Fill a Valid SSA SSA-44 Template

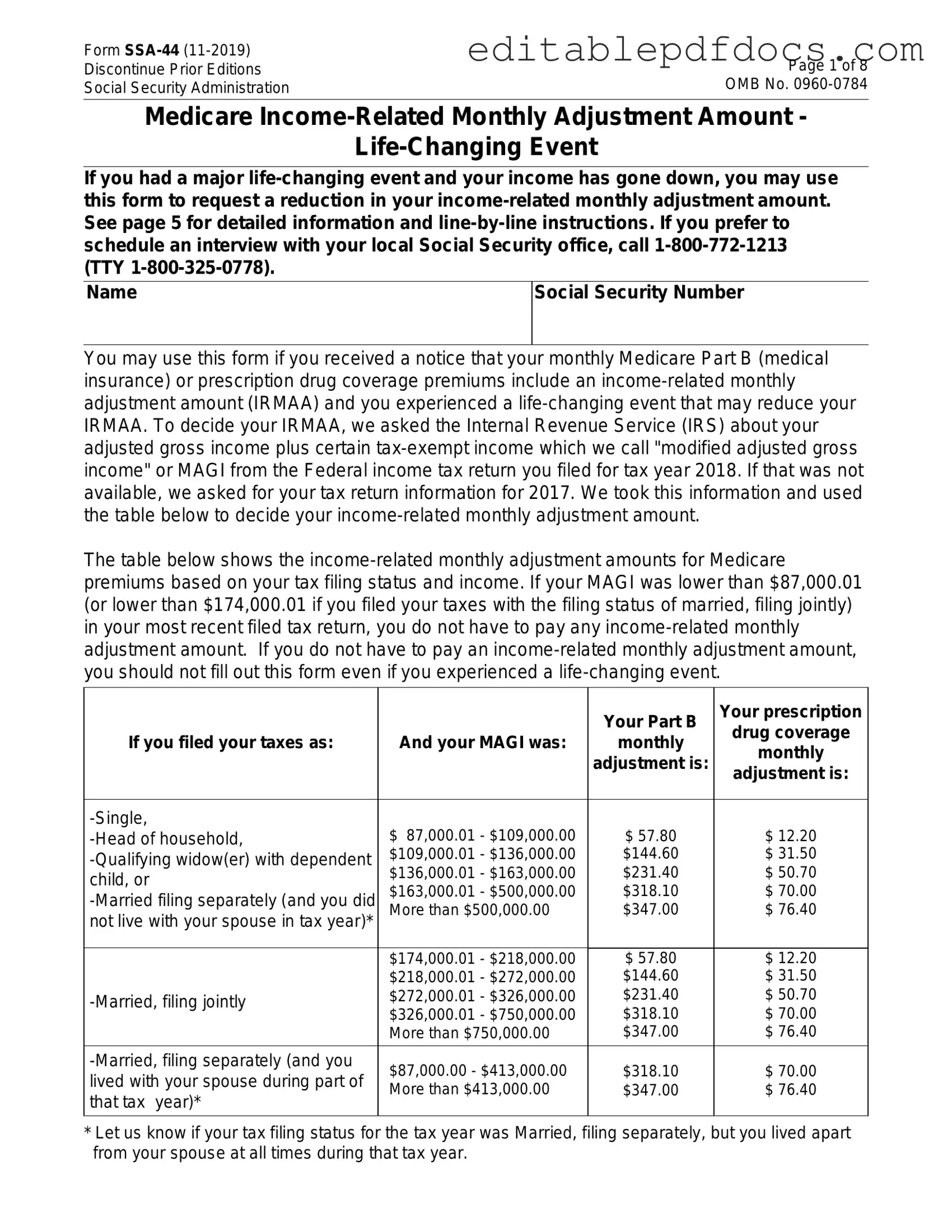

The SSA SSA-44 form plays a vital role for individuals seeking to adjust their Social Security benefits based on changing financial circumstances. This form is specifically designed for those who wish to report a significant decrease in income, which may qualify them for a higher benefit amount. By submitting the SSA-44, individuals can provide the Social Security Administration with the necessary information to reassess their eligibility for benefits, ensuring that they receive the support they need during challenging times. The form requires personal information, details about the income reduction, and any relevant documentation to substantiate the claim. Understanding the purpose and process of the SSA-44 can empower individuals to take proactive steps in managing their financial well-being, especially in light of unexpected life changes. Proper completion of this form can lead to a reassessment of benefits, potentially alleviating financial strain and providing peace of mind.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The SSA-44 form is used to request a reduction in the amount of Social Security benefits due to a change in circumstances, such as income or living situation. |

| Eligibility | Individuals who receive Social Security benefits and experience a change in their financial situation may be eligible to use the SSA-44 form. |

| Submission | The completed SSA-44 form must be submitted to the Social Security Administration either by mail or online through their official website. |

| Governing Law | The SSA-44 form is governed by federal laws related to Social Security benefits, specifically the Social Security Act. |

Dos and Don'ts

When filling out the SSA SSA-44 form, there are important guidelines to follow. Here is a list of things you should and shouldn't do:

- Do read the instructions carefully before starting.

- Do provide accurate information to avoid delays.

- Do double-check your answers for errors.

- Do keep a copy of the completed form for your records.

- Do submit the form on time to ensure your benefits are processed.

- Don't leave any sections blank unless instructed.

- Don't use pencil; always fill out the form in pen.

- Don't submit the form without signing it.

- Don't provide misleading or false information.

- Don't forget to include any necessary supporting documents.

Documents used along the form

The SSA SSA-44 form is used to request a reduction in the amount of Social Security benefits due to a change in income or circumstances. When filing this form, it is often necessary to submit additional documents to support your request. Below is a list of common forms and documents that may accompany the SSA SSA-44.

- SSA-1099 Form: This form provides a summary of the Social Security benefits received in the previous year. It is essential for verifying income when requesting a reduction.

- Employment Verification Form: This document is essential for confirming a job applicant's employment history and credentials. For convenient access, you can use the Fillable Forms to obtain this necessary form.

- Income Verification Documents: These can include pay stubs, tax returns, or bank statements. They serve to confirm current income levels and any changes that may affect benefits.

- Medical Records: If the request for a reduction is based on medical issues, relevant medical documentation may be required to substantiate the claim.

- SSA-827 Form: This form authorizes the release of medical information. It is particularly important if the reduction request is tied to health-related changes.

- Cover Letter: A cover letter outlining the purpose of the SSA SSA-44 submission can clarify the request and provide context for the reviewing agency.

Submitting the SSA SSA-44 along with the appropriate supporting documents can significantly enhance the chances of a successful outcome. Ensure that all documents are complete and accurate to avoid delays in processing your request.

Popular PDF Forms

Commercial Roof Inspection Form - Maintaining clear communication about roof warranties is critical for both parties.

The Texas Motor Vehicle Bill of Sale form is a legal document that facilitates the transfer of ownership of a vehicle from a seller to a buyer. This form captures essential details about the transaction, including the vehicle's identification and sale price. Understanding its significance helps ensure a smooth transfer process and protects both parties involved. For more information, visit https://topformsonline.com/.

Better Business Bureau Website - I was charged a fee without my consent or knowledge.

Similar forms

The SSA-44 form, used to request a reduction in income-related monthly adjustment amounts for Medicare, shares similarities with several other important documents. Here are four documents that are comparable to the SSA-44 form:

- SSA-16 (Application for Disability Insurance Benefits): Like the SSA-44, the SSA-16 is a request for financial assistance, specifically for those who are disabled and unable to work. Both forms require detailed personal and financial information to assess eligibility.

- SSA-827 (Authorization to Disclose Information to the Social Security Administration): This form allows individuals to authorize third parties to share their medical and financial information with the SSA. Similar to the SSA-44, it plays a crucial role in the decision-making process regarding benefits.

- SSA-1099 (Social Security Benefit Statement): The SSA-1099 provides a summary of benefits received in the previous year. While the SSA-44 requests a change in payment amounts, the SSA-1099 helps individuals understand their current financial situation and informs their decisions regarding adjustments.

- Florida Marriage Application Form: This document is essential for couples seeking to marry in Florida, requiring personal details necessary for the marriage license. Couples can download the document to begin the application process.

- SSA-1372 (Request for Change in Benefits): This form is used to request changes in benefit amounts due to various life circumstances. Both the SSA-44 and SSA-1372 require individuals to provide specific reasons for their requests, ensuring that the SSA has the necessary context to evaluate the claims.

Common mistakes

Filling out the SSA-44 form, which is used to request a reduction in income-related monthly adjustment amount (IRMAA) for Medicare, can be a daunting task. Many people make mistakes that can delay their application or even lead to denial. One common error is not providing adequate documentation. When you claim a life-changing event, such as retirement or a significant decrease in income, you must include proof. Failing to attach the necessary documents can lead to complications.

Another frequent mistake is miscalculating income. It's essential to report your income accurately, as the SSA uses this information to determine your eligibility for a reduction. Many people overlook certain sources of income or misunderstand what counts as income. This can result in an incorrect assessment and potentially affect your benefits.

Some individuals also fail to sign and date the form. It may seem minor, but an unsigned form is considered incomplete and will not be processed. Always double-check that you’ve signed and dated the form before submitting it. This simple step can save you time and frustration.

Additionally, many applicants overlook the deadline for submitting the SSA-44 form. There are specific timeframes in which you must file your request, especially if you want the reduction to apply retroactively. Missing this deadline could mean losing out on potential savings on your Medicare premiums.

Another mistake is not keeping a copy of the submitted form. It’s important to have a record of what you sent in case you need to follow up or provide additional information later. Without a copy, you may struggle to recall what you reported, which can complicate any future communications with the SSA.

Finally, some people do not follow up after submitting their application. It’s a good idea to check the status of your request. If you haven’t heard back in a reasonable time, reach out to the SSA. This proactive approach can help you address any issues early on and ensure that your application is processed smoothly.