Free Promissory Note for a Car Document

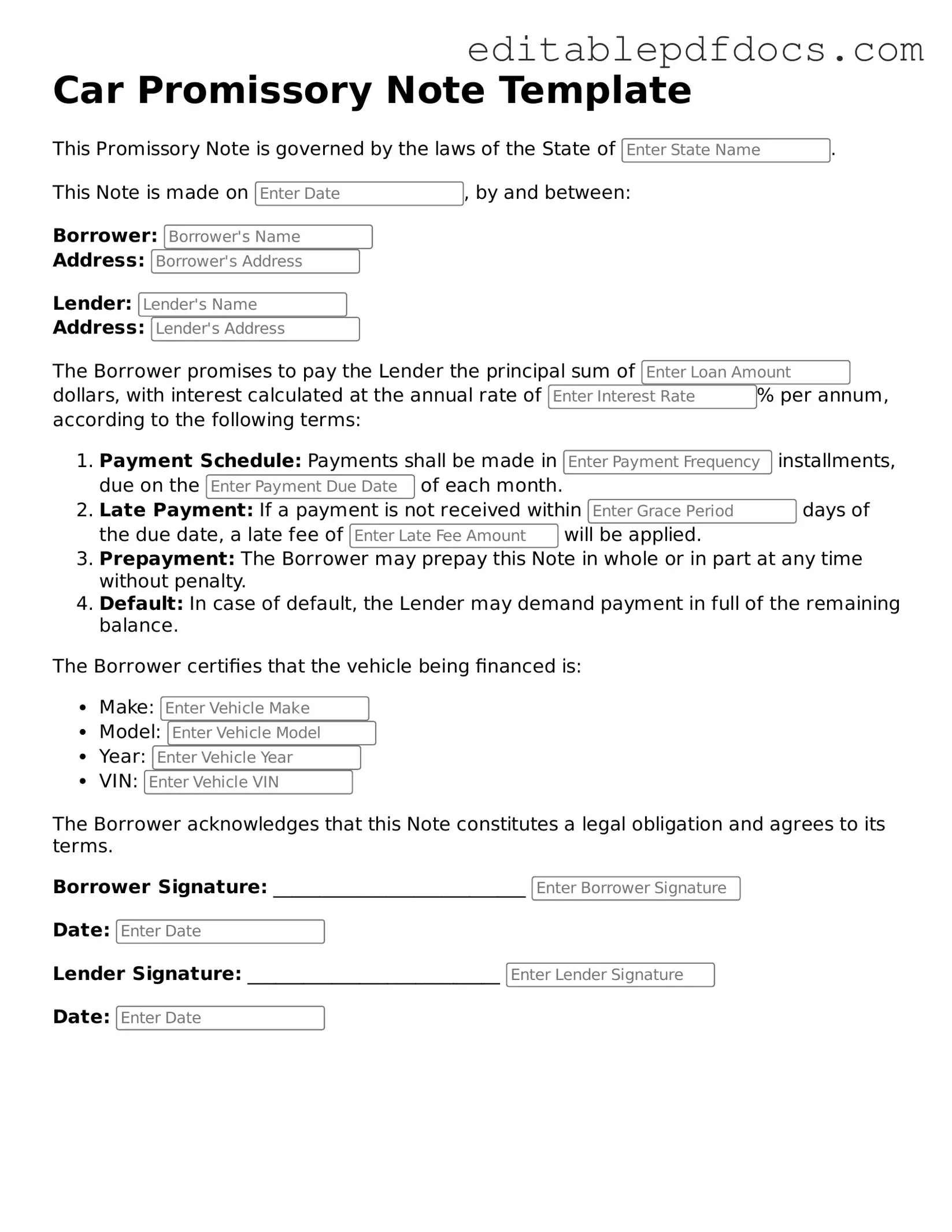

When purchasing a vehicle, understanding the financial commitments involved is crucial. One important document that comes into play is the Promissory Note for a Car. This form serves as a written promise to repay a specified amount over a set period, often outlining the terms of the loan, including the interest rate, payment schedule, and consequences of default. It protects both the buyer and the seller by clearly stating the obligations of each party. Additionally, the form typically includes essential details such as the vehicle identification number (VIN), the names of the parties involved, and the total amount financed. By having a well-structured Promissory Note, buyers can ensure they are fully aware of their responsibilities, while sellers can safeguard their financial interests. Understanding this document is key to a smooth transaction and can help prevent misunderstandings down the road.

File Information

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specific amount of money for the purchase of a vehicle. |

| Parties Involved | The document typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | The laws governing promissory notes vary by state. For example, in California, the Uniform Commercial Code (UCC) applies. |

| Payment Terms | It outlines the payment amount, frequency, and duration, ensuring both parties understand the repayment schedule. |

| Interest Rate | The note may include an interest rate, which is the cost of borrowing the money. This rate should be clearly stated. |

| Default Consequences | If the borrower fails to make payments, the lender has the right to take action, which may include repossession of the vehicle. |

Dos and Don'ts

When filling out the Promissory Note for a Car form, it's essential to approach the task with care. This document serves as a binding agreement between the borrower and the lender, outlining the terms of the loan. Here are ten important considerations to keep in mind:

- Do read the entire form carefully before filling it out.

- Don't rush through the process; take your time to ensure accuracy.

- Do provide complete and accurate information regarding the vehicle.

- Don't leave any sections blank; incomplete forms can lead to issues later.

- Do clearly state the loan amount and the repayment terms.

- Don't use vague language; be specific about payment dates and amounts.

- Do include both parties' names and contact information.

- Don't forget to date the document when signing.

- Do keep a copy of the signed Promissory Note for your records.

- Don't overlook the importance of understanding the consequences of defaulting on the loan.

By following these guidelines, you can help ensure that your Promissory Note is completed correctly and serves its intended purpose effectively.

Documents used along the form

When financing a vehicle, several important documents accompany the Promissory Note for a Car. Each of these forms plays a critical role in the transaction, ensuring that both the buyer and the seller are protected and that the terms of the agreement are clear. Below is a list of commonly used documents that you may encounter in this process.

- Bill of Sale: This document serves as proof of the transaction. It outlines the details of the sale, including the vehicle's identification number (VIN), sale price, and the names of both the buyer and seller.

- Title Transfer: The vehicle title must be transferred from the seller to the buyer. This document indicates the change of ownership and is essential for registering the vehicle in the new owner's name.

- Michigan Promissory Note: For those lending or borrowing money, the necessary Michigan promissory note guidelines ensure clarity and legal compliance in the transaction.

- Loan Agreement: If financing is involved, a loan agreement will detail the terms of the loan, including interest rates, payment schedules, and any penalties for late payments.

- Credit Application: This form is typically filled out by the buyer when seeking financing. It provides the lender with necessary information about the buyer's financial situation, which helps determine loan eligibility.

- Insurance Verification: Before finalizing the sale, the buyer usually must provide proof of insurance. This document verifies that the vehicle will be covered in case of accidents or damage.

- Odometer Disclosure Statement: This form records the vehicle's mileage at the time of sale. It protects against odometer fraud and ensures that the buyer is aware of the vehicle's usage history.

- Power of Attorney: In some cases, the seller may grant a power of attorney to another person to handle the title transfer or other aspects of the sale on their behalf.

- Warranty Documents: If the vehicle comes with a warranty, these documents outline the terms and conditions of the coverage, including what repairs are included and for how long.

Understanding these documents can significantly streamline the car buying process and protect all parties involved. It is advisable to review each form carefully and seek clarification on any terms that may seem unclear. Being well-informed ensures a smoother transaction and helps avoid potential disputes down the line.

Consider Popular Types of Promissory Note for a Car Templates

Release and Satisfaction of Promissory Note - Can help facilitate quicker future financing if needed.

Using a New Jersey Promissory Note can significantly reduce misunderstandings in financial agreements, as it clearly outlines the obligations of both the borrower and the lender. For more information and access to templates, you can visit https://newjerseyformspdf.com, where you can find editable forms that cater to different loan scenarios, ensuring that all necessary terms are understood and agreed upon by both parties involved.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions of borrowing money, similar to a promissory note. Both documents specify the repayment schedule, interest rates, and consequences of default.

- Lease Agreement: A lease agreement details the rental terms for a vehicle. Like a promissory note, it includes payment obligations, duration of the agreement, and conditions for termination.

- Sales Contract: A sales contract documents the sale of a vehicle. It includes the purchase price, payment terms, and any warranties, paralleling the financial commitment found in a promissory note.

- Security Agreement: A security agreement establishes collateral for a loan. It is similar to a promissory note in that it specifies the borrower’s obligations and the lender’s rights in case of default.

- Installment Agreement: An installment agreement allows a buyer to pay for a vehicle in installments. Both documents outline the payment plan and consequences for missed payments.

-

Pennsylvania Promissory Note: Understanding the All Pennsylvania Forms is crucial for ensuring the terms of repayment, interest rates, and borrower responsibilities are clearly defined in this legal agreement.

- Guarantee Agreement: A guarantee agreement involves a third party promising to fulfill the borrower’s obligations if they default. Like a promissory note, it provides assurance to the lender regarding repayment.

Common mistakes

Filling out a Promissory Note for a car can seem straightforward, but many people make common mistakes that can lead to complications later. One frequent error is not providing complete information. Every field on the form should be filled out accurately. Leaving out details like the full names of the parties involved or the car's Vehicle Identification Number (VIN) can create confusion and may even invalidate the agreement.

Another mistake is using incorrect dates. The date of the agreement is crucial. If you mistakenly enter the wrong date, it could affect the enforcement of the note. Always double-check that the date reflects when the agreement was made.

Many individuals also overlook the importance of specifying the loan amount clearly. This number should be precise and match any verbal agreements made. Ambiguity in the loan amount can lead to disputes down the line, making it essential to write this figure clearly and accurately.

Additionally, people often forget to include the interest rate. If the loan is not interest-free, failing to state the interest rate can lead to misunderstandings. It’s important to outline whether the rate is fixed or variable and how it will be calculated.

Another common issue is not detailing the payment schedule. A vague payment plan can lead to confusion about when payments are due and how much should be paid each time. Clearly stating the due dates and the amount of each payment helps avoid potential disputes.

Some individuals also neglect to include the consequences of default. It’s vital to outline what happens if the borrower fails to make payments. This section protects both parties and provides clarity on the next steps if issues arise.

People sometimes fail to sign the document properly. A Promissory Note is not valid without the signatures of both parties. Ensure that all required signatures are present and that they are dated correctly.

Another mistake is not keeping copies of the signed document. After filling out the form, both parties should retain a copy for their records. This can be crucial if any disagreements occur in the future.

Finally, some individuals do not seek legal advice when needed. If the terms of the loan are complex or if large sums are involved, consulting with a legal expert can help ensure that the Promissory Note is fair and legally binding.