Fill a Valid Release Of Lien Texas Template

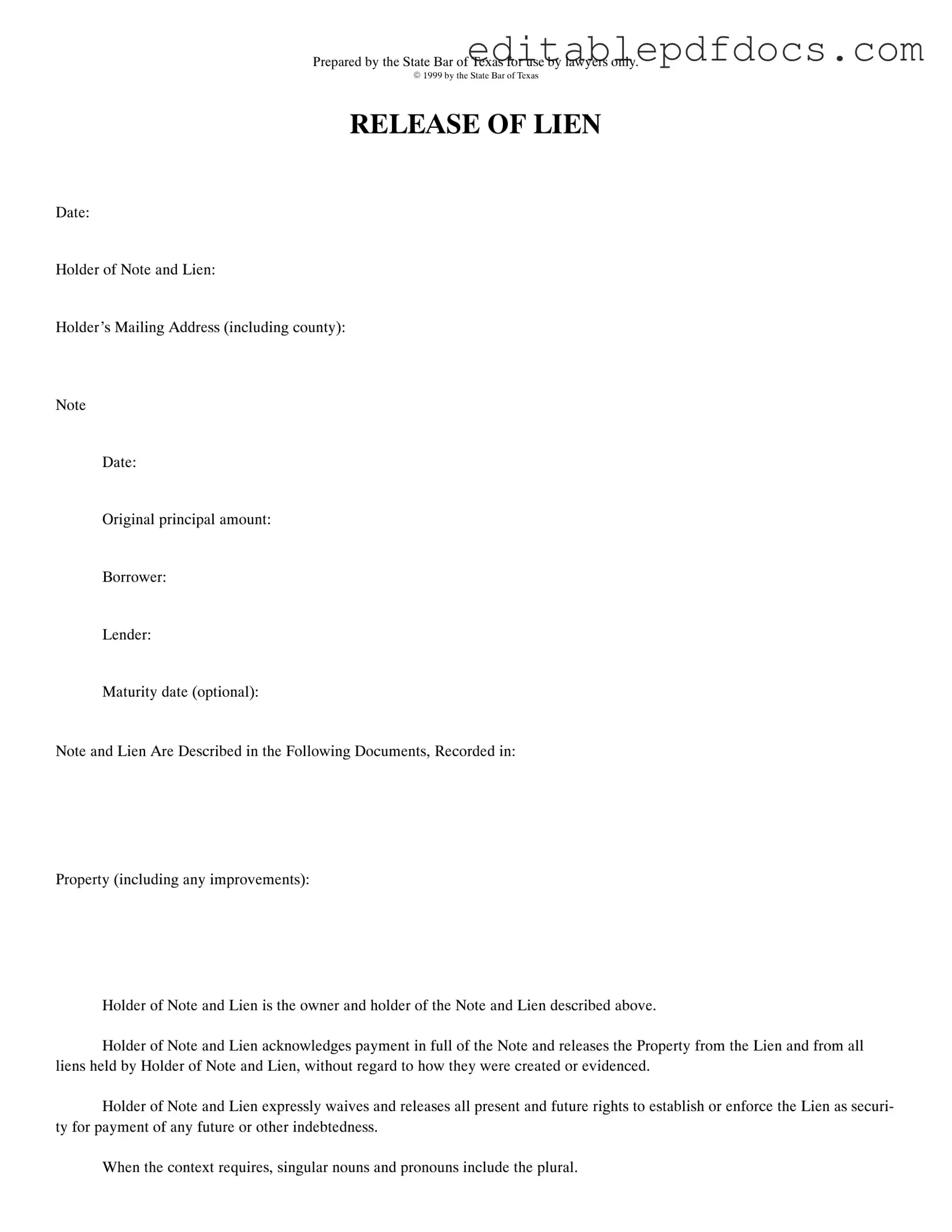

The Release of Lien Texas form is a crucial document in the process of clearing a property from any liens, ensuring that the property owner can enjoy clear title. This form is specifically designed for use by attorneys and is prepared by the State Bar of Texas. It includes essential details such as the date of the release, the holder of the note and lien, and the mailing address of the holder, which must include the county. The form also captures the original principal amount, the names of the borrower and lender, and the maturity date, if applicable. Additionally, it outlines the specific documents that describe the note and lien, as well as the property involved, including any improvements made. By signing this form, the holder of the note acknowledges that they have received full payment and are formally releasing the property from the lien, relinquishing all rights to enforce it for any future debts. The acknowledgment section requires notarization, ensuring that the release is legally binding and properly documented. This form not only facilitates the transfer of property rights but also provides peace of mind to property owners, confirming that their financial obligations have been satisfied.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | The Release of Lien form is used to officially acknowledge that a lien has been paid off and to release the property from any claims. |

| Governing Law | This form is governed by Texas Property Code, specifically sections related to liens and releases. |

| Who Can Use It | This form is prepared for use by lawyers only, as indicated by the State Bar of Texas. |

| Key Components | The form includes details such as the holder of the note, borrower, and property description, along with acknowledgment sections for notarization. |

Dos and Don'ts

When filling out the Release of Lien Texas form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do provide accurate information for each field, including the holder's name and mailing address.

- Don't leave any required fields blank; this may cause delays in processing.

- Do double-check the spelling of names and addresses to avoid errors.

- Don't use abbreviations or shorthand; clarity is essential.

- Do ensure that the acknowledgment section is completed correctly, including the notary's information.

- Don't forget to sign and date the form before submission.

Documents used along the form

When dealing with property transactions in Texas, the Release of Lien form is often accompanied by other important documents. These documents help clarify the terms of the transaction and ensure that all parties are on the same page. Below are several forms commonly used alongside the Release of Lien in Texas.

- Promissory Note: This document outlines the terms of a loan, including the amount borrowed, the interest rate, and the repayment schedule. It serves as a formal agreement between the borrower and lender, establishing the borrower's obligation to repay the debt.

- Deed of Trust: This legal document secures the loan by placing a lien on the property. It involves three parties: the borrower, the lender, and a third-party trustee. The Deed of Trust outlines the conditions under which the property can be foreclosed if the borrower defaults on the loan.

- Mortgage Agreement: Similar to a Deed of Trust, a mortgage agreement is a contract between the borrower and lender that secures the loan with the property. It specifies the rights and responsibilities of both parties, including payment terms and what happens in case of default.

- California Lease Agreement: This document is essential for defining the terms of rental agreements and includes resources like Fillable Forms to streamline the process.

- Title Insurance Policy: This document protects the lender and/or the buyer from potential losses due to defects in the title of the property. It ensures that the title is clear of any liens or encumbrances that could affect ownership rights.

- Settlement Statement: Also known as a Closing Disclosure, this document provides a detailed account of all the costs associated with the real estate transaction. It includes information about the sale price, loan fees, and other expenses that both the buyer and seller need to understand before finalizing the deal.

Understanding these documents can greatly enhance your ability to navigate property transactions in Texas. Each plays a critical role in ensuring that all parties are protected and that the transaction proceeds smoothly. Familiarity with these forms will empower you to make informed decisions and avoid potential pitfalls in the process.

Popular PDF Forms

Roof Certification Form - Capture the email address of the owner or manager for correspondence.

To gain a deeper understanding of the implications and usage of the Florida Durable Power of Attorney, you may read here for detailed information about this vital legal document that safeguards your financial interests during times of incapacity.

Cair Login - The form is available in both English and Spanish for accessibility.

What Is a Work Release Form - Completing the Work Release form is a step towards demonstrating responsible behavior.

Similar forms

-

Release of Mortgage: Similar to the Release of Lien, a Release of Mortgage indicates that a mortgage has been paid off. It formally removes the lender's claim on the property, ensuring the homeowner is free from that debt. Both documents serve to clear the title of a property.

-

Quitclaim Deed: A Quitclaim Deed transfers any ownership interest in a property from one party to another without guaranteeing that the title is clear. Like the Release of Lien, it can remove claims against the property, but it does not involve a debt being paid off.

-

Release of Judgment Lien: This document removes a lien placed on a property due to a court judgment. Similar to the Release of Lien, it acknowledges that the debt has been satisfied and clears the property title from the judgment creditor's claim.

-

Subordination Agreement: A Subordination Agreement allows a new lender to take priority over existing liens. While it doesn’t release a lien, it alters the priority of claims, akin to how the Release of Lien affects the standing of a lienholder.

-

Affidavit of Release: This document is often used to confirm that a lien has been paid and released. It provides a sworn statement that the debt has been satisfied, similar to the acknowledgment in the Release of Lien.

- Motor Vehicle Bill of Sale: Essential for transferring ownership of a vehicle, this document serves as legal evidence in the sale and is crucial for the buyer's registration process. For more information, visit https://nyforms.com/motor-vehicle-bill-of-sale-template.

-

Certificate of Satisfaction: This certificate is issued by a lender once a loan is paid in full. It serves a purpose similar to the Release of Lien, as it confirms that the borrower has fulfilled their obligations, thus releasing the lender's claim on the property.

-

Deed of Reconveyance: Used primarily in trust deeds, this document transfers the title back to the borrower after the loan is paid off. Like the Release of Lien, it signifies that the lender no longer has a claim on the property.

Common mistakes

Filling out the Release Of Lien Texas form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to provide complete and accurate information. Each section, from the holder's mailing address to the property description, must be filled out carefully. Missing details can delay the release process and may even result in the form being rejected.

Another mistake occurs when individuals do not properly identify the holder of the note and lien. It is crucial to ensure that the name listed matches the legal entity that holds the lien. If the name is incorrect or incomplete, it can create confusion and legal issues down the line. This can complicate matters when trying to enforce or clarify the release.

People often overlook the importance of acknowledging the payment in full. The form requires the holder of the note and lien to explicitly state that the debt has been satisfied. If this acknowledgment is missing, it could lead to future claims against the property. A clear statement of payment is essential to avoid misunderstandings.

Not using the correct format for dates is another common pitfall. Dates should be filled in clearly and accurately. Incomplete or incorrectly formatted dates can lead to ambiguity about when the lien was released, potentially causing problems for both the borrower and the lender.

Additionally, individuals may forget to include the notary acknowledgment. The form must be notarized to be legally binding. Without this step, the release may not hold up in court or during any future transactions involving the property. It is essential to ensure that the notary’s information is filled out correctly, including the commission expiration date.

Finally, some people neglect to keep a copy of the completed form. Once submitted, having a copy serves as a record of the transaction. This can be vital for future reference or if any disputes arise later. Keeping documentation helps protect the interests of all parties involved.