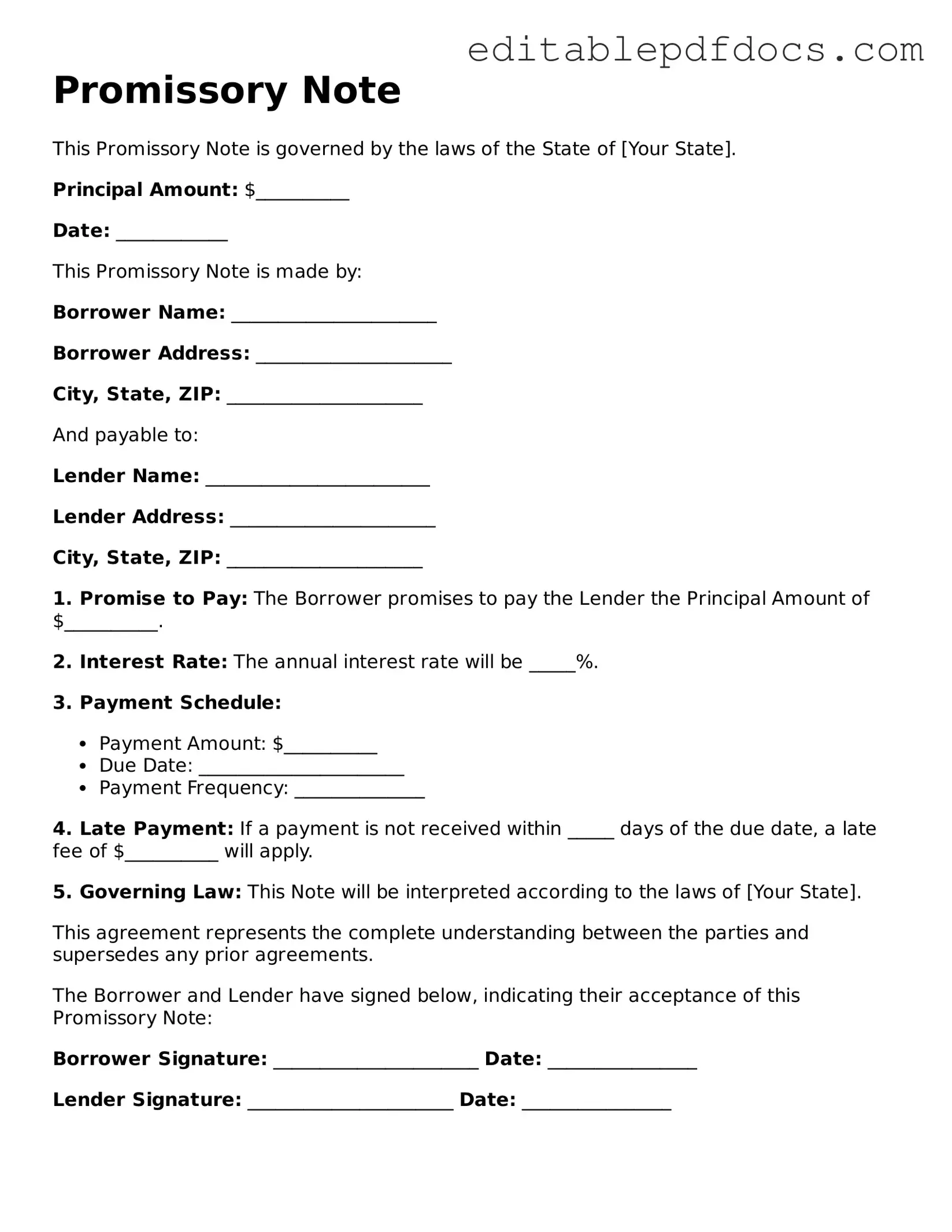

Free Promissory Note Document

In the realm of financial transactions, a Promissory Note serves as a crucial instrument that outlines the terms of a loan agreement between a borrower and a lender. This legally binding document specifies the amount of money being borrowed, the interest rate, and the repayment schedule, ensuring that both parties have a clear understanding of their obligations. Essential details such as the due date for payments, the consequences of default, and any collateral involved are also included in the note. By providing a structured framework, the Promissory Note not only protects the lender’s interests but also offers the borrower a transparent pathway for repayment. It is important to recognize that the language used in the note should be clear and unambiguous to prevent misunderstandings. This form can be customized to suit various lending scenarios, whether for personal loans, business financing, or real estate transactions. Understanding the components and implications of a Promissory Note can empower individuals and businesses to engage in financial agreements with confidence and clarity.

File Information

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. |

| Parties Involved | Typically involves two parties: the borrower (maker) and the lender (payee). |

| Legal Governing Law | In the U.S., promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3. |

| State Variations | Each state may have specific laws or requirements regarding promissory notes, so it's essential to check local regulations. |

| Interest Rates | The note can specify an interest rate, which can be fixed or variable, affecting the total repayment amount. |

| Default Conditions | It should outline what constitutes a default, including late payments or failure to pay. |

| Transferability | Promissory notes can often be transferred to another party, allowing for assignment of the debt. |

| Signatures Required | Both parties must sign the note for it to be legally binding, indicating their agreement to the terms. |

| Enforceability | Promissory notes are generally enforceable in court, provided they meet legal requirements. |

| Use Cases | Commonly used for personal loans, business loans, and real estate transactions. |

Promissory Note - Adapted for Each State

Promissory Note Types

Dos and Don'ts

When filling out a Promissory Note form, it’s important to pay attention to detail. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information, including names, addresses, and loan amounts.

- Do sign and date the document where indicated.

- Do keep a copy of the completed Promissory Note for your records.

- Don't leave any fields blank; if a section doesn’t apply, write “N/A.”

- Don't use abbreviations or shorthand that could lead to confusion.

Following these guidelines can help ensure that your Promissory Note is clear and legally binding. It’s always wise to double-check your work before submitting any legal documents.

Documents used along the form

A promissory note is a crucial document in the world of lending and borrowing. It serves as a written promise from one party to pay a specified sum to another. However, it often accompanies several other forms and documents that help clarify the terms of the agreement and protect the interests of both parties. Here’s a list of related documents that are commonly used alongside a promissory note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both parties.

- Security Agreement: If the loan is secured by collateral, this agreement details what assets are pledged as security. It protects the lender’s interest in case the borrower defaults.

- Disclosure Statement: This document provides borrowers with important information about the loan, including fees, interest rates, and other terms. It ensures transparency in the lending process.

- Personal Guarantee: In some cases, a third party may agree to be personally responsible for the loan. This document ensures that the lender can pursue the guarantor for repayment if the borrower defaults.

- Amortization Schedule: This table outlines the repayment plan, showing how much of each payment goes toward interest and principal over time. It helps borrowers understand their payment obligations.

- Room Rental Agreement: For those renting a room, our necessary Room Rental Agreement format streamlines the rental process and clarifies obligations.

- Payment Receipt: When payments are made, this document serves as proof of payment. It can be important for record-keeping and for resolving disputes.

- Default Notice: If a borrower fails to make payments, this notice formally informs them of the default. It often outlines the steps that will be taken if the situation is not remedied.

- Modification Agreement: If the terms of the loan need to be changed, this document outlines the new terms and conditions. It must be agreed upon by both parties to be valid.

- Release of Liability: Once the loan is paid off, this document releases the borrower from any further obligations. It provides peace of mind that the debt has been settled.

These documents work together to create a clear framework for the borrowing process. Each serves a specific purpose, ensuring that both the lender and borrower understand their rights and responsibilities. Having these forms in place can help prevent misunderstandings and disputes in the future.

More Templates

How to Write a Letter of Recommendation - An avenue to discuss the candidate's unique strengths.

The Employment Application PDF form is a critical document often utilized by job seekers to present their qualifications and experiences to potential employers. This form collects key information that helps employers make informed hiring decisions. For those looking to streamline this process, resources like PDF Documents Hub can be invaluable. Ready to take the next step in your career? Fill out the form by clicking the button below!

Loan Note Template - Can be used in conjunction with a vehicle title transfer.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including repayment schedules and interest rates. However, it often includes additional details like collateral and borrower obligations.

- IOU (I Owe You): An IOU is a simple acknowledgment of debt. While a promissory note is more formal and includes specific repayment terms, an IOU is usually less detailed.

- Mortgage: A mortgage is a type of promissory note that is secured by real property. It includes terms for repayment but also outlines what happens if the borrower defaults on the loan.

- Personal Loan Agreement: This document specifies the terms of a personal loan between individuals. Like a promissory note, it includes repayment terms but may also cover personal details and conditions.

- Credit Agreement: A credit agreement outlines the terms under which credit is extended. It shares similarities with a promissory note in that it details repayment terms but often includes revolving credit options.

- Lease Agreement: A lease agreement can resemble a promissory note in that it requires regular payments over time. However, it primarily pertains to rental arrangements rather than loans.

- Employment Application: This document is similar to a Promissory Note as it can outline the terms of employment and responsibilities of the employee. For those looking for a convenient way to complete their application, Fillable Forms can be beneficial.

- Business Loan Agreement: This is specifically for business financing. It includes terms similar to a promissory note but may also address business-specific conditions and collateral.

- Payment Plan Agreement: This document lays out a structured payment plan for settling a debt. It shares the repayment focus of a promissory note but is often used for smaller debts.

- Settlement Agreement: A settlement agreement resolves a dispute and may include payment terms. While it can be similar to a promissory note in its payment structure, it usually addresses a specific dispute rather than a straightforward loan.

Common mistakes

Filling out a Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not including all necessary parties. A Promissory Note typically involves at least two parties: the borrower and the lender. Omitting one of these parties can create confusion and potentially render the document unenforceable.

Another mistake is failing to specify the loan amount clearly. It’s crucial to write the amount in both numbers and words. For instance, writing “$5,000” and “five thousand dollars” helps eliminate any ambiguity. If only one format is used, it could lead to disputes regarding the actual amount owed.

People often overlook the importance of including the interest rate. If the note is meant to accrue interest, the rate should be clearly stated. Without this information, the lender may face challenges in enforcing the terms of the loan. It’s essential to check that the interest rate complies with state laws to avoid any legal issues.

Another common oversight is neglecting to outline the repayment terms. This includes specifying when payments are due and the method of payment. Whether it’s monthly, quarterly, or a lump sum, clarity in repayment terms helps prevent misunderstandings and ensures that both parties are on the same page.

Additionally, many individuals fail to sign and date the Promissory Note correctly. Both the borrower and lender must sign the document for it to be valid. Forgetting to include a date can also lead to complications, especially if disputes arise later regarding when the loan was established.

Lastly, some people do not keep a copy of the signed Promissory Note. It’s essential for both parties to retain a copy for their records. This document serves as proof of the agreement and can be crucial in the event of a dispute. Keeping a well-organized file can save time and stress if questions about the loan arise in the future.