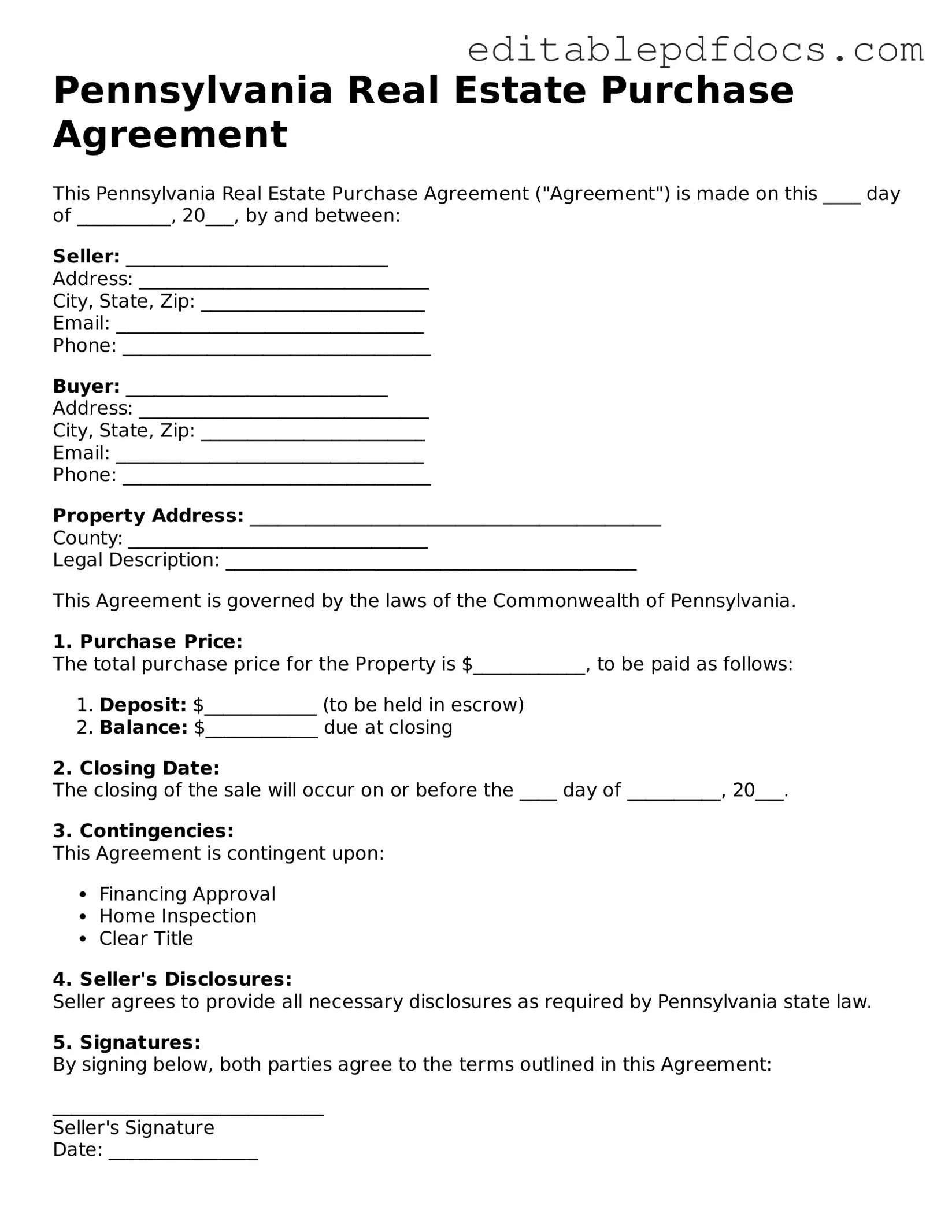

Real Estate Purchase Agreement Document for Pennsylvania

The Pennsylvania Real Estate Purchase Agreement form is a crucial document for anyone involved in buying or selling property in the state. This legally binding contract outlines the terms and conditions of the sale, ensuring that both parties understand their rights and obligations. Key elements of the agreement include the purchase price, financing details, property description, and contingencies such as inspections and appraisals. Additionally, it addresses important aspects like closing dates, earnest money deposits, and any specific terms negotiated between the buyer and seller. By clearly detailing these components, the form serves to protect both parties and facilitate a smooth transaction. Understanding the nuances of this agreement is essential for a successful real estate deal in Pennsylvania.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Real Estate Purchase Agreement is governed by Pennsylvania state law. |

| Purpose | This form serves as a legally binding contract between a buyer and a seller for the sale of real estate. |

| Essential Elements | The agreement typically includes the property description, purchase price, and terms of sale. |

| Earnest Money | Buyers often provide earnest money as a show of good faith, which is held in escrow until closing. |

| Contingencies | Common contingencies include home inspections, financing, and appraisal conditions. |

| Disclosure Requirements | Sellers are required to disclose known defects or issues with the property to potential buyers. |

| Closing Process | The closing process typically involves signing the final paperwork and transferring ownership of the property. |

| Default Provisions | The agreement outlines what happens if either party fails to fulfill their obligations. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties to be valid. |

| Legal Advice | It is advisable for both buyers and sellers to seek legal advice before signing the agreement. |

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property, including the address and legal description.

- Do clearly state the purchase price and any contingencies.

- Do include all necessary signatures from both the buyer and seller.

- Don't leave any blank spaces; fill in all required fields.

- Don't use ambiguous language or terms that could be misinterpreted.

Documents used along the form

When engaging in a real estate transaction in Pennsylvania, several documents accompany the Real Estate Purchase Agreement to ensure a comprehensive understanding of the terms and obligations involved. These documents help protect the interests of both buyers and sellers, facilitating a smoother process.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues or defects related to the property. It provides potential buyers with important information regarding the condition of the home, including structural problems, past repairs, and any environmental hazards.

- Property Inspection Report: After an inspection, this report details the findings regarding the property's condition. Buyers often request this report to assess any necessary repairs or maintenance before finalizing the purchase.

- Motor Vehicle Bill of Sale: This essential document facilitates the transfer of ownership for a motor vehicle in California, ensuring both parties are protected during the transaction. For more information on obtaining this form, visit Fillable Forms.

- Title Search Report: Conducted by a title company, this report verifies the legal ownership of the property and checks for any liens or encumbrances. It ensures that the buyer will receive clear title upon purchase.

- Closing Disclosure: This document outlines the final terms of the loan and details all closing costs associated with the transaction. It must be provided to the buyer at least three days before closing, allowing them to review and understand the financial aspects of their purchase.

Understanding these accompanying documents is crucial for anyone involved in a real estate transaction. Each plays a significant role in ensuring transparency and protecting the rights of all parties involved.

Consider Some Other Real Estate Purchase Agreement Templates for US States

Purchase and Sale Agreement Washington State - Specifies buyer and seller details, including signatures and dates.

In addition to completing the Employment Verification form, it may also be beneficial to provide a Job Verification Letter, which can further support your claims of employment status and can enhance the credibility of your application process.

Florida as Is Contract Inspection Period - A document outlining the terms of a real estate transaction.

For Sale by Owner Contract Pdf - Contains provisions for handling deposits and earnest money.

Tennessee Real Estate Forms Free - Specific timelines for various stages of the sale are laid out.

Similar forms

When it comes to real estate transactions, several documents share similarities with the Real Estate Purchase Agreement. Each of these documents plays a crucial role in the buying and selling process. Here’s a list of eight documents that are comparable to the Real Estate Purchase Agreement:

- Letter of Intent: This document outlines the preliminary agreement between the buyer and seller, expressing the intent to enter into a formal contract. It sets the stage for negotiations and can include key terms that will be finalized later.

- Sales Contract: Often used interchangeably with a purchase agreement, this document details the terms of the sale, including price, contingencies, and closing date. It serves as the binding agreement between the parties involved.

- Lease Agreement: While primarily for rental situations, a lease agreement can also include an option to purchase. This document outlines the terms of leasing the property and the conditions under which the tenant may buy it.

- Employment Verification Form: This form is crucial for verifying the employment eligibility of new hires, similar to how other documents ensure compliance and integrity in real estate transactions. For details, access the form here.

- Option to Purchase Agreement: This document gives the buyer the right, but not the obligation, to purchase a property at a predetermined price within a specified timeframe. It can be a strategic tool for buyers who want to secure a property while they decide.

- Disclosure Statement: Sellers are often required to provide a disclosure statement that details the condition of the property and any known issues. This document complements the purchase agreement by ensuring transparency between buyer and seller.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document summarizes all financial transactions related to the sale. It details costs, fees, and the distribution of funds at closing, ensuring both parties understand their financial obligations.

- Title Report: This report provides information about the property’s ownership history and any liens or encumbrances. It is essential for buyers to ensure they are purchasing a property free of legal issues, making it a critical component of the purchase process.

- Escrow Agreement: This document outlines the terms under which a neutral third party holds funds and documents until all conditions of the sale are met. It protects both the buyer and seller by ensuring that neither party receives anything until all obligations are fulfilled.

Understanding these documents can empower you as you navigate the real estate transaction process. Each one serves a unique purpose, but they all work together to create a smooth and legally sound transfer of property.

Common mistakes

When filling out the Pennsylvania Real Estate Purchase Agreement form, many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure a smoother transaction. One frequent error is failing to provide complete information about the property. Buyers and sellers must accurately describe the property, including the address and any relevant details. Omitting this information can create confusion and potential legal issues.

Another mistake is neglecting to specify the purchase price clearly. This figure should be prominently stated, as it forms the basis of the agreement. Ambiguities or vague terms can lead to disputes later. Additionally, not including earnest money details can cause problems. This deposit shows a buyer's commitment and should be clearly outlined in the agreement, including the amount and conditions for its return.

People often overlook the importance of including contingencies. Contingencies are conditions that must be met for the sale to proceed, such as obtaining financing or passing a home inspection. Without these, a buyer may find themselves in a difficult situation if issues arise. Furthermore, failing to state the closing date can lead to misunderstandings. It is essential to agree on when the transaction will be finalized to avoid delays.

Another common error is not addressing who is responsible for closing costs. These costs can include fees for inspections, title searches, and other expenses. Clearly stating who will bear these costs can prevent disputes. Additionally, individuals sometimes forget to include the necessary signatures. All parties involved must sign the agreement for it to be legally binding. Missing a signature can render the entire agreement void.

Misunderstanding the implications of “as-is” sales is also a frequent mistake. When a property is sold as-is, the seller is not obligated to make repairs. Buyers should be fully aware of what this means before signing. Lastly, not seeking legal advice can be detrimental. Real estate transactions can be complex, and consulting with a professional can help individuals avoid these mistakes and ensure their interests are protected.