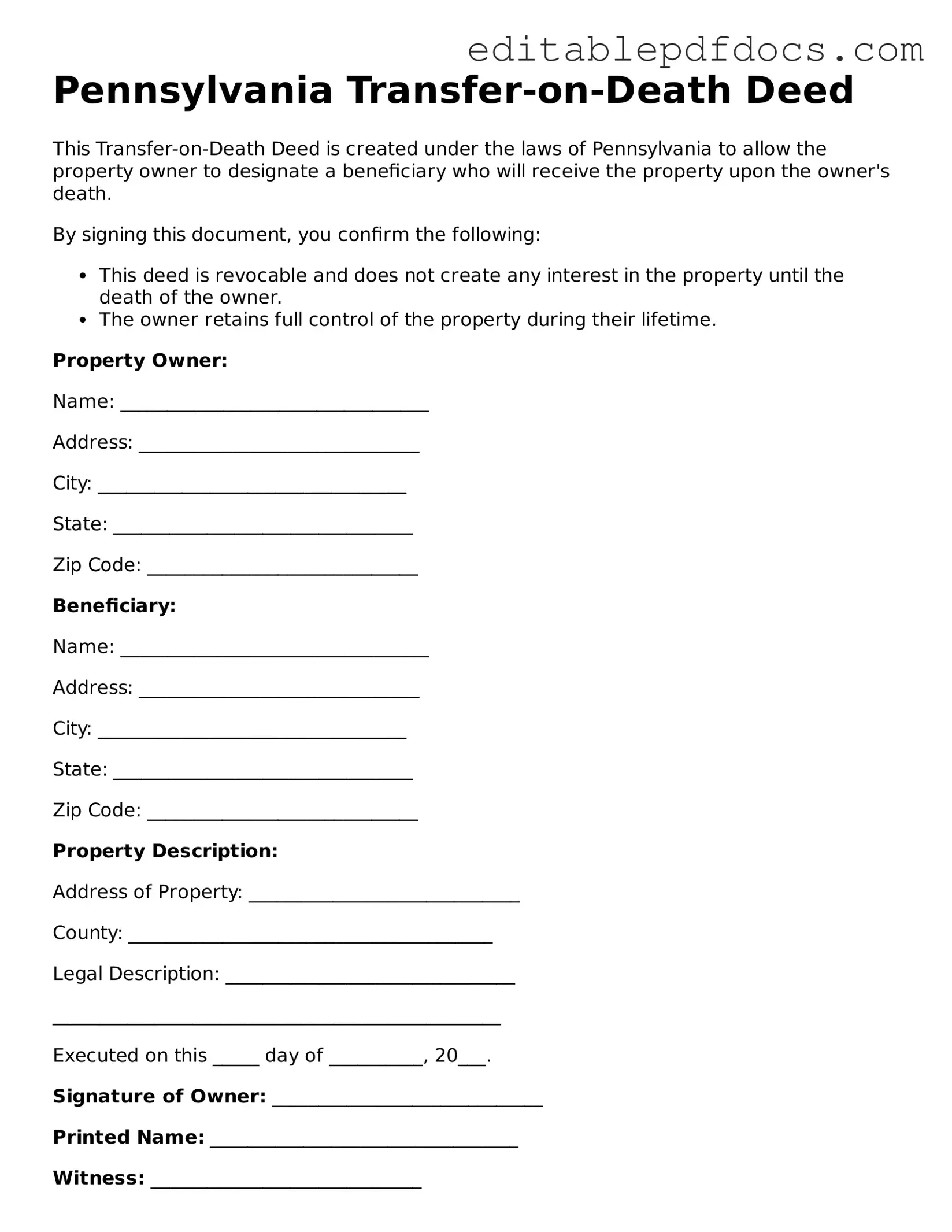

Transfer-on-Death Deed Document for Pennsylvania

The Pennsylvania Transfer-on-Death Deed (TODD) offers a straightforward mechanism for property owners to transfer real estate to designated beneficiaries upon their death, thereby bypassing the often cumbersome probate process. This form allows individuals to maintain full control over their property during their lifetime, ensuring that they can sell, mortgage, or otherwise manage their assets without interference. Upon the owner’s passing, the deed automatically transfers ownership to the named beneficiaries, simplifying the transition of property and minimizing potential disputes among heirs. Importantly, the TODD must be properly executed and recorded to be effective; failure to adhere to these procedural requirements can result in unintended consequences, such as the property reverting to the estate. Additionally, property owners should consider the implications of this deed on their estate planning strategy, as it can affect tax liabilities and the rights of surviving family members. Understanding these critical aspects of the Pennsylvania Transfer-on-Death Deed form is essential for anyone looking to streamline their estate planning and ensure their wishes are honored after their death.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Pennsylvania to transfer real estate to beneficiaries upon their death, without going through probate. |

| Governing Law | The Pennsylvania Transfer-on-Death Deed is governed by 20 Pa.C.S. § 6114. |

| Eligibility | Any individual who owns real estate in Pennsylvania can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | The deed can be revoked at any time by the property owner, as long as they are alive. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded in the county where the property is located to be effective. |

| No Immediate Transfer | Ownership does not transfer to the beneficiary until the death of the property owner. |

| Tax Implications | Beneficiaries may be subject to inheritance tax upon the property owner's death. |

| Legal Assistance | While not required, consulting with an attorney can help ensure the deed is properly executed and recorded. |

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it's important to approach the task with care. This document allows you to transfer property upon your passing, and accuracy is key. Here’s a list of things you should and shouldn’t do:

- Do: Ensure that all property details are accurate and complete.

- Do: Include the full legal names of all parties involved.

- Do: Sign the deed in the presence of a notary public.

- Do: File the deed with the appropriate county office after signing.

- Don't: Leave out any required information; incomplete forms can lead to issues.

- Don't: Forget to check for any local regulations that may affect the deed.

By following these guidelines, you can help ensure a smoother process when dealing with property transfer in Pennsylvania. Taking the time to do it right will save you and your loved ones potential headaches in the future.

Documents used along the form

The Pennsylvania Transfer-on-Death Deed is a useful tool for individuals looking to transfer real estate upon their death without going through the probate process. However, several other forms and documents often accompany this deed to ensure a smooth transfer of property. Below is a list of these commonly used documents, each serving a specific purpose in the property transfer process.

- Last Will and Testament: This legal document outlines how a person's assets should be distributed upon their death. It can complement a Transfer-on-Death Deed by providing instructions for any assets not covered by the deed.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for certain assets like bank accounts and life insurance policies. They ensure that these assets transfer directly to the named individuals, avoiding probate.

- California Motor Vehicle Bill of Sale: This essential document ensures a smooth transfer of vehicle ownership and is vital for buyers and sellers alike. For more details and a convenient option, visit Fillable Forms.

- Affidavit of Death: This document serves as proof of an individual's death. It may be required by financial institutions or other entities to facilitate the transfer of property or assets after the death of the property owner.

- Property Deed: The original property deed provides evidence of ownership and may need to be referenced or recorded alongside the Transfer-on-Death Deed to clarify the property being transferred.

Each of these documents plays a vital role in the overall estate planning and property transfer process. By understanding their functions, individuals can better prepare for a seamless transition of assets to their chosen beneficiaries.

Consider Some Other Transfer-on-Death Deed Templates for US States

How to Transfer a Deed After Death in Georgia - This deed is a straightforward option for those looking to simplify the transfer of real estate assets.

When engaging in a boat transaction in New York, it is crucial to utilize the New York Boat Bill of Sale, as it serves as the official record for ownership transfer between the seller and the buyer. This essential document not only acts as proof of sale but also provides security for both parties involved. For more information on how to create or obtain this form, you can visit topformsonline.com.

How to Transfer Property After Death - Inclusion of a Transfer-on-Death Deed in estate planning could lessen stress for loved ones during difficult times.

How to Transfer a Property Deed From a Deceased Relative in Florida - It’s advisable to review state-specific laws to understand the implications of this type of deed fully.

Similar forms

- Last Will and Testament: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries but goes through probate.

- Living Trust: This document holds assets during a person's lifetime and specifies how they should be distributed upon death. It avoids probate, similar to a Transfer-on-Death Deed.

- Beneficiary Designation Forms: Commonly used for accounts like life insurance or retirement plans, these forms allow individuals to name beneficiaries directly. This is similar in purpose to a Transfer-on-Death Deed, as both transfer assets outside of probate.

- Payable-on-Death (POD) Accounts: These bank accounts allow individuals to name a beneficiary who will receive the funds upon their death. Like a Transfer-on-Death Deed, POD accounts bypass probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to inherit each other's share automatically upon death. It functions similarly to a Transfer-on-Death Deed by facilitating a direct transfer of ownership.

- Motor Vehicle Bill of Sale: This document serves as crucial evidence when transferring ownership of a vehicle from seller to buyer, ensuring legal protection and aiding in the registration process. For more information, visit https://nyforms.com/motor-vehicle-bill-of-sale-template.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime, with the property passing to another person upon their death. It shares the goal of transferring property outside of probate.

- Transfer-on-Death Registration for Securities: This allows individuals to name a beneficiary for stocks and bonds. Like a Transfer-on-Death Deed, it ensures a direct transfer to the beneficiary without going through probate.

Common mistakes

Filling out the Pennsylvania Transfer-on-Death Deed form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is failing to include all required information. It’s essential to provide complete details about the property and the beneficiaries. Missing even a small piece of information can cause delays or invalidate the deed.

Another mistake involves not properly identifying the property. The form requires a clear description of the property being transferred, including the address and parcel number. Inaccuracies in this section can create confusion and may lead to disputes among heirs.

Some individuals overlook the need for notarization. A Transfer-on-Death Deed must be signed in the presence of a notary public. Without this step, the deed may not be legally recognized, which defeats its purpose. It’s crucial to ensure that all signatures are properly notarized before submission.

People often forget to record the deed after it is completed. Simply filling out the form is not enough; it must be filed with the county recorder of deeds. Failing to do so means the deed will not take effect upon the death of the property owner, leaving the property subject to probate.

Another common error is not updating the deed when circumstances change. Life events such as marriage, divorce, or the death of a beneficiary can affect the validity of the deed. Regularly reviewing and updating the document ensures it reflects the current intentions of the property owner.

Some may not fully understand the implications of the Transfer-on-Death Deed. It’s important to know that this deed does not transfer ownership until the owner passes away. Misunderstanding this can lead to confusion about property rights while the owner is still alive.

People sometimes neglect to consult with family members about their intentions. Open communication can prevent misunderstandings and disputes among heirs. Discussing the deed with beneficiaries ensures everyone is aware of the property owner’s wishes.

Another mistake is using outdated forms. Laws can change, and using an old version of the Transfer-on-Death Deed form may lead to issues. Always ensure that you are using the most current version available from official sources.

Finally, some individuals may rush through the process. Taking the time to carefully complete the form and double-check all entries can prevent mistakes. A rushed approach often leads to errors that could have been easily avoided.