Free Real Estate Power of Attorney Document

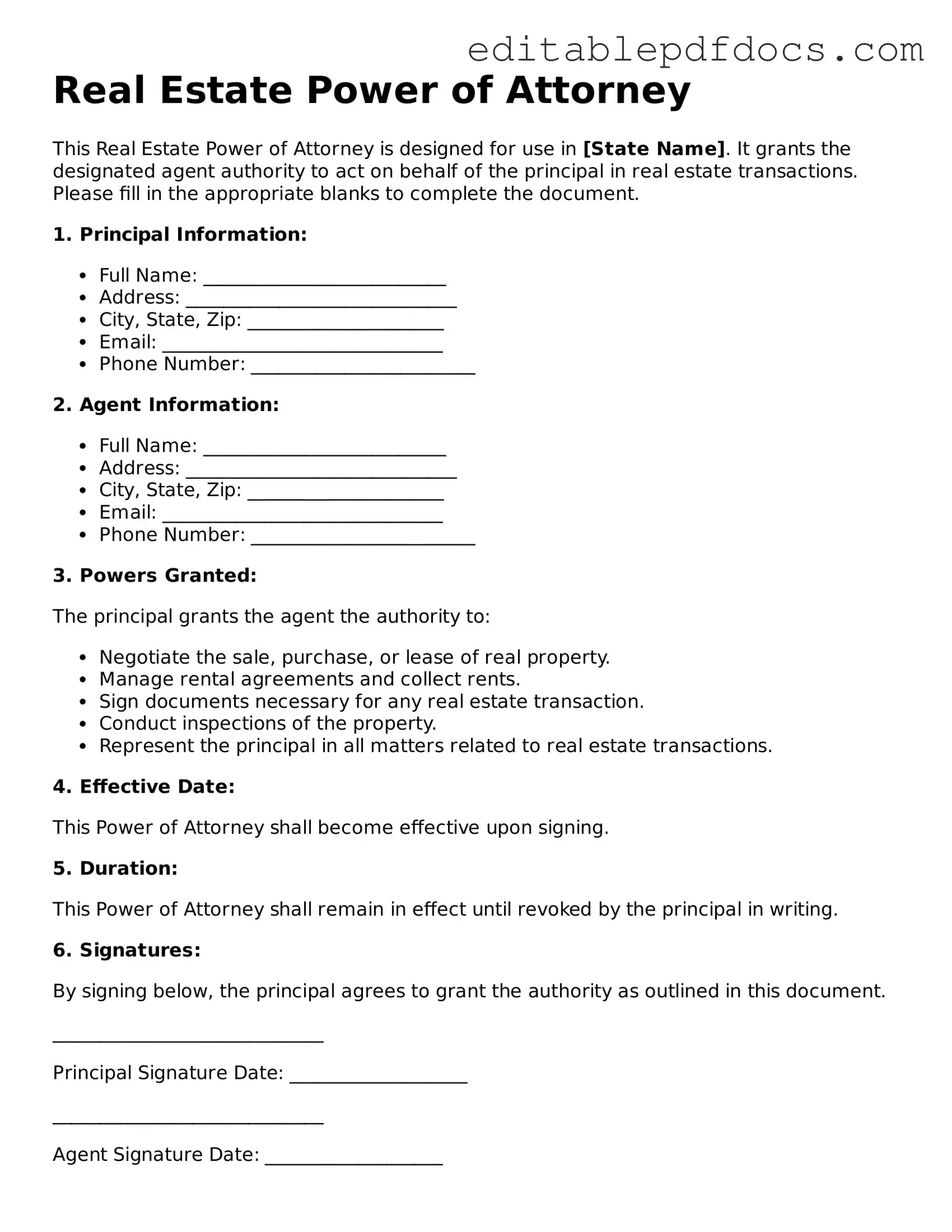

The Real Estate Power of Attorney form is a crucial document for anyone involved in real estate transactions. This form allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to handle specific real estate matters on their behalf. This can include buying, selling, leasing, or managing property. The form outlines the authority granted to the agent, ensuring they can act in the principal's best interest. It is important to specify the powers given, as well as any limitations, to avoid misunderstandings. Additionally, the form often requires notarization to confirm its validity. Whether you are unable to be present for a transaction or simply prefer to delegate these responsibilities, understanding this form is essential for smooth real estate dealings.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Real Estate Power of Attorney allows one person to act on behalf of another in real estate transactions. |

| Purpose | This document is used to facilitate buying, selling, or managing real estate when the principal cannot do so themselves. |

| Principal and Agent | The principal is the person granting authority, while the agent is the person receiving it. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| State-Specific Forms | Each state has its own requirements and forms. For example, California follows the California Probate Code Section 4000. |

| Durable vs. Non-Durable | A durable power of attorney remains effective even if the principal becomes incapacitated, while a non-durable does not. |

| Notarization | Most states require the document to be notarized to be legally valid. |

| Limitations | Some actions may be restricted by state law, such as transferring property to the agent themselves without explicit consent. |

Dos and Don'ts

When filling out the Real Estate Power of Attorney form, it is important to follow certain guidelines to ensure the document is valid and effective. Below is a list of things to do and avoid during this process.

- Do: Clearly identify the principal and the agent in the form.

- Do: Specify the powers granted to the agent in detail.

- Do: Include the date the document is signed.

- Do: Ensure the form is signed in the presence of a notary public.

- Don't: Leave any sections of the form blank; fill in all required information.

- Don't: Use vague language that could lead to misinterpretation of the powers granted.

- Don't: Forget to provide copies of the signed document to all relevant parties.

Adhering to these guidelines will help ensure that the Real Estate Power of Attorney form is completed correctly and serves its intended purpose.

Documents used along the form

When dealing with real estate transactions, a Real Estate Power of Attorney is often accompanied by several other important documents. Each of these documents serves a unique purpose and helps ensure that the transaction proceeds smoothly. Here’s a list of common forms and documents you might encounter.

- Purchase Agreement: This document outlines the terms and conditions of the sale between the buyer and seller. It includes details like the purchase price, closing date, and any contingencies.

- Deed: A deed transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be legally effective.

- California Power of Attorney Form: A crucial document for granting authority in real estate matters; simplify this process by using tools like Fill PDF Forms.

- Title Insurance Policy: This policy protects the buyer and lender from any issues related to the property’s title, such as liens or ownership disputes.

- Disclosure Statements: Sellers are often required to provide disclosures about the property’s condition, including any known defects or issues that could affect its value.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments made at closing.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be necessary, including the loan agreement and promissory note.

- Home Inspection Report: This report details the findings of a professional inspection of the property, highlighting any repairs or maintenance needed.

- Appraisal Report: An appraisal determines the property's market value, which is often required by lenders before approving a mortgage.

- Affidavit of Title: This sworn statement confirms that the seller has legal ownership of the property and that there are no undisclosed liens or claims against it.

Understanding these documents can make the real estate process less daunting. Each plays a crucial role in protecting the interests of all parties involved and ensuring a successful transaction.

Consider Popular Types of Real Estate Power of Attorney Templates

What's the Difference Between Power of Attorney and Durable Power of Attorney - Your chosen agent can manage your estate in accordance with your wishes.

Understanding the importance of having a Power of Attorney is crucial for anyone looking to plan for the future. This document not only designates an agent to handle important decisions but also provides peace of mind knowing that health, financial, and legal matters are in capable hands. For those interested in creating such a document, a convenient resource is available at https://nyforms.com/power-of-attorney-template, where you can find a template to start the process.

Power of Attorney Car Title - The form protects your interests while allowing another to manage your vehicle needs.

Similar forms

- Durable Power of Attorney: This document allows an individual to appoint someone to make decisions on their behalf, even if they become incapacitated. Like the Real Estate Power of Attorney, it grants authority to act in specific matters, but it is broader in scope.

- Financial Power of Attorney: Similar to the Real Estate Power of Attorney, this document enables a person to designate someone to manage their financial affairs. It can include real estate transactions but is not limited to them.

- Power of Attorney Form: Essential for anyone considering appointing an agent, this document allows a person to grant authority for a variety of decisions, including the ability to manage real estate and other important matters. More information can be found at https://topformsonline.com/.

- Healthcare Power of Attorney: This document empowers an individual to make medical decisions for another person. While it focuses on health-related matters, it shares the same principle of granting authority to act on behalf of someone else.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. It is not a power of attorney but often accompanies a Healthcare Power of Attorney to clarify healthcare decisions.

- Trust Agreement: A Trust Agreement allows an individual to transfer assets into a trust, managed by a trustee for the benefit of beneficiaries. It can include real estate and shares similarities in terms of delegating authority over property.

- Quitclaim Deed: This document transfers ownership interest in real property from one party to another. While it does not grant power of attorney, it is a legal instrument used in real estate transactions, similar in context.

- Bill of Sale: A Bill of Sale is used to transfer ownership of personal property. While it differs in focus, it serves a similar function in facilitating the transfer of property rights, akin to the Real Estate Power of Attorney.

Common mistakes

Filling out a Real Estate Power of Attorney form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to provide complete and accurate information. Individuals often overlook essential details such as the legal names of the parties involved, property descriptions, or the specific powers being granted. Incomplete information can render the document invalid, causing delays in real estate transactions.

Another common mistake is neglecting to sign the document properly. Signatures must be clear and consistent with the names provided in the form. Additionally, witnesses or notarization may be required depending on state laws. Omitting these steps can lead to disputes regarding the validity of the Power of Attorney, potentially complicating the transaction.

People also sometimes select an inappropriate agent or attorney-in-fact. It is crucial to choose someone trustworthy and capable of handling the responsibilities assigned to them. Selecting an individual without the necessary knowledge or experience can result in poor decision-making regarding the property. This choice can have significant financial implications for the principal.

Finally, individuals may fail to understand the scope of the powers they are granting. The form allows for specific powers to be designated, and it is essential to clearly outline what the agent can and cannot do. A lack of clarity can lead to misunderstandings and misuse of authority. It is advisable to review the powers carefully and ensure they align with the principal's intentions.