Rental Application Document for Pennsylvania

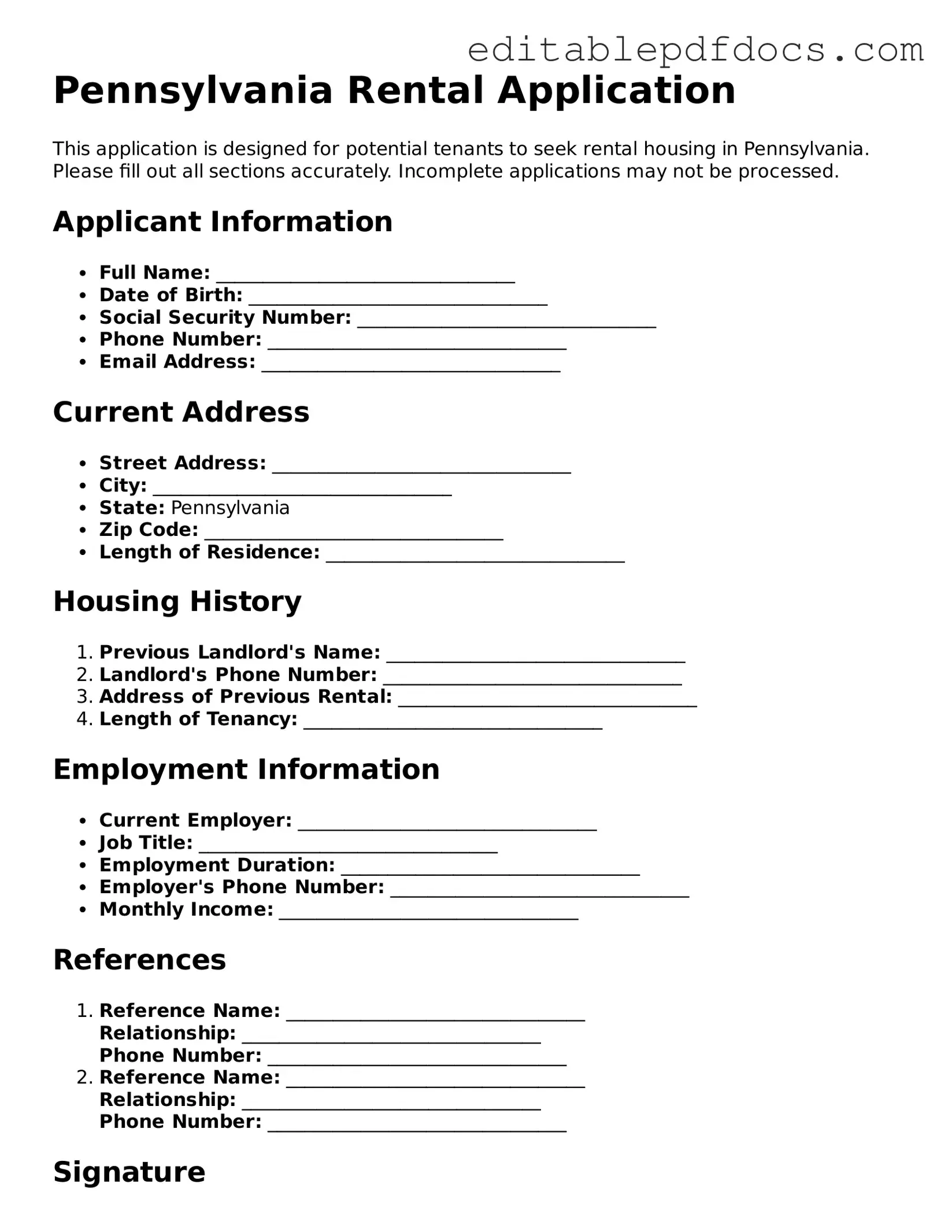

The Pennsylvania Rental Application form is a crucial document for both landlords and prospective tenants, serving as the first step in the rental process. This form typically requires essential information about the applicant, including their full name, contact details, employment history, and income verification. Landlords often use this information to assess the suitability of potential tenants. Additionally, the application may ask for references, rental history, and consent for background checks, allowing landlords to make informed decisions. Understanding the details of this form is vital for applicants to present themselves effectively and for landlords to ensure they find reliable tenants. By completing the Pennsylvania Rental Application accurately, applicants can enhance their chances of securing their desired rental property while landlords can streamline their tenant selection process.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Rental Application form is used by landlords to screen potential tenants. |

| Information Required | Applicants typically need to provide personal information, rental history, and employment details. |

| Application Fee | Landlords may charge a non-refundable application fee to cover screening costs. |

| Governing Law | The use of rental applications in Pennsylvania is governed by the Pennsylvania Landlord-Tenant Act. |

| Fair Housing Compliance | Landlords must ensure that the application process complies with federal and state fair housing laws. |

Dos and Don'ts

When filling out the Pennsylvania Rental Application form, it's essential to approach the process with care. Here are five key actions to consider, both what to do and what to avoid.

- Do provide accurate and complete information. Inaccuracies can delay the application process.

- Do include all necessary documentation, such as proof of income and identification. This strengthens your application.

- Do be honest about your rental history. Landlords appreciate transparency.

- Do follow the instructions carefully. Each application may have specific requirements.

- Do ask questions if you're unsure about any part of the application. Clarification can prevent mistakes.

- Don't omit any required information. Missing details can result in rejection.

- Don't provide false information. This can lead to disqualification and legal issues.

- Don't ignore deadlines. Timely submissions are crucial.

- Don't forget to proofread your application. Errors can create a negative impression.

- Don't hesitate to follow up after submission. A polite inquiry can show your interest.

Documents used along the form

When applying for a rental property in Pennsylvania, several documents often accompany the rental application form. These documents help landlords assess the suitability of potential tenants and ensure a smooth leasing process.

- Credit Report: A report that provides a summary of an applicant's credit history. It helps landlords evaluate the financial responsibility of potential tenants.

- Background Check: This document reveals any criminal history or past evictions. Landlords use it to ensure the safety and security of their property and other tenants.

- Proof of Income: Applicants may need to submit pay stubs, bank statements, or tax returns. This verifies that they can afford the rent.

- Vehicle Bill of Sale: This essential document captures the transfer of ownership for a motor vehicle, providing proof of transaction details between the buyer and seller, and can be easily accessed through Fillable Forms.

- Rental History: A document detailing previous rental agreements. It typically includes information about past landlords and payment history.

- Identification: A government-issued ID, such as a driver’s license or passport, is often required to confirm the identity of the applicant.

- Pet Application: If pets are allowed, this form provides information about the pet(s). It may include breed, size, and vaccination records.

- Lease Agreement: Once approved, this document outlines the terms of the rental arrangement. It includes details about rent, duration, and responsibilities of both parties.

Having these documents prepared can streamline the rental application process. It demonstrates responsibility and readiness, which can make a positive impression on landlords.

Consider Some Other Rental Application Templates for US States

Residential Application Form - Indicate how you learned about the rental opportunity.

When engaging in the transfer of personal property, using the New York Bill of Sale form is crucial for ensuring a clear and legal transaction. This document not only details the specifics of the item being sold but also serves as a formal receipt. For more information and a sample form, visit https://topformsonline.com, which offers valuable resources on how to properly complete the Bill of Sale.

House Rent Application - List any memberships in tenant organizations.

California Residential Rental Application - List your phone number for contact purposes.

Similar forms

Lease Agreement: This document outlines the terms and conditions of renting a property, similar to a rental application in that it requires personal information and details about the rental arrangement. Both documents serve to establish a formal relationship between the tenant and the landlord.

Background Check Authorization: A background check authorization form allows landlords to verify a potential tenant's history, including criminal records and credit history. Like the rental application, it collects personal information to assess the suitability of the applicant.

Employment Verification Form: This form is used to confirm a tenant's employment status and income level. It shares similarities with the rental application as both require financial information to ensure the applicant can afford the rent.

- Motor Vehicle Bill of Sale: This document is crucial for recording the transfer of vehicle ownership, ensuring legal compliance during the sale process. It serves as essential evidence for the buyer’s registration and titling, providing peace of mind for both parties. More details can be found at https://nyforms.com/motor-vehicle-bill-of-sale-template/.

Tenant Screening Report: A tenant screening report compiles various data points about an applicant, including credit scores and rental history. This document complements the rental application by providing a comprehensive view of the applicant's reliability and financial responsibility.

Common mistakes

When filling out the Pennsylvania Rental Application form, many applicants make mistakes that can hinder their chances of securing a rental property. One common error is providing inaccurate personal information. This includes misspelling names, incorrect Social Security numbers, or wrong dates of birth. Such inaccuracies can raise red flags for landlords and property managers, leading them to question the applicant's reliability.

Another frequent mistake is failing to disclose all sources of income. Many applicants only list their primary job, neglecting to mention side jobs, freelance work, or other income sources. Landlords often look for a comprehensive view of an applicant’s financial situation, and omitting this information can create doubt about one’s ability to pay rent.

Inadequate references can also be a stumbling block. Applicants sometimes provide references who are not familiar with their rental history or financial responsibility. It’s essential to choose references who can vouch for your reliability as a tenant. This might include previous landlords or employers who can speak positively about your character and habits.

Some individuals overlook the importance of a clean credit history. A poor credit score can significantly impact an application. Many landlords conduct credit checks, and a low score can lead to automatic disqualification. Applicants should review their credit reports beforehand and address any issues that may arise.

Additionally, neglecting to sign the application can be a simple yet critical error. An unsigned application may be considered incomplete, leading landlords to disregard it altogether. Always double-check that all required signatures are in place before submission.

Another mistake is not providing adequate documentation. Many rental applications require proof of income, such as pay stubs or bank statements. Failing to include these documents can delay the application process or result in denial. It’s best to gather all necessary paperwork ahead of time.

Some applicants also forget to read the fine print. Terms and conditions can include important information about fees, deposits, and lease terms. Ignoring these details can lead to misunderstandings later on, so it’s wise to familiarize yourself with the entire application.

Inconsistent information can also create problems. If an applicant provides different answers on different parts of the application, it can raise suspicions. Consistency is key, so ensure that all information matches across the board.

Lastly, many people underestimate the importance of a cover letter. A well-written cover letter can help applicants stand out in a competitive rental market. It’s an opportunity to convey enthusiasm and explain any potential concerns, such as a low credit score or gaps in rental history.