Free Purchase Letter of Intent Document

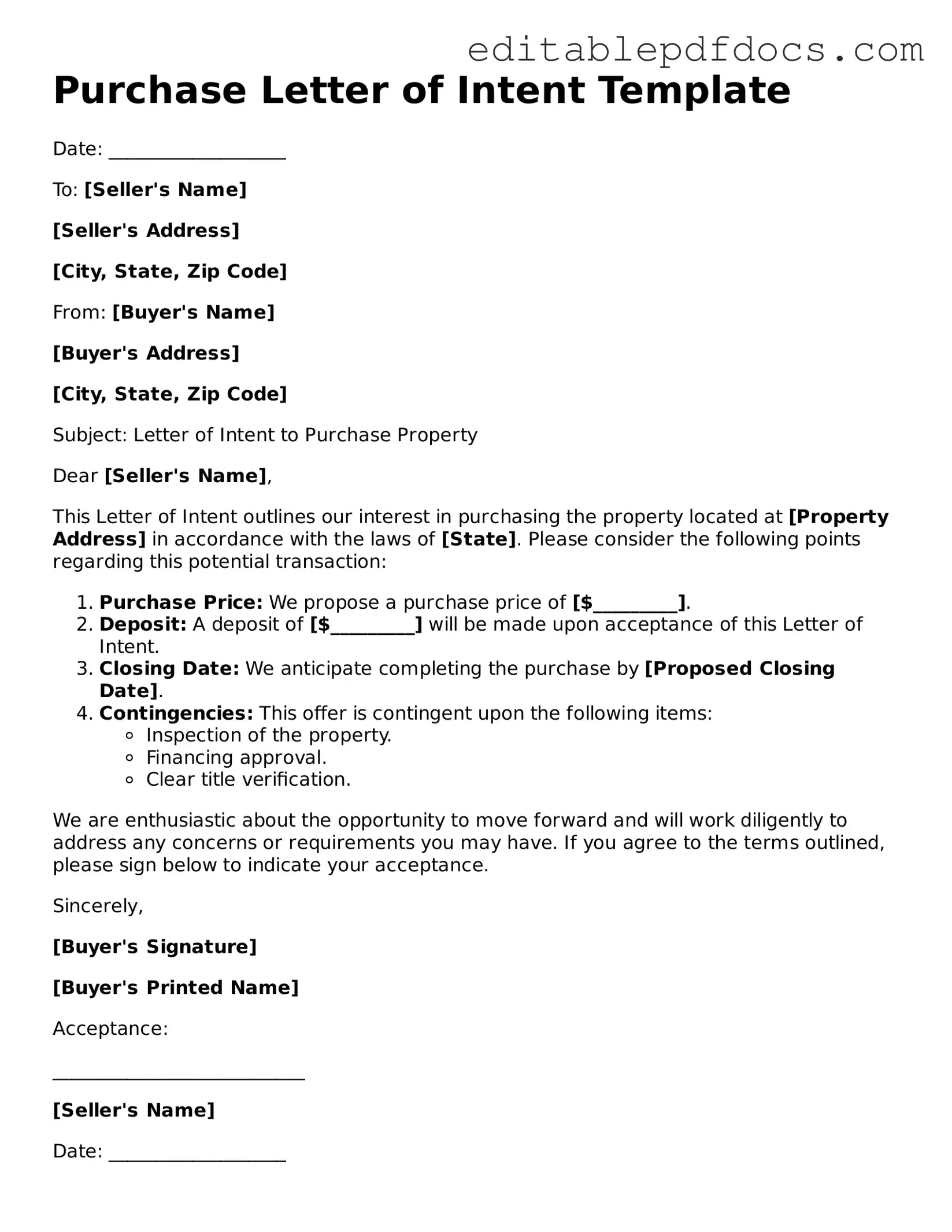

When embarking on a significant transaction, such as purchasing a business or property, clarity and intent are paramount. The Purchase Letter of Intent (LOI) serves as a crucial document in this process, outlining the preliminary terms and conditions agreed upon by the buyer and seller. It typically includes essential elements like the purchase price, payment structure, and any contingencies that must be met before the final agreement is executed. This document not only sets the stage for negotiations but also demonstrates the seriousness of the buyer’s intentions. Importantly, while the LOI is generally non-binding, it establishes a framework that guides both parties through the subsequent stages of the deal. By addressing key factors such as timelines, due diligence requirements, and confidentiality clauses, the Purchase Letter of Intent helps to foster a transparent and organized approach to what can often be a complex transaction. Understanding its components is vital for anyone looking to navigate the intricacies of business or real estate purchases effectively.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Purchase Letter of Intent (LOI) is a document outlining the preliminary terms of a potential purchase agreement between a buyer and a seller. |

| Purpose | The LOI serves to express the intent of the parties to negotiate and finalize a formal purchase agreement. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it does not legally obligate either party to complete the transaction. |

| Key Components | Common components include purchase price, payment terms, and timelines for due diligence and closing. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| State-Specific Forms | Some states may have specific forms or requirements for LOIs, governed by local contract laws. |

| Governing Law | For example, in California, the governing law for LOIs falls under the California Civil Code. |

| Negotiation Tool | The LOI acts as a negotiation tool, helping to clarify intentions and expectations between the parties. |

| Timeline | LOIs often include a timeline for negotiations, setting deadlines for finalizing the purchase agreement. |

Dos and Don'ts

When filling out a Purchase Letter of Intent form, it’s crucial to approach the task with care. Here are six essential guidelines to follow:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and financial details.

- Do clearly outline the terms of the proposed purchase. Specify the price, payment terms, and any contingencies.

- Do include a timeline for the transaction. Set clear deadlines for acceptance, due diligence, and closing.

- Do consult with legal or real estate professionals if needed. Their expertise can help avoid costly mistakes.

- Don't use vague language. Be specific about what you are proposing to avoid misunderstandings.

- Don't forget to sign and date the document. An unsigned letter may not hold any legal weight.

Documents used along the form

A Purchase Letter of Intent (LOI) serves as a preliminary agreement outlining the intention of parties to enter into a purchase agreement. It is often accompanied by various other forms and documents that help clarify the terms and conditions of the proposed transaction. Below is a list of commonly used documents alongside the Purchase Letter of Intent.

- Purchase Agreement: This is the formal contract that outlines the specific terms of the sale, including price, payment terms, and any contingencies.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document ensures that sensitive information shared during negotiations remains private.

- Due Diligence Checklist: A list that outlines the necessary investigations and verifications that need to be completed before finalizing the purchase.

- Financing Commitment Letter: This letter from a lender indicates the amount of financing available to the buyer, confirming their ability to proceed with the purchase.

- Letter of Authorization: A document that grants permission for certain individuals to act on behalf of a party in the transaction, often used to facilitate negotiations.

- Escrow Agreement: This document outlines the terms under which funds or assets will be held in escrow until the transaction is completed.

- Letter of Intent: This document signifies the initial commitment between the parties, laying the groundwork for negotiations on key terms. For assistance in drafting a comprehensive LOI, consider using PDF Templates Online.

- Title Report: A report that provides information about the legal ownership of the property and any claims or liens against it, ensuring clear title for the buyer.

- Inspection Report: A detailed evaluation of the property’s condition, identifying any issues that may need to be addressed before the sale.

- Closing Statement: This document summarizes the final financial transaction, including all costs and fees associated with the sale, and is presented at the closing of the deal.

Each of these documents plays a crucial role in the purchasing process, helping to ensure that both parties are informed and protected throughout the transaction. Understanding these forms can facilitate smoother negotiations and contribute to a successful purchase experience.

Consider Popular Types of Purchase Letter of Intent Templates

Letter of Intent to Sue Example - This form serves as a warning to the other party about potential litigation.

Letter of Intent Investment - It serves as a catalyst for initiating the investment process.

The Investment Letter of Intent form serves as a preliminary agreement between parties interested in making an investment. This document outlines the essential terms and conditions that will guide future commitments. A valuable resource for understanding this process can be found at documentonline.org. Often considered a first step in negotiations, it helps lay the groundwork for a more formal investment agreement.

How to Do Letter of Intent - A proactive approach to securing financial resources for your project.

Similar forms

- Purchase Agreement: This document outlines the terms and conditions for the sale of a property or business. Like the Purchase Letter of Intent, it establishes the intent to finalize a transaction but is more detailed and legally binding.

- Memorandum of Understanding (MOU): An MOU is a non-binding agreement that outlines the intentions of parties to work together. Similar to a Purchase Letter of Intent, it serves to clarify expectations before a formal contract is drafted.

- Letter of Intent (LOI): An LOI expresses a party's intention to enter into a formal agreement. It is similar in purpose to a Purchase Letter of Intent, often used in various business transactions.

- Term Sheet: A term sheet summarizes the key points of a deal. Like the Purchase Letter of Intent, it lays out the basic terms that both parties agree upon before drafting a more detailed contract.

- Homeschool Letter of Intent: To formally notify your local school district of your homeschooling decision, refer to the essential Homeschool Letter of Intent documentation that ensures compliance with state regulations.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared during negotiations. While it serves a different purpose, it often accompanies a Purchase Letter of Intent to ensure confidentiality during discussions.

- Confidentiality Agreement: Similar to an NDA, this agreement ensures that parties keep shared information private. It often works in tandem with a Purchase Letter of Intent to protect both parties’ interests.

- Due Diligence Checklist: This document outlines the information needed to evaluate a potential purchase. It is similar in that it supports the intent to buy by ensuring that all necessary information is gathered before finalizing a deal.

- Closing Statement: A closing statement summarizes the final terms of a sale. While it comes at the end of a transaction, it relates to the Purchase Letter of Intent by detailing the agreed-upon terms that were initially outlined in the intent.

Common mistakes

When filling out a Purchase Letter of Intent (LOI), individuals often make several common mistakes that can lead to confusion or complications later in the process. One frequent error is failing to clearly define the terms of the agreement. Without precise language, misunderstandings may arise regarding the intentions of the parties involved.

Another mistake is neglecting to include essential details about the property or asset being purchased. Omitting information such as the address, legal description, or specific terms can create ambiguity. This lack of clarity might lead to disputes or delays in the transaction.

Many people also overlook the importance of specifying a timeline for the transaction. A well-defined timeline helps ensure that both parties have a mutual understanding of when key milestones should be achieved. Without this, the process can become prolonged and frustrating.

In addition, some individuals fail to consider the inclusion of contingencies in the LOI. Contingencies serve as protective measures, allowing the buyer to back out of the agreement under certain conditions. Not including these can expose the buyer to unnecessary risks.

Another common oversight is not addressing the confidentiality of the negotiations. Parties may wish to keep the details of the transaction private. If confidentiality is not mentioned, sensitive information could be disclosed, potentially harming the interests of those involved.

People sometimes also neglect to consult with legal or financial advisors before submitting the LOI. Professional guidance can provide valuable insights and help avoid pitfalls. Skipping this step may lead to unintentional mistakes that could have been easily avoided.

Lastly, failing to review the document thoroughly before signing is a significant mistake. Errors in the LOI can have serious implications. Taking the time to carefully read through the entire document ensures that all parties are in agreement and that the terms are understood.