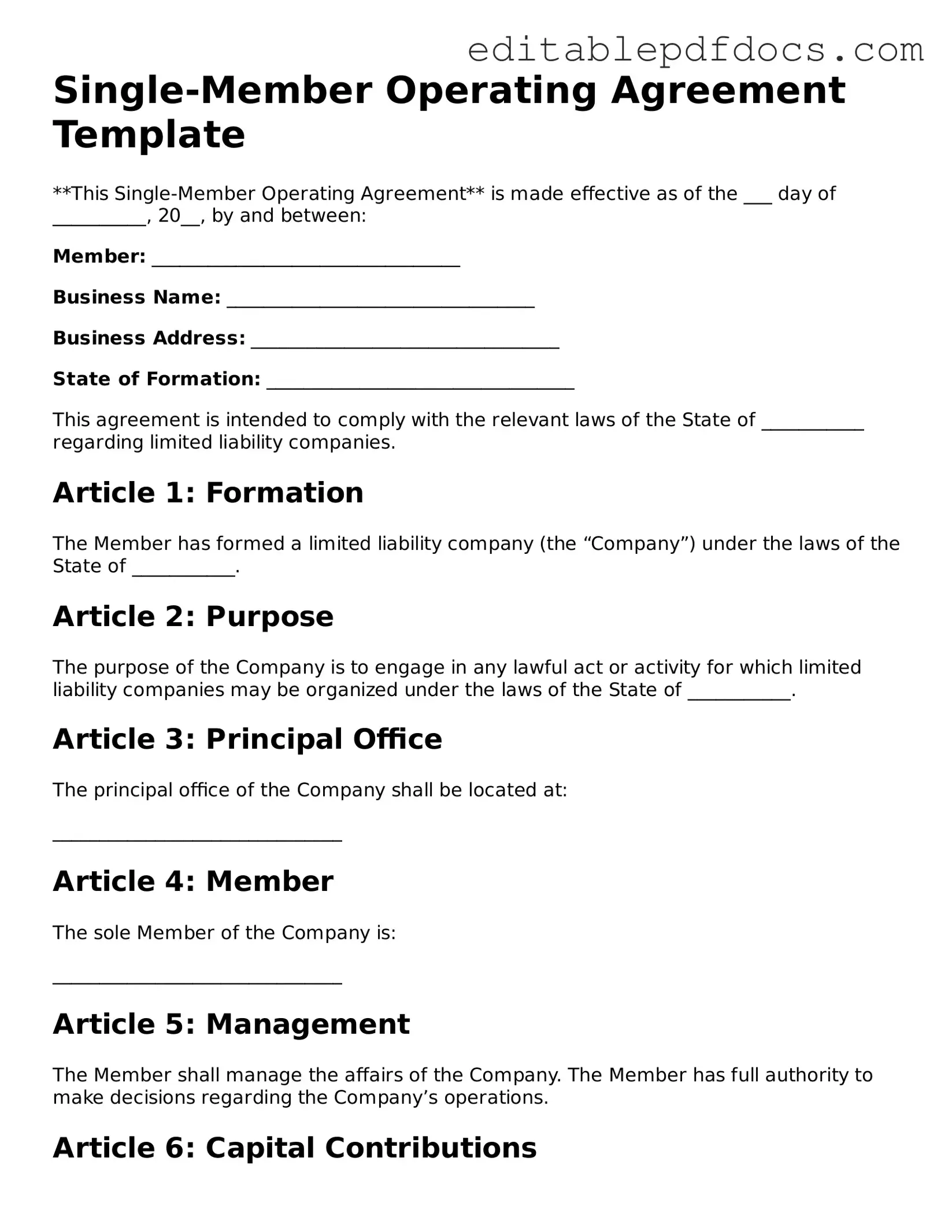

Free Single-Member Operating Agreement Document

When starting a single-member LLC, having a well-structured operating agreement is crucial. This document serves as the foundation for how the business will operate and outlines the rights and responsibilities of the owner. A Single-Member Operating Agreement provides clarity on various aspects, including the management structure, financial arrangements, and decision-making processes. It helps to separate personal and business liabilities, offering protection in case of legal disputes. Additionally, this agreement can specify how profits and losses will be handled, ensuring that the owner understands their financial obligations. By establishing clear guidelines, the Single-Member Operating Agreement not only helps in maintaining professionalism but also enhances credibility with banks and potential investors. Understanding its components is essential for any entrepreneur looking to solidify their business framework and navigate the complexities of running a single-member LLC effectively.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management and operational structure of a single-member limited liability company (LLC). |

| Legal Requirement | While not always legally required, having an operating agreement is highly recommended for single-member LLCs to clarify ownership and management roles. |

| Governing Law | The governing laws for Single-Member Operating Agreements vary by state. For example, in California, it is governed by the California Corporations Code. |

| Flexibility | The agreement allows the owner to customize the management structure, distribution of profits, and other operational details according to personal preferences. |

| Protection of Assets | Having an operating agreement helps protect the owner's personal assets from business liabilities, reinforcing the limited liability status of the LLC. |

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do provide accurate and complete information. Ensure that all sections are filled out correctly.

- Do review the document thoroughly before submission. Double-check for any errors or omissions.

- Do keep a copy of the signed agreement for your records. This will be important for future reference.

- Do consult with a legal professional if you have questions. It's better to seek clarity than to guess.

- Don't rush through the process. Take your time to ensure everything is correct.

- Don't ignore state-specific requirements. Each state may have its own rules regarding operating agreements.

Documents used along the form

A Single-Member Operating Agreement is a crucial document for any sole proprietorship structured as a limited liability company (LLC). It outlines the management structure and operational guidelines for the business. However, several other forms and documents complement this agreement, helping to establish a comprehensive legal framework for the business. Below is a list of these important documents.

- Articles of Organization: This document is filed with the state to formally create the LLC. It includes basic information such as the business name, address, and the name of the registered agent.

- Operating Agreement: To establish a clear framework for your LLC's structure, consider the essential Operating Agreement document that details management and operational guidelines.

- Employer Identification Number (EIN): Issued by the IRS, an EIN is necessary for tax purposes. It allows the LLC to hire employees, open a bank account, and file tax returns.

- Bylaws: While not always required, bylaws outline the internal rules and procedures for managing the LLC. They can cover aspects like voting rights and meeting protocols.

- Membership Certificate: This certificate serves as proof of ownership in the LLC. It can be issued to the single member to signify their stake in the business.

- Business License: Depending on the type of business and location, a business license may be required. This document permits the LLC to operate legally within a specific jurisdiction.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can include policies on employee conduct, customer service, and financial management.

- Tax Election Forms: If the single-member LLC chooses to be taxed as a corporation rather than a sole proprietorship, specific forms must be filed with the IRS to make this election.

Each of these documents plays a significant role in establishing and maintaining the legal and operational integrity of a single-member LLC. Together, they create a solid foundation for the business, ensuring compliance with state and federal regulations while promoting effective management practices.

Consider Popular Types of Single-Member Operating Agreement Templates

Multi Member Operating Agreement - The agreement can include a buy-sell provision for member shares if needed.

The New York Operating Agreement form is a crucial document for any Limited Liability Company (LLC) operating in the state of New York. This agreement outlines the management structure, responsibilities, and ownership interests of the members, serving as a roadmap for the LLC's operations. To facilitate the creation of this important document, you can utilize Fillable Forms, which provide a comprehensive template that can help prevent misunderstandings and promote smooth business operations.

Similar forms

- Partnership Agreement: Similar to a Single-Member Operating Agreement, this document outlines the roles and responsibilities of partners in a business. It defines how profits and losses are shared, much like how an operating agreement details the management of a single-member LLC.

- Bylaws: Bylaws govern the internal management of a corporation. They establish rules for meetings and voting, similar to how an operating agreement sets forth the management structure of a single-member LLC.

Operating Agreement: To effectively manage your LLC, consider the comprehensive operating agreement insights that help define rules and responsibilities among members.

- Shareholder Agreement: This document is used in corporations to outline the rights and obligations of shareholders. Like an operating agreement, it helps clarify ownership and operational procedures.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information. While not directly related to management, it serves to safeguard business interests, similar to how an operating agreement protects the LLC's structure.

- Business Plan: A business plan outlines the strategy for a business's future. It shares some similarities with an operating agreement by defining the vision and operational strategy of the business.

- Employment Agreement: This document outlines the terms of employment for an employee. It can be similar to an operating agreement in that it defines roles and responsibilities within the organization.

- Articles of Incorporation: These documents establish a corporation's existence. They are similar to an operating agreement in that both define the structure and purpose of a business entity.

- LLC Membership Certificate: This document serves as proof of ownership in an LLC. It is related to the operating agreement, which defines ownership rights and responsibilities for members.

Common mistakes

Filling out a Single-Member Operating Agreement form can seem straightforward, but many people stumble over common mistakes that can lead to complications down the road. One of the most frequent errors is neglecting to include essential details about the business. For instance, failing to state the business name or its purpose can create confusion and might lead to issues with compliance or legal recognition.

Another common mistake is not specifying the ownership structure clearly. While it may seem obvious that you are the sole owner, explicitly stating this in the agreement reinforces your position and avoids potential disputes in the future. Additionally, some individuals overlook the importance of including the date of formation. This date is crucial for establishing timelines and ensuring that all legal requirements are met from the start.

Many people also forget to outline the management structure of the business. Even as a single-member entity, it’s important to clarify how decisions will be made. Will you operate independently, or will you involve others in decision-making processes? Clearly defining this can help prevent misunderstandings later on.

Another pitfall is not addressing the financial aspects of the business. Failing to outline how profits and losses will be handled can lead to confusion when tax time rolls around. It’s essential to specify whether you plan to reinvest profits back into the business or distribute them to yourself.

Some individuals may skip the section on amendments, thinking that their initial agreement will never need changes. However, businesses evolve, and having a clear process for making amendments can save time and headaches in the future. It’s wise to include a simple clause that outlines how changes can be made to the agreement.

In addition, many overlook the importance of signing and dating the document. An unsigned agreement can be deemed invalid, leaving your business vulnerable. Ensure that you not only sign but also date the agreement to provide a clear record of when it was executed.

Finally, some people fail to keep a copy of the completed agreement. Once the form is filled out, it’s crucial to store it in a safe place where it can be easily accessed. This document serves as a foundational piece of your business structure, and having it readily available can help in various situations, from banking to legal matters.

By avoiding these common mistakes, you can create a robust Single-Member Operating Agreement that supports your business goals and protects your interests. Taking the time to carefully fill out this form can pay off significantly in the long run.