Free Rental Application Document

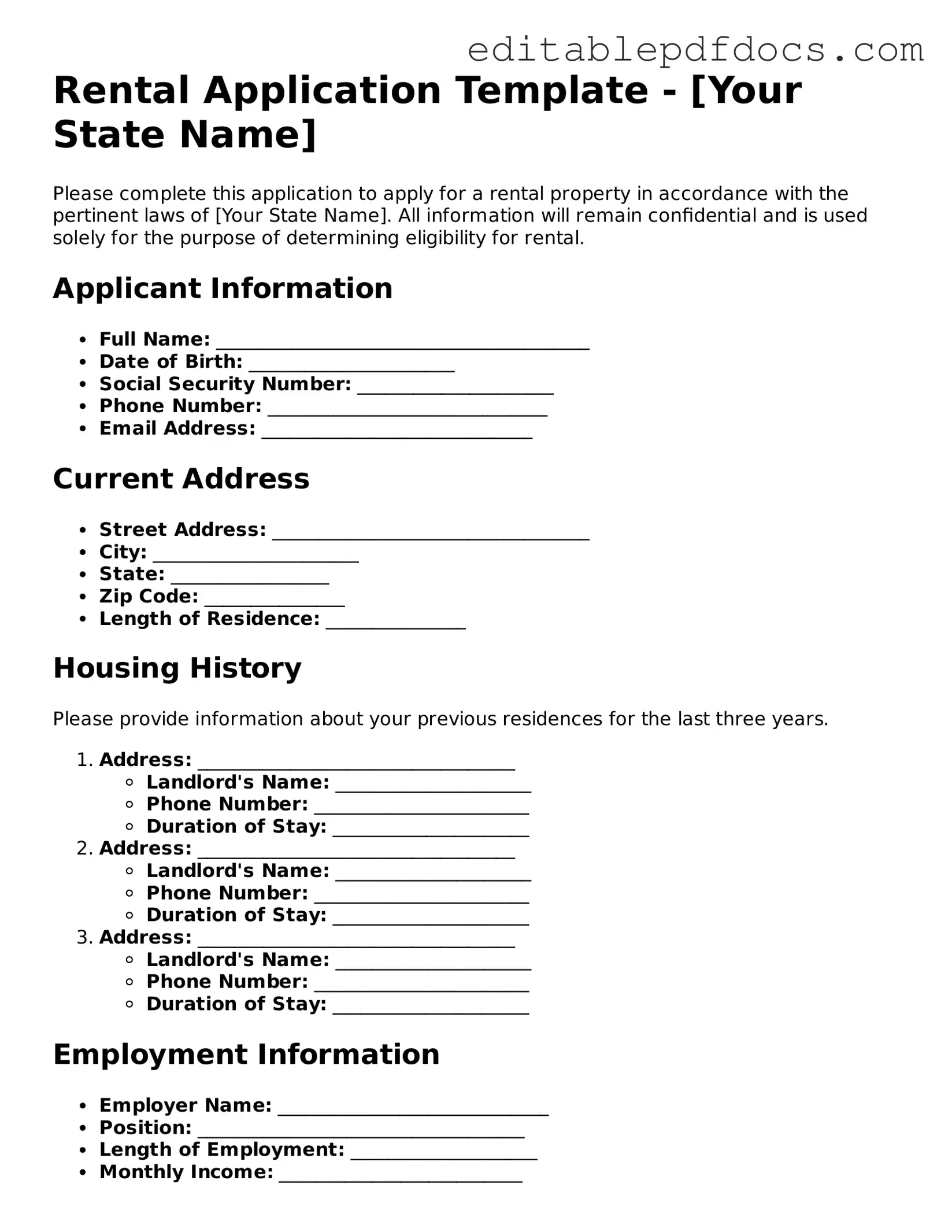

When seeking a new place to call home, the rental application form plays a crucial role in the process. This document is designed to gather essential information about potential tenants, helping landlords make informed decisions. Typically, the form requests personal details such as your name, contact information, and social security number. It often includes questions about your employment history, income, and rental history, allowing landlords to assess your financial stability and reliability as a tenant. Additionally, references from previous landlords or employers may be required, providing further insight into your character and responsibility. Some applications also inquire about pets, vehicle information, and any criminal history, ensuring that landlords have a comprehensive view of applicants. Understanding the components of this form can help you prepare and present yourself as a strong candidate for your desired rental property.

File Information

| Fact Name | Description |

|---|---|

| Purpose of Rental Application | The rental application form is used by landlords to evaluate potential tenants. It gathers essential information to assess the applicant's suitability for renting a property. |

| Common Information Required | Typically, applicants must provide personal details, rental history, employment information, and references. This helps landlords make informed decisions. |

| Application Fee | Many landlords charge a non-refundable application fee to cover background and credit checks. This fee varies by location and property type. |

| Fair Housing Laws | Landlords must comply with Fair Housing laws, which prohibit discrimination based on race, color, national origin, religion, sex, familial status, or disability. |

| State-Specific Forms | Some states have specific requirements for rental applications. For example, California mandates that landlords provide a notice of the application process and any screening criteria used. |

| Tenant Screening | After receiving the application, landlords often conduct tenant screening, which may include credit checks, criminal background checks, and rental history verification. |

| Right to Privacy | Applicants have a right to privacy. Landlords must handle personal information responsibly and cannot share it without consent. |

Rental Application - Adapted for Each State

Dos and Don'ts

When filling out a rental application form, it's essential to present yourself in the best light possible. Here are some guidelines to help you navigate the process effectively.

- Do: Provide accurate information. Ensure that all details about your income, employment, and rental history are truthful.

- Do: Be thorough. Complete every section of the application. Missing information can lead to delays or rejection.

- Do: Include references. Having personal or professional references can strengthen your application.

- Do: Review your application before submission. Double-check for any typos or errors that could raise concerns.

- Don't: Lie or exaggerate. Misrepresenting your financial situation or rental history can lead to serious consequences.

- Don't: Leave blank spaces. If a question doesn’t apply to you, write “N/A” instead of leaving it empty.

- Don't: Rush the process. Take your time to ensure that everything is filled out correctly and completely.

- Don't: Forget to follow up. After submitting your application, a polite inquiry can show your continued interest.

Documents used along the form

When applying for a rental property, a Rental Application form is just one piece of the puzzle. Alongside this form, several other documents may be required to help landlords assess potential tenants. These documents provide essential information about the applicant's background, financial stability, and rental history. Below is a list of commonly used forms and documents that often accompany a Rental Application.

- Credit Report: This document provides a detailed account of the applicant's credit history, including credit scores, outstanding debts, and payment history. Landlords use it to evaluate financial responsibility.

- Background Check Authorization: This form gives permission for the landlord to conduct a background check, which may include criminal history and past evictions. It helps landlords ensure a safe living environment.

- Proof of Income: Applicants typically provide recent pay stubs, tax returns, or bank statements to demonstrate their ability to pay rent. This information reassures landlords of the applicant's financial stability.

- Rental History Verification: This document outlines the applicant's previous rental experiences, including addresses, landlord contact information, and duration of stay. It helps landlords assess the applicant's reliability as a tenant.

- Employment Verification: A letter or form from the applicant's employer confirming their job title, salary, and length of employment. This document adds credibility to the applicant's financial claims.

- ADP Pay Stub: To ensure accurate tracking of earnings and deductions, it’s important to provide the Adp Pay Stub form as part of your application documentation.

- Personal References: A list of individuals who can vouch for the applicant's character and reliability. These references may include friends, family, or previous landlords.

- Pet Policy Agreement: If the applicant has pets, this document outlines the terms and conditions regarding pet ownership in the rental property. It may include pet deposits or breed restrictions.

- Identification: A government-issued ID, such as a driver's license or passport, is often required to verify the applicant's identity. This helps prevent fraud during the application process.

Having these documents ready can streamline the application process and increase the chances of securing the desired rental property. Being organized and transparent with information not only builds trust with potential landlords but also simplifies their decision-making process.

Consider Popular Types of Rental Application Templates

Letter to Landlord to End Tenancy - This letter reinforces the importance of notice in rental agreements.

Additionally, for those looking to understand the specifics of the shipping process, you can find further resources on the importance of the FedEx Bill of Lading at PDF Documents Hub, which can provide insights into properly filling out this essential shipping document.

Roommate Rules Template - Set forth the duration of the rental agreement and renewal options.

Parking Space Rental Agreement Template - A Garage Lease Agreement outlines the terms for renting a garage space.

Similar forms

-

Lease Agreement: This document outlines the terms and conditions under which a tenant agrees to rent a property. Similar to a rental application, it requires personal information and details about the rental history.

-

Credit Application: A credit application collects personal and financial information to assess an individual's creditworthiness. Both documents aim to evaluate the applicant's reliability and ability to meet financial obligations.

-

Employment Verification Form: This form confirms a tenant's employment status and income level. Like a rental application, it requires details about the applicant's job and financial stability.

-

Background Check Consent Form: This document allows landlords to conduct background checks on potential tenants. It shares similarities with a rental application in that it collects personal information and consent for verification.

- Employment Verification Form: Utilize our essential Employment Verification documentation to confirm income and tenure when applying for loans or rentals.

-

Rental History Report: A rental history report provides information about an applicant's previous rental experiences. This document, like a rental application, assesses the applicant's behavior as a tenant.

-

Guarantor Application: A guarantor application is used when a tenant requires a co-signer for the lease. It collects similar information to a rental application, focusing on the guarantor’s financial stability and reliability.

-

Pet Application: A pet application gathers information about a tenant's pets if they wish to keep them in a rental property. This document is akin to a rental application as it assesses the tenant’s responsibility and adherence to property rules.

Common mistakes

Filling out a rental application form can seem straightforward, but many applicants make common mistakes that could jeopardize their chances of securing a lease. One frequent error is providing incomplete information. Landlords and property managers rely on thorough applications to assess potential tenants. Omitting details such as previous addresses, employment history, or income can raise red flags. It is essential to ensure that every section of the application is fully completed.

Another mistake often seen is inaccuracies in personal information. This includes misspellings of names, incorrect Social Security numbers, or wrong dates of birth. Such inaccuracies can lead to delays in processing the application or even rejection. It is advisable to double-check all personal details before submitting the form.

Many applicants also fail to disclose necessary information regarding their rental history. This includes evictions, late payments, or disputes with previous landlords. While it may be tempting to omit negative experiences, honesty is crucial. Landlords typically conduct background checks, and undisclosed issues may surface later, leading to complications or termination of the lease.

Finally, neglecting to provide supporting documents can hinder the application process. Many landlords require proof of income, references, or identification. Failing to include these documents can result in delays or a denial of the application. It is wise to gather all necessary paperwork ahead of time and ensure that it accompanies the application.