Fill a Valid Profit And Loss Template

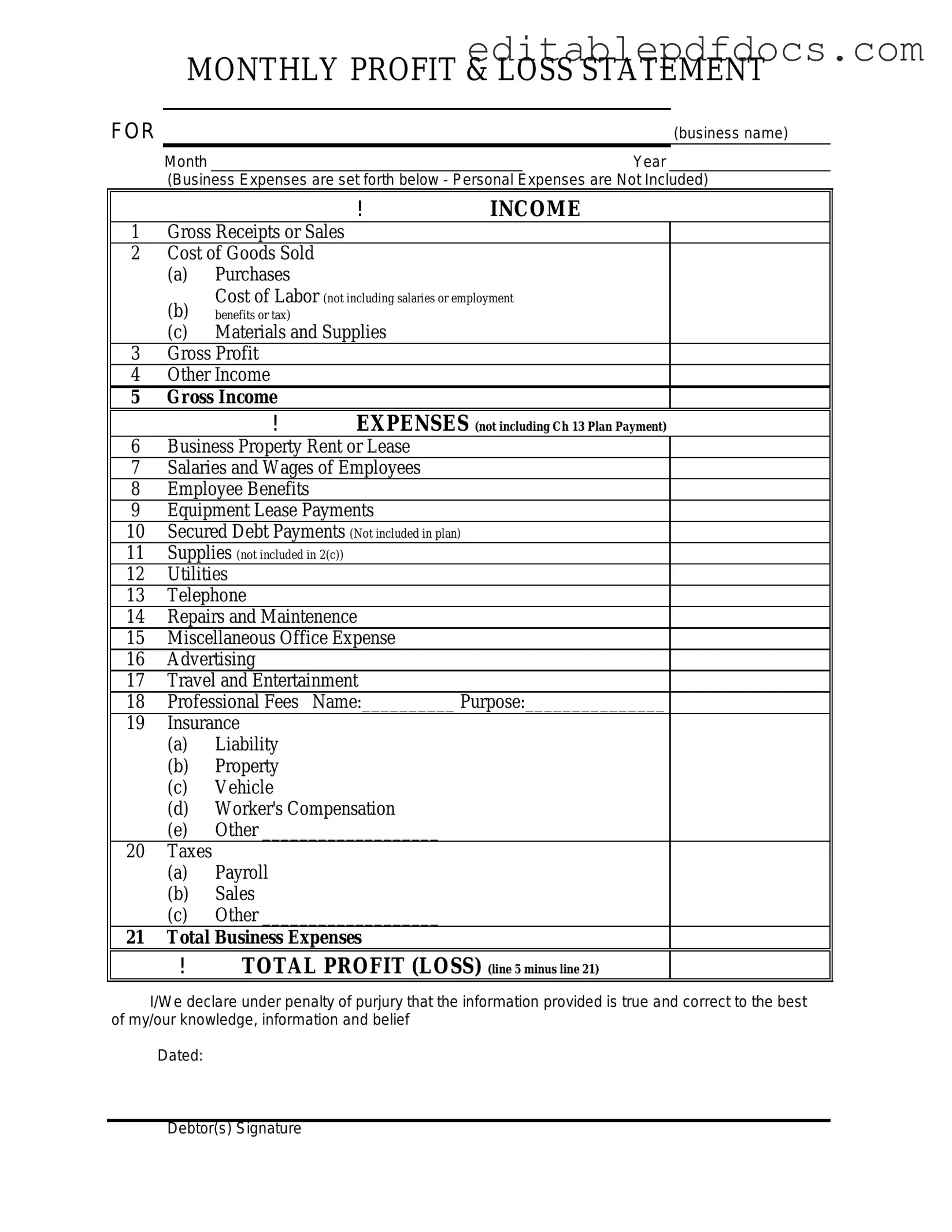

The Profit and Loss form, often referred to as the P&L statement, serves as a crucial financial document for businesses of all sizes. It provides a clear overview of a company's revenues and expenses over a specific period, typically a month, quarter, or year. This form is essential for assessing the financial health of a business, as it highlights the net income or loss generated during that timeframe. Key components of the P&L statement include total sales, cost of goods sold, gross profit, operating expenses, and net profit. Each section plays a vital role in helping business owners and stakeholders understand where money is being earned and spent. By analyzing this information, companies can make informed decisions about budgeting, forecasting, and strategic planning. Furthermore, the P&L form is not only useful for internal management but also serves as an important tool for external parties, such as investors and creditors, who seek to evaluate the company’s profitability and operational efficiency.

Document Details

| Fact Name | Description |

|---|---|

| Definition | A Profit and Loss form, also known as an income statement, summarizes revenues and expenses over a specific period. |

| Purpose | This form helps businesses evaluate their financial performance and profitability. |

| Components | Key components include total revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Frequency | Businesses typically prepare this form on a monthly, quarterly, or annual basis. |

| Governing Laws | In the United States, the Generally Accepted Accounting Principles (GAAP) govern the preparation of Profit and Loss forms. |

Dos and Don'ts

When filling out the Profit and Loss form, it’s important to be careful and thorough. Here are some things you should and shouldn’t do:

- Do: Read the instructions carefully before starting.

- Do: Use accurate and up-to-date financial data.

- Do: Double-check your calculations for errors.

- Do: Keep your records organized for easy reference.

- Don’t: Rush through the process; take your time.

- Don’t: Leave any sections blank unless instructed to do so.

- Don’t: Forget to include all sources of income.

Following these tips will help ensure that your Profit and Loss form is filled out correctly and completely.

Documents used along the form

When managing a business's financial health, several documents complement the Profit and Loss form. These documents provide a comprehensive view of your financial situation, helping you make informed decisions. Below is a list of essential forms and documents that are often used alongside the Profit and Loss form.

- Balance Sheet: This document summarizes a company's assets, liabilities, and equity at a specific point in time. It provides a snapshot of what the business owns and owes, allowing for a clear understanding of its financial position.

- Cash Flow Statement: This statement tracks the flow of cash in and out of the business over a period. It highlights how well the company generates cash to fund its obligations and expenses, crucial for maintaining liquidity.

- Budget: A budget outlines planned income and expenditures for a specific period. It serves as a financial roadmap, guiding spending decisions and helping businesses manage their resources effectively.

- Tax Returns: These forms report income, expenses, and other relevant financial information to tax authorities. They are essential for compliance and provide insights into the business's profitability and tax obligations.

- Divorce Settlement Agreement: For couples in Washington State, our step-by-step Divorce Settlement Agreement instructions ensure clarity and fairness in outlining divorce terms.

- Accounts Receivable Aging Report: This report details outstanding invoices and their respective due dates. It helps businesses manage collections and understand cash flow issues related to unpaid customer invoices.

- Sales Reports: These documents provide insights into sales performance over a specific period. They help identify trends, measure success against goals, and inform future sales strategies.

Utilizing these documents alongside the Profit and Loss form can significantly enhance your understanding of your business's financial landscape. By regularly reviewing and updating these forms, you can ensure better financial management and strategic planning.

Popular PDF Forms

Australian Passport Renewal Application (pc7) Form - Contact the Australian Passport Information Service if your passport is lost or stolen overseas.

Utilizing the appropriate documentation is crucial in the eviction process. The crucial Notice to Quit is the first official step that landlords must take to inform tenants of the impending eviction, establishing a clear timeline for compliance or departure.

Veteran Status Verification Form - The VSD 001 form is designed for veterans in California seeking verification of their veteran status or service-connected disability.

Can One Parent Take a Child on a Cruise Royal Caribbean - This parental consent form is specific to Royal Caribbean’s policies.

Similar forms

- Income Statement: This document summarizes revenues and expenses over a specific period, similar to the Profit and Loss form, which also shows how much money was made or lost.

- FedEx Release Form: This form is essential for customers who may not be available for package delivery. By authorizing delivery without a signature, you can streamline the process and ensure that your items arrive on time. For ease of use, you can access Fillable Forms to complete this authorization.

- Balance Sheet: While the Profit and Loss form focuses on income and expenses, the Balance Sheet provides a snapshot of assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: This document tracks the flow of cash in and out of a business, complementing the Profit and Loss form by detailing cash movements related to operations, investing, and financing.

- Statement of Changes in Equity: This shows how equity changes over time, similar to the Profit and Loss form, which affects retained earnings and overall equity.

- Tax Return: A tax return includes income and expenses, similar to the Profit and Loss form, but it is specifically used for reporting to tax authorities.

- Budget Report: This document outlines planned income and expenses, serving as a comparison to the actual figures reported in the Profit and Loss form.

- Sales Report: This report details sales performance over a specific period, which contributes to the revenue figures found in the Profit and Loss form.

- Expense Report: This document itemizes business expenses, similar to the expense section of the Profit and Loss form, helping to track spending.

- Financial Forecast: This predicts future income and expenses based on past performance, aligning with the Profit and Loss form's purpose of assessing financial health.

Common mistakes

Filling out a Profit and Loss form can be a straightforward task, but many individuals make common mistakes that can lead to inaccurate financial reporting. One of the most frequent errors is failing to include all income sources. It's essential to account for every revenue stream, whether it’s from sales, services, or investments. Omitting any income can skew the overall picture of financial health.

Another common mistake is misclassifying expenses. Individuals often mix up operational costs with capital expenditures. Understanding the difference between these categories is crucial, as it affects both tax liabilities and financial analysis. Proper categorization ensures that financial statements accurately reflect business performance.

Many people also overlook the importance of accurate dates. Entering the wrong date can lead to confusion about when income was earned or expenses incurred. This misalignment can result in misreporting profits and losses, impacting financial decisions and tax filings.

Some individuals fail to regularly update their forms. Financial situations change frequently, and it’s vital to keep the Profit and Loss form current. Regular updates help in tracking trends and making informed business decisions based on the latest data.

Another mistake involves not reconciling with bank statements. Failing to cross-check figures with bank records can lead to discrepancies. Regular reconciliation helps identify errors early, ensuring that the Profit and Loss form reflects true financial standing.

Additionally, people often neglect to account for non-cash expenses, such as depreciation or amortization. These expenses can significantly impact the bottom line and should not be ignored. Including them provides a clearer view of financial performance.

Some individuals also overlook the need for detailed notes. Providing explanations for unusual transactions or significant changes in income or expenses can clarify the financial picture for anyone reviewing the form. This transparency is especially important for stakeholders and auditors.

Another frequent error is not seeking professional advice when needed. Many individuals attempt to fill out the form without consulting an accountant or financial advisor. Professional input can help avoid costly mistakes and ensure compliance with financial regulations.

Lastly, people sometimes rush through the process. Taking the time to carefully review each entry can prevent errors. A thorough approach is essential for producing an accurate and reliable Profit and Loss form.