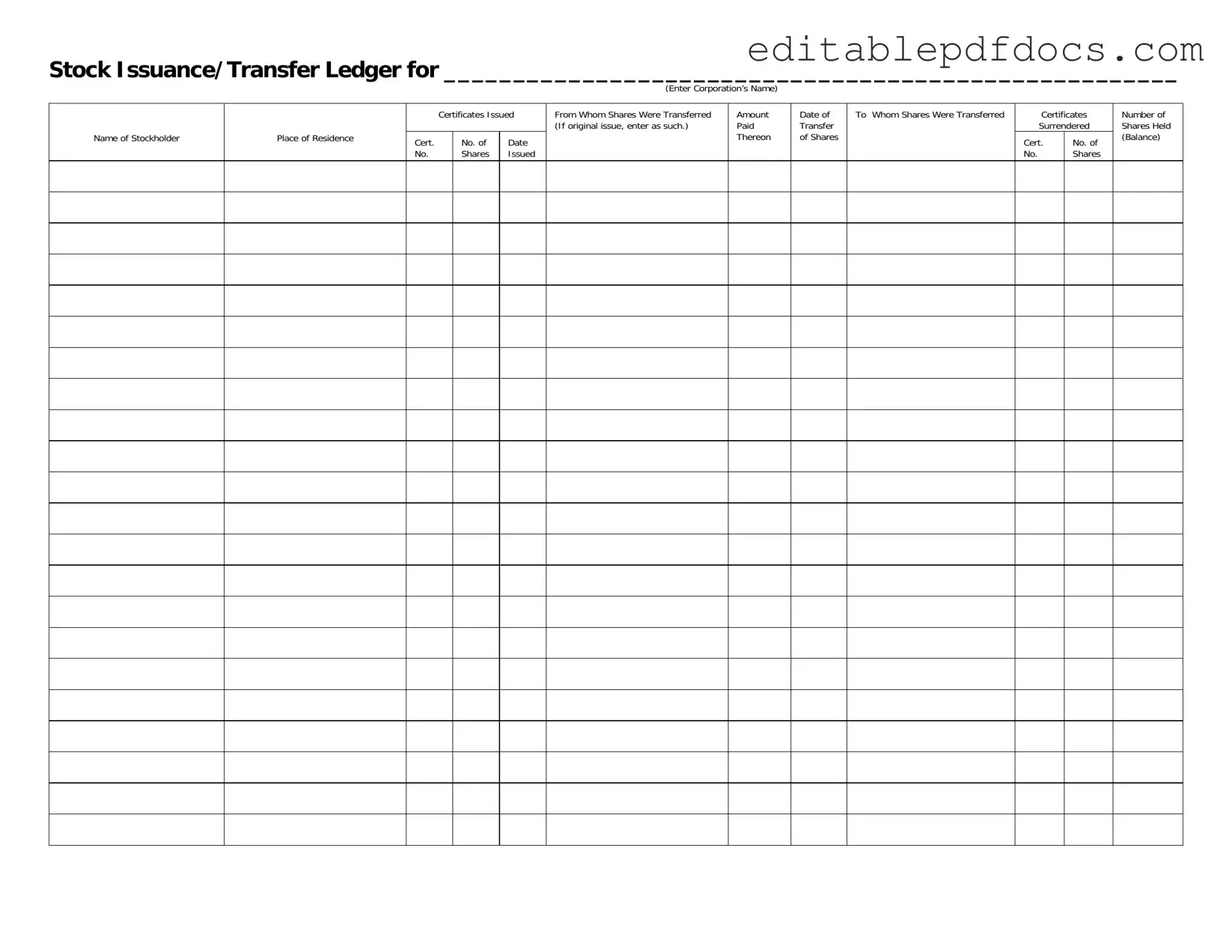

The Stock Transfer Ledger form serves as a crucial document for corporations managing their stock transactions. It provides a clear and organized way to track the issuance and transfer of shares among stockholders. Each entry on the form includes essential details such as the name of the corporation, the stockholder’s name, and their place of residence. This ensures that all parties involved are accurately identified. Additionally, the form records the certificates issued, including their certificate numbers and the dates on which shares were issued. When shares are transferred, the ledger captures vital information about the transferor and transferee, including the amount paid for the shares and the date of transfer. This meticulous documentation helps maintain transparency and accountability within the corporation. The form also notes the certificates surrendered during the transfer process and provides a balance of the number of shares held by each stockholder, ensuring that the corporation has an up-to-date record of its stock ownership. Overall, the Stock Transfer Ledger form is an indispensable tool for any corporation looking to manage its equity effectively.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | The Stock Transfer Ledger tracks the issuance and transfer of shares in a corporation. |

| Required Information | It includes the corporation's name, stockholder details, certificate information, and transfer data. |

| Stockholder Details | Information about the stockholder's name and place of residence is required. |

| Certificates Issued | The form records the certificates issued, including their numbers and dates. |

| Transfer Tracking | The ledger tracks from whom shares were transferred and to whom they were transferred. |

| Original Issue | If shares are newly issued, the form allows you to indicate this by entering "original issue." |

| Amount Paid | The amount paid for the shares must be recorded on the ledger. |

| Date of Transfer | The date when shares are transferred is a critical piece of information. |

| Certificates Surrendered | The form includes a section for noting any certificates that have been surrendered. |

| Balance of Shares | The ledger shows the number of shares held after the transfer, indicating the balance. |

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. The following list outlines ten important do's and don'ts to ensure accuracy and compliance.

- Do enter the full name of the corporation clearly at the top of the form.

- Don't leave any fields blank; every section must be filled out completely.

- Do provide the stockholder's complete name and place of residence.

- Don't use abbreviations or nicknames for the stockholder's name.

- Do accurately list the certificate numbers and the corresponding number of shares issued.

- Don't mix up the certificate numbers; ensure they match the shares issued.

- Do specify the date of transfer clearly.

- Don't forget to indicate the amount paid for the shares transferred.

- Do indicate the name of the person or entity to whom the shares were transferred.

- Don't neglect to surrender the old certificates when issuing new ones.

By following these guidelines, you can help ensure that the Stock Transfer Ledger form is completed correctly and efficiently, thereby minimizing potential issues in the future.

Documents used along the form

The Stock Transfer Ledger form is an essential document for corporations managing stock transfers. It records vital information about stockholders, shares issued, and transfers, ensuring transparency and accuracy in ownership records. In addition to this form, several other documents are commonly used in conjunction with stock transfers to provide a comprehensive framework for corporate governance and compliance.

- Stock Certificate: This document serves as a physical representation of ownership in a corporation. It includes details such as the stockholder's name, the number of shares owned, and the company's name. Stock certificates are often issued when shares are initially sold or transferred.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders within a corporation. It can cover various aspects, including voting rights, share transfer procedures, and dispute resolution mechanisms, ensuring all parties are aware of their obligations.

- Motorcycle Bill of Sale: This form is essential for the legal transfer of motorcycle ownership in New York, containing key details such as purchase price and motorcycle specifics, and can be found at nyforms.com/motorcycle-bill-of-sale-template/.

- Board Resolution: A board resolution is a formal document that records decisions made by a corporation's board of directors. When shares are transferred, a resolution may be necessary to approve the transfer, providing an official record of the board's consent.

- Transfer Agent Report: This report is generated by a transfer agent, who manages the transfer of shares on behalf of the corporation. It includes details about the shares transferred, the parties involved, and any relevant transaction dates, ensuring accurate tracking of stock ownership.

- Form 1099-DIV: This tax form reports dividends and distributions to shareholders. It is essential for shareholders to receive this form for tax reporting purposes, as it details income received from their investments in the corporation.

Each of these documents plays a crucial role in the management of stock transfers and shareholder relations. Together, they help ensure that all transactions are properly documented and compliant with legal requirements, promoting trust and clarity within the corporate structure.

Popular PDF Forms

Alabama High School Physical Form - This form emphasizes the importance of establishing a healthy foundation for student-athletes.

Emergency Custody Order Minnesota - Clear disclosure of any criminal history may be required on the form.

The California Motorcycle Bill of Sale is a crucial legal document that outlines the details of a motorcycle transaction between a buyer and a seller. It serves to protect both parties by providing evidence of the sale and confirming the transfer of ownership. For those looking to streamline the process, utilizing Fillable Forms can be incredibly helpful. Understanding this form is essential for anyone involved in buying or selling a motorcycle in California.

P45 Ireland - If an employee leaves and did not complete the P45, they may end up overpaying taxes at their next job.

Similar forms

The Stock Transfer Ledger form is a crucial document for tracking the issuance and transfer of shares within a corporation. Several other documents serve similar purposes in maintaining accurate records of stock transactions. Here are five such documents:

- Stock Certificate: This document represents ownership of shares in a corporation. Like the Stock Transfer Ledger, it includes details such as the stockholder's name, number of shares, and certificate number, providing proof of ownership.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders. Similar to the Stock Transfer Ledger, it may include information about share transfers and ownership, ensuring all parties are informed about their interests in the corporation.

- Corporate Bylaws: These rules govern the internal management of a corporation. They often include provisions regarding the issuance and transfer of shares, aligning with the Stock Transfer Ledger's purpose of documenting stock transactions.

- Operating Agreement: This document is essential for Limited Liability Companies (LLCs) in New York as it defines the management structure and members' responsibilities. For further details on this crucial agreement, visit topformsonline.com.

- Minutes of Shareholder Meetings: These records document the proceedings and decisions made during shareholder meetings. They may include approvals for stock transfers, similar to the Stock Transfer Ledger, which tracks such transactions.

- Stock Option Agreement: This document grants employees the right to purchase shares at a set price. It shares similarities with the Stock Transfer Ledger by detailing the number of shares involved and the terms of the transfer, ensuring clarity in ownership changes.

Common mistakes

Filling out the Stock Transfer Ledger form can seem straightforward, but many people make common mistakes that can lead to confusion or delays. One frequent error is forgetting to enter the corporation’s name at the top of the form. This information is essential for identifying which company the stock pertains to, and without it, the entire document may be rendered invalid.

Another mistake involves the name of the stockholder. Some individuals write their name incorrectly or use nicknames instead of their legal names. It’s crucial to use the exact name as it appears on official documents to avoid issues with ownership verification.

People often overlook the section where they need to specify the place of residence of the stockholder. This detail is important for record-keeping and may be required for tax purposes. Omitting this information can lead to complications in the future.

When it comes to the certificates issued, many individuals fail to accurately record the certificate numbers. Each certificate has a unique identifier, and missing or incorrect numbers can cause significant problems when tracking ownership.

Another common oversight is not providing the date of issuance for the shares. This date is important for establishing the timeline of ownership and can affect the rights associated with the shares. Make sure to double-check this detail.

In the section that asks for the amount paid for the shares, mistakes can occur if individuals do not include the correct figures. This information is vital for understanding the financial aspects of the transfer and should be filled out with care.

Some people forget to indicate the date of transfer when shares are being transferred. This date is crucial for legal and tax reasons, and failing to include it could lead to disputes about when ownership changed hands.

Another area where mistakes happen is when filling out the section regarding to whom shares were transferred. It’s important to provide accurate information about the new owner. Incorrect details can complicate future transactions and ownership claims.

Additionally, individuals sometimes neglect to mention the certificates surrendered. If shares are being transferred, the old certificates must be surrendered to ensure a clean transfer of ownership. Failing to document this can create confusion.

Finally, people often forget to update the number of shares held after a transfer. This balance is crucial for both the stockholder and the corporation. Keeping accurate records helps maintain clarity in ownership and can prevent disputes down the line.