Free Personal Guarantee Document

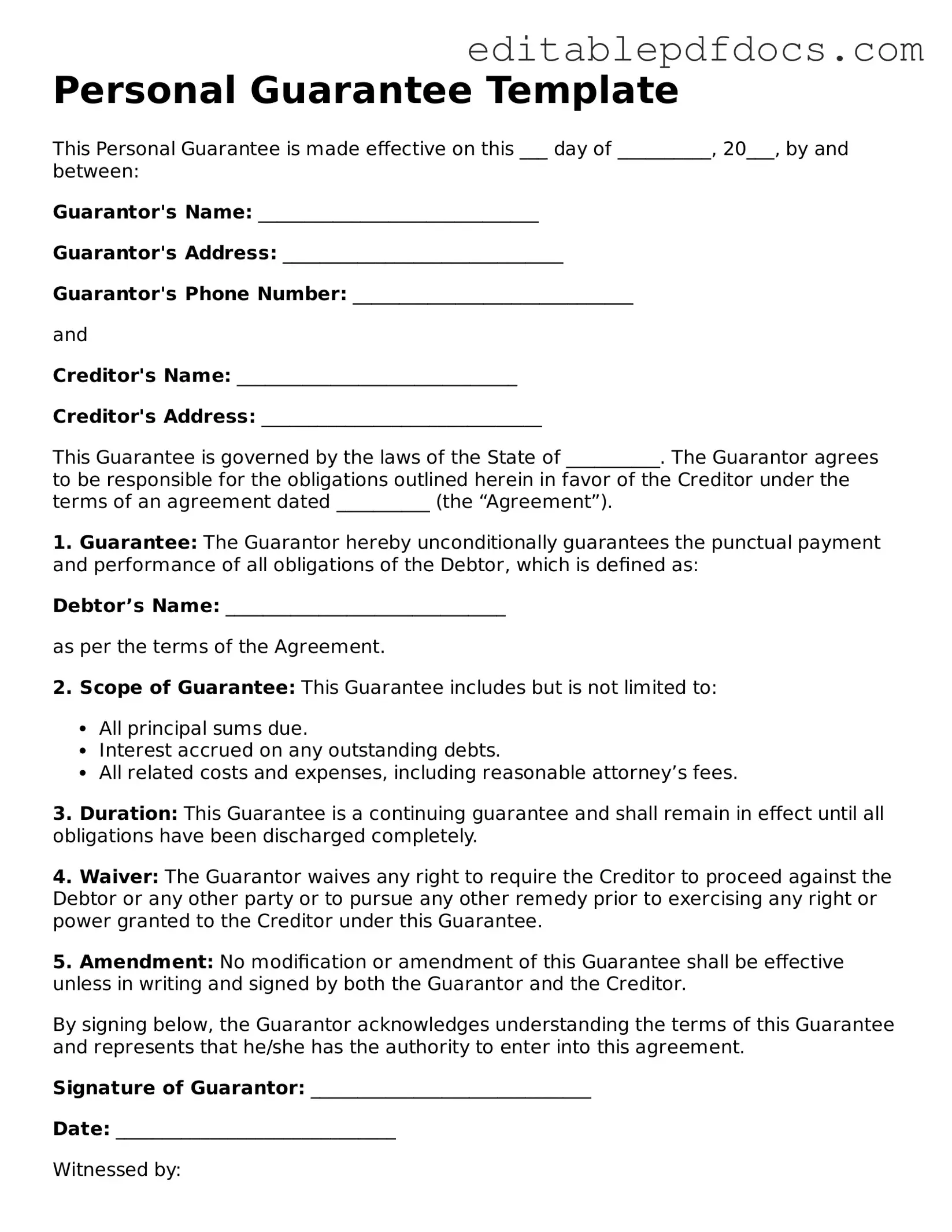

The Personal Guarantee form is a crucial document in various financial and business transactions, serving as a binding agreement between a guarantor and a lender or creditor. This form typically outlines the terms under which the guarantor agrees to be personally liable for the debts or obligations of another party, often a business entity. It is essential for establishing trust and security in lending arrangements, as it provides an additional layer of assurance to creditors. Key components of the form include the identification of the parties involved, the specific obligations being guaranteed, and any limitations or conditions that may apply. Furthermore, the form may require the guarantor to disclose personal financial information, ensuring that the lender can assess the guarantor's ability to fulfill their obligations. Understanding the implications of signing a Personal Guarantee is vital, as it can have significant financial consequences for the guarantor, including potential impacts on personal credit and assets. As businesses navigate complex financial landscapes, the Personal Guarantee form remains a critical tool for securing necessary funding while mitigating risk for lenders.

File Information

| Fact Name | Description |

|---|---|

| Definition | A personal guarantee is a legal commitment made by an individual to repay a loan or debt if the primary borrower defaults. |

| Purpose | This form is typically used by lenders to secure loans, ensuring that they have recourse to the individual's personal assets if necessary. |

| State-Specific Forms | Different states may have specific requirements for personal guarantees, including additional disclosures or notary requirements. |

| Governing Laws | The enforceability of personal guarantees is often governed by state contract laws, which can vary significantly from one state to another. |

| Risks | Signing a personal guarantee can put your personal assets at risk, including your home and savings, if the borrower fails to meet their obligations. |

Dos and Don'ts

When filling out a Personal Guarantee form, it's important to ensure accuracy and clarity. Below are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't sign the form without understanding your obligations.

- Don't submit the form without reviewing it for accuracy.

Documents used along the form

When entering into agreements that require a Personal Guarantee, several other forms and documents may be necessary to ensure all parties are protected and obligations are clear. Below is a list of commonly used documents that often accompany a Personal Guarantee.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any conditions that must be met by the borrower.

- Security Agreement: This form details the collateral that secures the loan. It specifies what assets the lender can claim if the borrower defaults.

- Promissory Note: A legal instrument in which the borrower promises to repay the loan amount to the lender, detailing the terms of repayment.

- Business License: This document proves that a business is legally permitted to operate in its respective jurisdiction, which may be required by lenders.

- Financial Statements: These documents provide insight into the financial health of the business or individual, often including balance sheets and income statements.

- Real Estate Purchase Agreement: This essential document outlines the terms and conditions for buying or selling property in Colorado, ensuring all parties understand their rights and obligations. For further details, you can refer to https://coloradoformpdf.com/.

- Articles of Incorporation: For corporate borrowers, this document establishes the existence of the corporation and outlines its structure and purpose.

- Operating Agreement: This agreement is essential for LLCs and outlines the management structure and operational procedures of the business.

- Personal Financial Statement: This form provides a detailed overview of an individual’s personal finances, including assets, liabilities, income, and expenses.

Each of these documents plays a crucial role in the overall agreement process. Together, they create a comprehensive framework that protects both the lender and the borrower, ensuring clarity and accountability in financial transactions.

Consider Popular Types of Personal Guarantee Templates

Purchase Agreement Addendum - It can be used to extend the closing date of the transaction.

Owner Finance Agreement - It may include adjustable rates or fixed rates based on negotiation.

For those interested in entering the real estate market, a valuable resource is a robust guide on the Real Estate Purchase Agreement process, which ensures all parties are well-informed of their obligations and rights before finalizing the deal. You can find more information at a thorough overview of the Real Estate Purchase Agreement essentials.

Terminate Real Estate Agent Contract Letter - It can help prevent misunderstandings about the status of the property following the agreement's termination.

Similar forms

- Loan Agreement: This document outlines the terms under which a borrower receives funds from a lender. Like a Personal Guarantee, it holds the borrower accountable for repayment.

- Real Estate Purchase Agreement: This essential document defines the terms of the sale between buyers and sellers, ensuring clarity in one of the most significant transactions of their lives. For more information on how to fill this out, visit https://texasformspdf.com/fillable-real-estate-purchase-agreement-online.

- Promissory Note: A written promise to pay a specified amount of money at a certain time. Similar to a Personal Guarantee, it establishes an obligation to repay a debt.

- Lease Agreement: This contract allows one party to use property owned by another. It often requires a guarantee to ensure payment of rent, similar to a Personal Guarantee.

- Business Loan Application: When applying for a business loan, this document may require personal guarantees from owners. It serves to assess the risk to the lender, akin to a Personal Guarantee.

- Collateral Agreement: This document specifies assets pledged to secure a loan. It shares similarities with a Personal Guarantee in that both provide assurance to the lender.

- Indemnity Agreement: This document protects one party from losses or damages caused by another. Like a Personal Guarantee, it places responsibility on one party for another's obligations.

- Co-Signer Agreement: This agreement involves a third party who agrees to take on the responsibility for a loan if the primary borrower defaults. It functions similarly to a Personal Guarantee in ensuring the lender's security.

Common mistakes

Filling out a Personal Guarantee form is an important step for many individuals and businesses. However, mistakes can lead to significant issues down the line. Here are ten common errors to avoid.

First, many people forget to read the entire form before signing. Skimming through the document can result in missing crucial information or terms that could affect their obligations. It’s vital to understand what you are agreeing to.

Another frequent mistake is providing incomplete information. Omitting details such as your full name, address, or social security number can cause delays or even rejection of the guarantee. Ensure that all fields are filled out completely and accurately.

Some individuals fail to use their legal name. Using a nickname or an abbreviated version can create confusion and may invalidate the guarantee. Always use your full legal name as it appears on official documents.

People often neglect to date the form. A missing date can raise questions about the timing of the agreement and complicate enforcement if needed. Always include the date when you sign the document.

In some cases, individuals do not provide the necessary identification. A Personal Guarantee may require a government-issued ID or other documentation to verify identity. Be prepared to include copies of these documents.

Another common error is misunderstanding the scope of the guarantee. Some individuals may not realize that they are personally liable for the debts of the business. Clarify what you are guaranteeing to avoid unexpected liabilities.

Failing to consult with a legal professional can be a critical mistake. Many overlook the importance of seeking advice, which can help in understanding the implications of the guarantee. Consulting a lawyer can provide clarity and protection.

People also sometimes sign on behalf of another party without proper authority. If you are signing as a representative, ensure that you have the authority to do so. Otherwise, the guarantee may not be enforceable.

Another error is not keeping a copy of the signed form. After signing, retain a copy for your records. This can be essential if disputes arise in the future.

Finally, individuals may fail to follow up with the lender or creditor after submitting the form. Confirming receipt and understanding any next steps can help ensure that the guarantee is processed correctly.