Free Quitclaim Deed Document

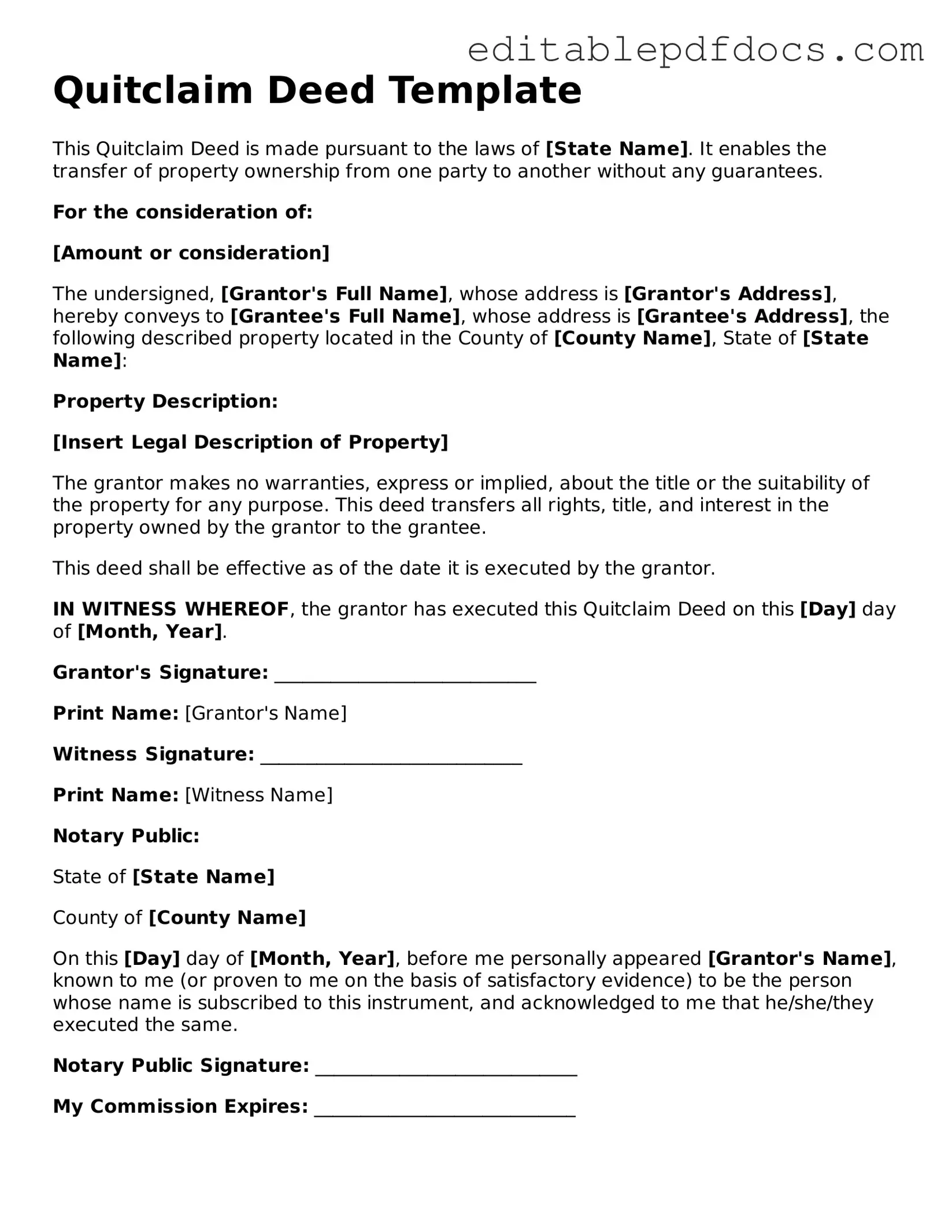

The Quitclaim Deed form serves as a crucial instrument in real estate transactions, particularly when transferring ownership of property. This form allows an individual, known as the grantor, to relinquish any claim or interest they may have in a property to another party, referred to as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property; it merely conveys whatever interest the grantor possesses, if any. This makes it an ideal option for situations involving family transfers, divorces, or clearing up title issues. Additionally, the Quitclaim Deed is often simpler and faster to execute than other deeds, as it typically requires less formal documentation and fewer legal obligations. However, it is essential for both parties to understand the implications of using this form, as the lack of warranties can lead to potential disputes over property rights. By carefully considering the circumstances and intentions behind the transfer, individuals can make informed decisions regarding the use of a Quitclaim Deed.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property title. |

| Use Cases | This type of deed is commonly used among family members, in divorce settlements, or to clear up title issues. |

| State-Specific Forms | Each state may have its own version of the quitclaim deed form. For example, in California, the form is governed by California Civil Code Section 1092. |

| Limitations | Unlike warranty deeds, quitclaim deeds do not provide any protection against claims on the property. The grantee takes the property "as is." |

| Execution Requirements | Most states require the quitclaim deed to be signed by the grantor and notarized for it to be legally valid. |

| Recording | It is advisable to record the quitclaim deed with the local county recorder's office to provide public notice of the ownership transfer. |

| Tax Implications | Transferring property via a quitclaim deed may have tax implications, such as potential gift tax if the property is given without consideration. |

Quitclaim Deed - Adapted for Each State

Dos and Don'ts

When filling out a Quitclaim Deed form, it is important to follow certain guidelines to ensure the process is smooth and legally valid. Here are eight key points to consider:

- Do ensure that the names of all parties involved are clearly printed and spelled correctly.

- Don't leave any sections of the form blank; all required fields must be filled out.

- Do include a complete legal description of the property being transferred.

- Don't use vague terms or abbreviations in the property description.

- Do sign the document in the presence of a notary public to validate the deed.

- Don't forget to check local laws regarding any additional requirements for the deed.

- Do keep a copy of the completed Quitclaim Deed for your records.

- Don't submit the deed without ensuring all parties have agreed to the terms of the transfer.

Documents used along the form

A Quitclaim Deed is often used in real estate transactions to transfer ownership of property without guaranteeing the title. When preparing to use a Quitclaim Deed, several other documents may be necessary to ensure a smooth process. Here are some common forms and documents that accompany a Quitclaim Deed.

- Title Search Report: This document provides a detailed history of the property’s ownership. It helps identify any liens, claims, or issues with the title that may affect the transfer.

- Property Tax Receipts: These receipts confirm that all property taxes have been paid up to date. Buyers often require proof of tax payments to avoid future liabilities.

- Affidavit of Title: This sworn statement by the seller asserts their ownership of the property and confirms there are no undisclosed claims against it. It provides additional assurance to the buyer.

- Purchase Agreement: This contract outlines the terms of the sale, including the purchase price and any contingencies. It serves as a formal agreement between the buyer and seller.

- Room Rental Agreement: When renting a room, ensure you have the proper Room Rental Agreement document to outline terms and avoid misunderstandings.

- Transfer Tax Declaration: This document is often required by local governments to report the transfer of property. It helps assess any applicable transfer taxes that may need to be paid.

Using these documents alongside a Quitclaim Deed can help facilitate a more effective and secure property transfer. Always ensure that all necessary paperwork is complete and accurate to avoid complications in the future.

Consider Popular Types of Quitclaim Deed Templates

What Is a Deed-in-lieu of Foreclosure? - The agreement often includes specific terms about property condition and maintenance until transfer.

Filling out the application correctly is essential for potential candidates as it presents their qualifications and experiences effectively; for those looking to streamline the process, resources like Fillable Forms can provide valuable assistance in completing the Chick-fil-A Job Application form accurately.

Similar forms

- Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. Unlike a quitclaim deed, it offers more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed conveys ownership but may not provide as extensive a warranty. It assures that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

Employment Application PDF: This form is essential for job seekers to formally present their qualifications. It gathers important information for employers to assess candidates effectively. You can find more details at PDF Documents Hub.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the debt is paid. It is often used in real estate transactions to ensure lenders have a claim on the property.

- Lease Agreement: While not a deed, a lease agreement allows one party to use property owned by another for a specified time in exchange for rent. It establishes rights and obligations similar to those in a quitclaim deed.

- Title Insurance Policy: This document protects against losses due to defects in title. While it does not transfer ownership, it serves a similar purpose by ensuring the buyer's rights to the property are protected.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of any claims against the property. It can accompany a quitclaim deed to provide additional assurance to the buyer.

- Power of Attorney: This legal document allows one person to act on behalf of another in transactions, including property transfers. It is similar in that it can facilitate the execution of a quitclaim deed.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it does not transfer title, it is often used in conjunction with a quitclaim deed to finalize the transaction.

Common mistakes

When filling out a Quitclaim Deed form, individuals often make mistakes that can lead to complications down the line. One common error is not including the legal description of the property. This description should be precise and detailed. Omitting it can create confusion about which property is being transferred.

Another frequent mistake is failing to identify all parties involved. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly named. If a party is missing or incorrectly named, it may invalidate the deed.

People sometimes overlook the need for notarization. A Quitclaim Deed typically requires a signature in the presence of a notary public. Without this step, the document may not hold up in court or during a property transaction.

Incorrectly filling out the date can also be problematic. The date on the Quitclaim Deed indicates when the transfer takes place. If this is left blank or incorrectly entered, it can lead to disputes about the timing of the property transfer.

Another mistake involves misunderstanding the implications of a Quitclaim Deed. Some individuals believe that it guarantees clear title or ownership. In reality, it transfers whatever interest the grantor has, which may not always be complete or clear. This misunderstanding can lead to future legal issues.

People often forget to check local laws regarding the filing of the Quitclaim Deed. Each state has its own requirements for recording such documents. Not adhering to these rules can result in delays or rejection of the deed.

Finally, neglecting to keep copies of the completed Quitclaim Deed can create problems later. It's essential to retain a copy for personal records. If any disputes arise, having documentation of the transfer can be invaluable.