Free Release of Promissory Note Document

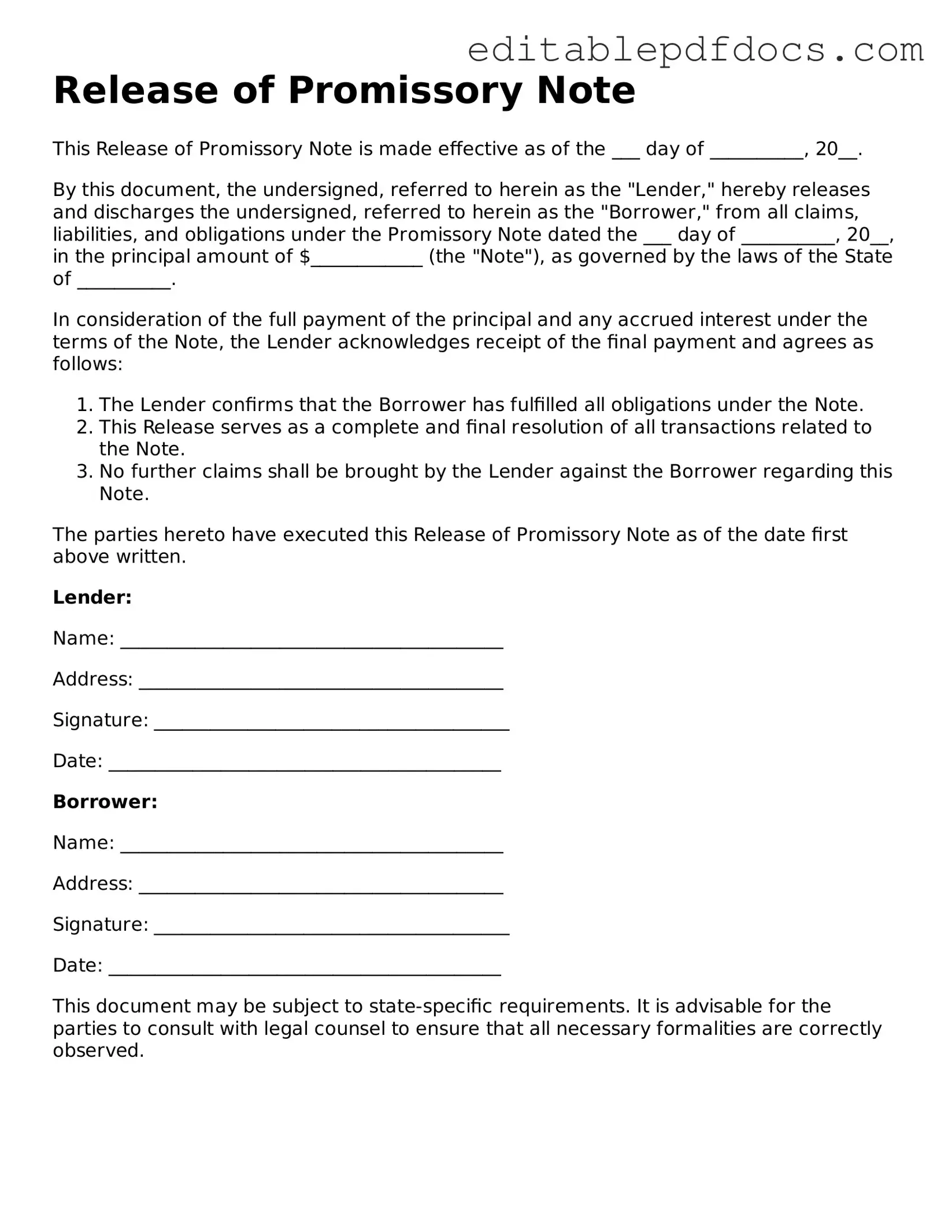

The Release of Promissory Note form is an essential document in financial transactions, particularly when a borrower has fulfilled their obligation to repay a loan. This form signifies the lender's acknowledgment that the debt has been satisfied, thereby releasing the borrower from any further liability associated with the promissory note. It typically includes key details such as the names of both parties, the original loan amount, and the date of repayment. By completing this form, both the lender and borrower can ensure clarity and prevent future disputes regarding the loan. Additionally, the form may require signatures from both parties, providing a record that the transaction has been officially documented. Understanding the significance of this form is crucial for anyone involved in lending or borrowing money, as it serves to protect the interests of both parties and contributes to transparent financial dealings.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Release of Promissory Note form is used to officially document the cancellation of a promissory note. |

| Governing Law | This form is governed by state-specific laws, which vary by location. For example, in California, it falls under the California Civil Code. |

| Signatures Required | Typically, the form must be signed by both the lender and the borrower to validate the release. |

| Filing | While not always required, it is advisable to file the release with the appropriate county office to ensure public record. |

Dos and Don'ts

When filling out the Release of Promissory Note form, there are several important dos and don’ts to keep in mind. This will help ensure that the process goes smoothly and that the form is completed correctly.

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the parties involved.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Do consult a legal expert if you have any questions.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to check for any additional requirements specific to your state.

- Don't submit the form without verifying all information is correct.

Documents used along the form

When dealing with a Release of Promissory Note form, several other documents may come into play to ensure that all parties are protected and that the transaction is clear. Below are some commonly used forms that often accompany the release.

- Promissory Note: This is the original document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payments. It serves as the foundational agreement between the borrower and lender.

- Blank Promissory Note Template: This form is useful for those looking to create a promissory note from scratch, providing a framework to outline essential details such as loan amount, repayment terms, and interest rates. You can find a useful template at https://patemplates.com.

- Loan Agreement: This document details the terms and conditions of the loan beyond what is included in the promissory note. It may cover aspects such as collateral, obligations of both parties, and what happens in the event of default.

- Payment Receipt: This form acts as proof that the borrower has made a payment towards the loan. It typically includes the date, amount paid, and a signature from the lender acknowledging receipt of the payment.

- Settlement Agreement: If there are any disputes or negotiations regarding the loan, a settlement agreement may be created. This document outlines the terms under which the parties agree to resolve their differences, often leading to the release of the promissory note.

These documents play a crucial role in ensuring that the terms of the loan are clear and that all parties understand their rights and responsibilities. Keeping organized records can help prevent misunderstandings and disputes in the future.

Consider Popular Types of Release of Promissory Note Templates

Loan Note Template - Ensures that payment history can be tracked over time.

To create a valid and enforceable agreement in New Jersey, parties often rely on the clarity and structure provided by standardized documents. The New Jersey Promissory Note serves this purpose by detailing vital information such as the loan amount and repayment schedule. For those seeking to draft this important legal document, resources like NJ PDF Forms offer customizable templates that simplify the process and ensure compliance with state laws.

Similar forms

-

Release of Liability Agreement: This document releases one party from any future claims or liabilities that may arise from a specific event or transaction. Like the Release of Promissory Note, it formalizes the end of obligations between parties, ensuring that the releasing party cannot pursue further claims related to the matter at hand.

Promissory Note Template: Utilizing a reliable template can simplify the process of creating a legally binding promissory note. For an effective example, consider visiting https://nyforms.com/promissory-note-template to ensure all necessary terms and conditions are covered correctly.

-

Mutual Release Agreement: This agreement involves two parties agreeing to release each other from any claims or obligations. Similar to the Release of Promissory Note, it serves to finalize all outstanding issues between the parties, preventing any future disputes regarding the subject of the agreement.

-

Settlement Agreement: A Settlement Agreement resolves disputes between parties, often involving compensation or the relinquishment of claims. Like the Release of Promissory Note, it signifies that all parties have reached a consensus and no further actions will be taken regarding the settled matter.

-

Waiver of Rights: This document allows a party to voluntarily give up specific rights or claims. It is similar to the Release of Promissory Note in that it ensures that the waiving party cannot later assert those rights, thereby closing the door on potential future claims.

Common mistakes

Filling out a Release of Promissory Note form requires attention to detail. One common mistake is failing to include all necessary parties. Each individual or entity involved in the original promissory note must be listed. Omitting a party can lead to disputes later on, as it may appear that the release does not apply to all relevant parties.

Another frequent error involves the lack of a clear date. The date of the release is essential for establishing when the obligations under the promissory note are considered fulfilled. Without a date, there may be confusion regarding the timing of the release, which can complicate future legal matters.

People often neglect to provide adequate identification of the promissory note itself. This includes referencing the note's date, amount, and any identifying numbers. Failing to do so can create ambiguity about which note is being released, leading to potential legal complications.

Additionally, individuals sometimes overlook the need for signatures. All parties involved must sign the form for it to be valid. A missing signature can render the release ineffective, which may leave the original obligations intact.

Finally, not keeping a copy of the completed form is a mistake many make. Retaining a copy ensures that all parties have access to the release documentation, which is important for future reference. Without a copy, proving the release may become difficult if disputes arise later.