Fill a Valid Sample Tax Return Transcript Template

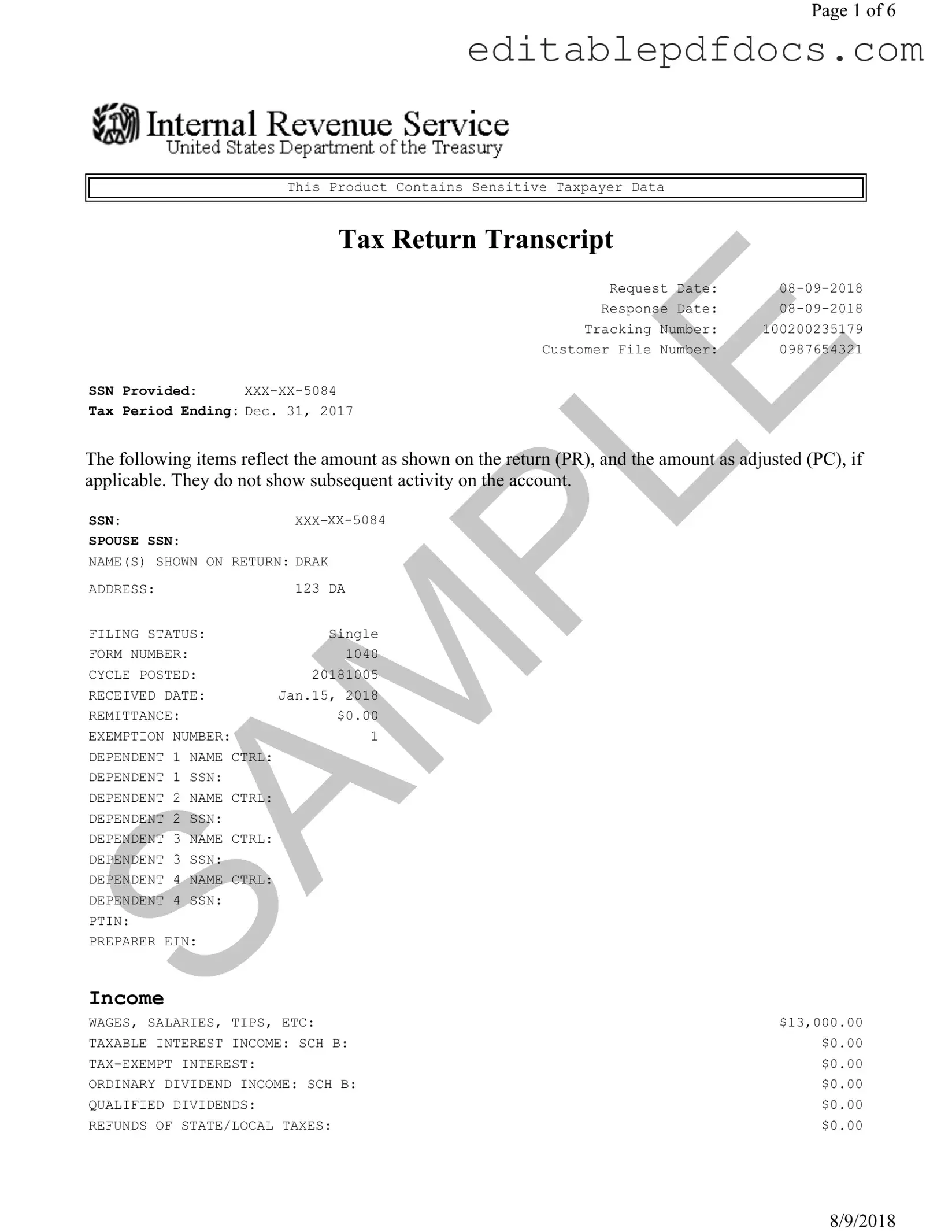

The Sample Tax Return Transcript form serves as a crucial document for taxpayers, providing a detailed summary of an individual's tax information as reported to the IRS. This form includes essential data such as the taxpayer's Social Security Number (SSN), filing status, and income details for the specified tax period. For instance, it outlines wages, salaries, and other income sources, along with adjustments to income, resulting in the adjusted gross income. Additionally, the form highlights tax liabilities, including tentative taxes and any credits applied, such as the Earned Income Credit. It also details payments made, including federal income tax withheld and any amounts owed or refunds due. Importantly, this transcript does not reflect any subsequent account activity, making it a snapshot of the taxpayer's financial situation for the given year. Overall, the Sample Tax Return Transcript is an essential tool for individuals seeking to verify their tax information, apply for loans, or address any discrepancies with the IRS.

Document Details

| Fact Name | Details |

|---|---|

| Form Type | Tax Return Transcript |

| Request Date | August 9, 2018 |

| Tax Period Ending | December 31, 2017 |

| Filing Status | Single |

| Total Income | $15,500.00 |

| Amount Owed | $103.00 |

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, there are certain best practices to follow. Here’s a list of things you should and shouldn't do:

- Do ensure all personal information is accurate, including your Social Security Number and filing status.

- Do double-check the income amounts reported to avoid discrepancies.

- Do keep a copy of the completed form for your records.

- Do submit the form before the deadline to avoid any penalties.

- Don't leave any sections blank; fill in all applicable fields.

- Don't use incorrect or outdated forms; always use the latest version.

- Don't forget to sign and date the form if required.

- Don't share sensitive information unless necessary and ensure it’s sent securely.

Documents used along the form

The Sample Tax Return Transcript is often accompanied by various other forms and documents that provide additional information about a taxpayer's financial situation. Below is a list of some common forms that may be used alongside the transcript.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. It reports income, deductions, and credits to calculate the tax owed or refund due.

- Employment Verification Form: To confirm your employment history efficiently, refer to the necessary Employment Verification documentation that supports various verification processes.

- Schedule C: This form is used to report income or loss from a business operated as a sole proprietorship. It includes details about income, expenses, and net profit or loss.

- Form W-2: Employers provide this form to report wages, tips, and other compensation paid to employees. It also includes the amount of taxes withheld from the employee’s paycheck.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. It is commonly used for freelance work, interest income, and dividends.

- Form 8862: This form is used to claim the Earned Income Credit after a prior denial. It provides information to determine eligibility for the credit in the current tax year.

- Form 4506-T: This is a request for a transcript of a tax return. Taxpayers use this form to obtain a copy of their tax return information from the IRS.

These documents collectively help to clarify a taxpayer's financial status and support the information presented in the Sample Tax Return Transcript. Each form serves a specific purpose and can be essential for accurate tax reporting and compliance.

Popular PDF Forms

Car Title Copy - The details specified in this form are critical to reflect the scope of work and any outstanding financial obligations.

I864 - This form requires the sponsor to disclose any previous I-864s they have filed.

When dealing with shipments, it's essential to utilize proper documentation, such as the FedEx Bill of Lading, to ensure a smooth transport process. This document not only acts as a receipt for freight services but also serves as a binding contract between the shipper and carrier. For more in-depth guidelines and resources, you can refer to PDF Documents Hub, which provides helpful tools for completing your shipping paperwork accurately.

What Does Ucc 1-308 Mean in Simple Terms - This document showcases the commitment to legal transparency and accountability.

Similar forms

-

Tax Return Transcript: This document provides a summary of a taxpayer's return, including income, deductions, and credits. It is similar to the Sample Tax Return Transcript as it also reflects the amounts reported on the tax return and any adjustments made by the IRS.

-

Account Transcript: This document shows a taxpayer's account activity over a specific period. Like the Sample Tax Return Transcript, it includes information about payments, penalties, and any adjustments made to the account.

-

Record of Account: This combines both the tax return and account transcripts into one document. It shares similarities with the Sample Tax Return Transcript in that it provides a comprehensive view of a taxpayer's financial history with the IRS.

-

Wage and Income Transcript: This document lists all income reported to the IRS by employers and other payers. It is similar to the Sample Tax Return Transcript because it details income information, including wages and other earnings.

- Bill of Sale: A Bill of Sale form is crucial when transferring ownership of personal property, as it provides legal proof of the transaction and outlines essential details like the item sold and the parties involved.

-

Verification of Non-filing Letter: This document confirms that the IRS has no record of a filed return for a specific tax year. While it differs in purpose, it is similar to the Sample Tax Return Transcript in that both documents provide essential information about a taxpayer's filing status.

Common mistakes

Filling out the Sample Tax Return Transcript form can be challenging. Many people make mistakes that can lead to delays or issues with their tax returns. Here are eight common mistakes to avoid.

One mistake is not providing complete information. Ensure that all sections are filled out accurately. Missing data can cause the form to be rejected or delayed. Double-check the Social Security Number (SSN) and names. Any discrepancies can lead to problems.

Another frequent error is miscalculating income. It's essential to report all sources of income correctly. For example, if you have business income, ensure that the amounts match your records. Inaccurate figures can result in incorrect tax calculations.

People often overlook deductions and credits. Make sure to review all possible deductions you may qualify for. Missing out on these can lead to a higher tax bill. Take your time to understand which deductions apply to your situation.

Additionally, some individuals forget to sign and date the form. This step is crucial. An unsigned form is considered incomplete and will not be processed. Always verify that you have signed before submitting.

Another common mistake is using outdated forms. Tax laws change frequently. Ensure that you are using the most current version of the form. Using an old form can lead to errors and complications.

Providing inaccurate bank information for refunds is also a common issue. If you expect a refund, make sure your bank account details are correct. Incorrect information can delay your refund or cause it to be sent to the wrong account.

Many people fail to keep copies of their submitted forms. It is wise to keep a copy for your records. This can be helpful if you need to reference it later or if any issues arise.

Lastly, not seeking help when needed can be a mistake. If you are unsure about any part of the form, consider consulting a tax professional. They can provide valuable guidance and help ensure that your form is completed correctly.