Promissory Note Document for Pennsylvania

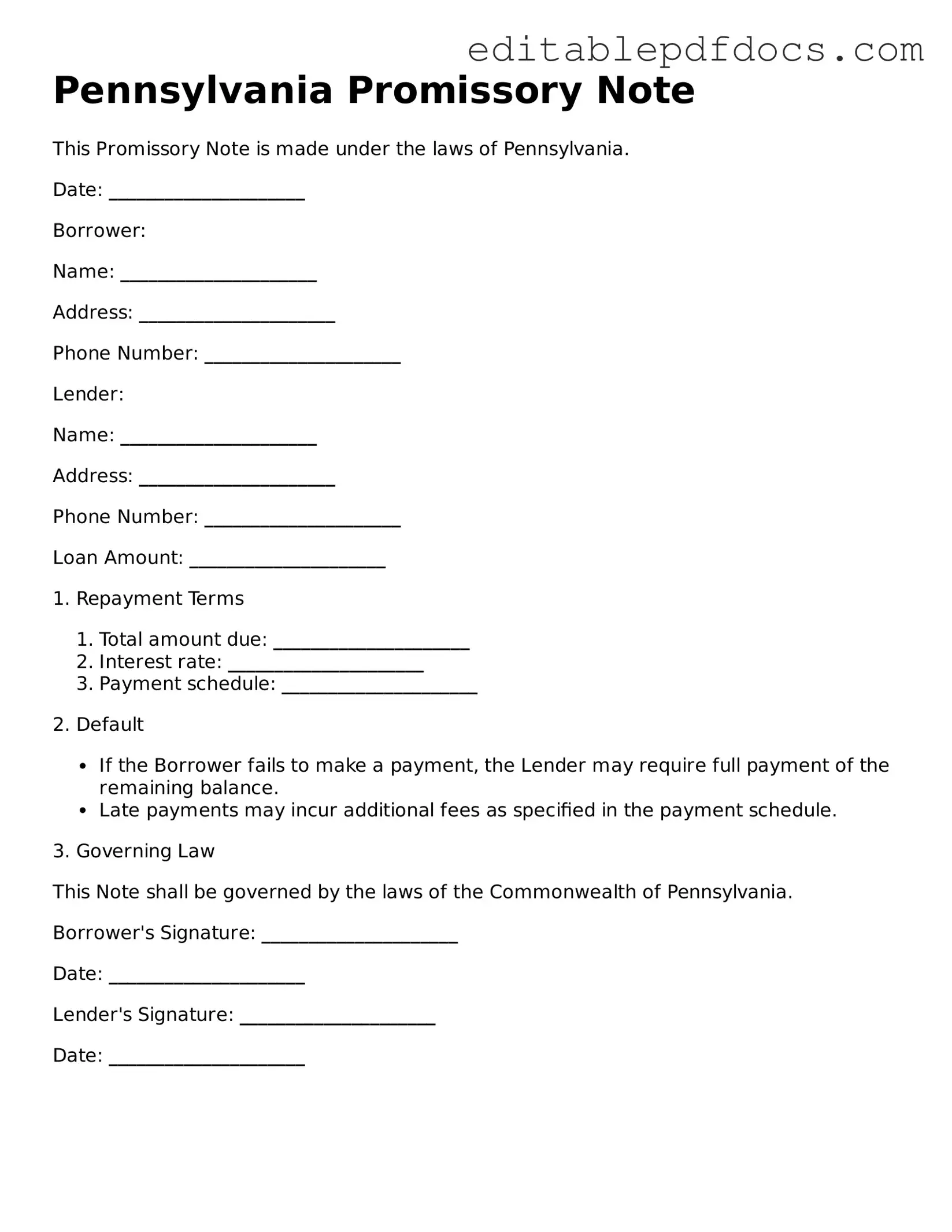

The Pennsylvania Promissory Note form serves as a vital tool for individuals and businesses entering into a loan agreement. This legally binding document outlines the borrower's promise to repay a specified amount of money to the lender, detailing the terms of the loan including the interest rate, repayment schedule, and any penalties for late payments. In Pennsylvania, this form must include essential elements such as the names and addresses of both parties, the principal amount, and the date of the agreement. Additionally, it may specify whether the note is secured or unsecured, which can affect the lender's rights in the event of default. Clear and concise language is crucial in this document to avoid misunderstandings and ensure enforceability. Proper execution of the form, including signatures from both parties, is necessary for the note to be legally recognized. Understanding these aspects is essential for anyone looking to enter into a loan agreement in Pennsylvania.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes in Pennsylvania. |

| Parties Involved | The note involves two parties: the maker (the person promising to pay) and the payee (the person receiving the payment). |

| Key Elements | Essential elements include the amount owed, interest rate (if applicable), payment terms, and signatures of the parties involved. |

| Enforceability | To be enforceable, the note must be clear and unambiguous, and all parties must agree to its terms. |

| Legal Remedies | If the maker defaults, the payee may pursue legal remedies, including filing a lawsuit to recover the owed amount. |

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it’s important to follow certain guidelines to ensure that the document is valid and enforceable. Here’s a list of what you should and shouldn’t do:

- Do clearly state the amount of money being borrowed.

- Do include the names and addresses of both the borrower and the lender.

- Do specify the interest rate, if applicable, and how it will be calculated.

- Do outline the repayment schedule, including due dates and payment amounts.

- Don’t leave any sections blank; fill out all required information.

- Don’t forget to sign and date the document to make it legally binding.

By following these guidelines, you can help ensure that your Promissory Note is clear and enforceable, protecting both parties involved in the agreement.

Documents used along the form

When engaging in a financial agreement that involves a promissory note in Pennsylvania, several other documents and forms may be necessary to ensure clarity and legal protection for all parties involved. Each of these documents serves a unique purpose and helps to outline the terms and conditions surrounding the loan or debt. Below is a list of common forms that accompany a Pennsylvania Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It provides a comprehensive overview of the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security. It outlines the rights of the lender in the event of default and provides clarity on how collateral can be claimed.

- Emotional Support Animal Letter: This document is essential for individuals seeking to use their emotional support animals for mental health reasons, as it verifies the support provided by the animal. For more information on how to obtain this letter, you can visit Fillable Forms.

- Disclosure Statement: This document informs the borrower of the terms of the loan, including any fees, penalties, and interest rates. It ensures that the borrower understands the financial implications before signing the promissory note.

- Payment Schedule: A detailed timeline that outlines when payments are due, the amount of each payment, and how they will be applied to the principal and interest. This helps both parties keep track of payment obligations.

- Personal Guarantee: In cases where the borrower is a business entity, a personal guarantee may be required from an individual. This document holds the individual personally responsible for the debt if the business defaults.

- Amendment Agreement: If there are changes to the original terms of the promissory note, an amendment agreement is necessary. This document outlines the specific changes and requires signatures from all parties involved.

- Default Notice: Should the borrower fail to meet their obligations, this notice formally informs them of the default. It serves as a record of communication and may be required before further legal action is taken.

- Release of Liability: Once the loan is paid off, this document releases the borrower from any further obligations under the promissory note. It provides peace of mind and confirms that the debt has been settled.

Having these documents in place can help ensure that both lenders and borrowers are protected and informed throughout the lending process. It fosters transparency and can prevent misunderstandings, making financial transactions smoother and more secure.

Consider Some Other Promissory Note Templates for US States

Georgia Promissory Note Template - This document can serve as foundational evidence in legal disputes regarding debts.

Promissory Note Template Arizona - Collecting interest on a promissory note is common practice to compensate the lender.

Washington Promissory Note - It can provide peace of mind for lenders worried about repayment.

The Employment Verification Form is a crucial document designed to confirm an individual's employment status and history. It serves as a key resource for potential employers, lenders, and other entities needing to verify a person's work background. For further assistance or to access the form online, you can visit PDF Documents Hub. Understanding and filling out this form accurately is essential, so take a moment to ensure you’re ready to complete it by clicking the button below.

Promissory Note Florida - It can outline payment methods accepted by the lender.

Similar forms

- Loan Agreement: A loan agreement outlines the terms of a loan, including repayment schedules and interest rates, similar to a promissory note which specifies the borrower's promise to repay the borrowed amount.

- Mortgage: A mortgage is a secured loan for real estate, requiring the borrower to repay the loan amount, akin to the repayment obligation in a promissory note.

- Installment Agreement: This document allows for repayment in installments over time, paralleling the structured payment plan often detailed in a promissory note.

- Ohio Living Will Form: To express your healthcare wishes, utilize the comprehensive Ohio Living Will documentation for clarity and legal compliance.

- Secured Note: A secured note is backed by collateral, similar to a promissory note that may also specify collateral to ensure repayment.

- Unsecured Note: An unsecured note does not require collateral, much like a promissory note that is based solely on the borrower's promise to repay.

- Personal Guarantee: A personal guarantee involves an individual promising to pay a debt if the primary borrower defaults, reflecting the personal commitment found in a promissory note.

- Credit Agreement: A credit agreement sets the terms under which credit is extended, similar to how a promissory note specifies the terms of repayment.

- Debt Acknowledgment: This document acknowledges the existence of a debt and the obligation to repay, paralleling the promise made in a promissory note.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily reduce or suspend payments, while still being bound to repay the original debt as outlined in a promissory note.

Common mistakes

Filling out a Pennsylvania Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to include all necessary information. It’s important to provide complete details, such as the full names and addresses of both the borrower and the lender. Omitting any of this information can create confusion and potentially make the note unenforceable.

Another mistake often seen is not specifying the repayment terms clearly. The note should outline how much is being borrowed, the interest rate, and the repayment schedule. If these details are vague or missing, it can lead to misunderstandings about when payments are due and how much is owed.

People sometimes forget to include a date on the promissory note. This date is crucial as it establishes when the agreement begins. Without it, there could be disputes over when the repayment period starts, which can complicate matters if any issues arise later.

Additionally, some individuals neglect to sign the document. Both the borrower and the lender must sign the promissory note for it to be valid. A signature indicates that both parties agree to the terms laid out in the document. Without signatures, the note may not hold up in court.

Not having witnesses or a notary present can also be a significant oversight. While not always required, having a witness or a notary can add an extra layer of protection. This can help verify that both parties are entering into the agreement willingly and understand the terms.

Lastly, people often fail to keep a copy of the signed note. After the document is completed and signed, both parties should retain a copy for their records. This ensures that everyone has access to the terms agreed upon and can refer back to them if necessary.