Free Real Estate Purchase Agreement Document

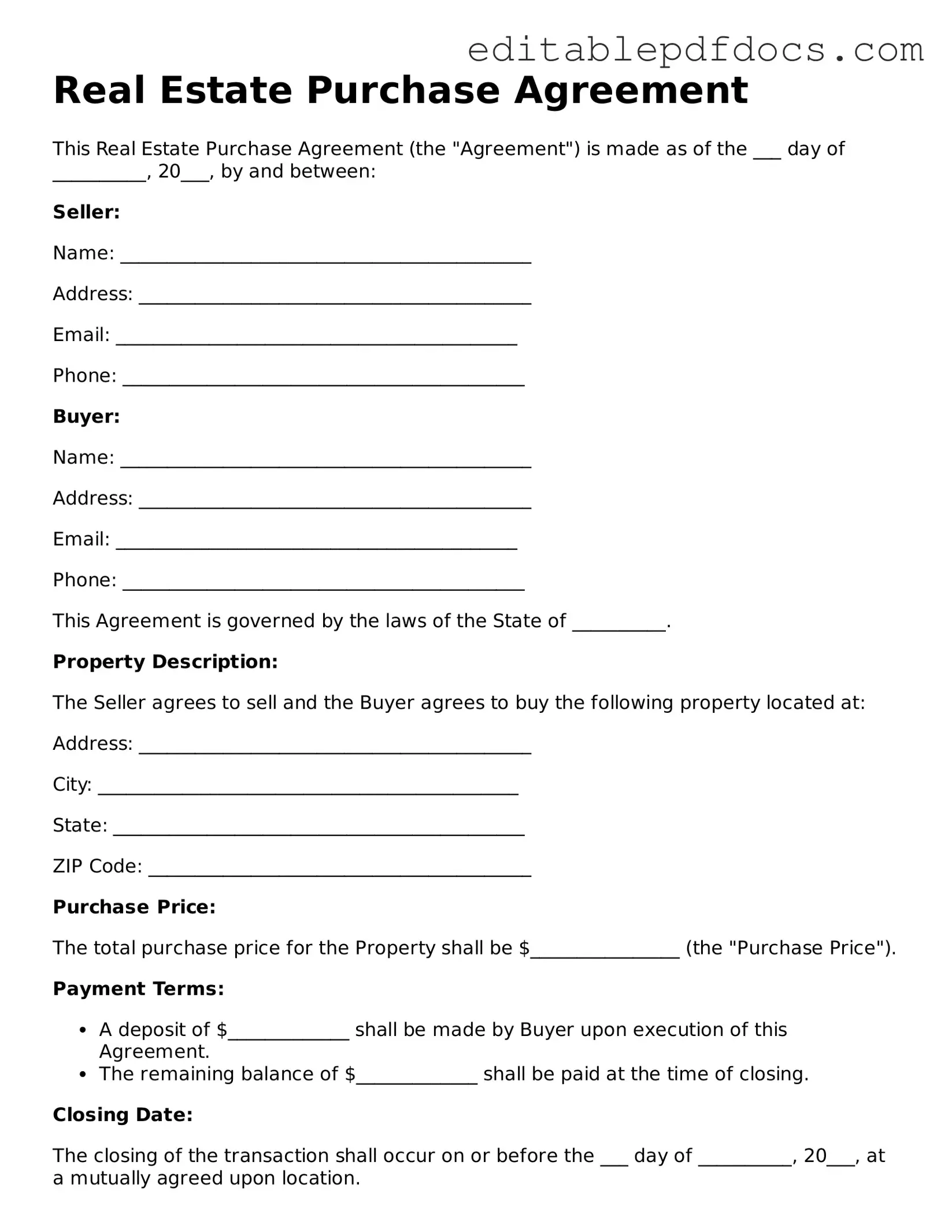

When embarking on the journey of buying or selling a home, one of the most crucial documents you'll encounter is the Real Estate Purchase Agreement. This form serves as a roadmap for the transaction, detailing the terms and conditions agreed upon by both the buyer and seller. It outlines essential elements such as the purchase price, financing details, and any contingencies that may affect the sale. Additionally, the agreement specifies the closing date, which is the moment when ownership officially changes hands. It also addresses any repairs or inspections that need to be conducted prior to finalizing the deal. Understanding this document is vital, as it not only protects the interests of both parties but also ensures a smooth transition throughout the buying or selling process. With clear terms laid out, both buyers and sellers can move forward with confidence, knowing they have a solid foundation for their real estate transaction.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. |

| Key Components | This agreement typically includes details such as the purchase price, property description, closing date, and any contingencies that must be met. |

| Governing Law | The laws governing real estate transactions vary by state. For example, in California, the California Civil Code applies, while in Texas, the Texas Property Code governs these agreements. |

| Contingencies | Common contingencies may involve financing, home inspections, and the sale of the buyer’s current home. These conditions must be satisfied for the sale to proceed. |

| Negotiation | Both parties can negotiate the terms of the agreement. This process ensures that the needs and concerns of both the buyer and seller are addressed. |

| Signatures | For the agreement to be legally binding, both the buyer and seller must sign the document. This signifies their acceptance of the terms outlined. |

Real Estate Purchase Agreement - Adapted for Each State

Real Estate Purchase Agreement Types

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it is important to approach the task with care and attention to detail. Here are some guidelines to help you navigate this process effectively:

- Do: Read the entire agreement carefully before filling it out. Understanding each section is crucial.

- Do: Provide accurate information. Double-check names, addresses, and other details to avoid errors.

- Do: Consult with a real estate agent or attorney if you have questions about the terms or conditions.

- Do: Sign and date the agreement in the designated areas. This step is essential for the document to be valid.

- Don't: Rush through the form. Taking your time can prevent mistakes that may complicate the transaction.

- Don't: Leave any sections blank unless instructed otherwise. Each part of the agreement typically requires a response.

- Don't: Ignore deadlines. Timely submission of the agreement is often necessary to keep the process moving forward.

Documents used along the form

When entering into a real estate transaction, several important documents accompany the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth process. Below is a list of commonly used forms and documents.

- Property Disclosure Statement: This document provides information about the condition of the property. Sellers must disclose any known issues that could affect the property's value or desirability.

- Title Report: A title report outlines the legal ownership of the property and reveals any liens, easements, or other claims against it. This ensures that the buyer is aware of any potential issues before the purchase.

- Georgia Sop form: The Georgia Sop form outlines the standard operating procedures for inmate visitation within the Georgia Department of Corrections, establishing crucial guidelines for fostering positive relationships.

- Loan Estimate: If the buyer is financing the property, a loan estimate details the terms of the mortgage, including interest rates, monthly payments, and closing costs. This document helps buyers understand their financial obligations.

- Closing Disclosure: This document is provided before the closing date. It summarizes the final terms of the mortgage and all closing costs. Buyers should review this carefully to ensure accuracy.

- Escrow Agreement: This agreement outlines the terms under which the escrow agent will hold funds and documents until all conditions of the sale are met. It protects both the buyer and seller during the transaction.

These documents are essential for a successful real estate transaction. Understanding each one helps buyers and sellers navigate the process with confidence.

More Templates

Small Business Sale Agreement Pdf Free - The agreement often requires the seller to conduct business as usual before the sale is finalized.

Power of Attorney Example - Granting Power of Attorney can relieve stress by ensuring your properties are handled appropriately.

Understanding the importance of a notary acknowledgement document is vital for anyone engaged in legal processes. This form ensures that the signatures on official documents are verified and trusted, creating a layer of security against potential disputes about signature authenticity.

Parent Consent Form - Complete this form to provide legal permission for a minor's outings or events.

Similar forms

Lease Agreement: This document outlines the terms under which a tenant may occupy a property. Similar to a Real Estate Purchase Agreement, it specifies the parties involved, the property in question, and the terms of payment. However, a lease typically grants temporary rights, while a purchase agreement conveys ownership.

Option to Purchase Agreement: This agreement gives a tenant the right to buy the property at a specified price within a certain timeframe. Like the Real Estate Purchase Agreement, it involves negotiation of terms and conditions but focuses on the option rather than an immediate sale.

Sales Contract: A sales contract for personal property shares similarities with a Real Estate Purchase Agreement. Both documents detail the sale conditions, including price and delivery terms. However, a sales contract is typically used for movable items, while the purchase agreement is specific to real estate.

Purchase and Sale Agreement: Often used interchangeably with the Real Estate Purchase Agreement, this document also outlines the terms of buying and selling property. It may include additional contingencies and disclosures, but the core purpose remains the same: to formalize the transaction.

Joint Venture Agreement: In real estate, a joint venture agreement may involve multiple parties collaborating to purchase property. While it focuses on the partnership aspect, it shares the essential elements of outlining responsibilities and financial contributions, similar to a Real Estate Purchase Agreement.

Real Estate Listing Agreement: This document is used between a property owner and a real estate agent. It establishes the terms under which the agent will market the property. Both agreements require clear terms and conditions, though the listing agreement does not result in a sale but facilitates one.

-

Free And Invoice PDF Form: The Free And Invoice PDF form is a simple and effective tool designed to assist individuals and businesses in creating professional-looking invoices. This form streamlines the billing process, making it easier to track payments and manage finances. With customizable fields and a user-friendly layout, it caters to various needs while ensuring clarity and efficiency in communication. For more resources, you can visit Fillable Forms.

Title Transfer Document: This document is crucial for legally transferring ownership of property from one party to another. It is similar to a Real Estate Purchase Agreement in that it finalizes the transaction, but it focuses specifically on the transfer of title rather than the sale terms.

Common mistakes

When filling out a Real Estate Purchase Agreement, many individuals make common mistakes that can lead to confusion or complications later on. One frequent error is failing to include all necessary parties in the agreement. It’s essential to ensure that all buyers and sellers are clearly identified. Omitting a party can create legal issues down the line.

Another common mistake is neglecting to specify the property address accurately. A vague or incorrect address can lead to disputes over which property is being sold. Always double-check that the address is complete, including unit numbers if applicable.

People often overlook the importance of detailing the purchase price. It's not enough to simply write a number; the agreement should clearly state the purchase price and any deposits required. This clarity helps prevent misunderstandings between parties.

Additionally, many individuals fail to include contingencies. Contingencies protect buyers and sellers by outlining conditions that must be met for the sale to proceed. Without these clauses, you might find yourself in a difficult situation if issues arise during the transaction.

Another mistake involves not specifying the closing date. This date is crucial for both parties, as it marks when the ownership of the property will officially transfer. Leaving this date open-ended can lead to confusion and potential delays.

People sometimes forget to review the financing terms. It’s important to clarify how the purchase will be financed, whether through a mortgage, cash, or other means. This detail can significantly impact the transaction process.

Many buyers and sellers also fail to include a detailed description of any personal property that is part of the sale. Items like appliances, fixtures, or furniture should be explicitly listed to avoid disputes later on.

Finally, not seeking legal advice can be a significant oversight. While it may seem unnecessary, having a professional review the agreement can help catch mistakes and ensure that all terms are fair and legally sound.