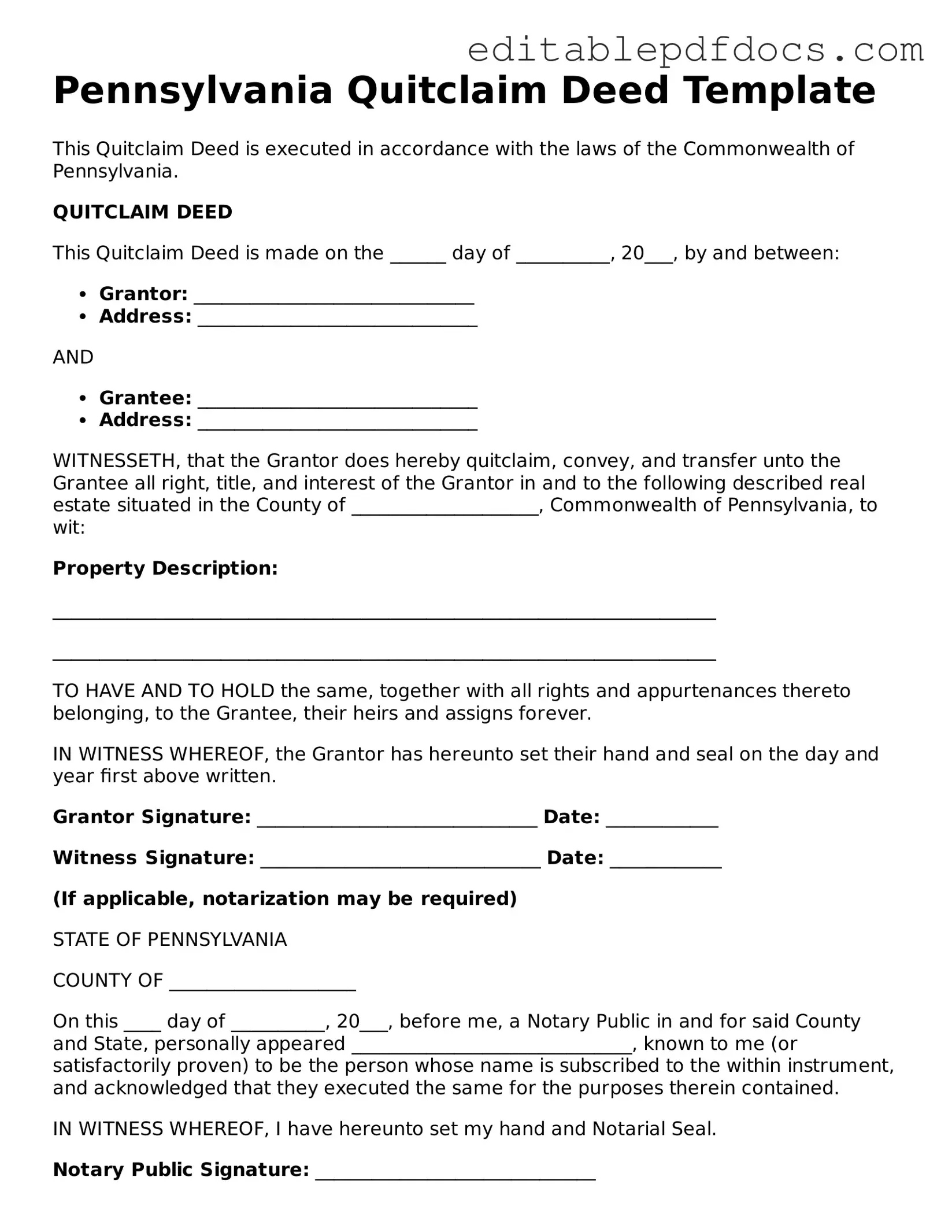

Quitclaim Deed Document for Pennsylvania

In Pennsylvania, the Quitclaim Deed form serves as a vital tool for property owners looking to transfer ownership rights without the complexities often associated with traditional sales. This straightforward document allows one party, known as the grantor, to convey their interest in a property to another party, the grantee, with minimal formalities. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor holds clear title to the property or that there are no liens or claims against it. This makes them particularly useful in specific situations, such as transferring property between family members, settling estate matters, or clearing up title issues. The form requires essential details, including the names of both parties, a description of the property, and the signature of the grantor. Additionally, it must be notarized and recorded with the local county office to ensure the transfer is legally recognized. Understanding the nuances of the Quitclaim Deed can empower individuals to navigate property transfers effectively, making it an essential aspect of real estate transactions in Pennsylvania.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties about the title. |

| Governing Law | In Pennsylvania, quitclaim deeds are governed by Title 21 of the Pennsylvania Consolidated Statutes, specifically under the Uniform Conveyancing Act. |

| Usage | This type of deed is often used between family members, in divorce settlements, or to clear up title issues. |

| Limitations | Quitclaim deeds do not guarantee that the grantor has valid ownership of the property, nor do they protect the grantee from any claims against the property. |

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, it is essential to follow certain guidelines to ensure the document is completed correctly. Below is a list of things to do and things to avoid.

- Do provide accurate information about the property, including the legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the form in the presence of a notary public.

- Do ensure that the form is dated correctly.

- Do check for any local requirements that may apply to your specific situation.

- Don't leave any fields blank; all sections must be filled out.

- Don't use incorrect or outdated property descriptions.

- Don't forget to have the document notarized before submission.

- Don't submit the form without reviewing it for errors.

- Don't overlook the need to file the deed with the county recorder's office after completion.

Documents used along the form

The Pennsylvania Quitclaim Deed is a vital document used to transfer ownership of real estate from one party to another. However, several other forms and documents often accompany it to ensure a smooth transaction and proper record-keeping. Below is a list of these essential documents, each serving a specific purpose in the real estate transfer process.

- Property Transfer Tax Statement: This form is required to report the transfer of property and calculate any applicable taxes. It provides the state with necessary information about the transaction.

- Affidavit of Residence: This document may be necessary to confirm the residency status of the grantor or grantee. It helps establish eligibility for certain tax exemptions or benefits.

- Ohio Living Will Form: When planning for healthcare decisions, consider the essential Ohio Living Will documentation to ensure your medical preferences are honored.

- Title Search Report: Conducting a title search is crucial to ensure that the property is free of liens or encumbrances. This report outlines any claims against the property that could affect ownership.

- Closing Statement: Often prepared by the closing agent, this document summarizes the financial aspects of the transaction, including purchase price, fees, and any credits or debits between the parties.

- Deed of Trust or Mortgage: If financing is involved, a deed of trust or mortgage will be necessary. This document secures the loan by placing a lien on the property until the debt is repaid.

- Power of Attorney: In some cases, a party may be unable to attend the closing. A power of attorney allows another individual to act on their behalf, ensuring the transaction can proceed smoothly.

- Notice of Settlement: This document informs all relevant parties about the closing date and location. It serves as a reminder and helps ensure that everyone is prepared for the transaction.

Each of these documents plays a significant role in the real estate transfer process in Pennsylvania. By understanding their purposes, parties involved can navigate the complexities of property transactions more effectively.

Consider Some Other Quitclaim Deed Templates for US States

Washington State Quit Claim Deed - This deed is a quick and relatively low-cost way to change property ownership between parties.

Quick Claim Deeds in Florida - A quitclaim deed can facilitate quick property transfers when time is of the essence.

Quit Claim Deed Form Free - In certain instances, it may be necessary to re-title the property if a Quitclaim Deed is utilized.

A New York Non-disclosure Agreement (NDA) form is a legally binding document used to protect sensitive information from being disclosed. By signing this form, parties agree not to share proprietary knowledge, trade secrets, or other confidential data with unauthorized individuals. It serves as a critical tool for businesses and individuals aiming to safeguard their competitive edge and privacy in various transactions and interactions within New York. For more information, you can visit https://nyforms.com/non-disclosure-agreement-template.

Warranty Deed - Property owners sometimes use this deed to facilitate quick sales.

Similar forms

- Warranty Deed: Similar to a quitclaim deed, a warranty deed provides a guarantee that the grantor holds clear title to the property. However, it offers more protection to the grantee by ensuring that the property is free from any encumbrances, unlike a quitclaim deed, which does not provide such assurances.

- Emotional Support Animal Letter: This essential document validates the need for an emotional support animal, enabling individuals to access necessary support. For more information on how to obtain this letter, visit Fillable Forms.

- Grant Deed: A grant deed also transfers ownership of property but includes implied warranties regarding the title. This means that the grantor has not sold the property to anyone else and that the property is free from undisclosed liens, which is not guaranteed in a quitclaim deed.

- Deed of Trust: A deed of trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose than a quitclaim deed, both documents are related to property ownership and transfer.

- Special Purpose Deed: This type of deed is used for specific situations, such as transferring property into a trust or during a divorce. Like a quitclaim deed, it may not provide the same level of warranty regarding the title but facilitates the transfer of ownership.

- Affidavit of Title: An affidavit of title is a sworn statement that affirms the seller’s ownership of the property and the absence of any claims against it. Although it does not transfer ownership like a quitclaim deed, it serves to clarify the status of the title before a sale.

Common mistakes

When filling out the Pennsylvania Quitclaim Deed form, one common mistake is failing to provide accurate property descriptions. The deed must clearly identify the property being transferred. Omitting details such as the lot number, block number, or other identifying features can lead to confusion and potential legal disputes in the future. Ensure that the description is precise and matches the information on the property's current deed.

Another frequent error involves not including the names of all parties involved in the transaction. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be correctly named. Missing or misspelled names can complicate the transfer process and may render the deed invalid. Double-check that all names are spelled correctly and that they reflect the legal names of the individuals or entities involved.

People often overlook the necessity of notarization. In Pennsylvania, a Quitclaim Deed must be signed in the presence of a notary public to be legally binding. Failing to have the document notarized can lead to issues with recording the deed at the county office. It is essential to ensure that the signature is witnessed and notarized before submission.

Finally, individuals may neglect to consider the implications of the transfer. A Quitclaim Deed does not guarantee that the property is free of liens or other encumbrances. It simply transfers whatever interest the grantor has in the property. Understanding this limitation is crucial. It is advisable to conduct a title search to uncover any potential issues before finalizing the deed.